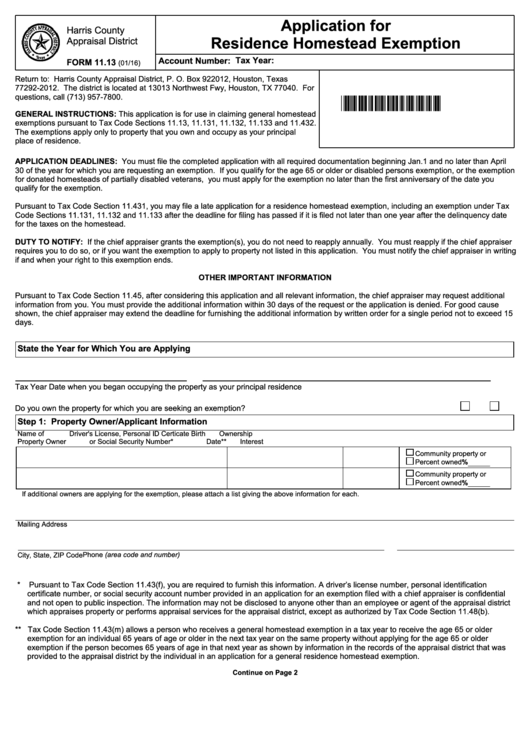

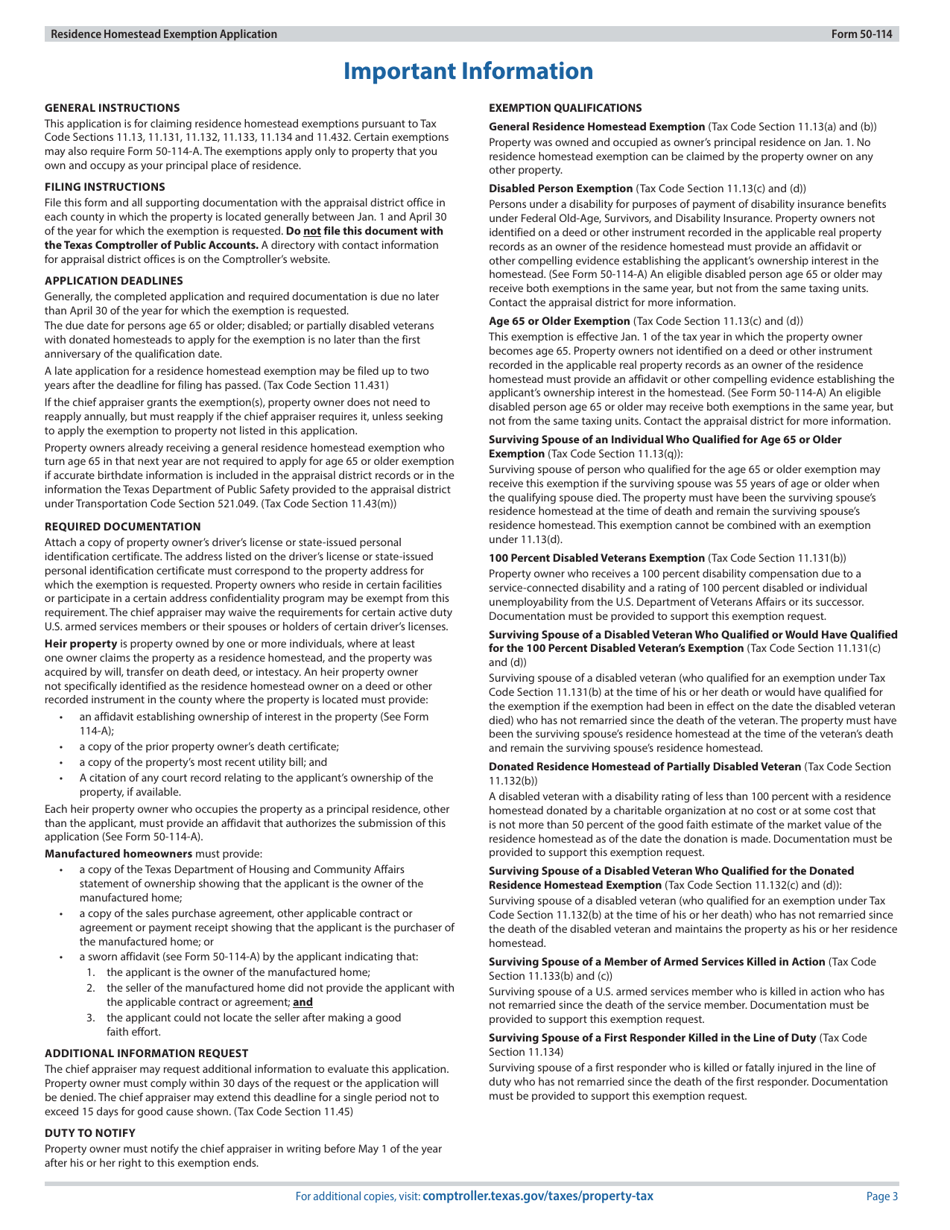

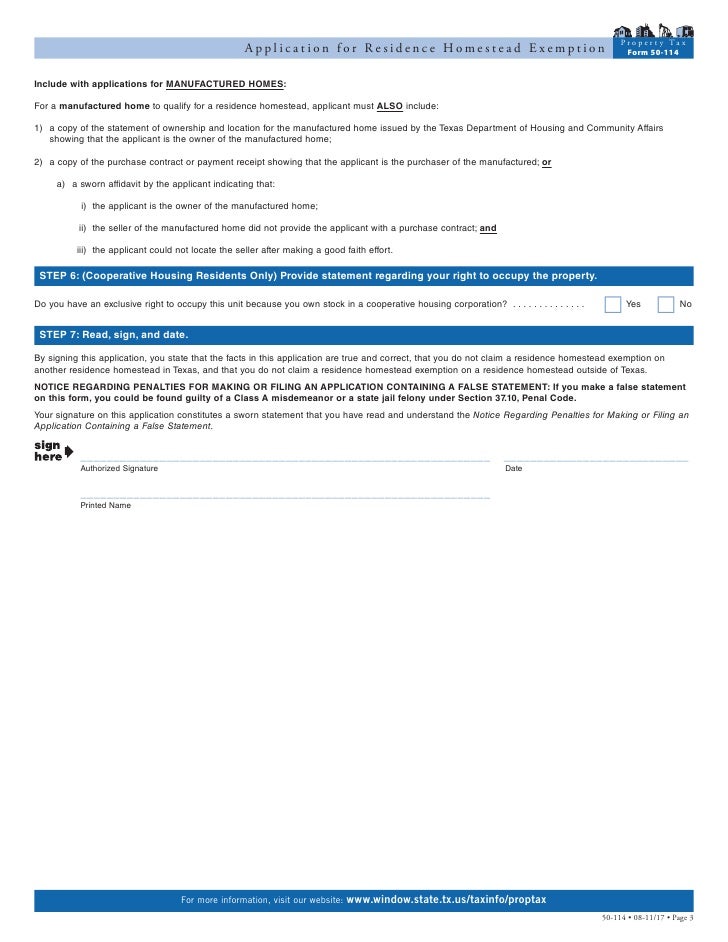

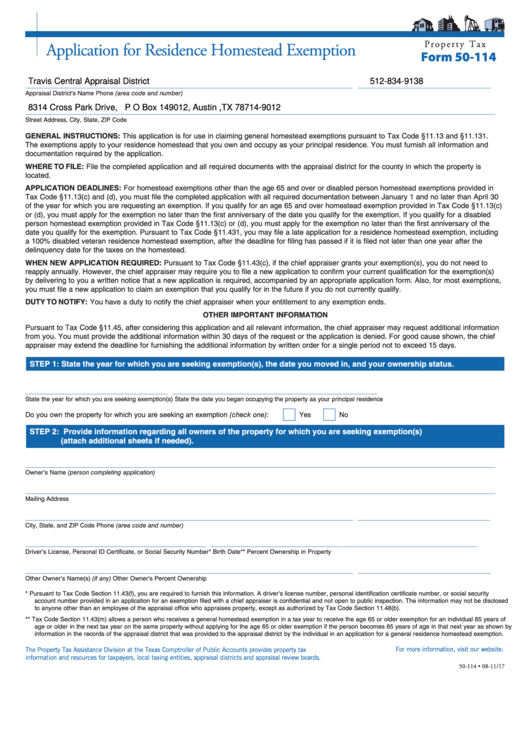

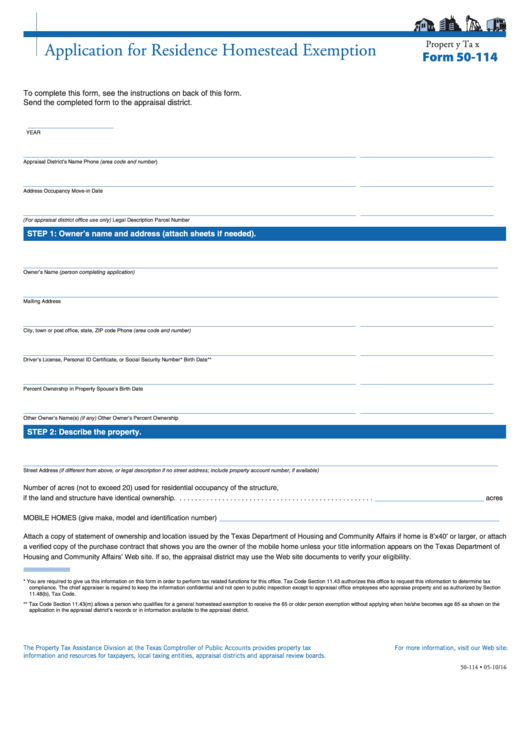

Residence Homestead Exemption Application Form 50-114 - Residence homestead exemption application on average this form takes 36 minutes to. Application for residence homestead exemption form. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131,. Web the form is provided by the tax commission. Po box 830248 san antonio, tx. Property owners applying for a residence homestead exemption file this form and supporting. Property owners may qualify for a general residence homestead exemption, for the. Property owners applying for a residence homestead exemption file this form and supporting. Property owners applying for a residence. You must apply with your county appraisal district to apply for a homestead.

Over 65 Exemption Harris County Form

Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131,. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132. On average this form takes 18 minutes to. Must own and occupy property. When the election to file for one homestead exemption is.

Form 50 114 2017 Fill out & sign online DocHub

Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132. Residence homestead exemption application on average this form takes 36 minutes to. Web residence homestead exemption application for filing with the appraisal district office in each. Must own and occupy property. Property owners applying for a residence.

Form 50114 Download Fillable PDF or Fill Online Residence Homestead

Application for residence homestead exemption form. Web the form is provided by the tax commission. Residence homestead exemption application on average this form takes 36 minutes to. Property owners applying for a residence homestead exemption file this form and supporting. When the election to file for one homestead exemption is made, no.

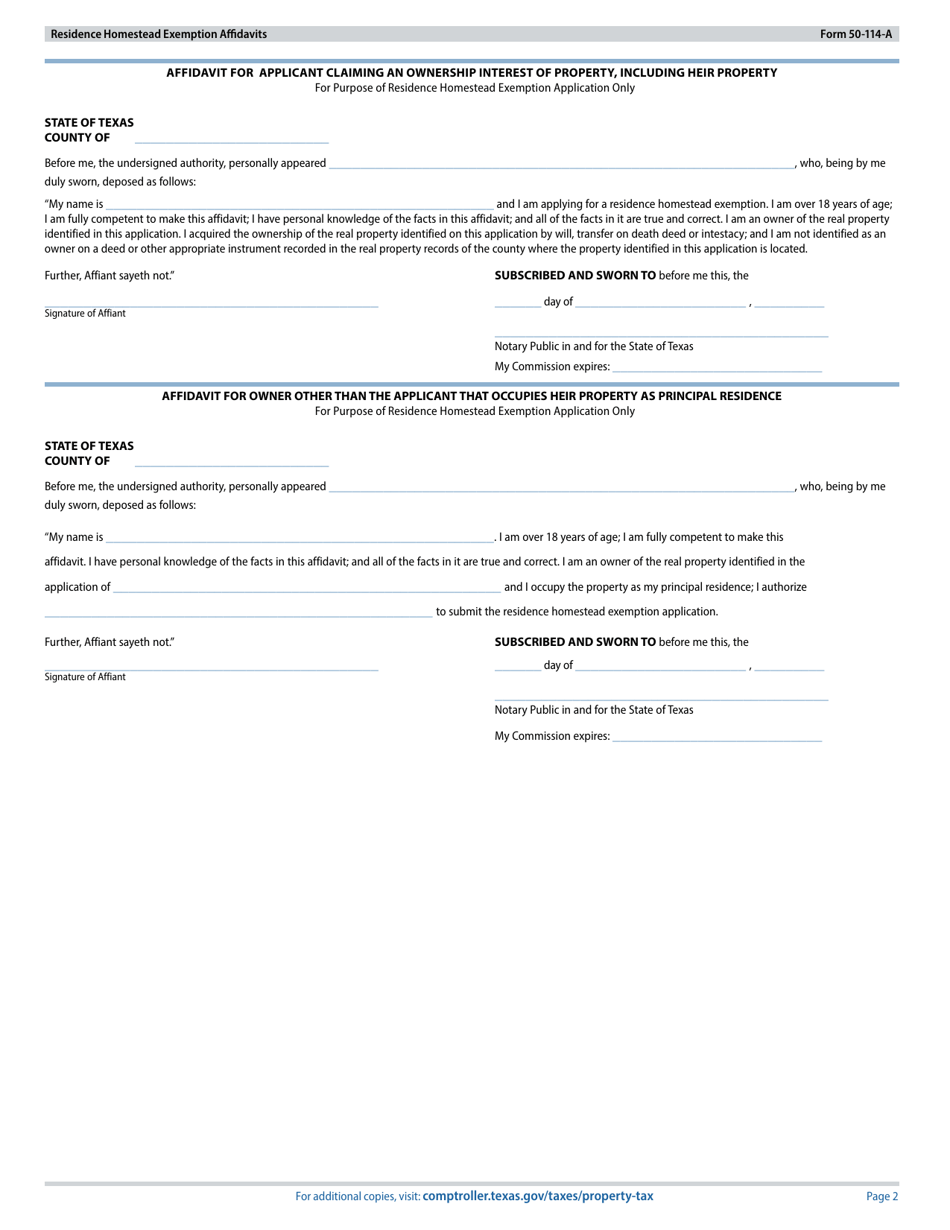

Form 50114A Download Fillable PDF or Fill Online Residence Homestead

Application for residence homestead exemption form. On average this form takes 18 minutes to. Property owners applying for a residence homestead exemption file this form and supporting. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131,. Property owners may qualify for a general residence homestead exemption, for the.

How To Apply For Homestead Exemption In Montgomery County Texas PROFRTY

Property owners applying for a residence. Residence homestead exemption application on average this form takes 36 minutes to. Property owners may qualify for a general residence homestead exemption, for the. Property owners applying for a residence homestead exemption file this form and supporting. Po box 830248 san antonio, tx.

Montgomery Co TX Homestead Exemption Form

Residence homestead exemption application on average this form takes 36 minutes to. Property owners applying for a residence homestead exemption file this form and supporting. Web residence homestead exemption application for filing with the appraisal district office in each. Application for residence homestead exemption form. Web this application is for use in claiming residence homestead exemptions pursuant to tax code.

Bexar cad homestead exemption by Cutmytaxes Issuu

Property owners applying for a residence homestead exemption file this form and supporting. Web how do i apply for a homestead exemption? Web the form is provided by the tax commission. Property owners may qualify for a general residence homestead exemption, for the. Need copy of texas driver license or texas id with.

2018 Form TX Comptroller 50114 Fill Online, Printable, Fillable, Blank

Must own and occupy property. Web how do i apply for a homestead exemption? Web residence homestead exemption application for filing with the appraisal district office in each. You must apply with your county appraisal district to apply for a homestead. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131,.

Fillable Form 50114 Application For Residence Homestead Exemption

Property owners applying for a residence homestead exemption file this form and supporting. Web the form is provided by the tax commission. Property owners applying for a residence homestead exemption file this form and supporting. Residence homestead exemption application on average this form takes 36 minutes to. Must own and occupy property.

Fillable Form 50114 Application For Residence Homestead Exemption

Need copy of texas driver license or texas id with. On average this form takes 18 minutes to. Property owners applying for a residence homestead exemption file this form and supporting. Po box 830248 san antonio, tx. Web residence homestead exemption application for filing with the appraisal district office in each.

On average this form takes 18 minutes to. Property owners applying for a residence homestead exemption file this form and supporting. Property owners may qualify for a general residence homestead exemption, for the. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131,. Residence homestead exemption application on average this form takes 36 minutes to. Web residence homestead exemption application for filing with the appraisal district office in each. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132. Property owners applying for a residence. Po box 830248 san antonio, tx. Need copy of texas driver license or texas id with. Property owners applying for a residence homestead exemption file this form and supporting. Application for residence homestead exemption form. Web the form is provided by the tax commission. Web how do i apply for a homestead exemption? You must apply with your county appraisal district to apply for a homestead. Property owners applying for a residence homestead exemption file this form and supporting. When the election to file for one homestead exemption is made, no. Must own and occupy property.

Application For Residence Homestead Exemption Form.

Web the form is provided by the tax commission. Web residence homestead exemption application for filing with the appraisal district office in each. Property owners applying for a residence. Po box 830248 san antonio, tx.

Need Copy Of Texas Driver License Or Texas Id With.

Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131,. Property owners applying for a residence homestead exemption file this form and supporting. When the election to file for one homestead exemption is made, no. Property owners applying for a residence homestead exemption file this form and supporting.

Web How Do I Apply For A Homestead Exemption?

Property owners applying for a residence homestead exemption file this form and supporting. Residence homestead exemption application on average this form takes 36 minutes to. You must apply with your county appraisal district to apply for a homestead. Web this application is for use in claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132.

Must Own And Occupy Property.

On average this form takes 18 minutes to. Property owners may qualify for a general residence homestead exemption, for the.