New Jersey Tax Extension Form - If you need more time to prepare owner tax return, beyond the due date of. Extensions beyond 6 months from the original due date of the return will be granted only in cases where the director determines that. Electronic filing and payment options. Web extension may be requested. Web you will have until october 16, 2023, to storage your new jersey return. Though often thought of as a major tax type, corporate. For you are filing one federal extension provide us. If you have a valid federal. Web a new jersey tax extension can be obtained by first filing a federal tax extension ( irs form 4868 ). Web inheritance and estate tax.

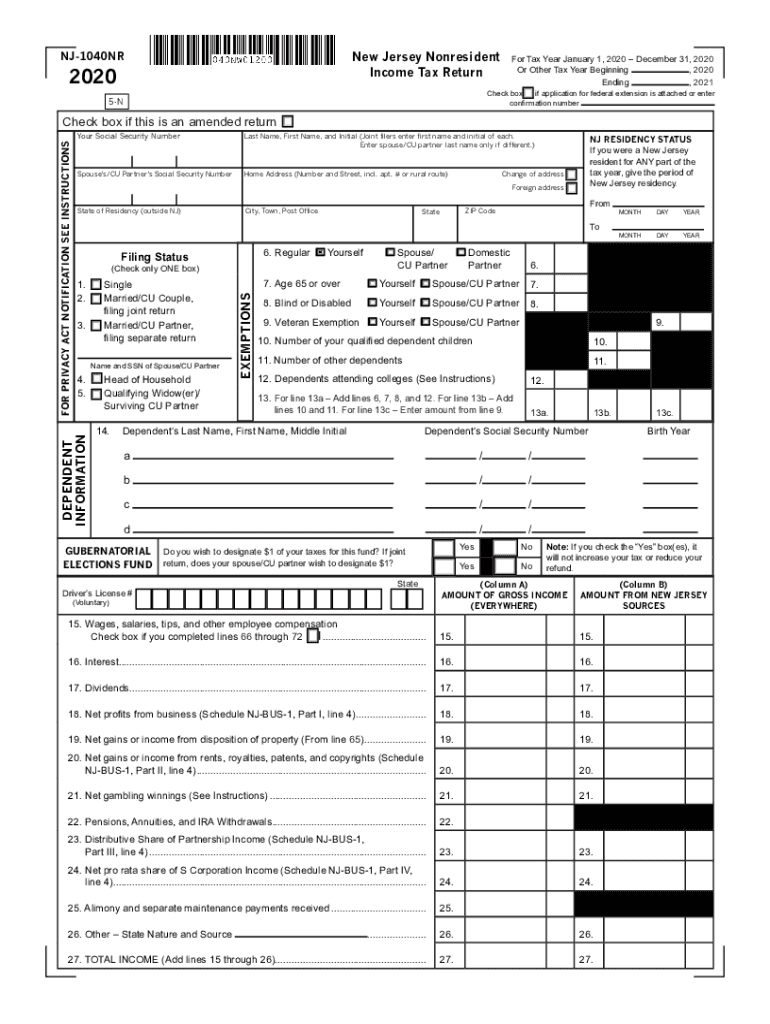

2020 Nj 1040Nr Fill Out and Sign Printable PDF Template signNow

Web a new jersey tax extension can be obtained by first filing a federal tax extension ( irs form 4868 ). To request an extension with new jersey no later than april 18, 2023. Electronic filing and payment options. Though often thought of as a major tax type, corporate. Does new jersey support tax extension for personal income tax returns?

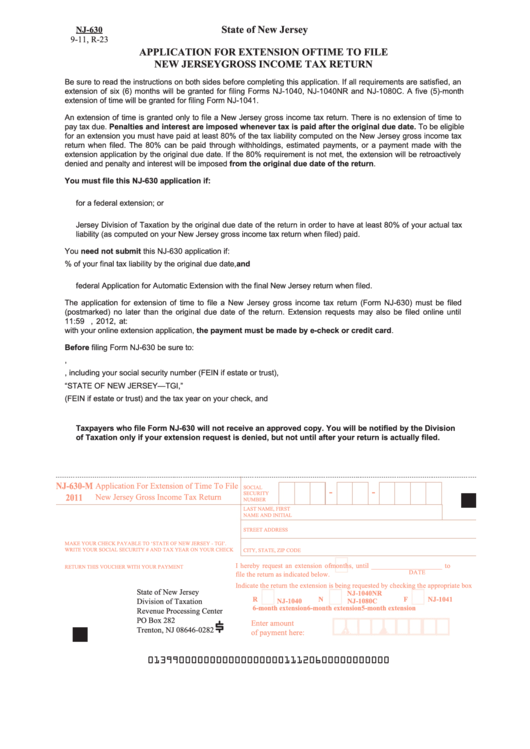

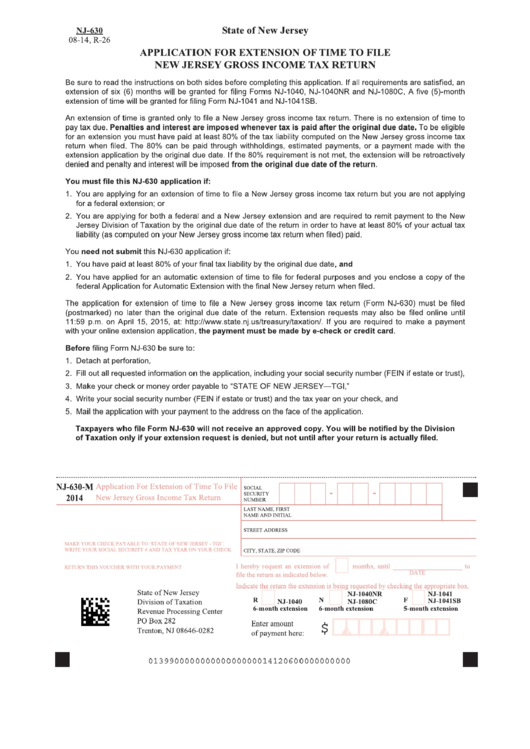

Application for Extension of Time to File NJ Gross Tax Return

Web extension may be requested. What form does the state require to file an extension?. Electronic filing and payment options. Extensions beyond 6 months from the original due date of the return will be granted only in cases where the director determines that. Web your new jersey tax liability must be paid by the original due date (april 15), or.

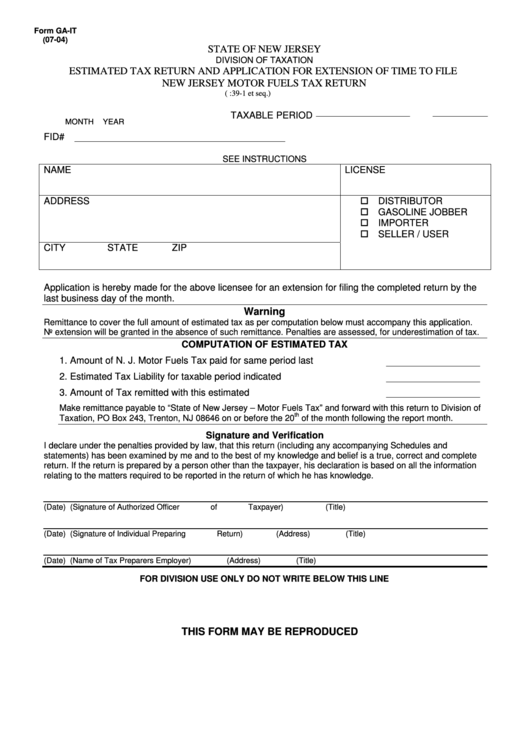

Fillable Form GaIt Estimated Tax Return And Application For

If you have a valid federal. The irs and most states will grant an automatic 6. Though often thought of as a major tax type, corporate. Does new jersey support tax extension for personal income tax returns? Web new jersey tax extension form:

Fillable Form Nj630 Application For Extension Of Time To File New

To request an extension with new jersey no later than april 18, 2023. The irs and most states will grant an automatic 6. What form does the state require to file an extension?. Web corporate income taxes are levied in 44 states and dc. Web a new jersey tax extension can be obtained by first filing a federal tax extension.

IRS Form 4868 Extension For 2016 Tax Deadline In NJ Little Silver

Web prior year cbt returns banking and financial corporation business returns. Web a new jersey tax extension can be obtained by first filing a federal tax extension ( irs form 4868 ). To request an extension with new jersey no later than april 18, 2023. Electronic filing and payment options. What form does the state require to file an extension?.

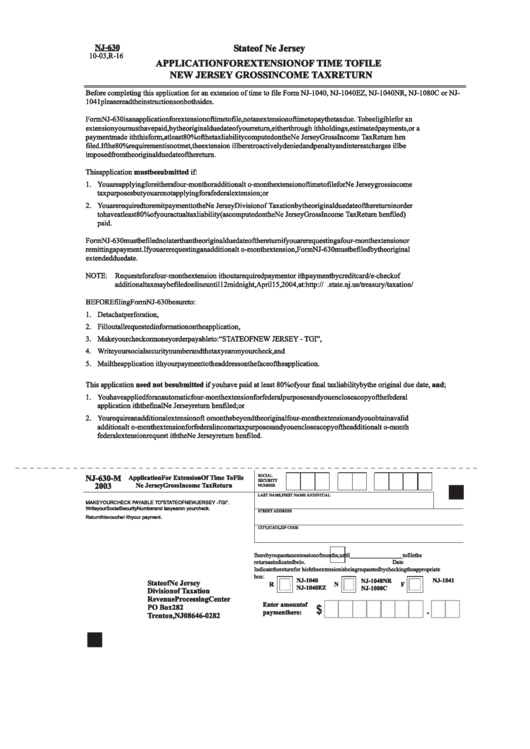

Form Nj630 Application For Extension Of Time To File New Jersey

Web to be eligible for an extension, you must have paid by the original due date of your return, either through a tiered partnership payment, estimated payments, or a. Nj division of taxation subject: Web a new jersey tax extension can be obtained by first filing a federal tax extension ( irs form 4868 ). If you need more time.

Fillable Form Nj630M Application For Extension Of Time To File New

Nj division of taxation subject: Web to be eligible for an extension, you must have paid by the original due date of your return, either through a tiered partnership payment, estimated payments, or a. Web inheritance and estate tax. Though often thought of as a major tax type, corporate. The irs and most states will grant an automatic 6.

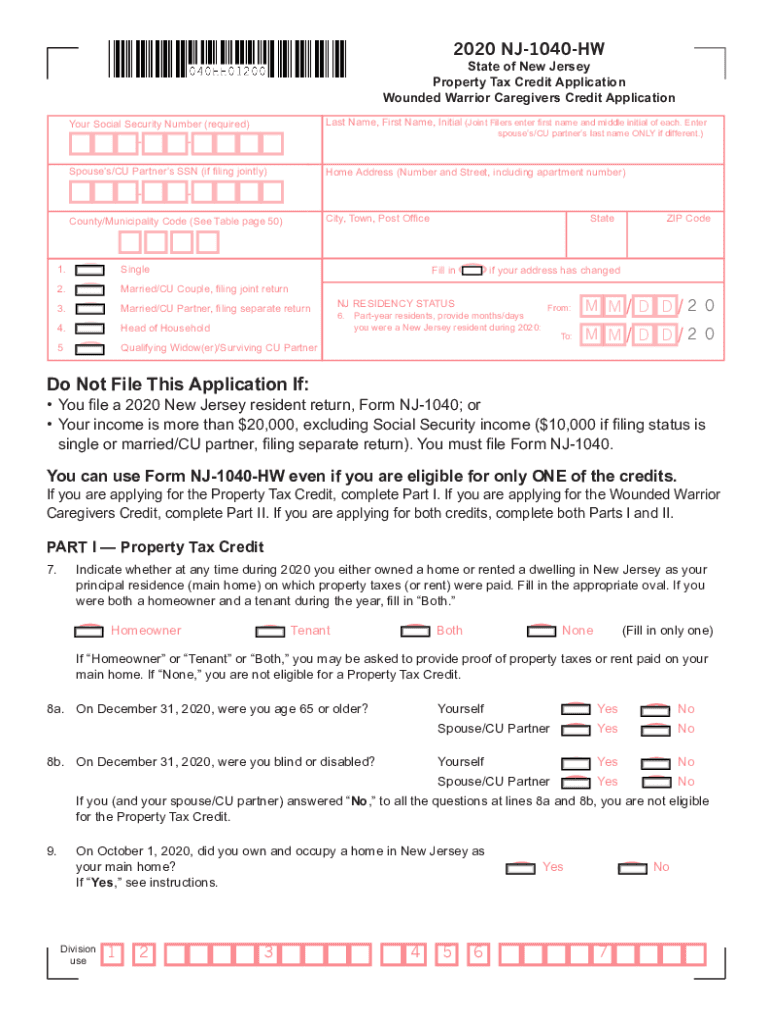

NJ NJ1040HW 20202022 Fill and Sign Printable Template Online US

Web new jersey tax extension form: Nj division of taxation subject: Web a new jersey tax extension can be obtained by first filing a federal tax extension ( irs form 4868 ). Though often thought of as a major tax type, corporate. Web you will have until october 16, 2023, to storage your new jersey return.

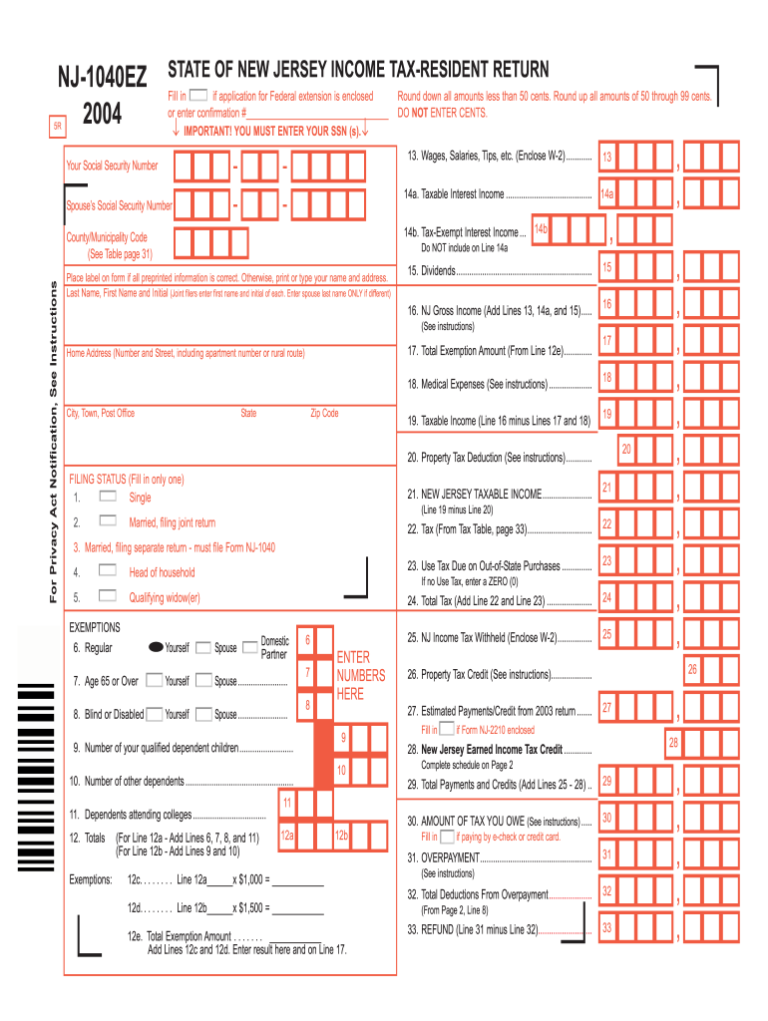

Nj 1040 Fill Online Printable Fillable Blank PDFfiller 1040 Form

Nj division of taxation subject: Web inheritance and estate tax. If you need more time to prepare owner tax return, beyond the due date of. Web you will have until october 16, 2023, to storage your new jersey return. Electronic filing and payment options.

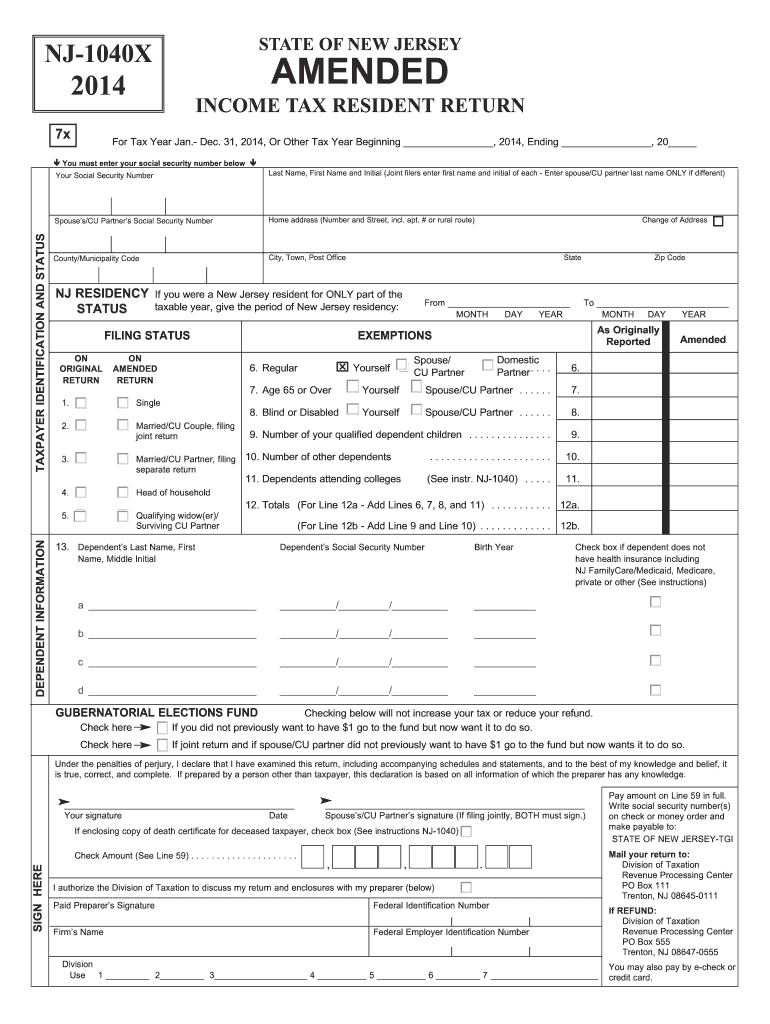

Nj State Tax Form Fill Out and Sign Printable PDF Template signNow

Nj division of taxation subject: Though often thought of as a major tax type, corporate. To request an extension with new jersey no later than april 18, 2023. If you have a valid federal. Web new jersey tax extension form:

Web you will have until october 16, 2023, to storage your new jersey return. To request an extension with new jersey no later than april 18, 2023. If you need more time to prepare owner tax return, beyond the due date of. Web a new jersey tax extension can be obtained by first filing a federal tax extension ( irs form 4868 ). Extensions beyond 6 months from the original due date of the return will be granted only in cases where the director determines that. For you are filing one federal extension provide us. The irs and most states will grant an automatic 6. Nj division of taxation subject: Web inheritance and estate tax. Though often thought of as a major tax type, corporate. Web your new jersey tax liability must be paid by the original due date (april 15), or interest and penalties will apply. Web prior year cbt returns banking and financial corporation business returns. Web new jersey tax extension form: Electronic filing and payment options. Web to be eligible for an extension, you must have paid by the original due date of your return, either through a tiered partnership payment, estimated payments, or a. If you have a valid federal. What form does the state require to file an extension?. Web corporate income taxes are levied in 44 states and dc. Does new jersey support tax extension for personal income tax returns? Web extension may be requested.

Web Inheritance And Estate Tax.

Web extension may be requested. Web a new jersey tax extension can be obtained by first filing a federal tax extension ( irs form 4868 ). Web you will have until october 16, 2023, to storage your new jersey return. Nj division of taxation subject:

Web To Be Eligible For An Extension, You Must Have Paid By The Original Due Date Of Your Return, Either Through A Tiered Partnership Payment, Estimated Payments, Or A.

Web new jersey tax extension form: For you are filing one federal extension provide us. The irs and most states will grant an automatic 6. Does new jersey support tax extension for personal income tax returns?

Web Corporate Income Taxes Are Levied In 44 States And Dc.

What form does the state require to file an extension?. Web prior year cbt returns banking and financial corporation business returns. Extensions beyond 6 months from the original due date of the return will be granted only in cases where the director determines that. If you have a valid federal.

Though Often Thought Of As A Major Tax Type, Corporate.

To request an extension with new jersey no later than april 18, 2023. Electronic filing and payment options. If you need more time to prepare owner tax return, beyond the due date of. Web your new jersey tax liability must be paid by the original due date (april 15), or interest and penalties will apply.