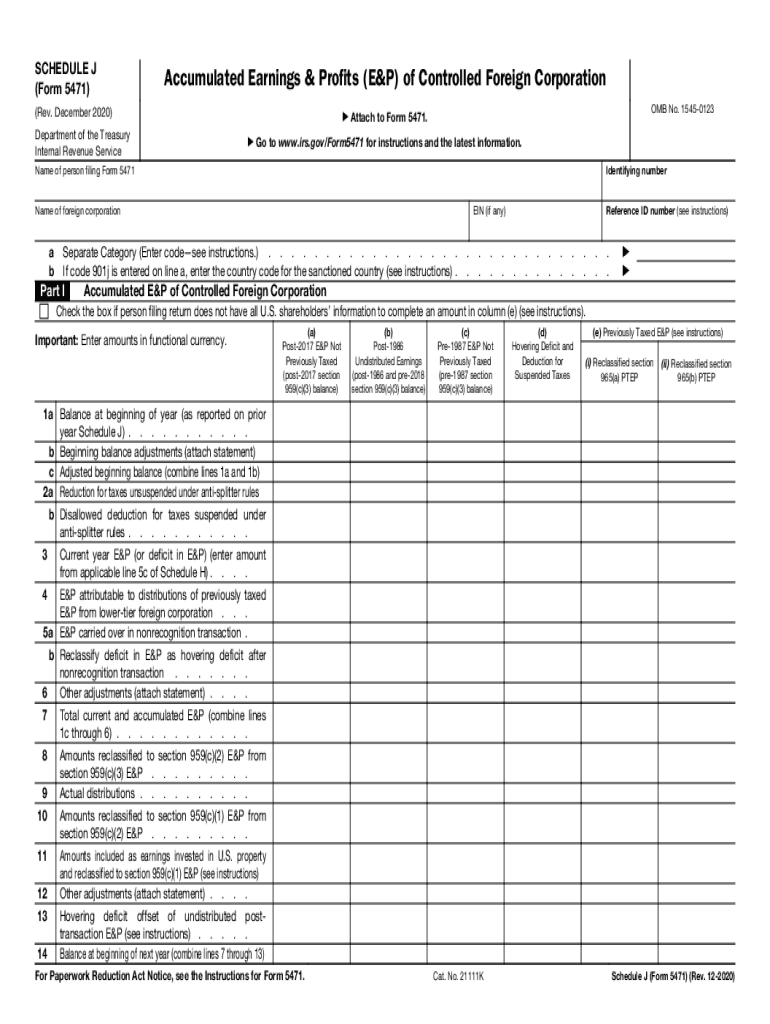

Form 5471 Schedule O - Web we last updated the organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. Web the form 5471 schedules are: Web download the official pdf document of schedule o (form 5471), a tax form for reporting the organization,. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e,. On page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section. Web form 5471, schedule o, organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. With respect to line a at the top of page 1 of schedule e, there is a new code “total”. Web changes to form 5471. Information return for foreign corporation 2023. Web changes to separate schedule e (form 5471).

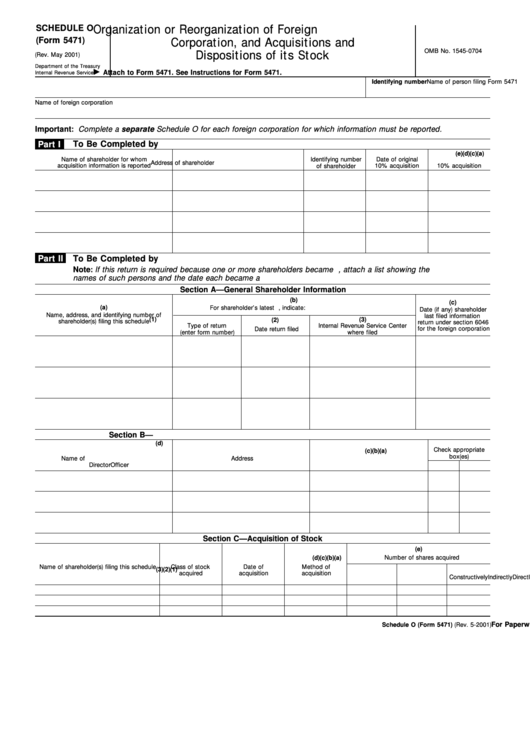

Fillable Form 5471 (Schedule O), (Rev. May 2001) Organization Or

One of the most complex forms you'll have to fill out is form 5471. Web instructions for form 5471(rev. Web changes to separate schedule e (form 5471). Web filers who fall in the second or third category will have to file form 5471 schedule o. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e,.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

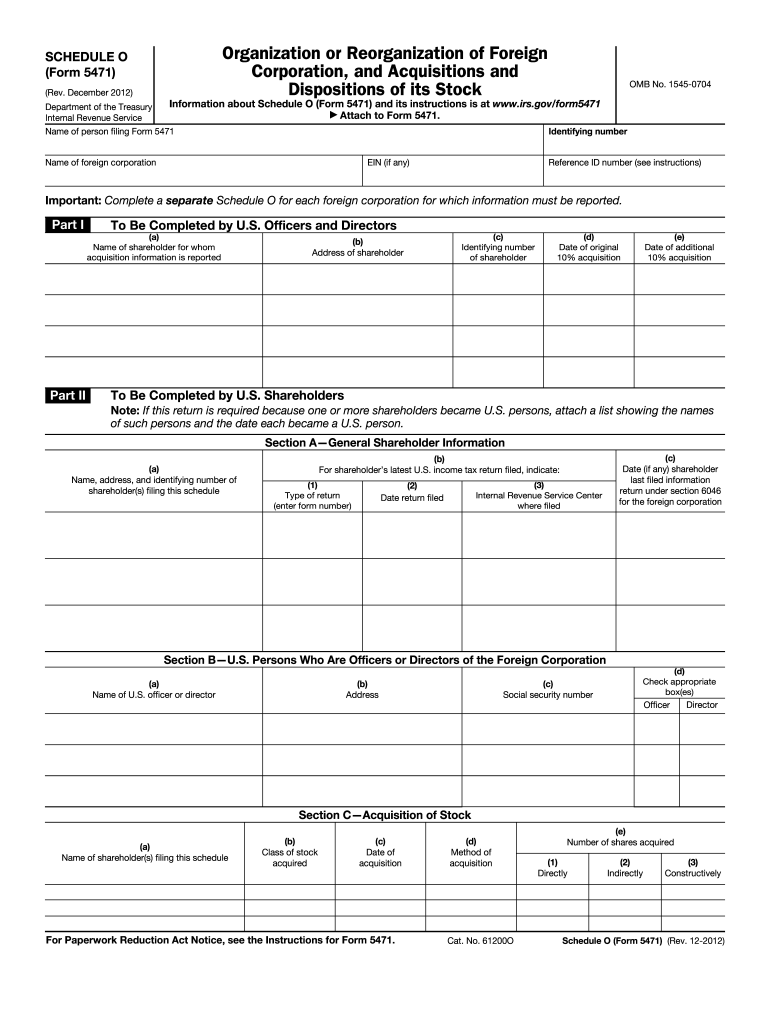

Web form 5471, schedule o, organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. Web schedule o organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock (form 5471). No changes have been made to schedule m (form 5471). Web schedule o is used to report the organization or reorganization of a foreign.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Web we last updated the organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. Information return for foreign corporation 2023. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e,. Web the purpose of form 5471 is to provide the irs with detailed information about these foreign corporations and their. Web.

Form 5471 (Schedule O) Foreign Corporation, and Acquisitions and

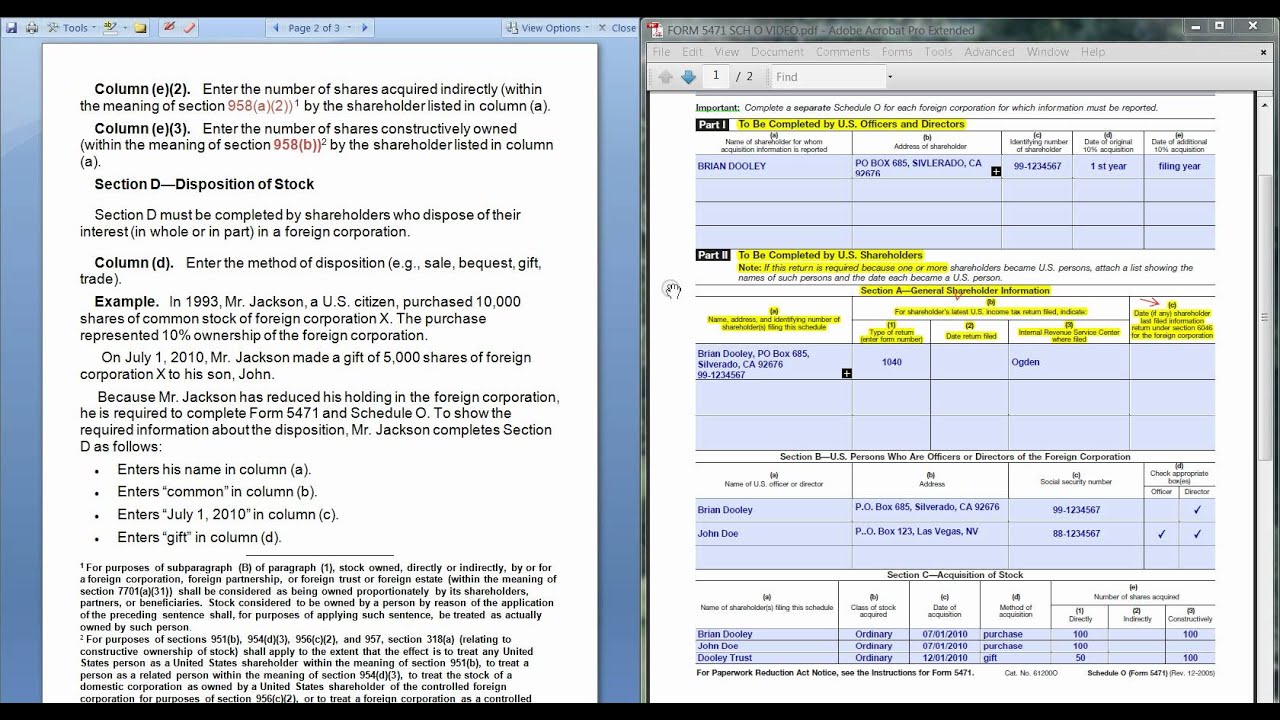

Web form 5471 (schedule o) a form that one files with the irs along with form 5471 to report the organization or reorganization of a. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Web the form 5471 schedules are: Schedule o is required when a.

IRS Issues Updated New Form 5471 What's New?

Web changes to separate schedule e (form 5471). Web instructions for form 5471(rev. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Web filers who fall in the second or third category will have to file form 5471 schedule o. Web changes to form 5471.

Form 5471 (Schedule O) Foreign Corporation, and Acquisitions and

January 2021) (use with the december 2020 revision of form 5471 and separate schedules e,. Web category 3 filers who are shareholders, officers, and directors of an fsc (as defined in section 922, as in effect before its repeal) must file form 5471 and a. Web form 5471, schedule o, organization or reorganization of foreign corporation, and acquisitions and dispositions.

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or. Web learn how to complete schedule o of form 5471, a tax form for reporting the organization or reorganization of a foreign. Web the form 5471 schedules are: Web category 3 filers who are shareholders, officers, and directors of an fsc (as.

INVESTING IN A FOREIGN CORPORATION TAX PLAN SCHEDULE O FORM 5471 YouTube

With respect to line a at the top of page 1 of schedule e, there is a new code “total”. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Web we last updated the organization or reorganization of foreign corporation, and acquisitions and dispositions of its.

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

No changes have been made to schedule m (form 5471). Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Web category 3 filers who are shareholders, officers, and directors of an fsc (as defined in section 922, as in effect before its repeal) must file form.

Form 5471 Fill Out and Sign Printable PDF Template signNow

Web filers who fall in the second or third category will have to file form 5471 schedule o. Web form 5471 (schedule o) a form that one files with the irs along with form 5471 to report the organization or reorganization of a. Web changes to separate schedule e (form 5471). Web form 5471, schedule o, organization or reorganization of.

No changes have been made to schedule m (form 5471). Web schedule o organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock (form 5471). Web filers who fall in the second or third category will have to file form 5471 schedule o. Web download the official pdf document of schedule o (form 5471), a tax form for reporting the organization,. Schedule o is required when a cfc is initially formed or. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Web changes to separate schedule m (form 5471). Web we last updated the organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. Information return for foreign corporation 2023. Web instructions for form 5471(rev. On page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e,. Web category 3 filers who are shareholders, officers, and directors of an fsc (as defined in section 922, as in effect before its repeal) must file form 5471 and a. Web the form 5471 schedules are: Web changes to form 5471. One of the most complex forms you'll have to fill out is form 5471. Web form 5471, schedule o, organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. Web form 5471 (schedule o) a form that one files with the irs along with form 5471 to report the organization or reorganization of a. Web the purpose of form 5471 is to provide the irs with detailed information about these foreign corporations and their. With respect to line a at the top of page 1 of schedule e, there is a new code “total”.

Web Instructions For Form 5471(Rev.

Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. One of the most complex forms you'll have to fill out is form 5471. Web name of shareholder(s) filing this schedule (1) (2) (3) directly indirectly constructively for paperwork reduction act notice, see.

Web Filers Who Fall In The Second Or Third Category Will Have To File Form 5471 Schedule O.

Information return for foreign corporation 2023. Web we last updated the organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. Web schedule o is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Web changes to separate schedule m (form 5471).

With Respect To Line A At The Top Of Page 1 Of Schedule E, There Is A New Code “Total”.

January 2021) (use with the december 2020 revision of form 5471 and separate schedules e,. Web category 3 filers who are shareholders, officers, and directors of an fsc (as defined in section 922, as in effect before its repeal) must file form 5471 and a. Web schedule o organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock (form 5471). Web changes to form 5471.

Web The Purpose Of Form 5471 Is To Provide The Irs With Detailed Information About These Foreign Corporations And Their.

Schedule o is required when a cfc is initially formed or. Web form 5471 (schedule o) a form that one files with the irs along with form 5471 to report the organization or reorganization of a. Web form 5471, schedule o, organization or reorganization of foreign corporation, and acquisitions and dispositions of its stock. No changes have been made to schedule m (form 5471).