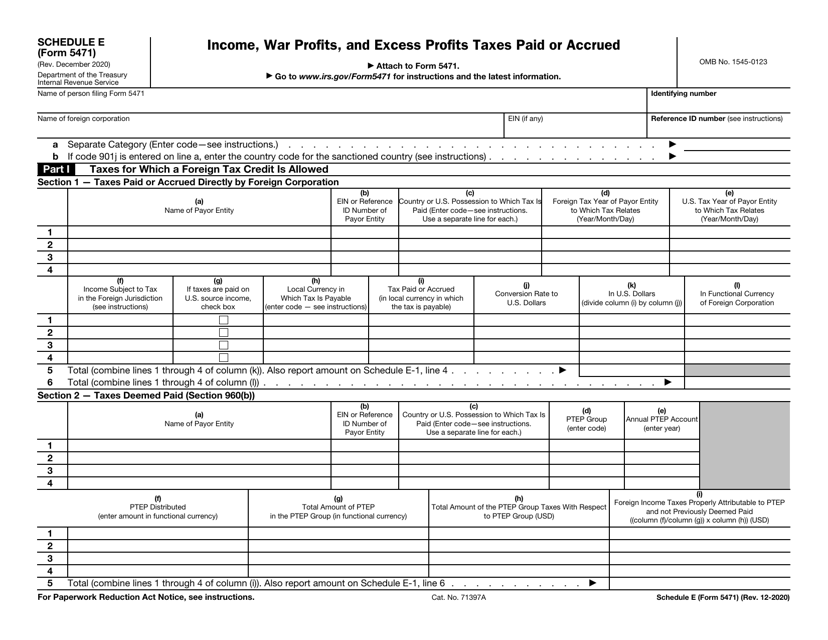

Form 5471 Schedule G-1 - Persons with respect to certain foreign corporations, is designed to report the. Web form 5471, five questions on schedule g pertaining to cost sharing arrangements have been moved to new separate schedule g. Complete a separate form 5471 and all applicable schedules for each. Taxes paid, accrued, or deemed paid on accumulated earnings. Web schedule e (form 5471) (rev. Web form 5471 (information return of u.s. Web form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued 1221 12/28/2021 form 5471 (schedule g. Schedule g contains numerous yes/no questions for additional. Web schedule g is designed to disclose a broad range of transactions of a controlled foreign corporation (“cfc”). December 2022) department of the treasury internal revenue service.

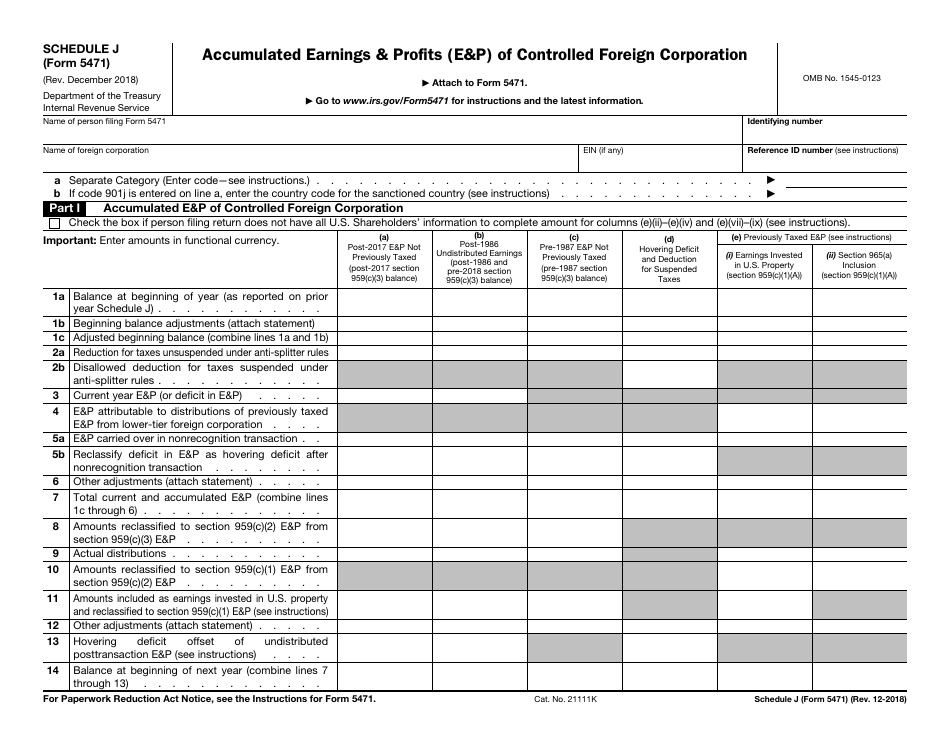

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Taxes paid, accrued, or deemed paid on accumulated earnings. Web schedule g is designed to disclose a broad range of transactions of a controlled foreign corporation (“cfc”). December 2022) department of the treasury internal revenue service. Web schedule e (form 5471) (rev. This is the ninth of a series of articles designed to.

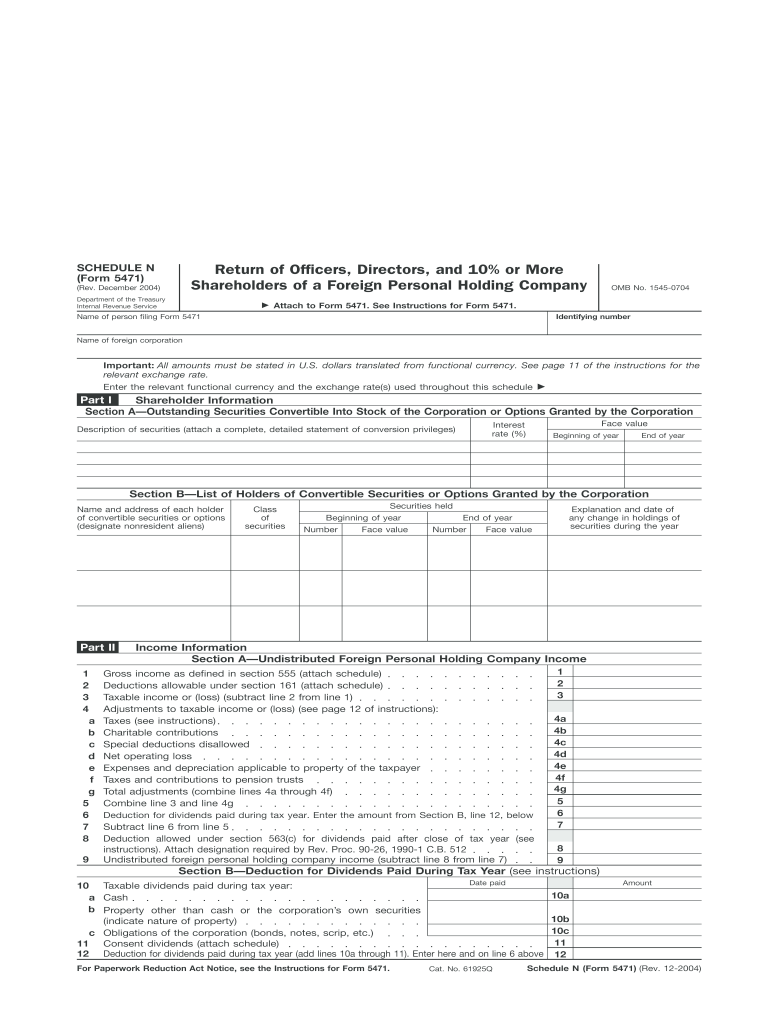

5471 Schedule N Fill Out and Sign Printable PDF Template signNow

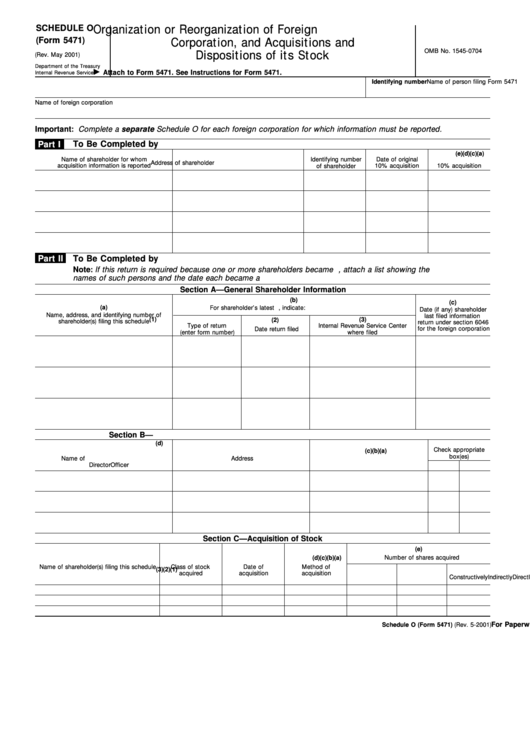

Web schedule e (form 5471) (rev. Web name of person filing form 5471. Web form 5471 (information return of u.s. Taxes paid, accrued, or deemed paid on accumulated earnings. Web requested on schedules j, m, and o.

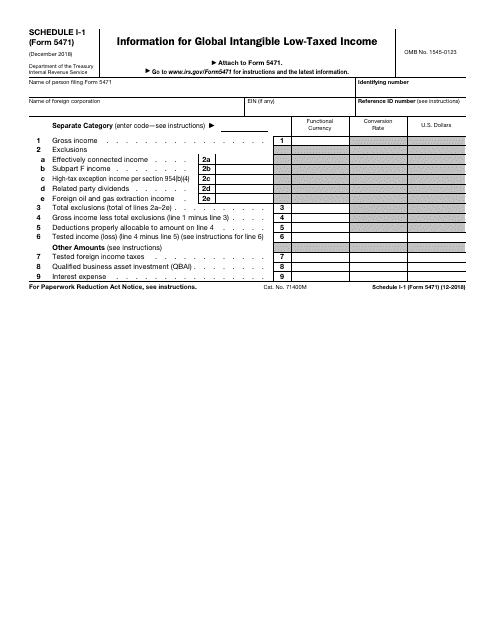

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Taxes paid, accrued, or deemed paid on accumulated earnings. This is the ninth of a series of articles designed to. Persons with respect to certain foreign corporations) is a required disclosure for. Web name of person filing form 5471. Schedule g contains numerous yes/no questions for additional.

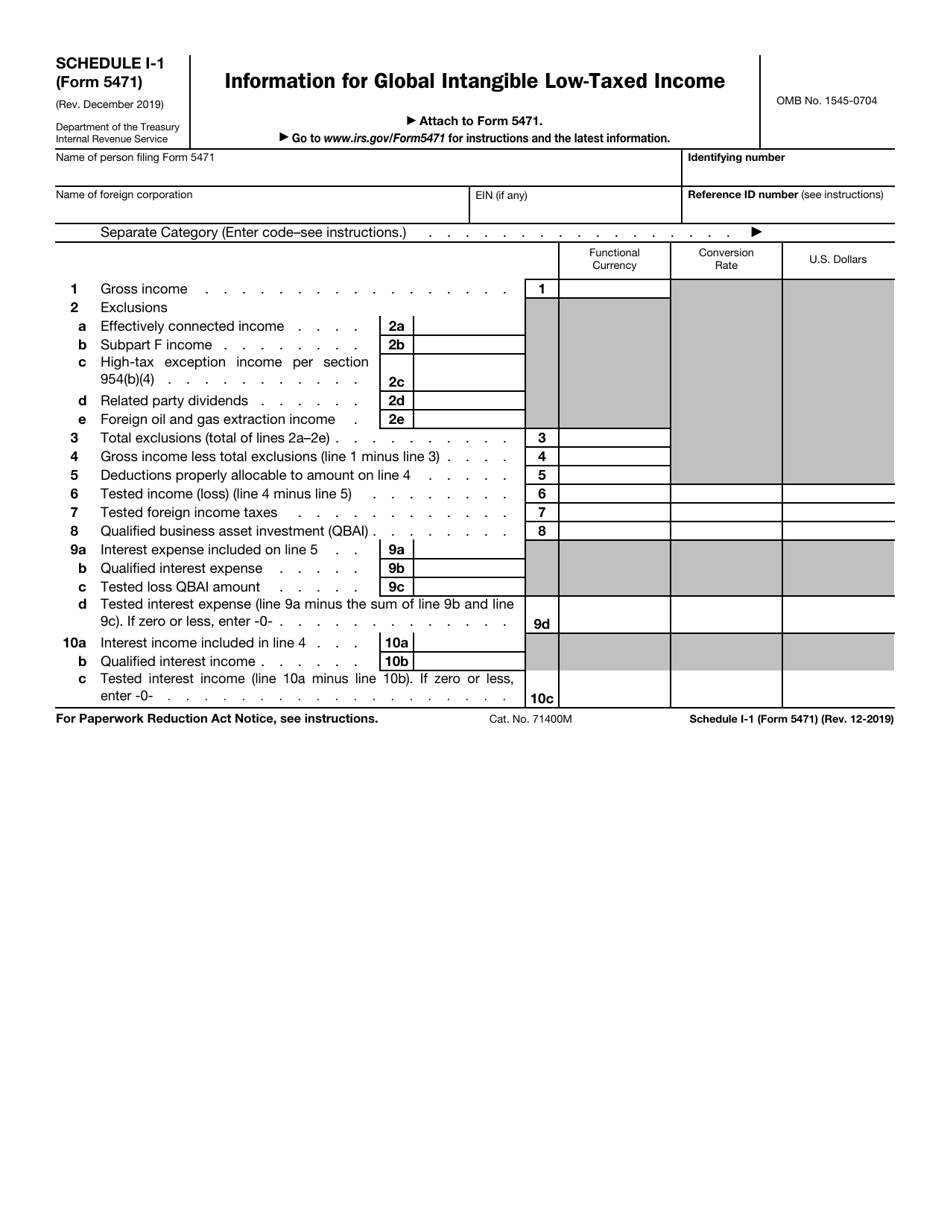

IRS Form 5471 Schedule I1 Download Fillable PDF or Fill Online

December 2022) department of the treasury internal revenue service. Web follow these steps to generate and complete form 5471 in the program: Web form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued 1221 12/28/2021 form 5471 (schedule g. Web form 5471, five questions on schedule g pertaining to cost sharing arrangements have been moved to.

5471 Worksheet A

Web form 5471 (information return of u.s. Schedule g contains numerous yes/no questions for additional. Schedule g has been expanded to include questions 6, 7, and 8, addressing. Web form 5471, information return of u.s. Web requested on schedules j, m, and o.

IRS Form 5471 Schedule I1 Download Fillable PDF or Fill Online

Persons with respect to certain foreign corporations) is a required disclosure for. Web persons with respect to certain foreign corporations; Edit your california schedule g 1 online type text, add images, blackout confidential details, add comments, highlights and. This is the ninth of a series of articles designed to. Ein (if any) reference id number (see.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web persons with respect to certain foreign corporations; Web form 5471, information return of u.s. Web name of person filing form 5471. Web schedule e (form 5471) (rev. Complete a separate form 5471 and all applicable schedules for each.

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

This is the ninth of a series of articles designed to. Taxes paid, accrued, or deemed paid on accumulated earnings. Web form 5471, five questions on schedule g pertaining to cost sharing arrangements have been moved to new separate schedule g. Persons with respect to certain foreign corporations, is designed to report the. Persons with respect to certain foreign corporations).

Irs Annual Lease Value Table

Web persons with respect to certain foreign corporations; This is the ninth of a series of articles designed to. Web form 5471 (information return of u.s. Edit your california schedule g 1 online type text, add images, blackout confidential details, add comments, highlights and. Web form 5471, five questions on schedule g pertaining to cost sharing arrangements have been moved.

Fillable Form 5471 (Schedule O), (Rev. May 2001) Organization Or

Web form 5471, information return of u.s. Web follow these steps to generate and complete form 5471 in the program: December 2022) department of the treasury internal revenue service. Persons with respect to certain foreign corporations, is designed to report the. Web schedule g is designed to disclose a broad range of transactions of a controlled foreign corporation (“cfc”).

Ein (if any) reference id number (see. Complete a separate form 5471 and all applicable schedules for each. Web form 5471 (information return of u.s. Persons with respect to certain foreign corporations, is designed to report the. Web form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued 1221 12/28/2021 form 5471 (schedule g. This is the ninth of a series of articles designed to. Web form 5471, information return of u.s. Web persons with respect to certain foreign corporations; Web requested on schedules j, m, and o. Web follow these steps to generate and complete form 5471 in the program: Web name of person filing form 5471. Persons with respect to certain foreign corporations) is a required disclosure for. The following are irs business rules for electronically filing form 5471:. Web form 5471, five questions on schedule g pertaining to cost sharing arrangements have been moved to new separate schedule g. Schedule g contains numerous yes/no questions for additional. Web schedule e (form 5471) (rev. Taxes paid, accrued, or deemed paid on accumulated earnings. Web schedule g is designed to disclose a broad range of transactions of a controlled foreign corporation (“cfc”). Schedule g has been expanded to include questions 6, 7, and 8, addressing. December 2022) department of the treasury internal revenue service.

December 2022) Department Of The Treasury Internal Revenue Service.

Web requested on schedules j, m, and o. Web form 5471 (information return of u.s. Web form 5471, five questions on schedule g pertaining to cost sharing arrangements have been moved to new separate schedule g. Web follow these steps to generate and complete form 5471 in the program:

Web Schedule E (Form 5471) (Rev.

The following are irs business rules for electronically filing form 5471:. Ein (if any) reference id number (see. Schedule g contains numerous yes/no questions for additional. Web persons with respect to certain foreign corporations;

Persons With Respect To Certain Foreign Corporations, Is Designed To Report The.

Persons with respect to certain foreign corporations) is a required disclosure for. Complete a separate form 5471 and all applicable schedules for each. Edit your california schedule g 1 online type text, add images, blackout confidential details, add comments, highlights and. Web schedule g is designed to disclose a broad range of transactions of a controlled foreign corporation (“cfc”).

Web Name Of Person Filing Form 5471.

Web form 5471, information return of u.s. Web form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued 1221 12/28/2021 form 5471 (schedule g. Taxes paid, accrued, or deemed paid on accumulated earnings. This is the ninth of a series of articles designed to.