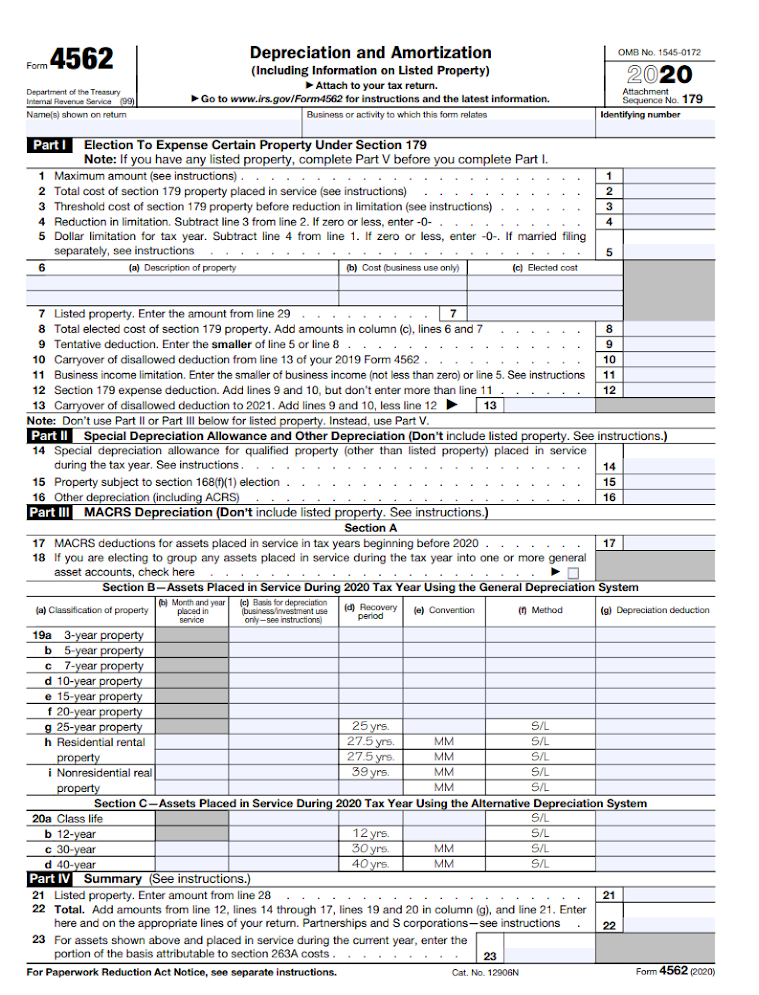

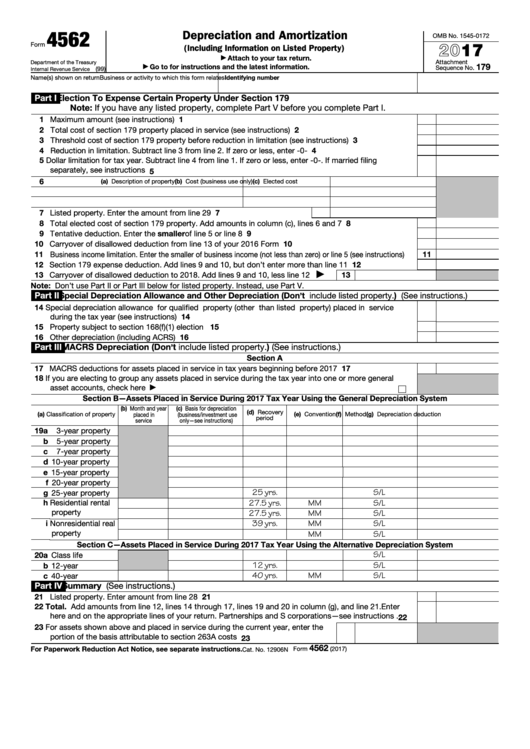

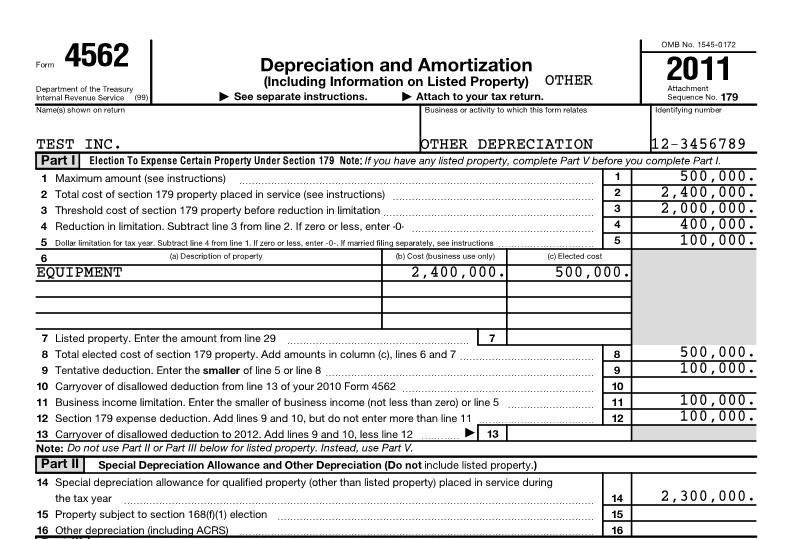

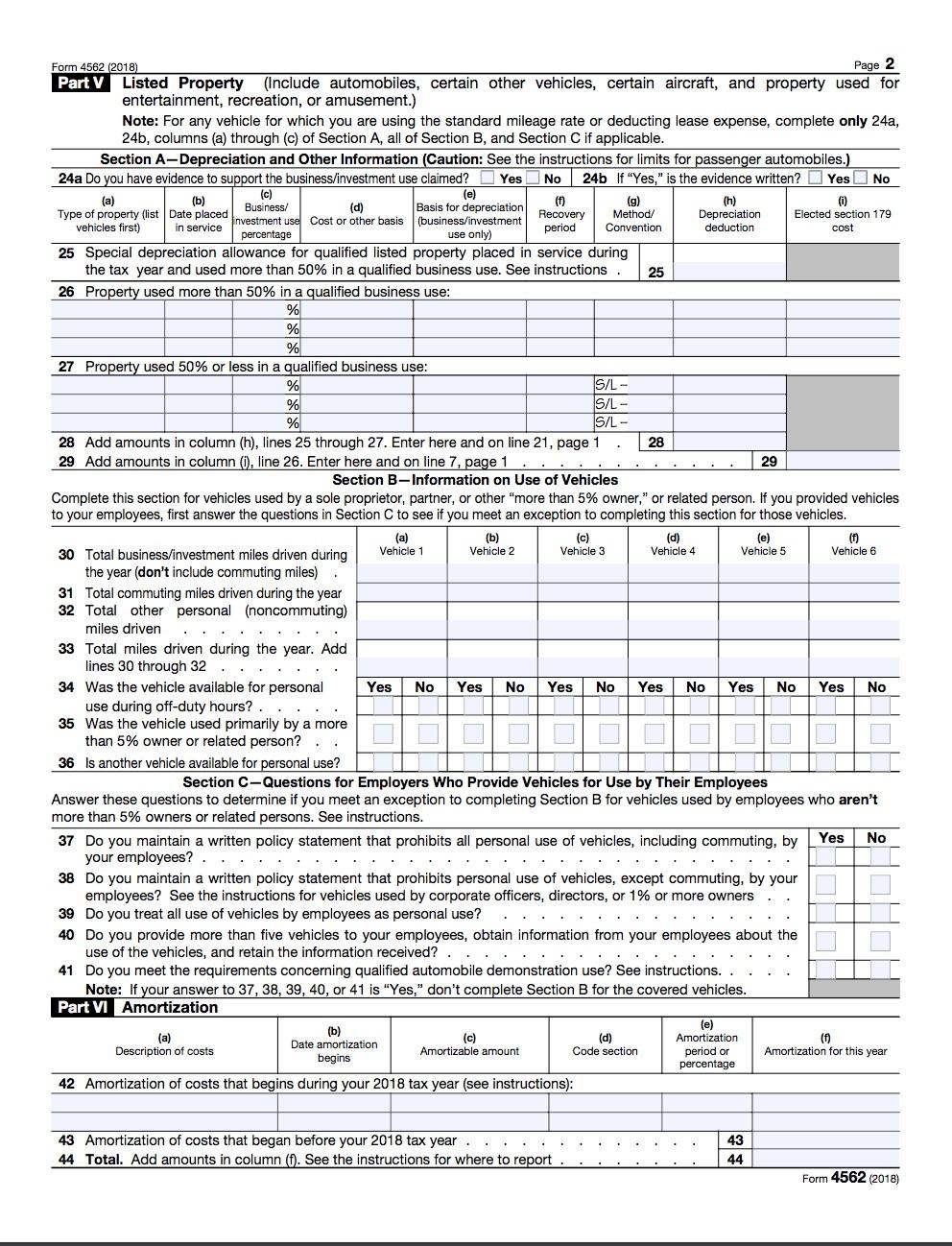

Form 4562 Line 11 - Web line 11 the total cost you can deduct is limited to your taxable income from the active conduct of a trade or business. Web line 11, form 4562 not counting rental income from line 3, schedule e i have a single rental property. Web if you filed form 4562 for 2021, enter the amount from line 13 of your 2021 form 4562. Web irs form 4562 is used to claim depreciation and amortization deductions. Web how does ultratax cs use the form 4562, line 11 business income limitation to determine the section 179 deduction. • claim your deduction for depreciation and amortization, • make the election under. Web how is the amount of business income calculated for line 11 of form 4562 used to determine the amount of section 179. Line 11 the total cost you can deduct is limited to your. Web line 11 of form 4562 is calculated by totaling the net income and losses from all trades and businesses you actively. Carry over any excess to 1995.

The New York Times > Business > Image > Form 4562

Web therefore, the amount on line 11 of the summary form 4562 will include all of the above income. Web line 11, form 4562 not counting rental income from line 3, schedule e i have a single rental property. Web irs form 4562 is used to claim deductions for depreciation and amortization. Per the irs instructions for. It’s also used.

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Web 10 carryover of disallowed deduction from line 13 of your 2010 form 4562. Error line 12 in 1120s and 1065. It’s also used to expense. Web purpose of form use form 4562 to: Web irs instructions for form 4562, line 11.

IRS Form 4562 Explained A StepbyStep Guide The Blueprint

Web how is the amount of business income calculated for line 11 of form 4562 used to determine the amount of section 179. The program will limit the section 179 on form 4562, line 11. Carry over any excess to 1995. Web if you filed form 4562 for 2021, enter the amount from line 13 of your 2021 form 4562..

IRS 4562 Instructions 2011 Fill out Tax Template Online US Legal Forms

10 11 business income limitation. Web irs form 4562 is used to claim depreciation and amortization deductions. Web irs form 4562 is used to claim deductions for depreciation and amortization. Web purpose of form use form 4562 to: Web therefore, the amount on line 11 of the summary form 4562 will include all of the above income.

Learn How to Fill the Form 4562 Depreciation and Amortization YouTube

Line 10 the carryover of disallowed deduction from 1993 is the amount of section 179. The program will limit the section 179 on form 4562, line 11. Web line 11 the total cost you can deduct is limited to your taxable income from the active conduct of a trade or business. Web how is the amount of business income calculated.

Fillable Form 4562 Depreciation And Amortization 2017 printable pdf

Web how is the amount of business income calculated for line 11 of form 4562 used to determine the amount of section 179. Web therefore, the amount on line 11 of the summary form 4562 will include all of the above income. Web how does ultratax cs use the form 4562, line 11 business income limitation to determine the section.

アーカイブ 20120626 USCPA勉強の足跡

Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible. It’s also used to expense. Web line 11 of form 4562 is calculated by totaling the net income and losses from all trades and businesses you actively. Error line 12 in 1120s and 1065. Web irs instructions for form 4562, line 11.

1040 US Form 4562, Line 11 business limitation PAL Section

Web irs form 4562 is used to claim depreciation and amortization deductions. Web 10 carryover of disallowed deduction from line 13 of your 2010 form 4562. Web line 11 of form 4562 is calculated by totaling the net income and losses from all trades and businesses you actively. The program will limit the section 179 on form 4562, line 11..

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Line 11 the total cost you can deduct is limited to your. Error line 12 in 1120s and 1065. Enter the smaller of business. Web irs form 4562 is used to claim depreciation and amortization deductions. Form 4562 is also used when.

Form 4562 Depreciation and Amortization Definition

Per the irs instructions for. Line 10 the carryover of disallowed deduction from 1993 is the amount of section 179. Web irs form 4562 is used to claim deductions for depreciation and amortization. Take note of the amounts on line 10 and line 11; Line 11 the total cost you can deduct is limited to your.

Web irs form 4562 is used to claim deductions for depreciation and amortization. Web purpose of form use form 4562 to: Web irs form 4562 is used to claim depreciation and amortization deductions. Web select sec 179 limit from the forms in the sidebar ; Carry over any excess to 1995. Web 10 carryover of disallowed deduction from line 13 of your 2010 form 4562. Take note of the amounts on line 10 and line 11; It’s also used to expense. Web how is the amount of business income calculated for form 4562, line 11 used to determine the amount of section 179. Web how does ultratax cs use the form 4562, line 11 business income limitation to determine the section 179 deduction. Per the irs instructions for. Web 10 carryover of disallowed deduction from line 13 of your 2021 form 4562. Web therefore, the amount on line 11 of the summary form 4562 will include all of the above income. Error line 12 in 1120s and 1065. • claim your deduction for depreciation and amortization, • make the election under. Web line 11, form 4562 not counting rental income from line 3, schedule e i have a single rental property. Form 4562 is also used when. Enter the smaller of business. Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible. Web irs instructions for form 4562, line 11.

Line 11 The Total Cost You Can Deduct Is Limited To Your.

Web 10 carryover of disallowed deduction from line 13 of your 2010 form 4562. Carry over any excess to 1995. Web line 11 the total cost you can deduct is limited to your taxable income from the active conduct of a trade or business. Web line 11, form 4562 not counting rental income from line 3, schedule e i have a single rental property.

Enter The Smaller Of Business.

Web if you filed form 4562 for 2021, enter the amount from line 13 of your 2021 form 4562. Web intuit help intuit how do i fix the error on form 4562 section 179 summary: Web 10 carryover of disallowed deduction from line 13 of your 2021 form 4562. Web how does ultratax cs use the form 4562, line 11 business income limitation to determine the section 179 deduction.

Web How Is The Amount Of Business Income Calculated For Line 11 Of Form 4562 Used To Determine The Amount Of Section 179.

The program will limit the section 179 on form 4562, line 11. • claim your deduction for depreciation and amortization, • make the election under. Form 4562 is also used when. Web purpose of form use form 4562 to:

Line 10 The Carryover Of Disallowed Deduction From 1993 Is The Amount Of Section 179.

Error line 12 in 1120s and 1065. Web irs instructions for form 4562, line 11. Web irs form 4562 is used to claim deductions for depreciation and amortization. Web irs form 4562 is used to claim depreciation and amortization deductions.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at9.35.53AM-18b6615f7bd449e6a035c8e074b14521.png)