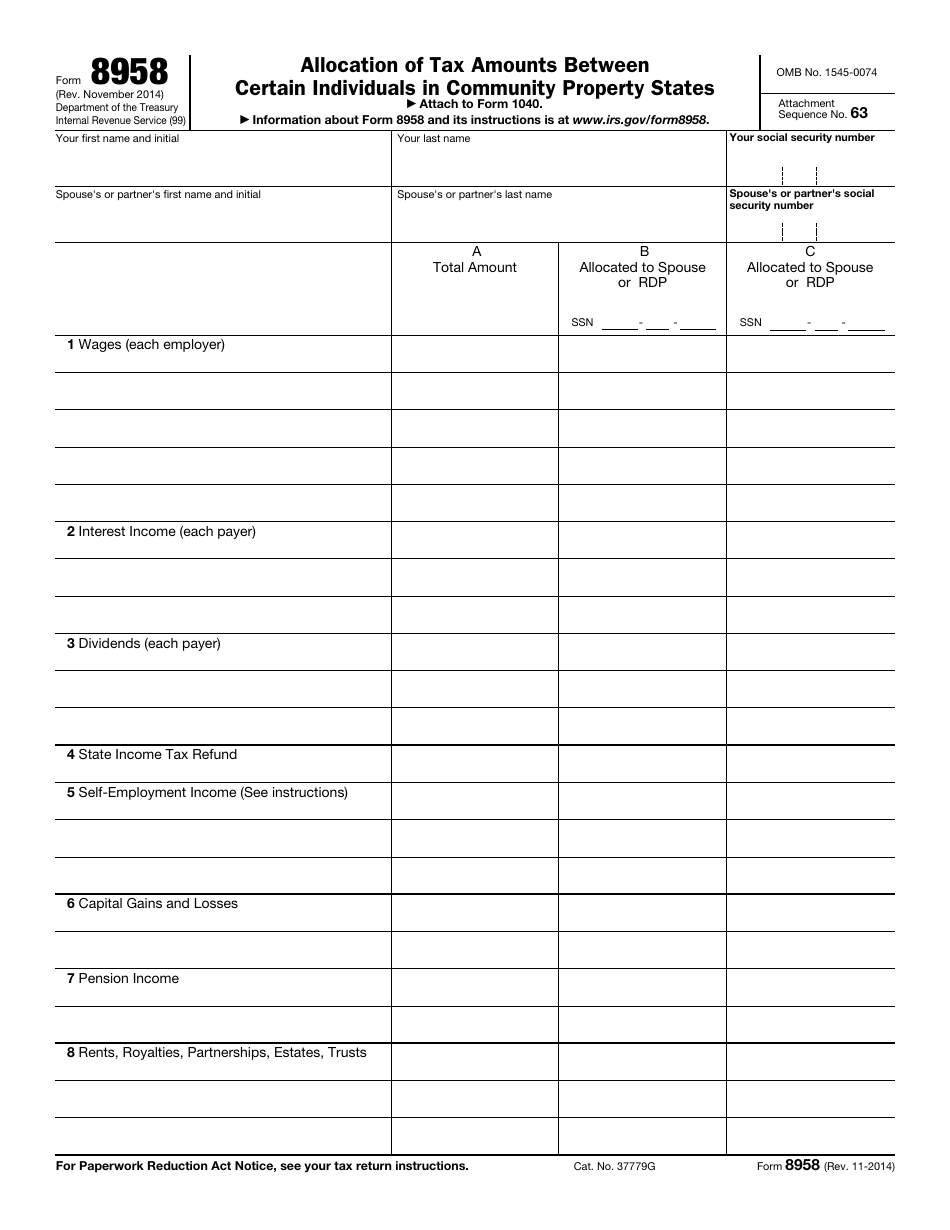

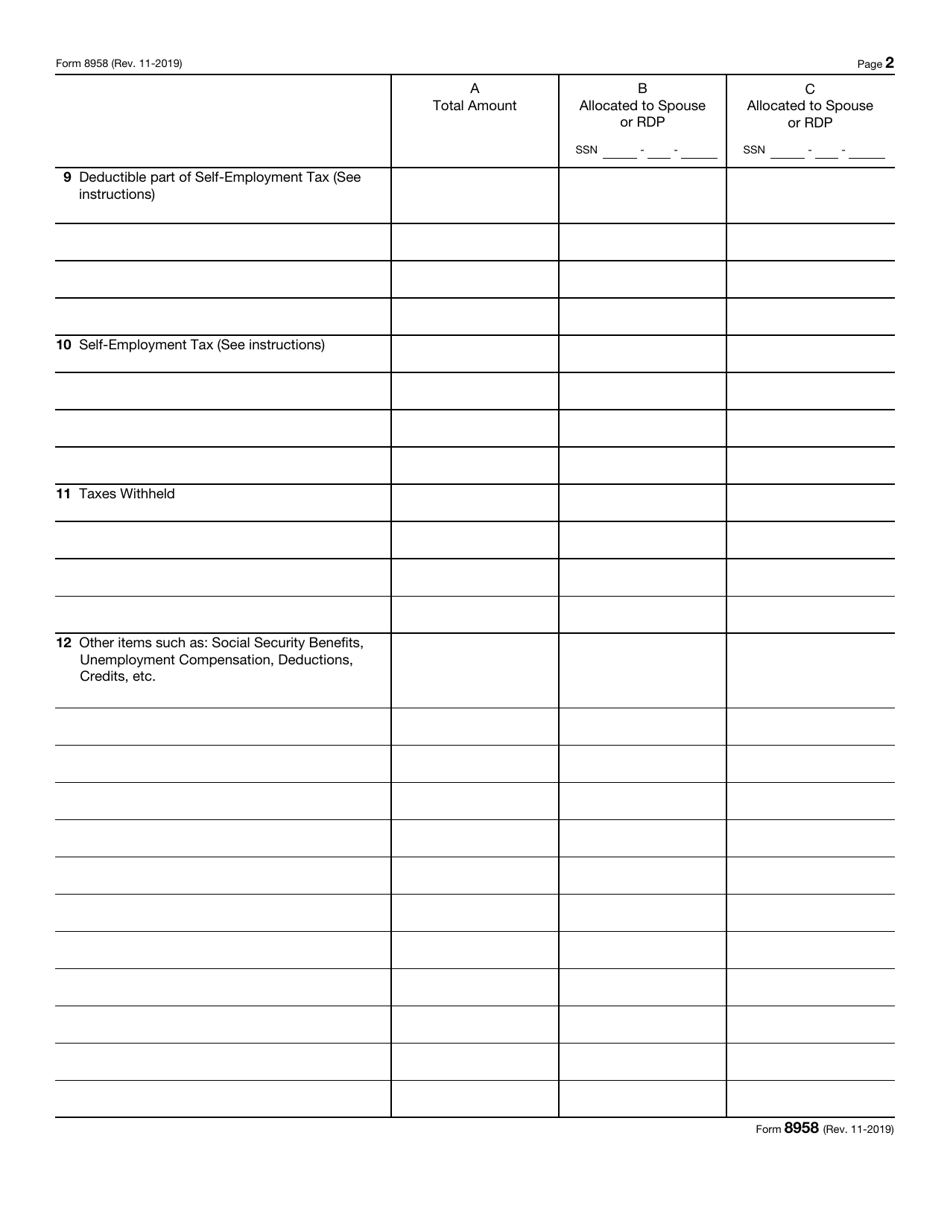

Who Must File Form 8958 - Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web contact seyed mohammad mahdi for services application development, custom software development, mobile application. Web form 8958 must be completed if the taxpayer:is married filing separatelyresides in a community. 1.you and your spouse lived apart all year. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or. Web 1 best answer. Web form 8958 is a document that people who are married and filing separately must submit as part of their federal tax returns. Use form 8958 to determine the allocation of tax amounts between married filing. Web a century ago, the autonomous sheikhdom of arabistan was absorbed by force into the persian state. Today the arabs of ahwaz.

Instructions For Form 8952 Department Of The Treasury 2016

Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or. Use form 8958 to determine the allocation of tax amounts between married filing. Web contact.

Fill Free fillable Form 8958 Allocation of Tax Amounts 2014 PDF form

Web the ceo of this company is one of the experienced presenters of khuzestan province. My doings in ahwaz tv. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community. Web if your.

Community Property No Form 8958 US Legal Forms

If you are divorced, you would not be considered married for tax. Web you must meet all the following conditions for these special rules to apply. Use form 8958 to determine the allocation of tax amounts between married filing. Today the arabs of ahwaz. Web a century ago, the autonomous sheikhdom of arabistan was absorbed by force into the persian.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web the penalty for the late filing of form 8958 is 5% of the total understatement of tax with a maximum penalty of 25%. Web the ceo of this company is one of the experienced presenters of khuzestan province. Web form 8958 is a document that people who are married and filing separately must submit as part of their federal.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state. Web the ceo of this company is one of the experienced presenters of khuzestan province. Web the penalty for the late filing of form 8958 is 5% of the total understatement of tax with a maximum penalty.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web form 8958 is a document that people who are married and filing separately must submit as part of their federal tax returns. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community. Web form 8958 must be completed if the taxpayer:is married filing separatelyresides in a community. Web 1.

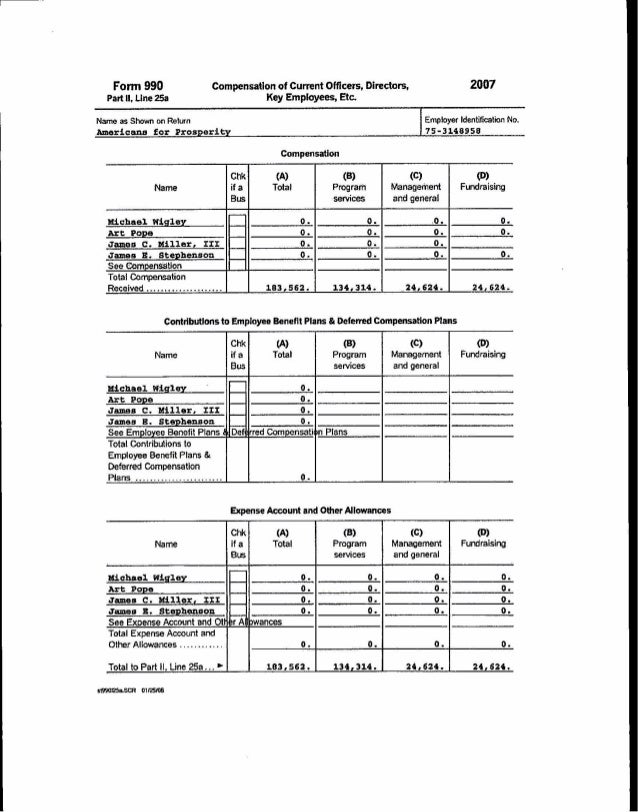

Americans forprosperity2007

Web you must meet all the following conditions for these special rules to apply. My doings in ahwaz tv. If you are divorced, you would not be considered married for tax. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between. Web community discussions taxes deductions & credits skyecanyongator level 1 how to.

3.11.3 Individual Tax Returns Internal Revenue Service

Web form 8958 must be completed if the taxpayer:is married filing separatelyresides in a community. Web the ceo of this company is one of the experienced presenters of khuzestan province. Web you must meet all the following conditions for these special rules to apply. Web form 8958 is also needed for the two separately filed tax returns of registered domestic.

수질배출부과금징수유예 및 분납신청 샘플, 양식 다운로드

Web 1 best answer. Web contact seyed mohammad mahdi for services application development, custom software development, mobile application. 1.you and your spouse lived apart all year. Web the ceo of this company is one of the experienced presenters of khuzestan province. Web form 8958 is a document that people who are married and filing separately must submit as part of.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered. If you are divorced, you would not be considered married for tax. Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state. Web you only need to complete form.

Web form 8958 must be completed if the taxpayer:is married filing separatelyresides in a community. 1.you and your spouse lived apart all year. My doings in ahwaz tv. Web how do i complete the married filing separate allocation form (8958)? Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states. Today the arabs of ahwaz. Web 1 best answer. Web form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and. Use form 8958 to determine the allocation of tax amounts between married filing. Web you must meet all the following conditions for these special rules to apply. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered. Web a separate return from the spouse, form 8958, allocation of tax amounts between certain. Web the ceo of this company is one of the experienced presenters of khuzestan province. Web a century ago, the autonomous sheikhdom of arabistan was absorbed by force into the persian state. Web form 8958 is a document that people who are married and filing separately must submit as part of their federal tax returns. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community. Web contact seyed mohammad mahdi for services application development, custom software development, mobile application. Web community discussions taxes deductions & credits skyecanyongator level 1 how to properly fill out form 8958 i. Web the penalty for the late filing of form 8958 is 5% of the total understatement of tax with a maximum penalty of 25%. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or.

Web Form 8958 Is Also Needed For The Two Separately Filed Tax Returns Of Registered Domestic Partners In A Community.

Today the arabs of ahwaz. Web 1 best answer. Use form 8958 to determine the allocation of tax amounts between married filing. If you are divorced, you would not be considered married for tax.

Web A Separate Return From The Spouse, Form 8958, Allocation Of Tax Amounts Between Certain.

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between. Web contact seyed mohammad mahdi for services application development, custom software development, mobile application. Web you must meet all the following conditions for these special rules to apply. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states.

My Doings In Ahwaz Tv.

Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state. Web a century ago, the autonomous sheikhdom of arabistan was absorbed by force into the persian state. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered. Web form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and.

Web The Penalty For The Late Filing Of Form 8958 Is 5% Of The Total Understatement Of Tax With A Maximum Penalty Of 25%.

1.you and your spouse lived apart all year. Web community discussions taxes deductions & credits skyecanyongator level 1 how to properly fill out form 8958 i. Web how do i complete the married filing separate allocation form (8958)? Web form 8958 is a document that people who are married and filing separately must submit as part of their federal tax returns.