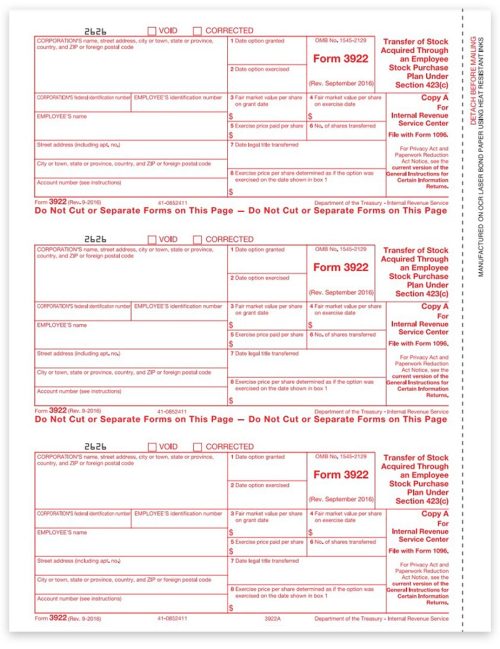

Where Does Form 3922 Go On 1040 - Form 3922 is the transfer of stock acquired through an employee stock purchase plan. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under. What do i do with form 3922? Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) form. Web irs form 3922 is used by the companies to report the transfer of stock acquired by the employee through the. Web form 3922 is for informational purposes only, for your employer to report to you information on your purchase(s) of espp.

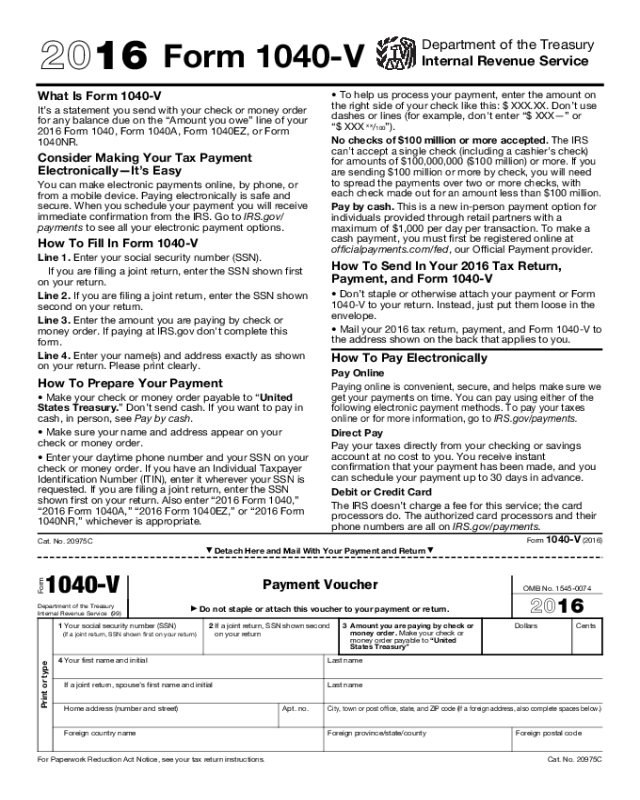

Form 1040v Edit, Fill, Sign Online Handypdf

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. This has changed from line 12b on the. Web what is irs form 3922? Web information about form.

IRS Form 3922 Software 289 eFile 3922 Software

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web what is irs form 3922? Web form 3922 is for informational purposes only, for your employer to report to you information on your purchase(s) of espp. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section.

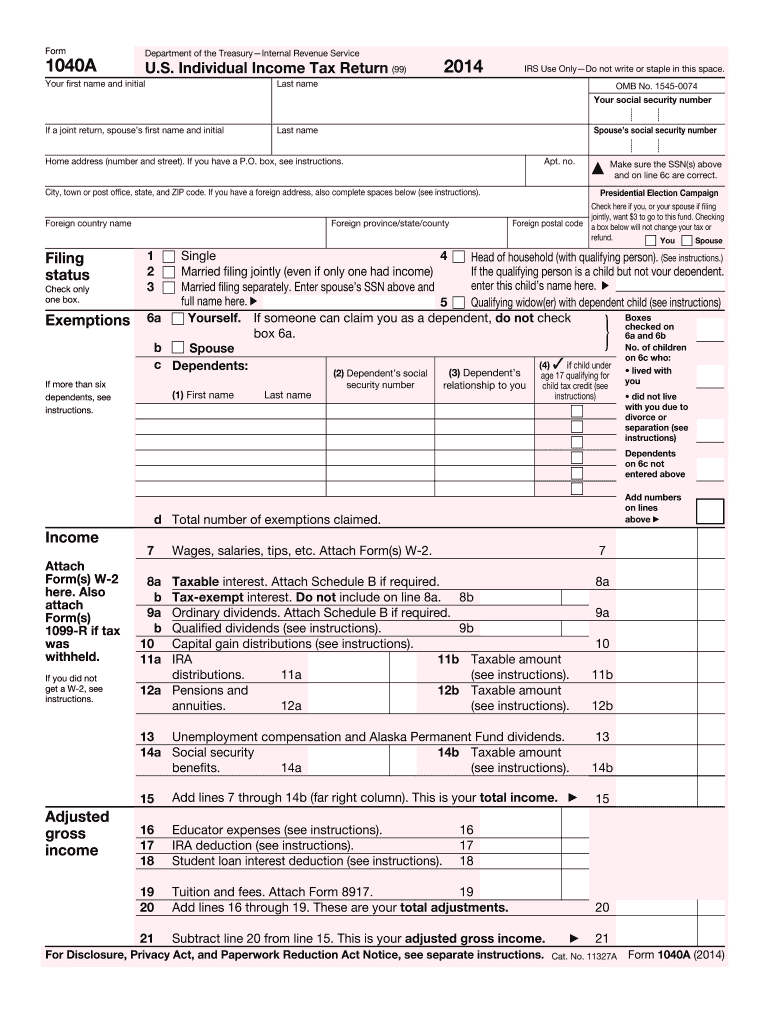

1040a Form Fill Out and Sign Printable PDF Template signNow

What do i do with form 3922? Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific details about the transfer of stock due to participation in an employee stock purchase plan, or.

3922 Forms, Employee Stock Purchase, IRS Copy A DiscountTaxForms

If you purchased espp shares, your employer will send you form 3922, transfer of stock. Web what is irs form 3922? Since you have not sold the stock, the. Web irs form 3922 is used by the companies to report the transfer of stock acquired by the employee through the. Web form 3922 transfer of stock acquired through an employee.

3922 Laser Tax Forms Copy B Free Shipping

Web you own the shares, so you can generally do what you want with them. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web form 3922 is for informational purposes only, for your employer to report to you information on your purchase(s) of espp. What do i.

Requesting your TCC for Form 3921 & 3922

Web irs form 3922 is used by the companies to report the transfer of stock acquired by the employee through the. Web working with form 3922. This has changed from line 12b on the. Web form 3922 is issued for employee stock options that you purchased but do not sell. Web form 3922 is for informational purposes only, for your.

IRS Form 3922

Web irs form 3922 is used by the companies to report the transfer of stock acquired by the employee through the. Web 1 best answer helenac new member if you purchased espp shares, your employer will send you form 3922,. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational. If.

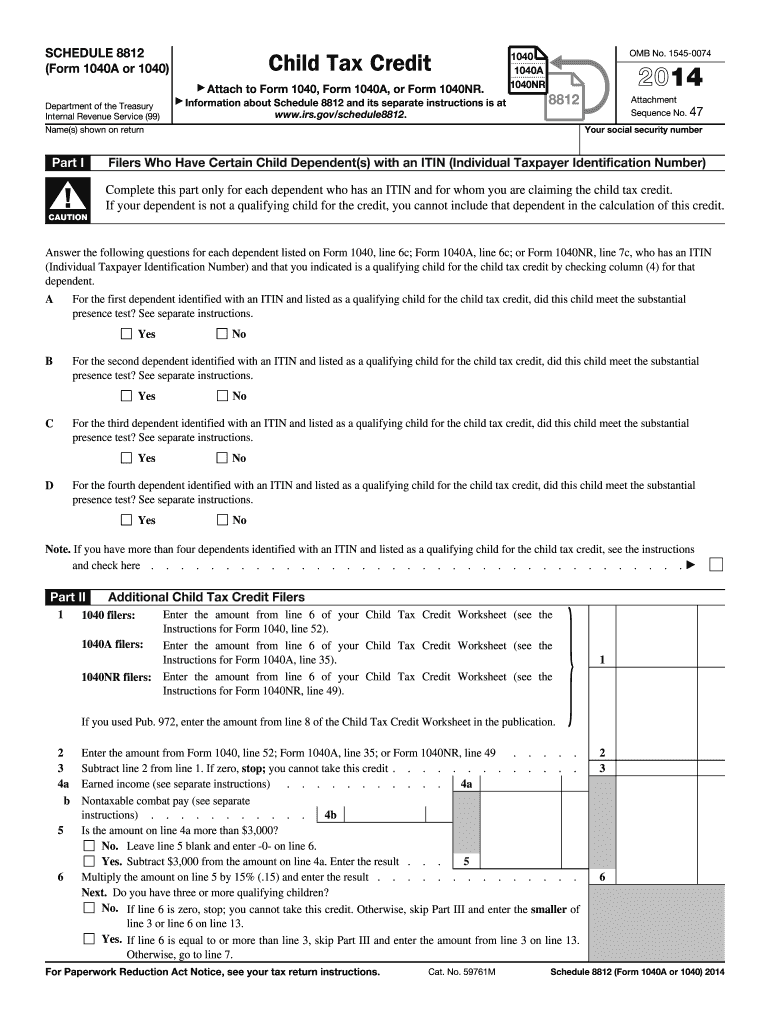

2014 Form IRS 1040 Schedule 8812 Fill Online, Printable, Fillable

Web what is irs form 3922? Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for. Web working with form 3922. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web information about form 3922, transfer of stock acquired through an employee stock purchase plan.

Form 3922 Transfer of Stock Acquired Through An Employee Stock

Web what is irs form 3922? Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web the totals from part i of schedule 2 go into line 17 on form 1040. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Irs form 3922,.

Tax Reporting For Stock Compensation Understanding Form W2, Form 3922

Form 3922 is the transfer of stock acquired through an employee stock purchase plan. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web working with form 3922. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. This has changed from line 12b on the.

Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Form 3922 is the transfer of stock acquired through an employee stock purchase plan. Web what is irs form 3922? Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web form 3922 is issued for employee stock options that you purchased but do not sell. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under. Web form 3922 is for informational purposes only, for your employer to report to you information on your purchase(s) of espp. Since you have not sold the stock, the. This has changed from line 12b on the. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific details about the transfer of stock due to participation in an employee stock purchase plan, or espp. Web working with form 3922. Web 1 best answer helenac new member if you purchased espp shares, your employer will send you form 3922,. Web the totals from part i of schedule 2 go into line 17 on form 1040. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web irs form 3922 is used by the companies to report the transfer of stock acquired by the employee through the. Web your company is required to file form 3922 with the irs and either give you a copy or present the same information on a. What do i do with form 3922? Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational.

Since You Have Not Sold The Stock, The.

Web you own the shares, so you can generally do what you want with them. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web form 3922 is for informational purposes only, for your employer to report to you information on your purchase(s) of espp. Web irs form 3922 is used by the companies to report the transfer of stock acquired by the employee through the.

If You Purchased Espp Shares, Your Employer Will Send You Form 3922, Transfer Of Stock.

Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web taxslayer support how do i report my 3922 form (transfer of stock acquired through an employee stock purchase plan under. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational.

Irs Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C), Reports Specific Details About The Transfer Of Stock Due To Participation In An Employee Stock Purchase Plan, Or Espp.

What do i do with form 3922? Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) form. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web working with form 3922.

Web Irs Form 3922 Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423 (C) Is For.

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Form 3922 is the transfer of stock acquired through an employee stock purchase plan. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under.