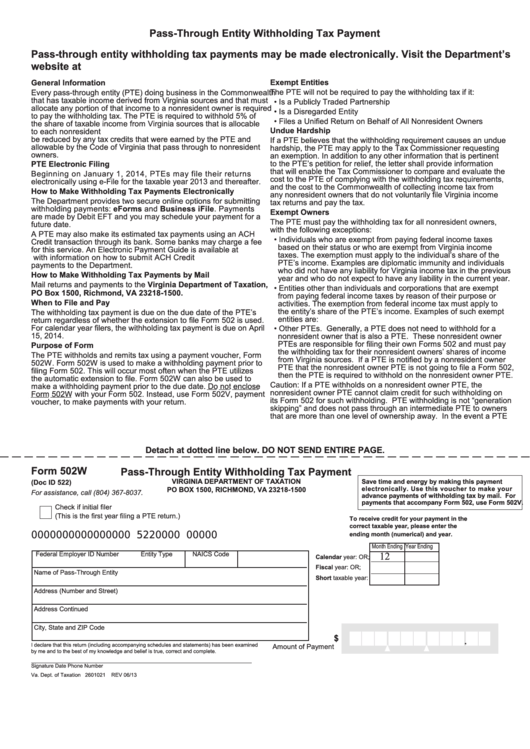

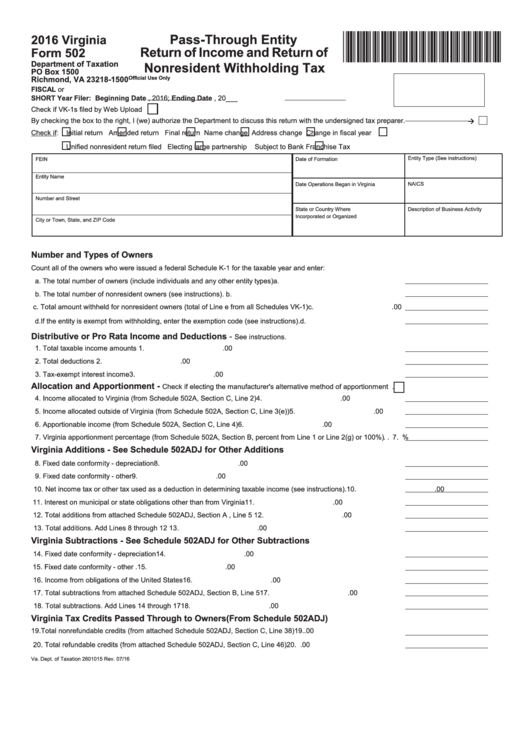

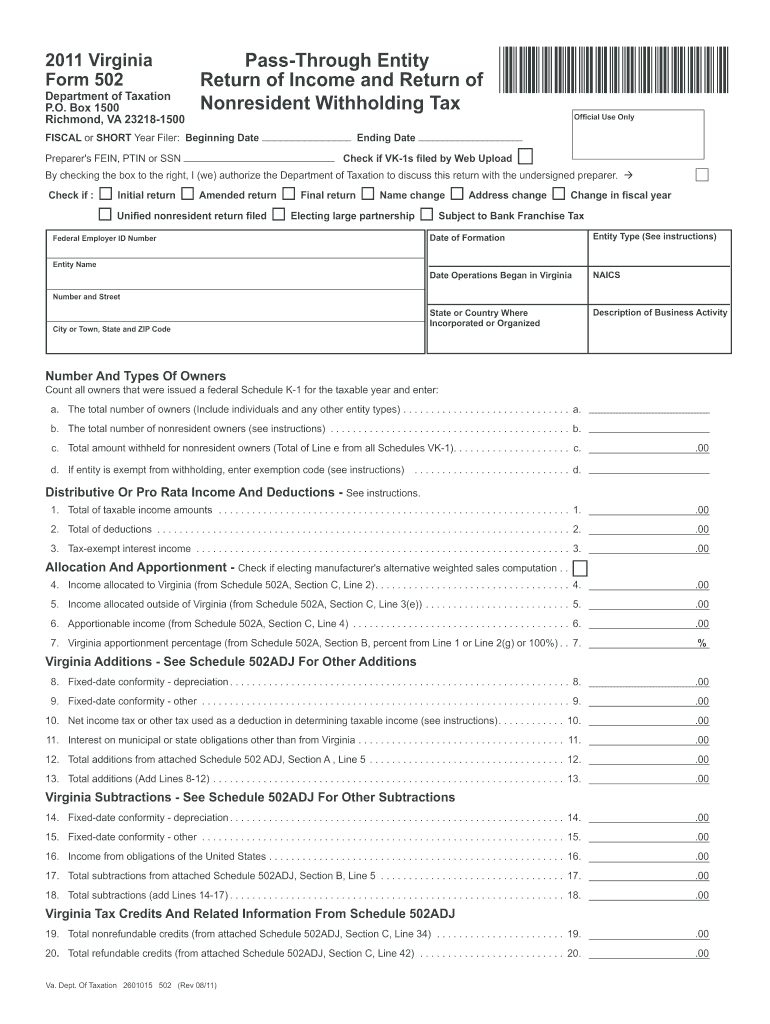

Virginia Form 502 Ptet - Web investment pte is not income from virginia sources, and form 502. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web although the instructions for virginia form 502 ptet section 1 line 1 indicate that you may enter a loss. I'm filing va form 502 with a virginia resident as 100% owner/shareholder. The withholding tax payment is due on the due date of the pte’s return, regardless of whether the extension. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident. (2) during tax year 2023 and. Previously s corporations were required to file their. For calendar year filers, that. Web s corporations, partnerships, and limited liability companies.

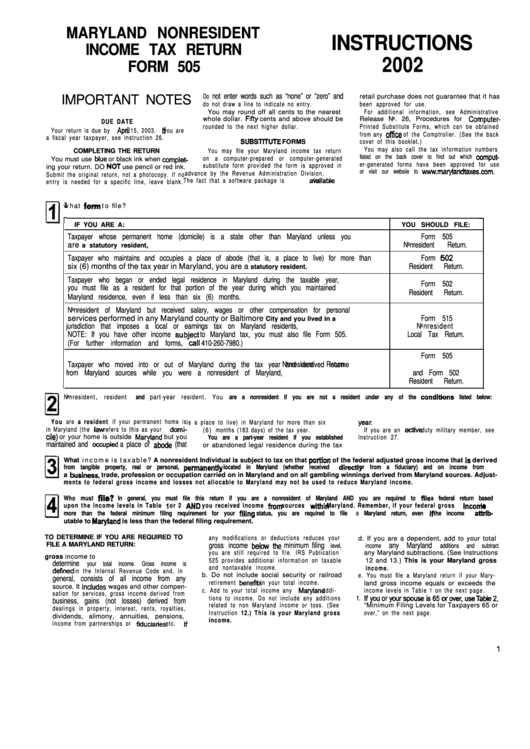

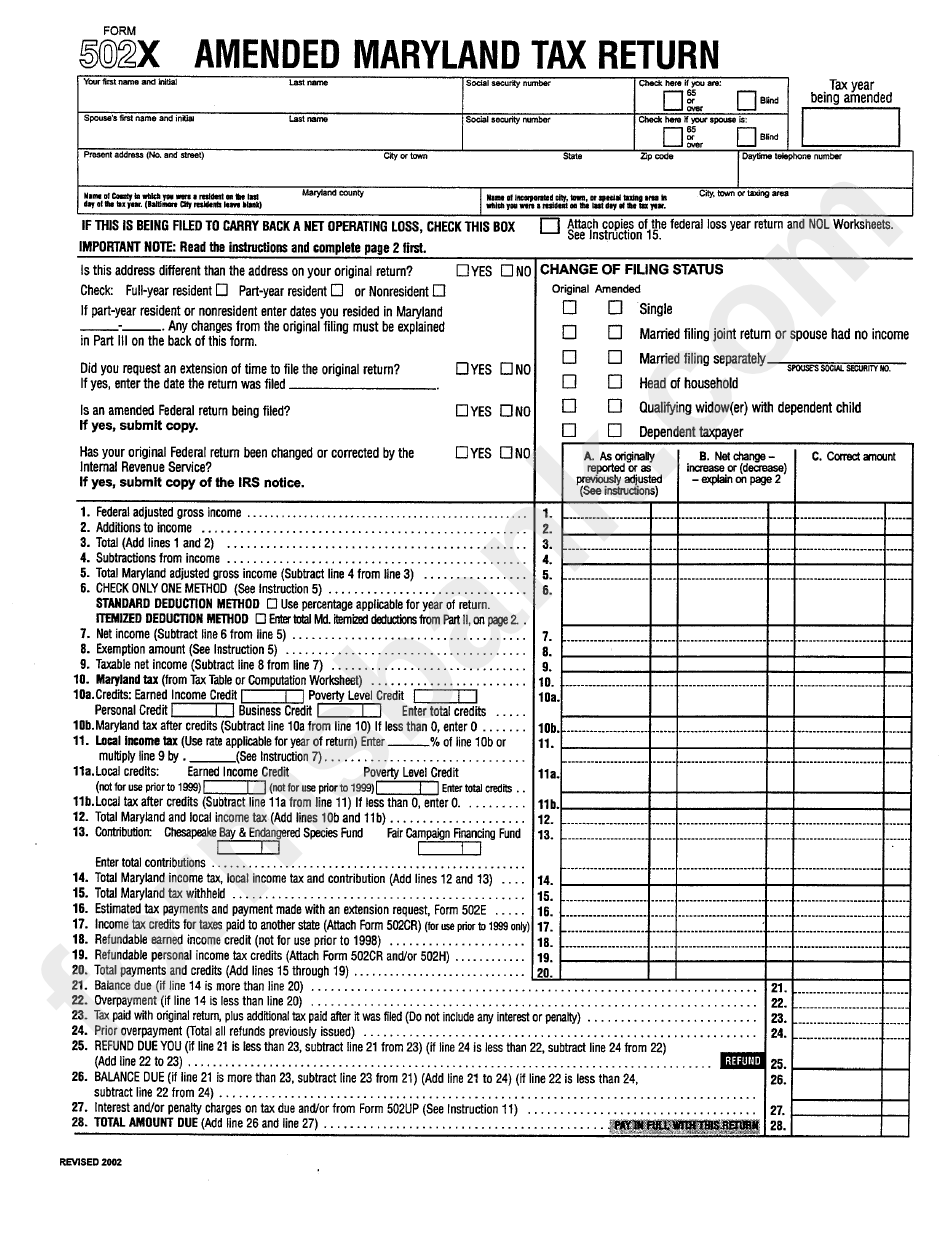

Maryland Form 502 Instructions 2019

Previously s corporations were required to file their. The withholding tax payment is due on the due date of the pte’s return, regardless of whether the extension. Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Web how to enter virginia pte in proseries. Web the guidelines.

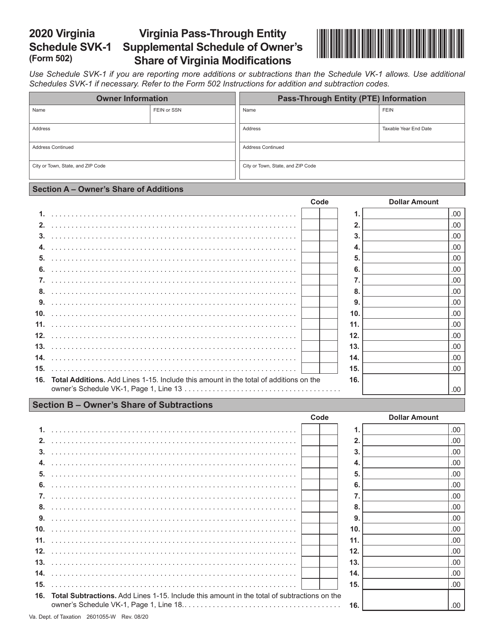

Form 502 Schedule SVK1 Download Fillable PDF or Fill Online Virginia

(2) during tax year 2023 and. The withholding tax payment is due on the due date of the pte’s return, regardless of whether the extension. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident. Web s corporations, partnerships, and limited liability companies. Web the virginia form 502ptet is a.

free direct deposit authorization form pdf word eforms 5 direct

For calendar year filers, that. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident. Web investment pte is not income from virginia sources, and form 502. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web the guidelines confirm that nonresident withholding payments.

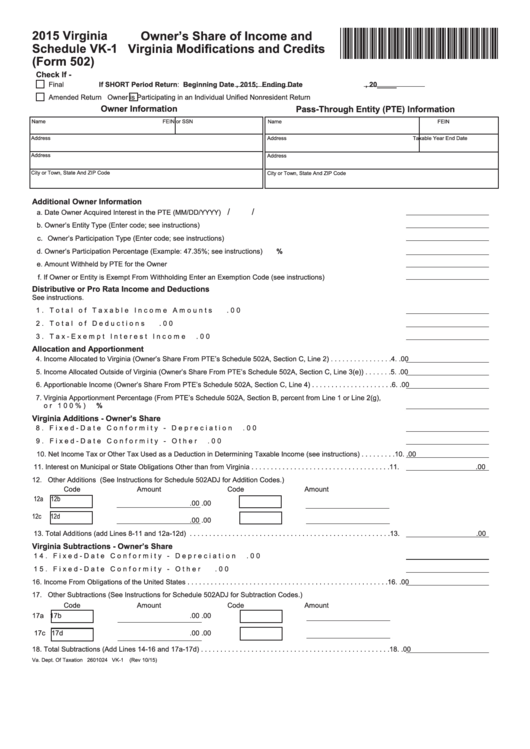

Top 11 Virginia Form 502 Templates free to download in PDF format

Web the guidelines confirm that nonresident withholding payments made before the pte made the ptet election may be claimed. Previously s corporations were required to file their. Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Web investment pte is not income from virginia sources, and form.

Fillable Schedule Vk1 (Form 502) Virginia Owner'S Share Of

Web although the instructions for virginia form 502 ptet section 1 line 1 indicate that you may enter a loss. For calendar year filers, that. Web virginia department of taxation rev. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident. Web investment pte is not income from virginia sources,.

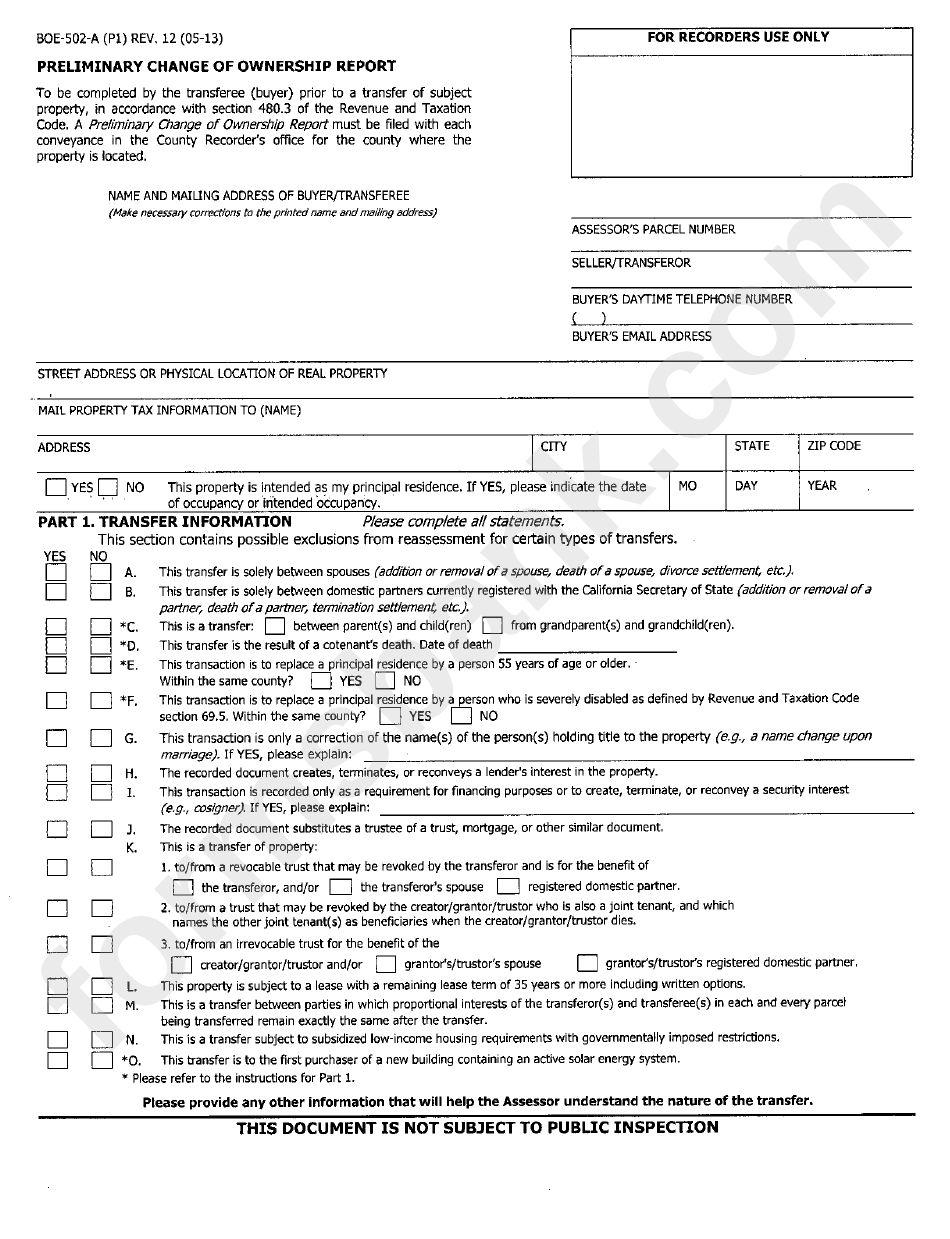

Form Boe502A (P1) Preliminary Change Of Ownership Report 2013

Web although the instructions for virginia form 502 ptet section 1 line 1 indicate that you may enter a loss. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web how to enter virginia pte in proseries. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who.

Maryland Form 502 Instructions 2019

Web how to enter virginia pte in proseries. Web virginia department of taxation rev. I'm filing va form 502 with a virginia resident as 100% owner/shareholder. Web although the instructions for virginia form 502 ptet section 1 line 1 indicate that you may enter a loss. Previously s corporations were required to file their.

Form 502x Amended Maryland Tax Return printable pdf download

Web virginia department of taxation rev. Web the virginia form 502ptet is a new form for the 2022 tax year. Previously s corporations were required to file their. Web the guidelines confirm that nonresident withholding payments made before the pte made the ptet election may be claimed. Web the form 502 should (1) report nonresident withholding only for income attributable.

Fillable Virginia Form 502 PassThrough Entity Return Of And

Previously s corporations were required to file their. Web s corporations, partnerships, and limited liability companies. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web the guidelines confirm that nonresident withholding payments made before the pte made the ptet election may be claimed. For calendar year filers, that.

2006 virginia form 502 2011 Fill out & sign online DocHub

For calendar year filers, that. Web although the instructions for virginia form 502 ptet section 1 line 1 indicate that you may enter a loss. Previously s corporations were required to file their. (2) during tax year 2023 and. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident.

Web although the instructions for virginia form 502 ptet section 1 line 1 indicate that you may enter a loss. Web virginia department of taxation rev. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident. For calendar year filers, that. Web how to enter virginia pte in proseries. (2) during tax year 2023 and. Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. The withholding tax payment is due on the due date of the pte’s return, regardless of whether the extension. Web investment pte is not income from virginia sources, and form 502. Web the virginia form 502ptet is a new form for the 2022 tax year. Web the guidelines confirm that nonresident withholding payments made before the pte made the ptet election may be claimed. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web s corporations, partnerships, and limited liability companies. Previously s corporations were required to file their. I'm filing va form 502 with a virginia resident as 100% owner/shareholder.

Web Although The Instructions For Virginia Form 502 Ptet Section 1 Line 1 Indicate That You May Enter A Loss.

For calendar year filers, that. (2) during tax year 2023 and. Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Web the virginia form 502ptet is a new form for the 2022 tax year.

Web The Guidelines Confirm That Nonresident Withholding Payments Made Before The Pte Made The Ptet Election May Be Claimed.

Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web s corporations, partnerships, and limited liability companies. I'm filing va form 502 with a virginia resident as 100% owner/shareholder. Web how to enter virginia pte in proseries.

Web The Form 502 Should (1) Report Nonresident Withholding Only For Income Attributable To Ineligible Owners Who Are Also Nonresident.

The withholding tax payment is due on the due date of the pte’s return, regardless of whether the extension. Web virginia department of taxation rev. Previously s corporations were required to file their. Web investment pte is not income from virginia sources, and form 502.