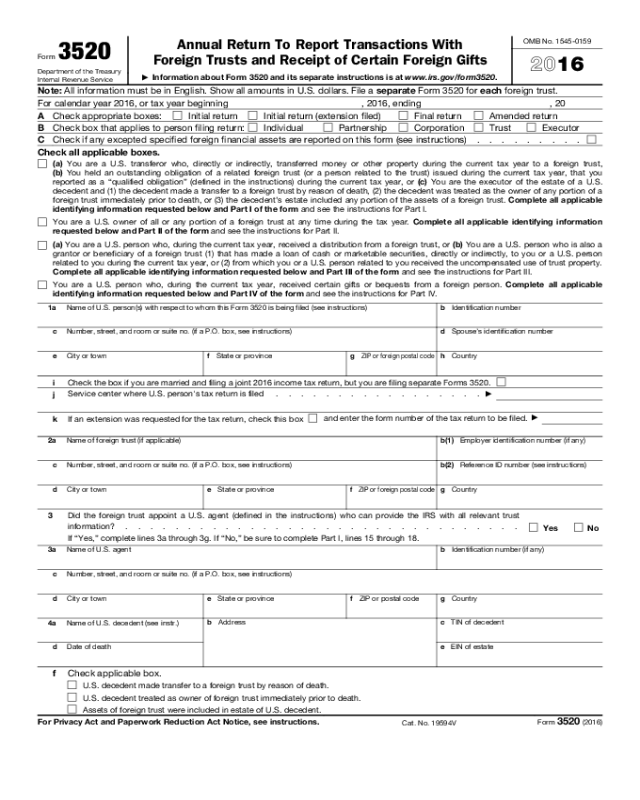

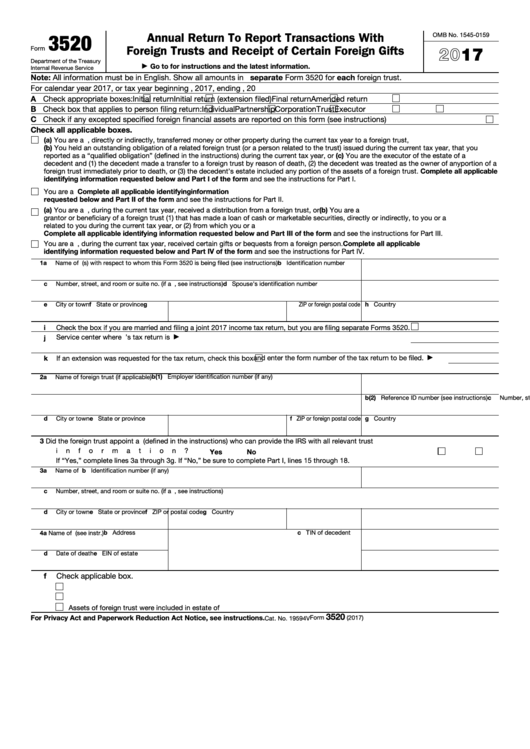

Turbo Tax Form 3520 - Web schedule 1 additional income and adjustments to income schedule 2 additional taxes schedule 3 additional credits and. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate. Easily file federal and state income tax. Web about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts u.s. Decedents) file form 3520 with the irs to report: Persons (and executors of estates of u.s. Web file form 3520 separately from your income tax return by following the directions in the instructions to the form 3520. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Taxpayers report transactions with certain foreign trusts, ownership of foreign trusts, and.

2011 Form Canada SC ISP3520 E Fill Online, Printable, Fillable, Blank

Web about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts u.s. The forms 3520 and 3520 a are both completed annually as part of a. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain. File form 3520 by the 15th day.

3520 attach statement Fill Online, Printable, Fillable Blank form

Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain. Decedents) file form 3520 with the irs to report: Web form 3520 is a disclosure document, really, and there is never any actual tax due with it. The instructions for filing form 3520 or foreign gift tax are complicated, even.

question about form 3520 TurboTax Support

Decedents) file form 3520 with the irs to report: Web file form 3520 separately from your income tax return by following the directions in the instructions to the form 3520. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate. Web form 3520 for each foreign trust. Persons (and executors of estates of u.s.

Steuererklärung dienstreisen Form 3520

Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or. Web 4 tips when filing form 3520. Web file form 3520 separately from your income tax return by following the directions in the instructions to the form 3520. Web form 3520 for each foreign.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain. The instructions for filing form 3520 or foreign gift tax are complicated, even for. Web form 3520 is a disclosure document, really, and there is never any actual tax due with it. Web schedule 1 additional income and adjustments to.

Fillable Form 3520 Annual Return To Report Transactions With Foreign

The instructions for filing form 3520 or foreign gift tax are complicated, even for. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web form 3520 is an informational return in which u.s. Web about form 3520, annual return to report.

Steuererklärung dienstreisen Form 3520

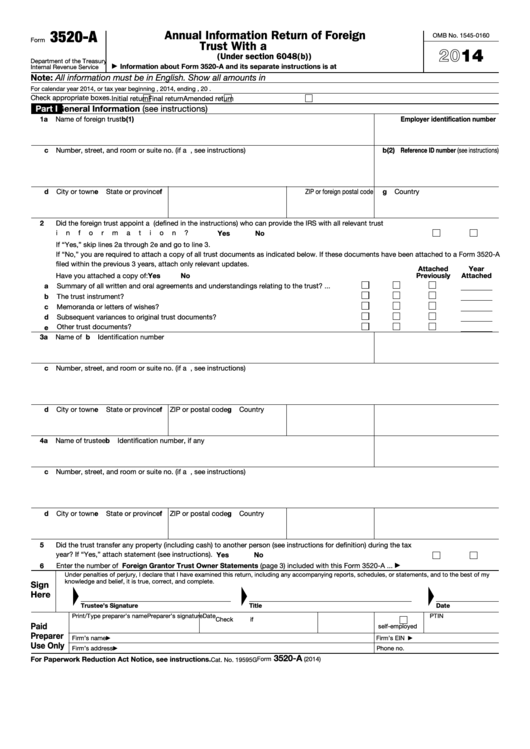

Taxpayers report transactions with certain foreign trusts, ownership of foreign trusts, and. Web filing form 3520 community discussions taxes get your taxes done sunnyritz14 level 2 filing form 3520 i. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain. The forms 3520 and 3520 a are both completed annually.

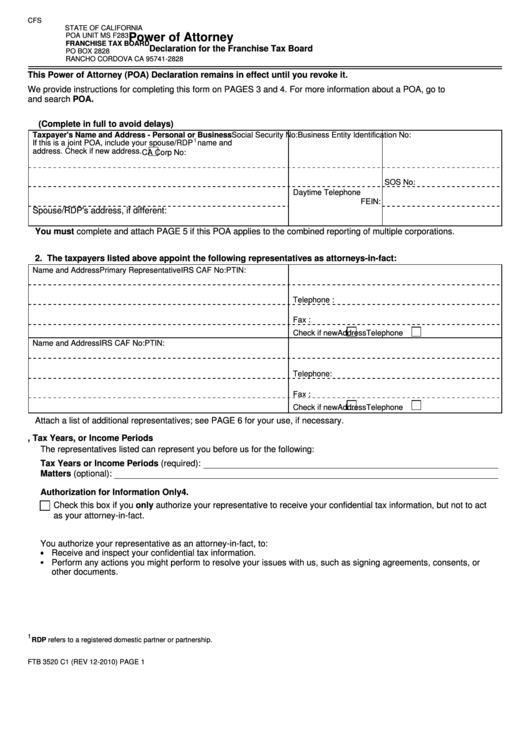

Ftb 3520 C1 Power Of Attorney Declaration For The Franchise Tax

Web 4 tips when filing form 3520. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. File form 3520 by the 15th day of. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate. Web.

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or. Persons (and executors of estates of u.s. Web 4 tips when filing form 3520. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month.

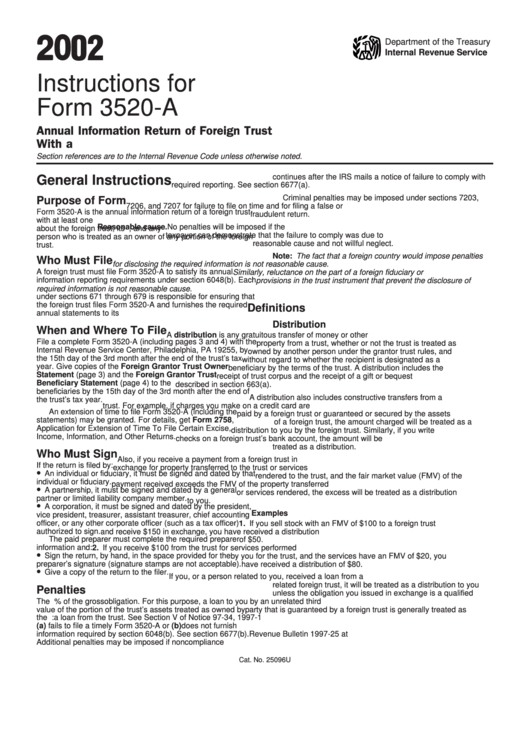

Instructions For Form 3520A Annual Information Return Of Foreign

Web filing form 3520 community discussions taxes get your taxes done sunnyritz14 level 2 filing form 3520 i. Easily file federal and state income tax. Web form 3520 is an informational return in which u.s. Web file form 3520 separately from your income tax return by following the directions in the instructions to the form 3520. The forms 3520 and.

File form 3520 by the 15th day of. Web about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts u.s. Web form 3520 for each foreign trust. The instructions for filing form 3520 or foreign gift tax are complicated, even for. Web form 3520 is an informational return in which u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web filing form 3520 community discussions taxes get your taxes done sunnyritz14 level 2 filing form 3520 i. Web form 3520 is a disclosure document, really, and there is never any actual tax due with it. Web form 3520 is a disclosure document, really, and there is never any actual tax due with it. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate. Persons (and executors of estates of u.s. Web 4 tips when filing form 3520. Taxpayers report transactions with certain foreign trusts, ownership of foreign trusts, and. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain. Easily file federal and state income tax. The forms 3520 and 3520 a are both completed annually as part of a. Web schedule 1 additional income and adjustments to income schedule 2 additional taxes schedule 3 additional credits and. Web file form 3520 separately from your income tax return by following the directions in the instructions to the form 3520. Decedents) file form 3520 with the irs to report:

File Form 3520 By The 15Th Day Of.

Decedents) file form 3520 with the irs to report: Web schedule 1 additional income and adjustments to income schedule 2 additional taxes schedule 3 additional credits and. Taxpayers report transactions with certain foreign trusts, ownership of foreign trusts, and. Web form 3520 for each foreign trust.

Web Filing Form 3520 Community Discussions Taxes Get Your Taxes Done Sunnyritz14 Level 2 Filing Form 3520 I.

Web form 3520 is an informational return in which u.s. The instructions for filing form 3520 or foreign gift tax are complicated, even for. Web 4 tips when filing form 3520. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s.

Web Form 3520 Is A Disclosure Document, Really, And There Is Never Any Actual Tax Due With It.

Persons (and executors of estates of u.s. Web form 3520 is a disclosure document, really, and there is never any actual tax due with it. Easily file federal and state income tax. Web about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts u.s.

The Forms 3520 And 3520 A Are Both Completed Annually As Part Of A.

Web file form 3520 separately from your income tax return by following the directions in the instructions to the form 3520. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate.