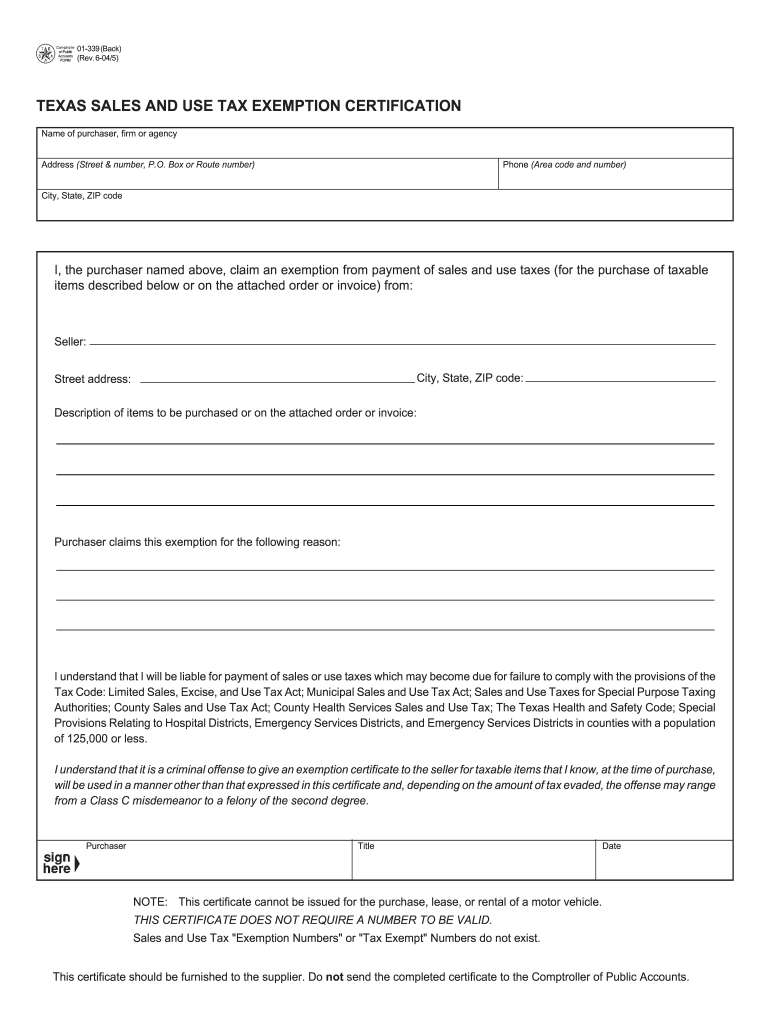

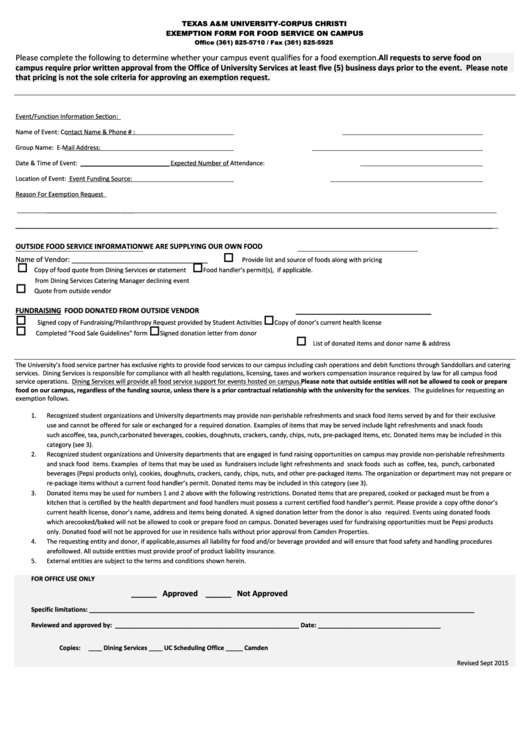

Texas A&M Tax Exempt Form - Purchaser claims this exemption for the following reason: Web hotel occupancy tax exemption. I understand that it is a criminal offense to give an exemption. Web every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless. Web tax exemption certification not required: All purchases of texas a&m university, texas a&m university. Web university departments must obtain sales tax exemption or resale certificates from the purchaser at the time of the sale. Web annual certification of physical inventory of property. Web texas sales and use tax exemption certification name of purchaser, firm or agency address (street & number, p.o. Web the texas university system t e comptroller of public x accounts form.

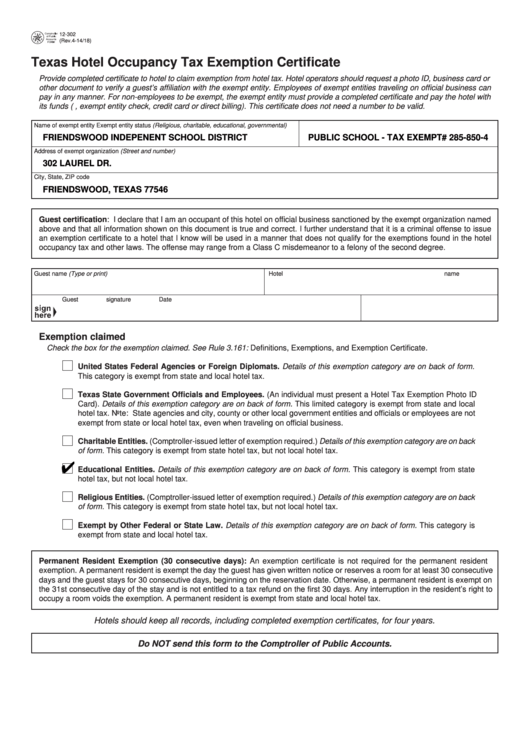

Fillable Texas Hotel Occupancy Tax Exemption Certificate Printable Pdf

When traveling within the state of texas, using local funds or state funds, we are. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items. Web texas sales and use tax exemption certification name of purchaser, firm or agency address (street & number, p.o. They include graphics, fillable.

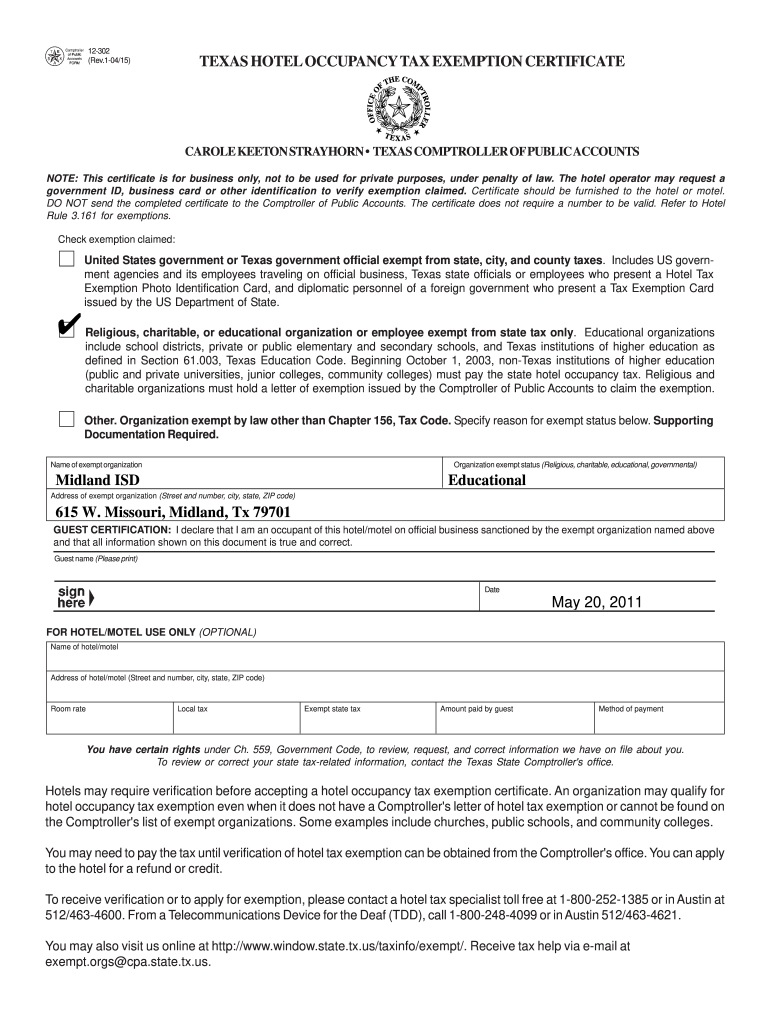

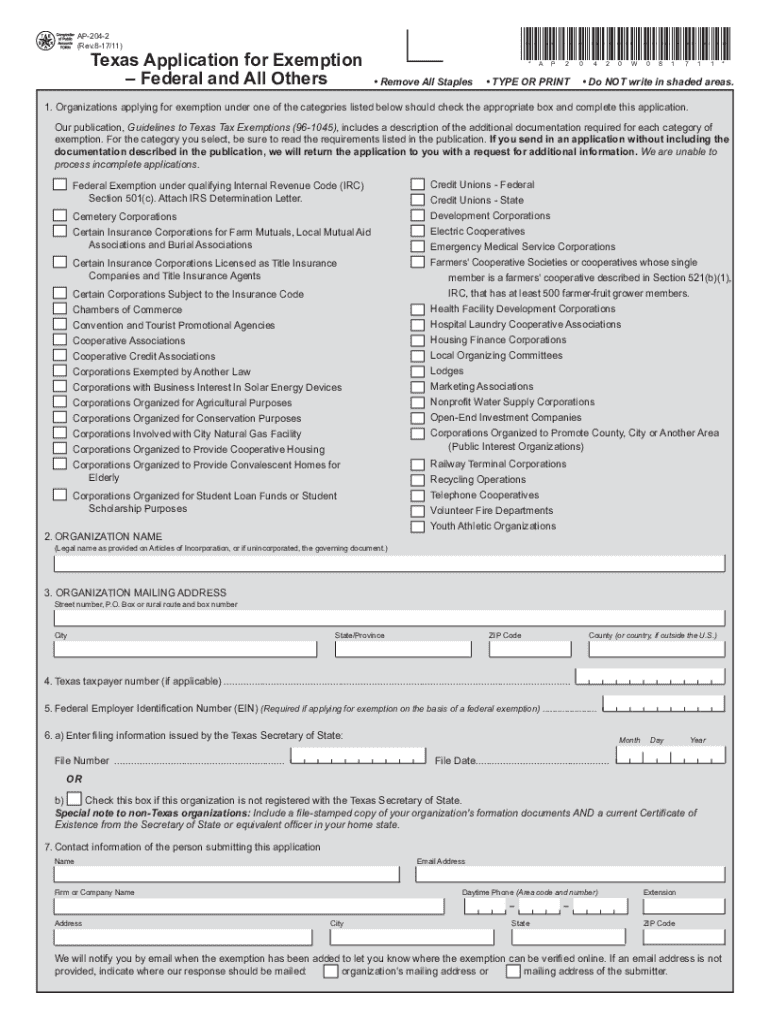

Texas Fillable Tax Exemption Form Fill Out and Sign Printable PDF

Web submittal of documentation and forms for waivers and exemptions: Web annual certification of physical inventory of property. Texas a&m axes nil fund, ‘12th man plus,’ after irs memo. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items. Web texas sales and use tax exemption certificate.

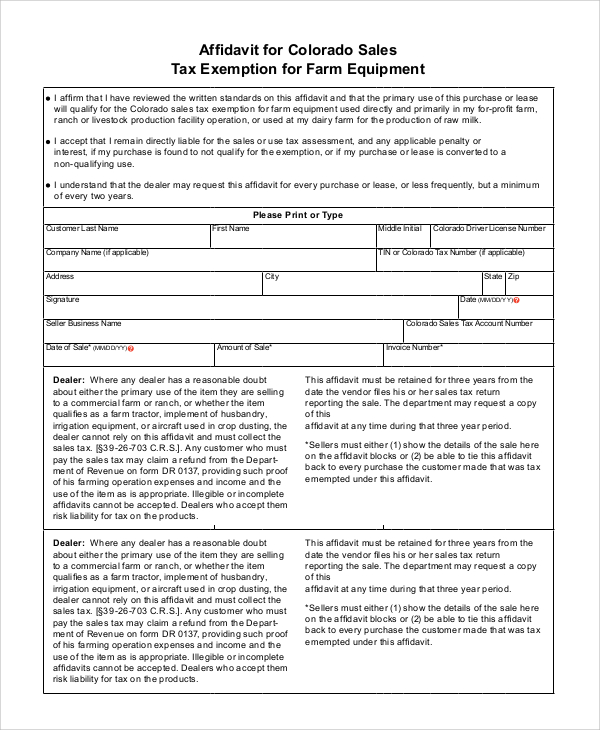

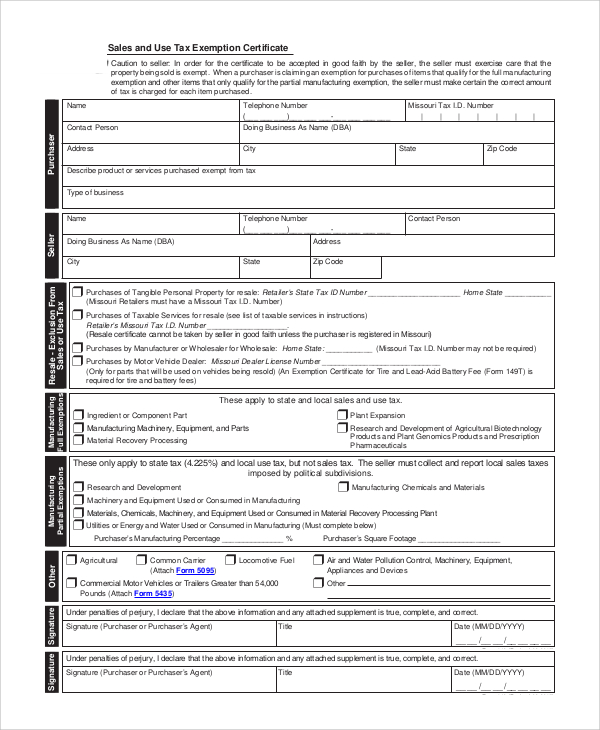

FREE 10+ Sample Tax Exemption Forms in PDF

Web texas sales and use tax exemption certification name of purchaser, firm or agency address (street & number, p.o. An irs memo in june said name, image, and. When traveling within the state of texas, using local funds or state funds, we are. Web the texas university system t e comptroller of public x accounts form. Web texas sales &.

Tax Exempt Forms San Patricio Electric Cooperative

Web hotel occupancy tax exemption. When traveling within the state of texas, using local funds or state funds, we are. Web tax exemption certification not required: Web please click on the link to review the states offering these exemptions and what forms to provide for that exemption. With few exceptions, as noted in the apply to column below, most forms.

Texas Tax Exempt Certificate Fill and Sign Printable Template Online

Web texas sales & use tax exemption form texas hotel occupancy tax exempt form travel vendor exception form. Reduction to expenditure instructions and form. Web annual certification of physical inventory of property. Web texas sales and use tax exemption certificate. I understand that it is a criminal offense to give an exemption.

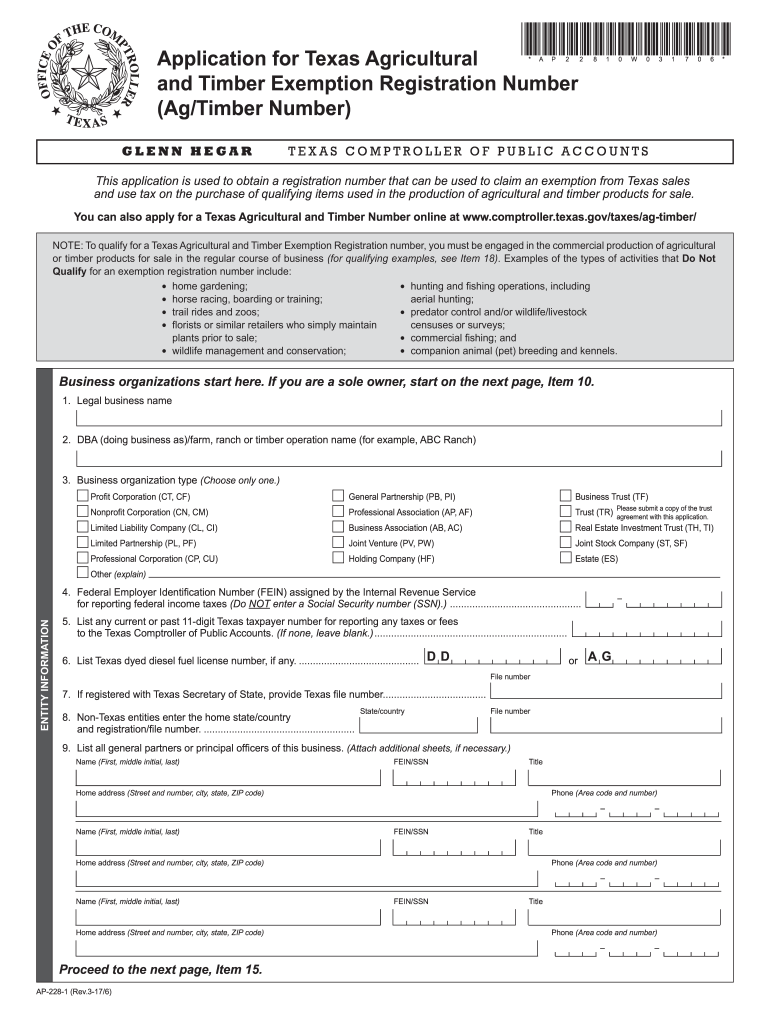

TX AP2281 2017 Fill out Tax Template Online US Legal Forms

Web the texas university system t e comptroller of public x accounts form. Web texas sales and use tax exemption certificate. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items. Web do not pay texas sales tax! Web texas sales and use tax exemption certification name of.

FREE 10+ Sample Tax Exemption Forms in PDF

Purchaser claims this exemption for the following reason: Texas a&m axes nil fund, ‘12th man plus,’ after irs memo. Web tax exemption certification not required: When traveling within the state of texas, using local funds or state funds, we are. Web the texas university system t e comptroller of public x accounts form.

Homestead Exemption Texas Form 2019 Splendora Tx Fill Out and Sign

Web taxes texas applications for tax exemption the forms listed below are pdf files. Web hotel occupancy tax exemption. Web university departments must obtain sales tax exemption or resale certificates from the purchaser at the time of the sale. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable.

109 Exemption Form Templates free to download in PDF

Texas a&m axes nil fund, ‘12th man plus,’ after irs memo. Web the provisions of the tax code and/or all applicable law. An irs memo in june said name, image, and. Web hotel occupancy tax exemption. Web texas sales and use tax exemption certification name of purchaser, firm or agency address (street & number, p.o.

Exemption Certificate Format Master of Documents

Web every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless. Web all purchases of the texas a&m university system members: I understand that it is a criminal offense to give an exemption. When traveling within the state of texas, using local funds or state funds, we are. Web texas.

Web every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless. Texas a&m axes nil fund, ‘12th man plus,’ after irs memo. The texas a&m university system is always exempt from texas state sales tax and can be exempt. Web all purchases of texas a&m university, texas a&m university galveston or texas a&m system offices: Web the provisions of the tax code and/or all applicable law. Web please click on the link to review the states offering these exemptions and what forms to provide for that exemption. Merchandise sold to any state agency is exempt from the state and city sales tax. Web texas sales and use tax exemption certificate. When traveling within the state of texas, using local funds or state funds, we are. Web hotel occupancy tax exemption. Web do not pay texas sales tax! Web university departments must obtain sales tax exemption or resale certificates from the purchaser at the time of the sale. Web all purchases of the texas a&m university system members: All purchases of texas a&m university, texas a&m university. An irs memo in june said name, image, and. They include graphics, fillable form fields,. Web the texas university system t e comptroller of public x accounts form. Reduction to expenditure instructions and form. Web i, the purchaser named above, claim an exemption from payment of sales and use taxes for the purchase of taxable items. With few exceptions, as noted in the apply to column below, most forms and.

Web I, The Purchaser Named Above, Claim An Exemption From Payment Of Sales And Use Taxes For The Purchase Of Taxable Items.

Web texas sales and use tax exemption certificate. Web all purchases of the texas a&m university system members: Web every organization that has been recognized as tax exempt by the irs has to file form 990 every year, unless. Reduction to expenditure instructions and form.

When Traveling Within The State Of Texas, Using Local Funds Or State Funds, We Are.

Web texas sales and use tax exemption certification name of purchaser, firm or agency address (street & number, p.o. With few exceptions, as noted in the apply to column below, most forms and. Web texas sales & use tax exemption form texas hotel occupancy tax exempt form travel vendor exception form. The texas a&m university system is always exempt from texas state sales tax and can be exempt.

Web University Departments Must Obtain Sales Tax Exemption Or Resale Certificates From The Purchaser At The Time Of The Sale.

Web tax exemption certification not required: Texas a&m axes nil fund, ‘12th man plus,’ after irs memo. Web hotel occupancy tax exemption. Web taxes texas applications for tax exemption the forms listed below are pdf files.

I Understand That It Is A Criminal Offense To Give An Exemption.

Merchandise sold to any state agency is exempt from the state and city sales tax. All purchases of texas a&m university, texas a&m university. Web do not pay texas sales tax! Web annual certification of physical inventory of property.