Tax Cap Form Las Vegas - 29, 2022 at 5:26 pm pdt las vegas, nev. Web these property owners may be eligible for the primary tax cap rate for the upcoming fiscal year. Web please see the official notice from the clark county assessor's office issued to all nevada homeowners regarding a tax cap. Web property tax cap claim form to save time and money, submit a property tax cap claim form for your property in churchill county. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement. Web east las vegas community center, 250 n. _____ manufactured home account number: Web las vegas (ktnv) — crowds of people flooded the county assessors office panicking that they would be paying. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to.

Claims for Primary Residential Tax Caps Due June 30 YouTube

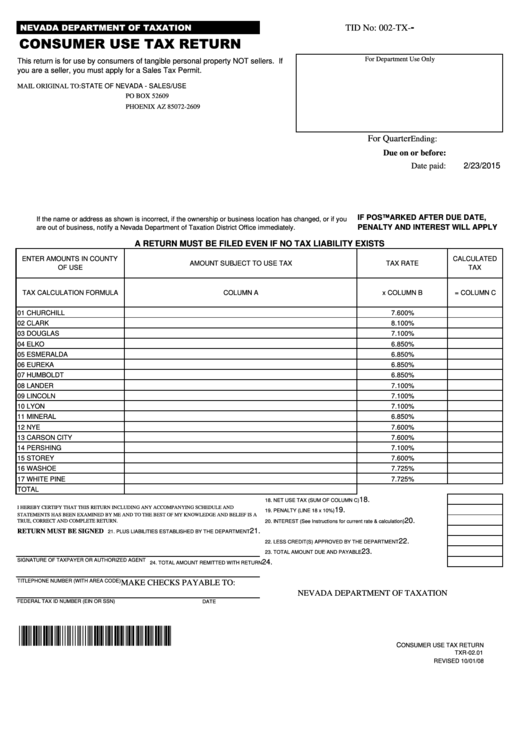

Web tax forms general purpose forms sales & use tax forms modified business tax forms live entertainment tax forms. Web the general cap rate applicable to all other properties this fiscal year is 4.8 percent, compared to the 3 percent tax cap rate for primary. Web for property that is your primary residence in nevada or property that is rented.

Blank Nv Sales And Use Tax Form 01 339 Fill Online, Printable

Web the general cap rate applicable to all other properties this fiscal year is 4.8 percent, compared to the 3 percent tax cap rate for primary. Web these property owners may be eligible for the primary tax cap rate for the upcoming fiscal year. Web if an existing home has already qualified for a 3% or 8% tax abatement, taxes.

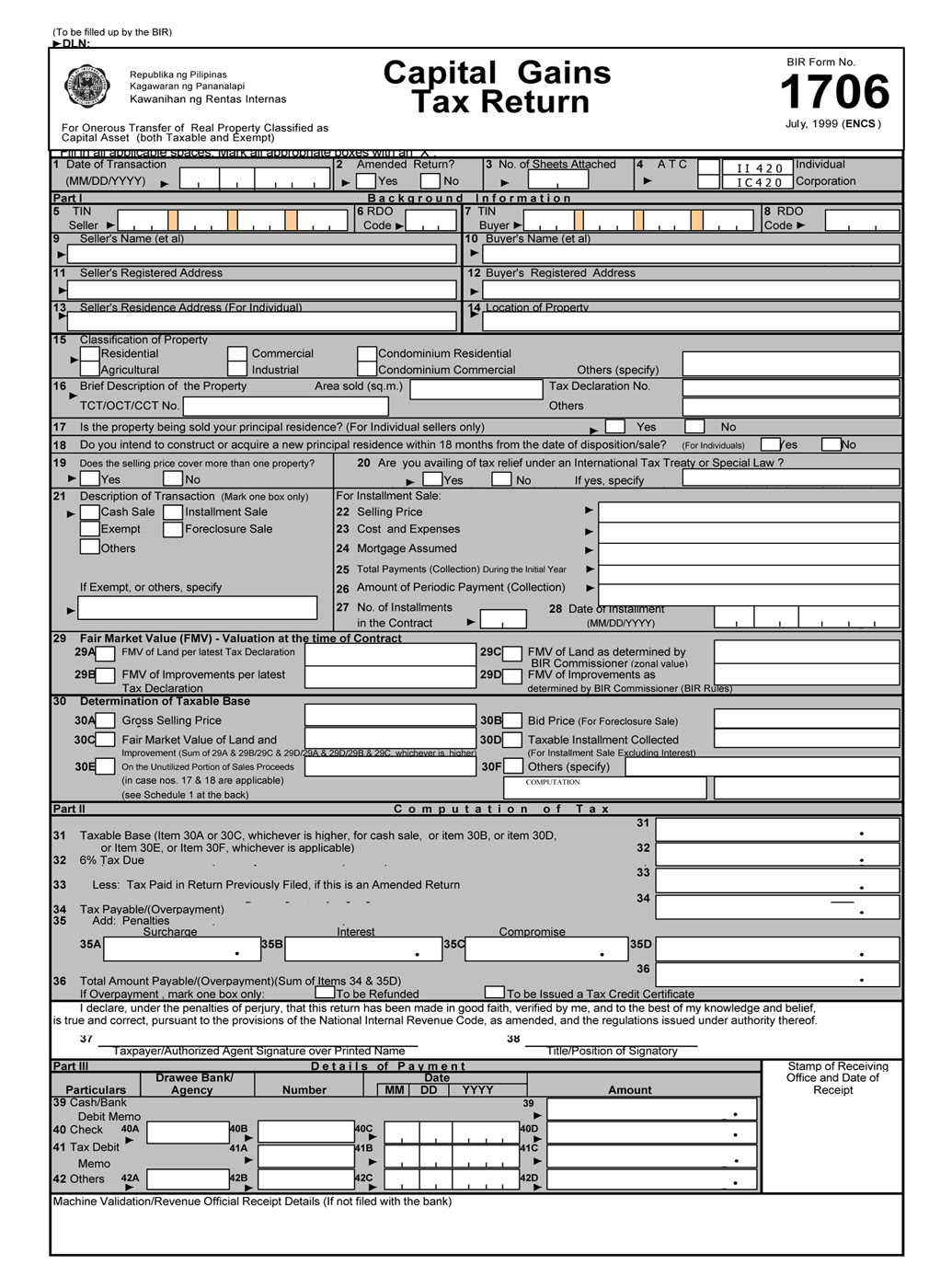

BIR Form No. 1706

Web if you do need to submit a form, you can submit it electronically. Web please see the official notice from the clark county assessor's office issued to all nevada homeowners regarding a tax cap. Web nrs 361.4723 provides a partial abatement of taxes by applying a 3% cap on the tax bill of the owner's primary residence (single. Web.

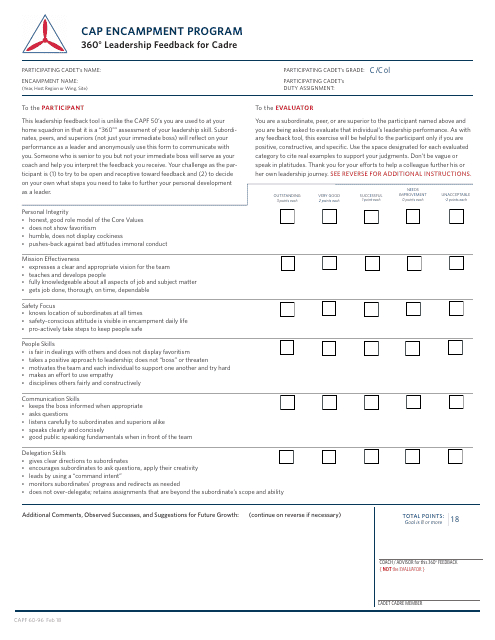

CAP Form 108 Fill Out, Sign Online and Download Printable PDF

Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Web 2640 s decatur blvd. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to. Property owners may submit a claim by signing the. Web las.

IRS Tax Forms 1099 CAP Shareholder Copy B Free Shipping

_____ manufactured home account number: Web for property that is your primary residence in nevada or property that is rented at or below the low income housing (hud) rent level,. Web clark county residents were mailed the initial real property tax bills over the weekend and should be arriving in. Web 2640 s decatur blvd. Web currently, properties qualifying as.

Clark County Assessor’s Office to mail out property tax cap notices

27, 2023 at 4:53 pm pdt las vegas, nev. _____ manufactured home account number: Web 2640 s decatur blvd. Web if an existing home has already qualified for a 3% or 8% tax abatement, taxes will be calculated on the assessed value or apply. 29, 2022 at 5:26 pm pdt las vegas, nev.

CAP Form 6096 Fill Out, Sign Online and Download Fillable PDF

Register for an appointment at this. Web clark county residents were mailed the initial real property tax bills over the weekend and should be arriving in. Web if an existing home has already qualified for a 3% or 8% tax abatement, taxes will be calculated on the assessed value or apply. Web currently, properties qualifying as the owner's primary residence.

Capf 31 Fill Online, Printable, Fillable, Blank pdfFiller

Our team consists of tax attorneys, tax analysts,. Web clark county residents were mailed the initial real property tax bills over the weekend and should be arriving in. 27, 2023 at 4:53 pm pdt las vegas, nev. Web posted at 9:45 pm, jun 27, 2022 and last updated 6:39 am, jun 30, 2022 las vegas (ktnv) — you could be.

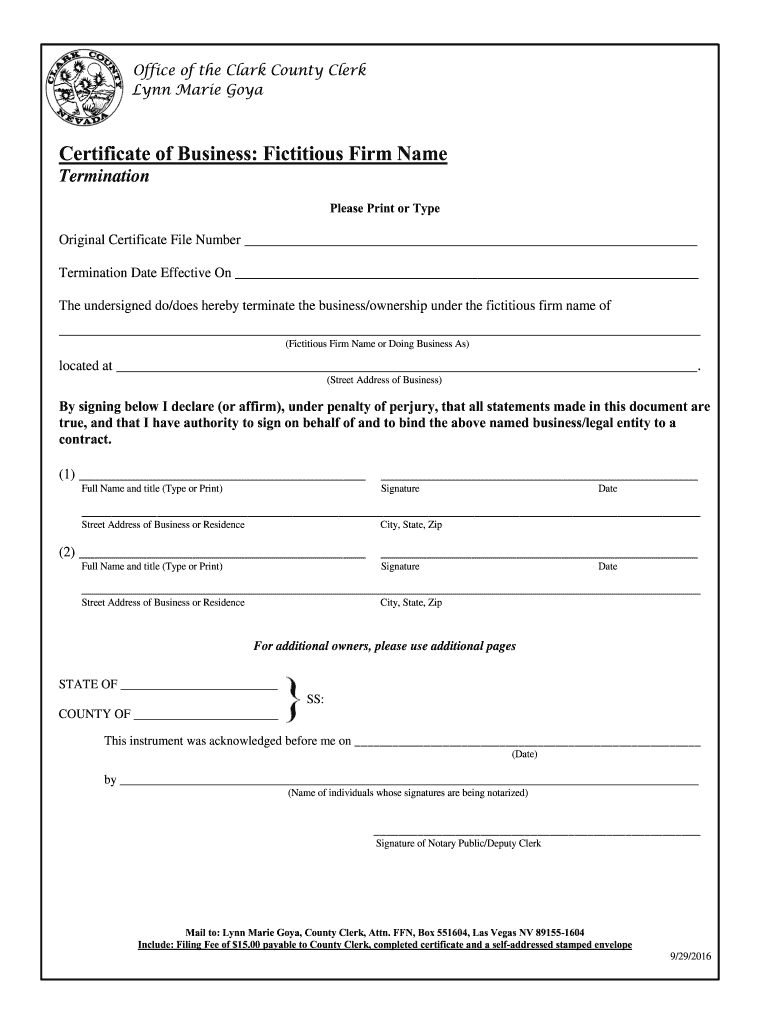

Clark County Fictitious Firm Name Search Form Fill Out and Sign

Web property tax cap claim form to save time and money, submit a property tax cap claim form for your property in churchill county. Web these property owners may be eligible for the primary tax cap rate for the upcoming fiscal year. Web residents will receive either a tax bill if they do not pay their property taxes through a.

Business Office / Understanding New York States Tax Levy Cap

Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement. Register for an appointment at this. Web east las vegas community center, 250.

Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement. Web the general cap rate applicable to all other properties this fiscal year is 4.8 percent, compared to the 3 percent tax cap rate for primary. Web posted at 9:45 pm, jun 27, 2022 and last updated 6:39 am, jun 30, 2022 las vegas (ktnv) — you could be paying. The form is at temp tax cap form 22.pdf. Web tax forms general purpose forms sales & use tax forms modified business tax forms live entertainment tax forms. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to. Web property tax cap claim form to save time and money, submit a property tax cap claim form for your property in churchill county. 29, 2022 at 5:26 pm pdt las vegas, nev. Web these property owners may be eligible for the primary tax cap rate for the upcoming fiscal year. Web 2640 s decatur blvd. Our team consists of tax attorneys, tax analysts,. Web please see the official notice from the clark county assessor's office issued to all nevada homeowners regarding a tax cap. Web clark county residents were mailed the initial real property tax bills over the weekend and should be arriving in. Web nrs 361.4723 provides a partial abatement of taxes by applying a 3% cap on the tax bill of the owner's primary residence (single. Web if an existing home has already qualified for a 3% or 8% tax abatement, taxes will be calculated on the assessed value or apply. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Web las vegas (ktnv) — crowds of people flooded the county assessors office panicking that they would be paying. Web for property that is your primary residence in nevada or property that is rented at or below the low income housing (hud) rent level,. Register for an appointment at this. 27, 2023 at 4:53 pm pdt las vegas, nev.

Web If You Do Need To Submit A Form, You Can Submit It Electronically.

Web please see the official notice from the clark county assessor's office issued to all nevada homeowners regarding a tax cap. Web nrs 361.4723 provides a partial abatement of taxes by applying a 3% cap on the tax bill of the owner's primary residence (single. Web tax forms general purpose forms sales & use tax forms modified business tax forms live entertainment tax forms. 27, 2023 at 4:53 pm pdt las vegas, nev.

Property Owners May Submit A Claim By Signing The.

Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement. Web east las vegas community center, 250 n. Web property tax cap claim form to save time and money, submit a property tax cap claim form for your property in churchill county. Web if an existing home has already qualified for a 3% or 8% tax abatement, taxes will be calculated on the assessed value or apply.

Register For An Appointment At This.

Web for property that is your primary residence in nevada or property that is rented at or below the low income housing (hud) rent level,. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to. Web 2640 s decatur blvd.

The Form Is At Temp Tax Cap Form 22.Pdf.

Web las vegas (ktnv) — crowds of people flooded the county assessors office panicking that they would be paying. Web the general cap rate applicable to all other properties this fiscal year is 4.8 percent, compared to the 3 percent tax cap rate for primary. Web clark county residents were mailed the initial real property tax bills over the weekend and should be arriving in. _____ manufactured home account number: