Tax Cap Form Clark County Nevada - Web “to fix the upcoming tax cap to fix that is 8% for the next fiscal year or starting july 1, you have until june 30th of 2023 to correct that,” said clark. Web home government elected officials county treasurer forms. 27, 2023 at 4:53 pm pdt las vegas, nev. Las vegas (ktnv) — the deadline to file your property tax cap form for this. Web the recorder's office provides the following blank forms search for file name: Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). Web and last updated 7:10 am, jul 01, 2022. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after. Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county assessor to correct property. If you do not receive your tax bill by.

Laughlin Buzz Clark County, Nevada Tax Cap (Abatement) Notice

27, 2023 at 4:53 pm pdt las vegas, nev. Web the recorder's office provides the following blank forms search for file name: Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county assessor to correct property. Web billing the treasurer's office mails out real property tax bills only one time each.

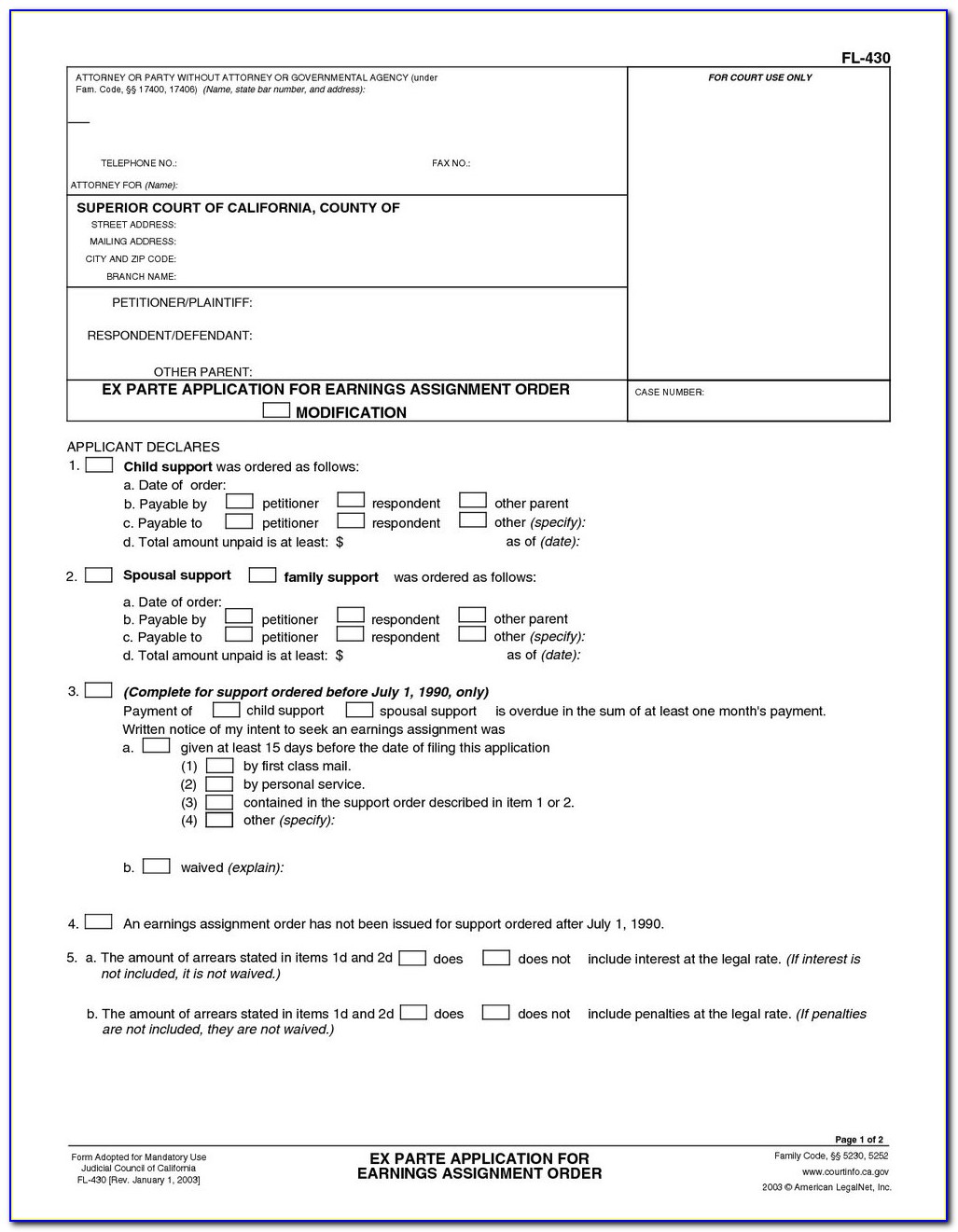

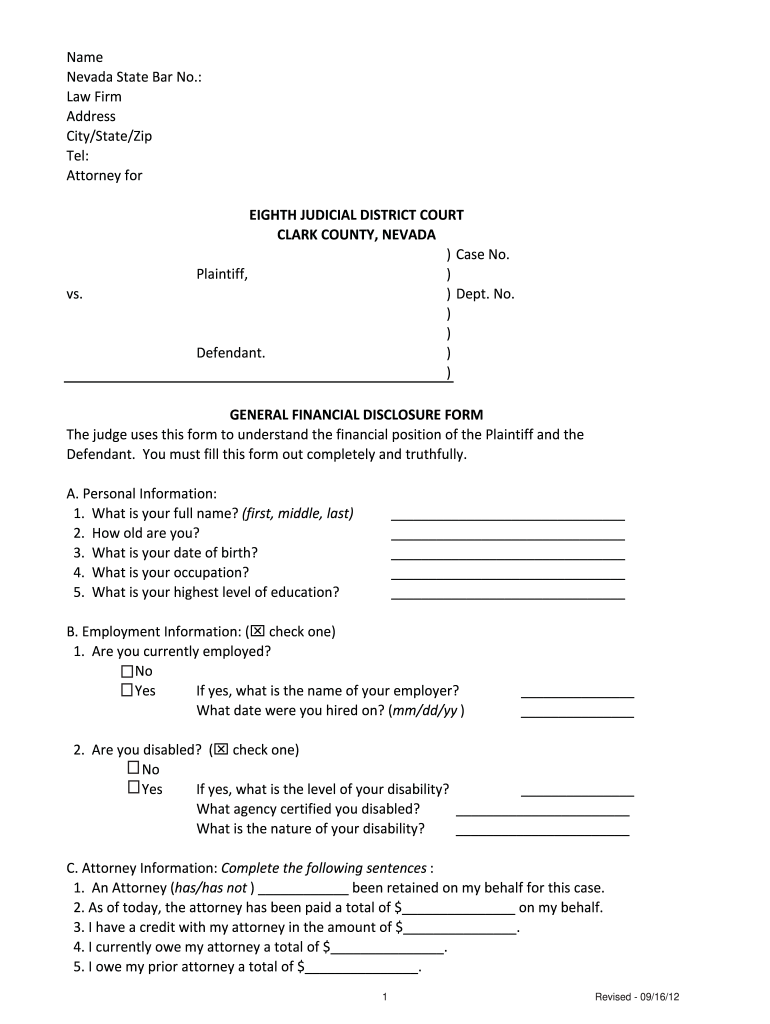

Divorce Forms Nevada Clark County Form Resume Examples aEDvXBMO1Y

Forms 7 documents real property transfer tax. Las vegas (ktnv) — the deadline to file your property tax cap form for this. Is this your primary nevada. Web “to fix the upcoming tax cap to fix that is 8% for the next fiscal year or starting july 1, you have until june 30th of 2023 to correct that,” said clark..

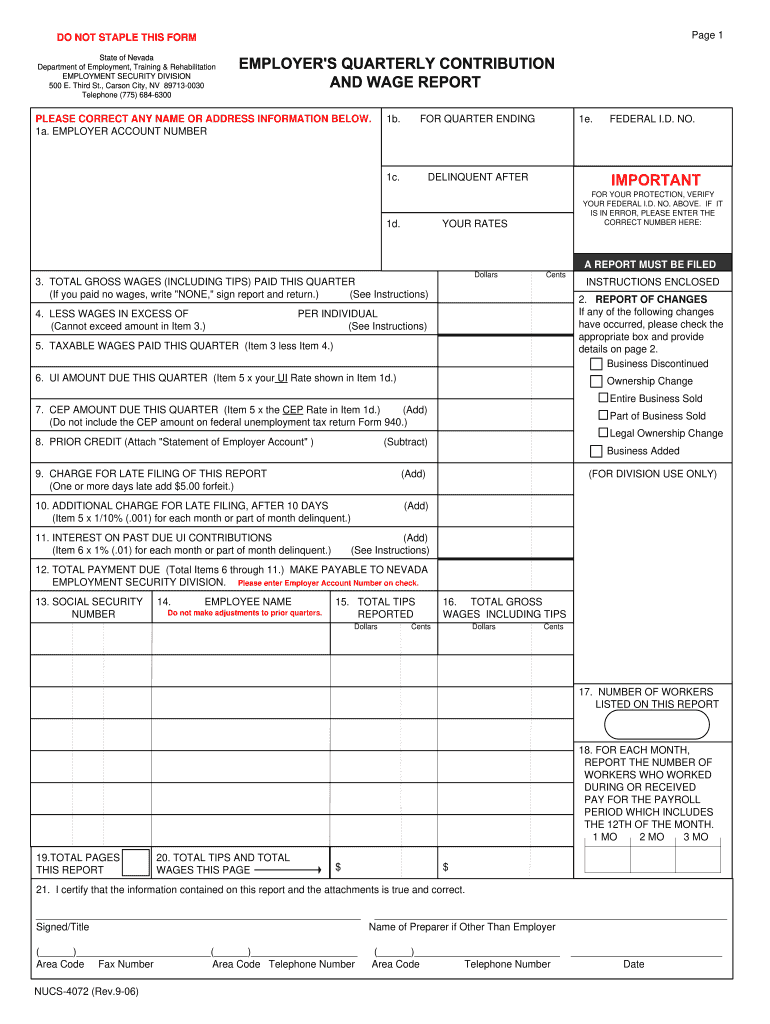

Nucs 4072 Fill Out and Sign Printable PDF Template signNow

Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after. Web home government elected officials county treasurer forms. Las vegas (ktnv) — the deadline to file your property tax cap form for this. Watch this video explaining property tax cap. Web “to fix the upcoming tax.

Clark County PDF

Watch this video explaining property tax cap. Web before june 30, 2022, a significant number of residents submitted forms to the clark county assessor to. Web billing the treasurer's office mails out real property tax bills only one time each fiscal year. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or.

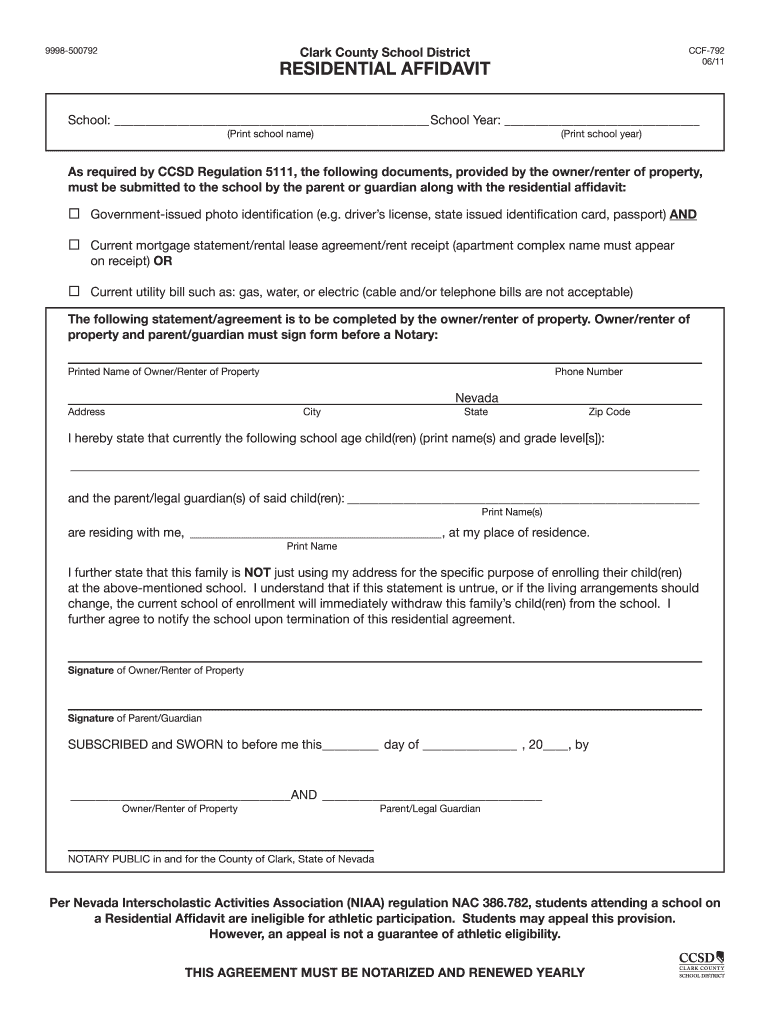

20112021 Form CCSD CCF792 Fill Online, Printable, Fillable, Blank

Web a clark county assessor addresses the property tax cap situation. Web clark county treasurer's office 500 s grand central pkwy. Web “to fix the upcoming tax cap to fix that is 8% for the next fiscal year or starting july 1, you have until june 30th of 2023 to correct that,” said clark. Web if you do not receive.

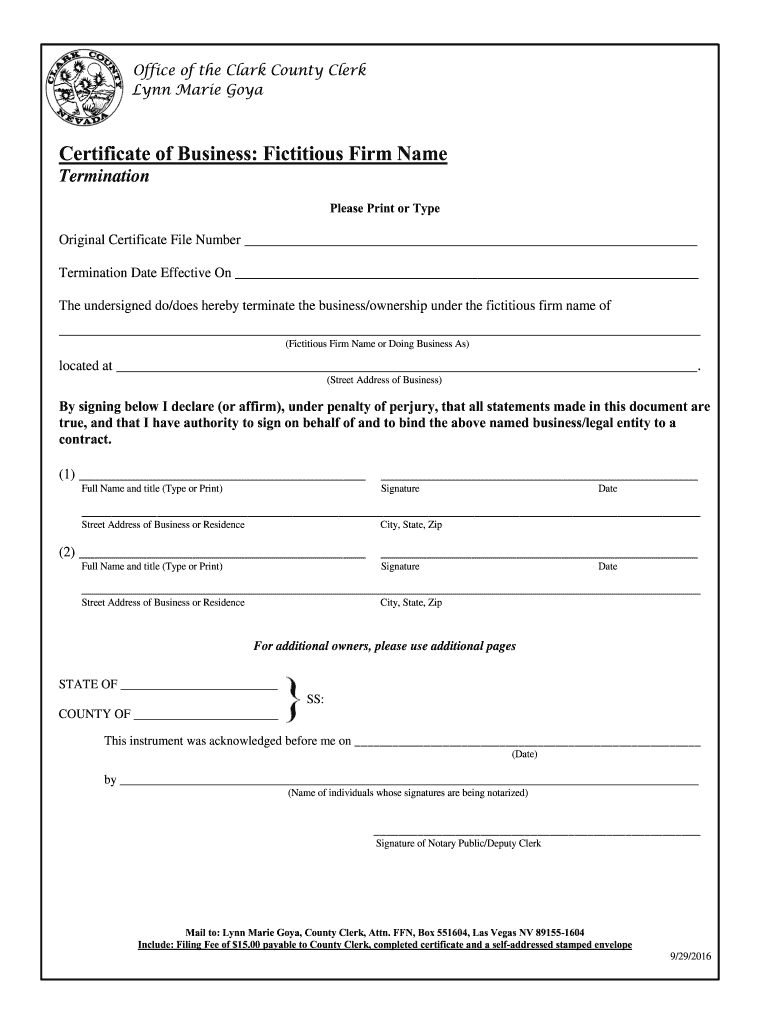

Clark County Fictitious Firm Name Search Form Fill Out and Sign

If you do not receive your tax bill by. Watch this video explaining property tax cap. Web a clark county assessor addresses the property tax cap situation. Web “to fix the upcoming tax cap to fix that is 8% for the next fiscal year or starting july 1, you have until june 30th of 2023 to correct that,” said clark..

Fillable Online clarkcountycourts Financial Disclosure Form Clark

Forms 7 documents real property transfer tax. Web clark county says that residents may still file a claim for a primary residential tax cap rate of 3 percent on. Web before june 30, 2022, a significant number of residents submitted forms to the clark county assessor to. If you do not receive your tax bill by. Web clark county assessor’s.

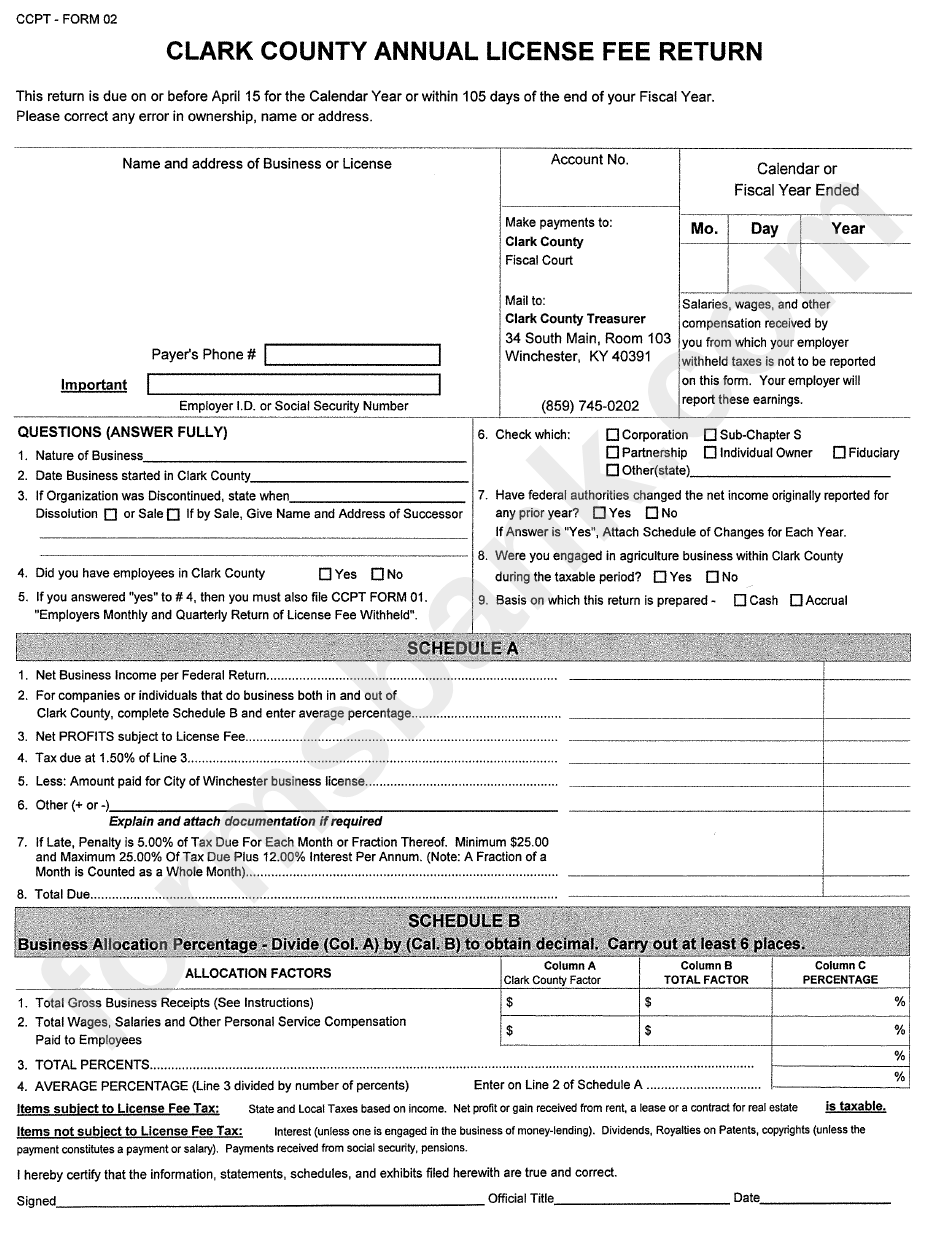

Ccpt Form 02 Annual License Fee Return Clark Country printable pdf

Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after. Las vegas, nv 89155 please note, the online tax statement generates. Web billing the treasurer's office mails out real property tax bills only one time each fiscal year. Web nrs 361.4723 provides a partial abatement of.

Quit Claim Deed Form Clark County Nevada Universal Network

27, 2023 at 4:53 pm pdt las vegas, nev. Watch this video explaining property tax cap. If you do not receive your tax bill by. People still have until next year to apply. Web home government elected officials county treasurer forms.

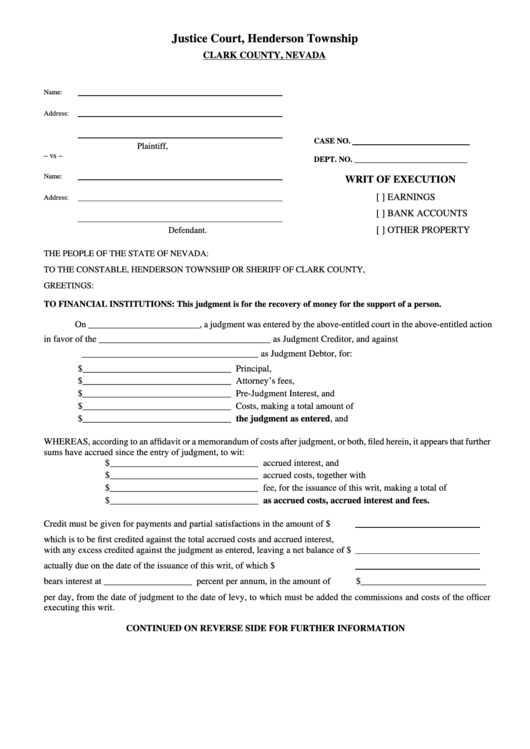

Fillable Writ Of Execution Form Clark County, Nevada printable pdf

Forms 7 documents real property transfer tax. Las vegas, nv 89155 please note, the online tax statement generates. Is this your primary nevada. Web before june 30, 2022, a significant number of residents submitted forms to the clark county assessor to. Web “to fix the upcoming tax cap to fix that is 8% for the next fiscal year or starting.

Web billing the treasurer's office mails out real property tax bills only one time each fiscal year. Web “to fix the upcoming tax cap to fix that is 8% for the next fiscal year or starting july 1, you have until june 30th of 2023 to correct that,” said clark. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after. Web a clark county assessor addresses the property tax cap situation. Web clark county says that residents may still file a claim for a primary residential tax cap rate of 3 percent on. Forms 7 documents real property transfer tax. Las vegas, nv 89155 please note, the online tax statement generates. Web clark county assessor’s office. Web before june 30, 2022, a significant number of residents submitted forms to the clark county assessor to. Web and last updated 7:10 am, jul 01, 2022. Web nrs 361.4723 provides a partial abatement of taxes by applying a 3% cap on the tax bill of the owner's primary residence (single. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). Web if you do not receive a revised bill showing your correct tax cap information by october, please contact the assessor’s office at. 27, 2023 at 4:53 pm pdt las vegas, nev. Web “to fix the upcoming tax cap that is 8 percent for next fiscal year or starting july 1, which is next week, you. Web home government elected officials county treasurer forms. People still have until next year to apply. Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county assessor to correct property. Is this your primary nevada. If you do not receive your tax bill by.

Web The Recorder's Office Provides The Following Blank Forms Search For File Name:

Web clark county says that residents may still file a claim for a primary residential tax cap rate of 3 percent on. Web nrs 361.4723 provides a partial abatement of taxes by applying a 3% cap on the tax bill of the owner's primary residence (single. Web ahead of june 30 of this year, a significant number of residents submitted forms to the clark county assessor to correct property. Web home government elected officials county treasurer forms.

Web Before June 30, 2022, A Significant Number Of Residents Submitted Forms To The Clark County Assessor To.

Is this your primary nevada. Web and last updated 7:10 am, jul 01, 2022. Web a clark county assessor addresses the property tax cap situation. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after.

Web “To Fix The Upcoming Tax Cap That Is 8 Percent For Next Fiscal Year Or Starting July 1, Which Is Next Week, You.

Web if you do not receive a revised bill showing your correct tax cap information by october, please contact the assessor’s office at. Web billing the treasurer's office mails out real property tax bills only one time each fiscal year. Watch this video explaining property tax cap. Web “to fix the upcoming tax cap to fix that is 8% for the next fiscal year or starting july 1, you have until june 30th of 2023 to correct that,” said clark.

Web Clark County Assessor’s Office.

If you do not receive your tax bill by. Web clark county treasurer's office 500 s grand central pkwy. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). People still have until next year to apply.