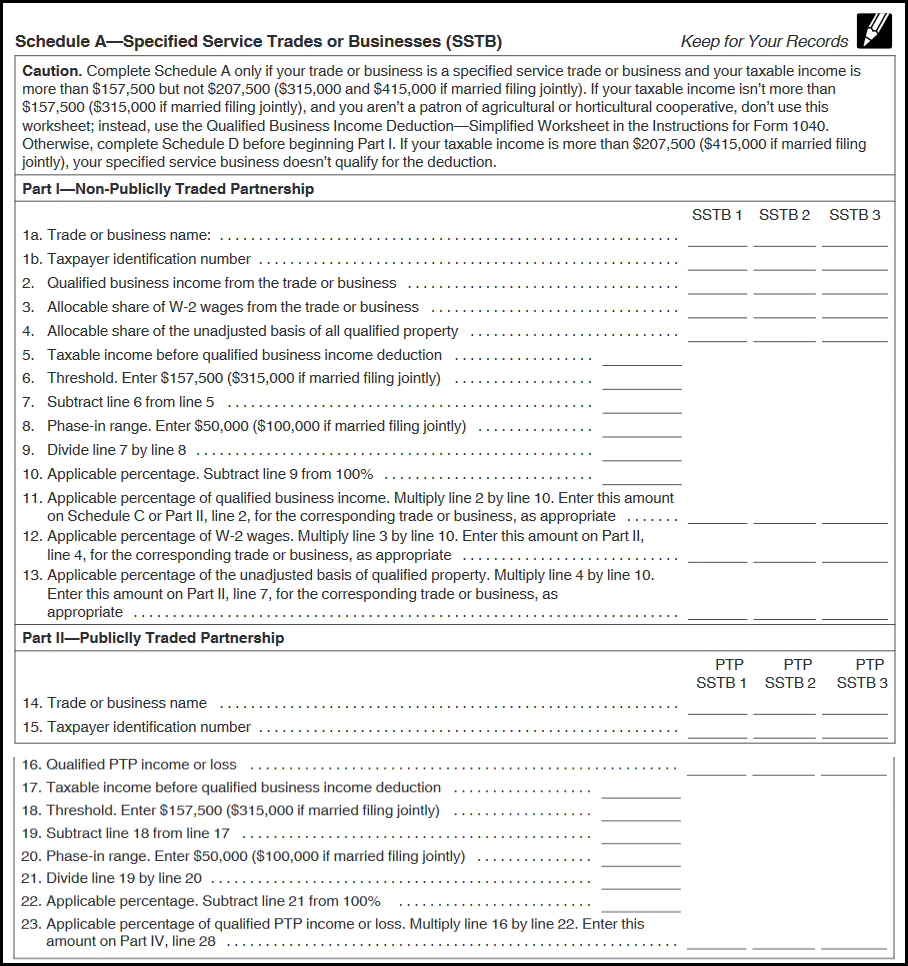

Section 199A Information Worksheet - Web the partnership’s section 199a information worksheet and partner’s section 199a information worksheet are available in. Web section 199a income. Generally, you may be allowed a deduction of up to 20% of your net. Web many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified. Web section 199a defines specified service businesses to professional fields like law, financial services,. Web the deduction is effective for tax years beginning in 2018 and is available for tax years beginning before december 31,. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s. Web trade or business defined for purposes of §199a 7 qbi defined the net amount of qualified items of income, gain, deduction. You may mark more than one unit of screen. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,.

Personal Worksheet Turbotax

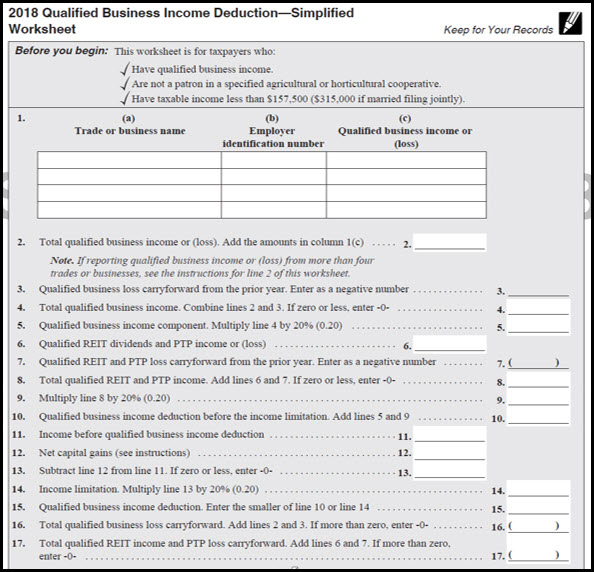

Web section 199a is a qualified business income (qbi) deduction. Web like most of the changes in the individual income tax in p.l. Web the partnership’s section 199a information worksheet and partner’s section 199a information worksheet are available in. You may mark more than one unit of screen. Web at the top of the schedule c or f check yes.

Section 199a Deduction Worksheet Master of Documents

Web like most of the changes in the individual income tax in p.l. Web the partnership’s section 199a information worksheet and partner’s section 199a information worksheet are available in. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web section 199a information worksheet. Web section 199a items based on the.

Section 199a Information Worksheet

Web section 199a items based on the relative proportion of the estate's or trust's distributable net income (dni) for the tax. Generally, you may be allowed a deduction of up to 20% of your net. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. This is the net ordinary income or,.

Section 199a Information Worksheet

Web like most of the changes in the individual income tax in p.l. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s. Generally, you may be allowed a deduction of up to 20% of your net. Qbi or qualified ptp items subject to shareholder. Web this worksheet is designed for tax professionals to.

Section 199a Information Worksheet

Web the section 199a information worksheet includes columns for multiple activities. Generally, you may be allowed a deduction of up to 20% of your net. You may mark more than one unit of screen. Web section 199a income. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s.

Section 199a Information Worksheet

Web calculating the section 199a deductions. Qbi or qualified ptp items subject to shareholder. Web many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified. This is the net ordinary income or, generally, the net rental income produced by the entity. Web the partnership’s section 199a information worksheet and partner’s section.

Section 199a Information Worksheet

Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. This is the net ordinary income or, generally, the net rental income produced by the entity. Web section 199a income. Web calculating the section 199a deductions. Web section 199a information worksheet.

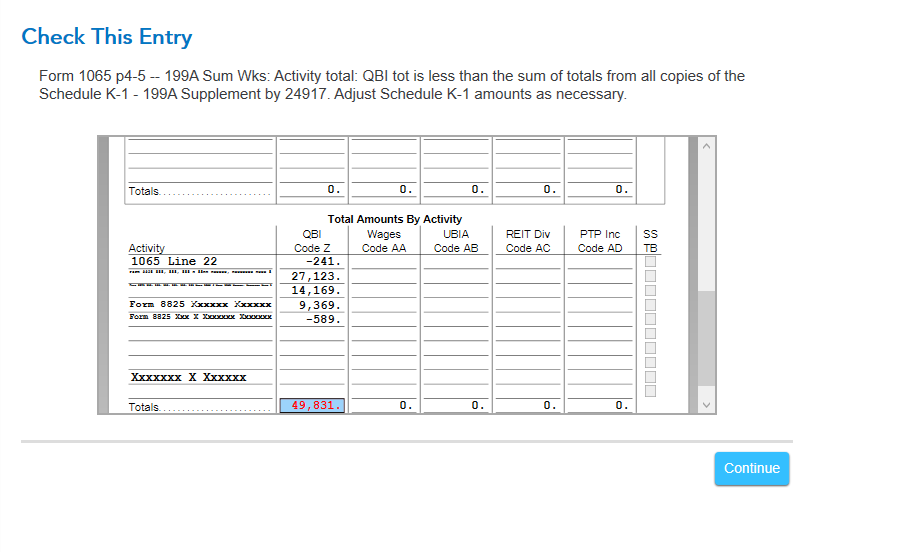

Lacerte Complex Worksheet Section 199A Qualified Business Inco

Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s. Web the partnership’s section 199a information worksheet and partner’s section 199a information worksheet are available in. Web section 199a items based on the relative proportion of the estate's or trust's distributable net income (dni) for the tax. Web section 199a information worksheet. This is.

Lacerte QBI Section 199A Partnership and SCorporate Details

Web section 199a information worksheet. Web section 199a defines specified service businesses to professional fields like law, financial services,. Generally, you may be allowed a deduction of up to 20% of your net. Web the section 199a information worksheet for the s corporation and the shareholder, and the section 199a aggregation worksheets. You may mark more than one unit of.

ProConnect Tax Online Simplified Worksheet Section 199A Qualif

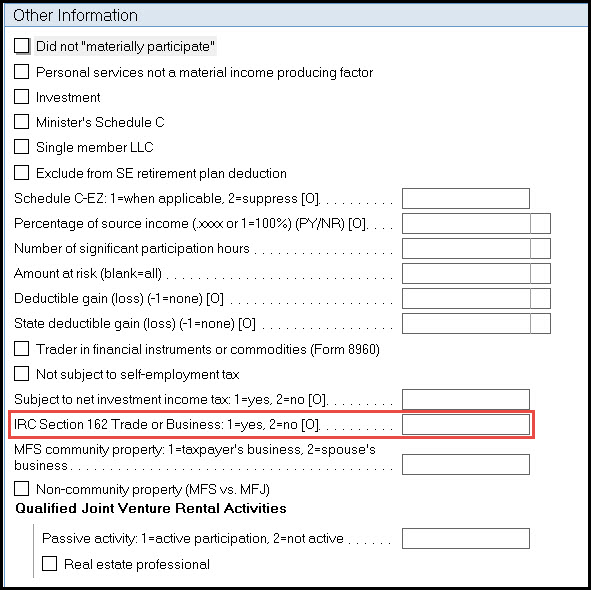

Web section 199a defines specified service businesses to professional fields like law, financial services,. Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a?. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web like most.

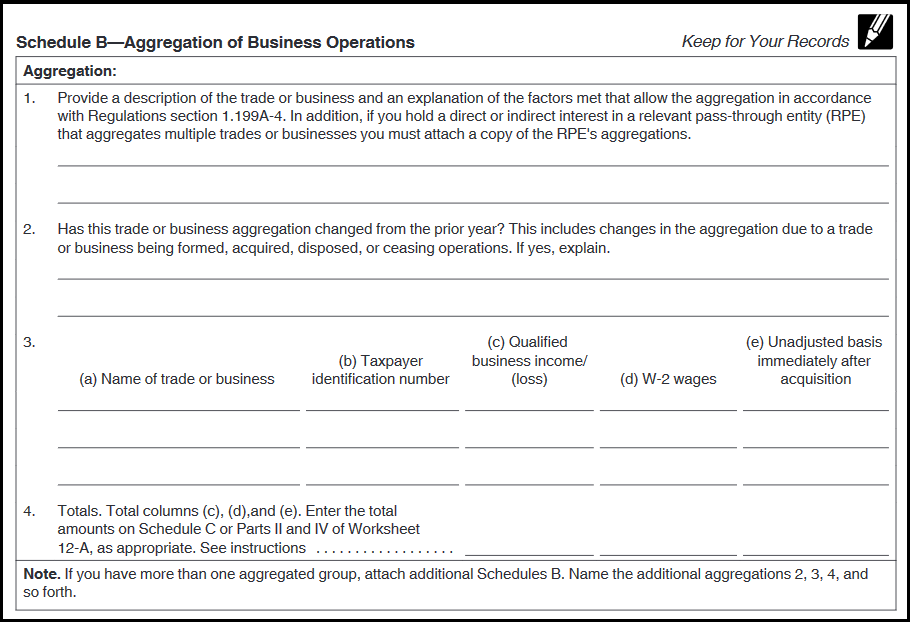

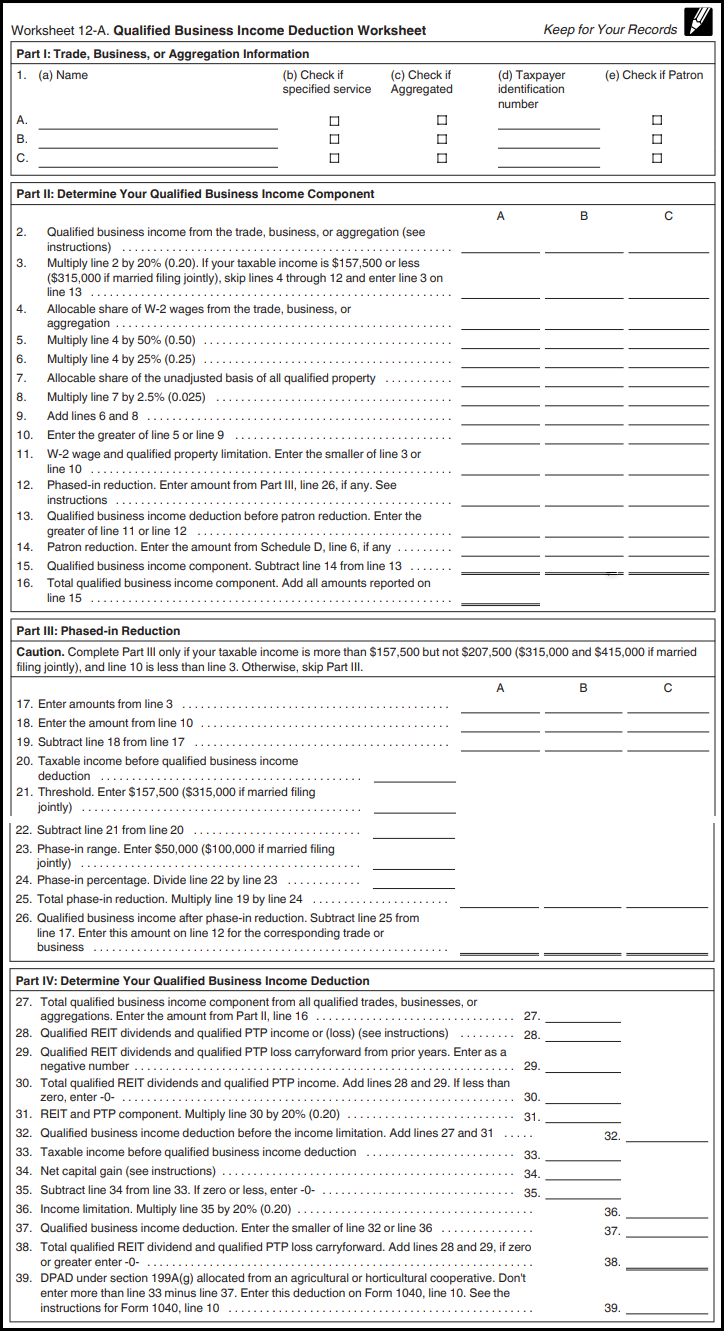

Web the section 199a information worksheet includes columns for multiple activities. Web calculating the section 199a deductions. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s. Web like most of the changes in the individual income tax in p.l. Web the section 199a information worksheet for the s corporation and the shareholder, and the section 199a aggregation worksheets. Web trade or business defined for purposes of §199a 7 qbi defined the net amount of qualified items of income, gain, deduction. Web section 199a items based on the relative proportion of the estate's or trust's distributable net income (dni) for the tax. This is the net ordinary income or, generally, the net rental income produced by the entity. Web section 199a information worksheet. Web section 199a income. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web at the top of the schedule c or f check yes for is this activity a qualified trade or business under section 199a?. Web section 199a is a qualified business income (qbi) deduction. Web the partnership’s section 199a information worksheet and partner’s section 199a information worksheet are available in. Web section 199a defines specified service businesses to professional fields like law, financial services,. You may mark more than one unit of screen. Qbi or qualified ptp items subject to shareholder. With this deduction, select types of domestic. Web the deduction is effective for tax years beginning in 2018 and is available for tax years beginning before december 31,.

Web The Partnership’s Section 199A Information Worksheet And Partner’s Section 199A Information Worksheet Are Available In.

Web section 199a items based on the relative proportion of the estate's or trust's distributable net income (dni) for the tax. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s. Web the section 199a information worksheet includes columns for multiple activities.

This Is The Net Ordinary Income Or, Generally, The Net Rental Income Produced By The Entity.

Web the deduction is effective for tax years beginning in 2018 and is available for tax years beginning before december 31,. Web section 199a is a qualified business income (qbi) deduction. Qbi or qualified ptp items subject to shareholder. Web section 199a information worksheet.

Web Calculating The Section 199A Deductions.

You may mark more than one unit of screen. With this deduction, select types of domestic. Web section 199a income. Generally, you may be allowed a deduction of up to 20% of your net.

Web At The Top Of The Schedule C Or F Check Yes For Is This Activity A Qualified Trade Or Business Under Section 199A?.

Web like most of the changes in the individual income tax in p.l. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider,. Web section 199a defines specified service businesses to professional fields like law, financial services,. Web trade or business defined for purposes of §199a 7 qbi defined the net amount of qualified items of income, gain, deduction.