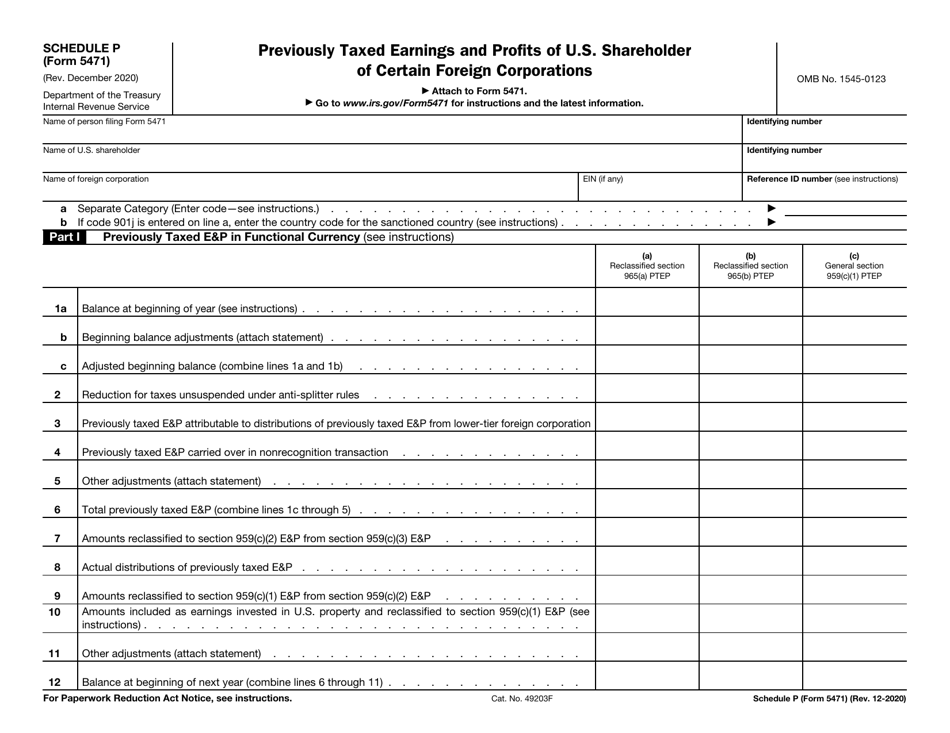

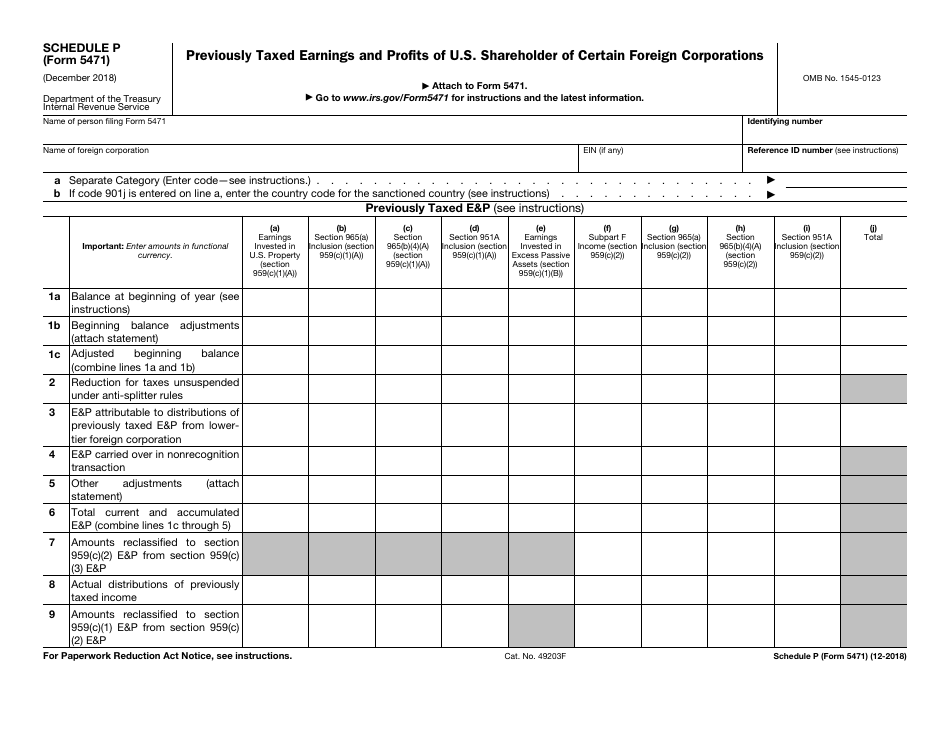

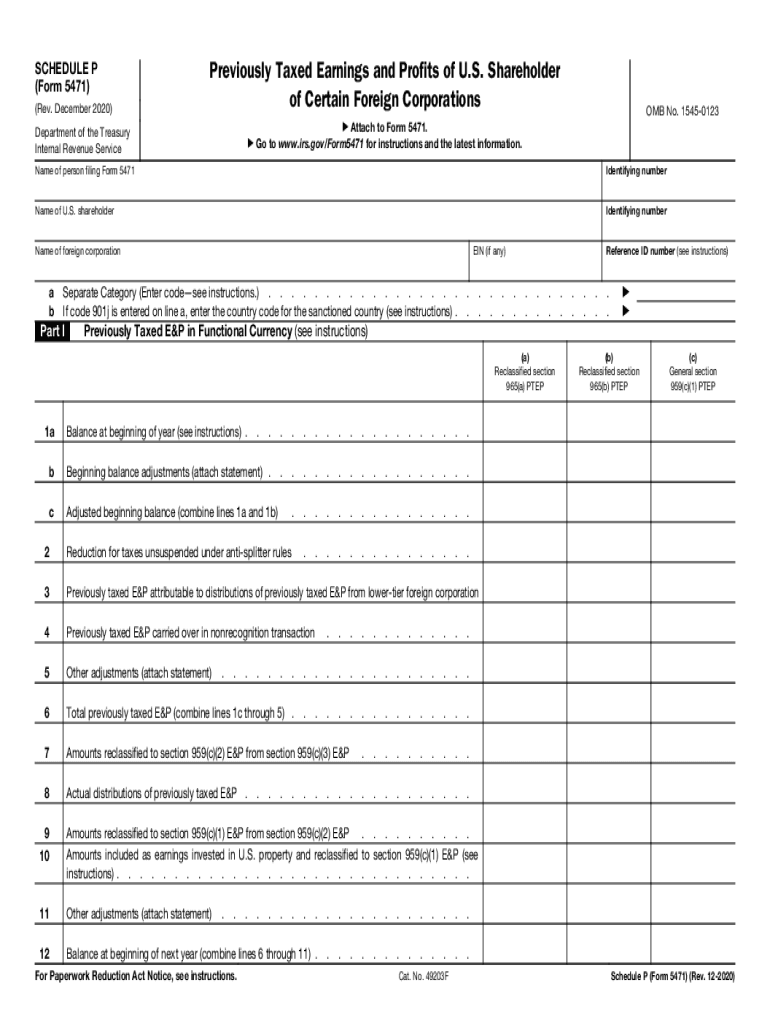

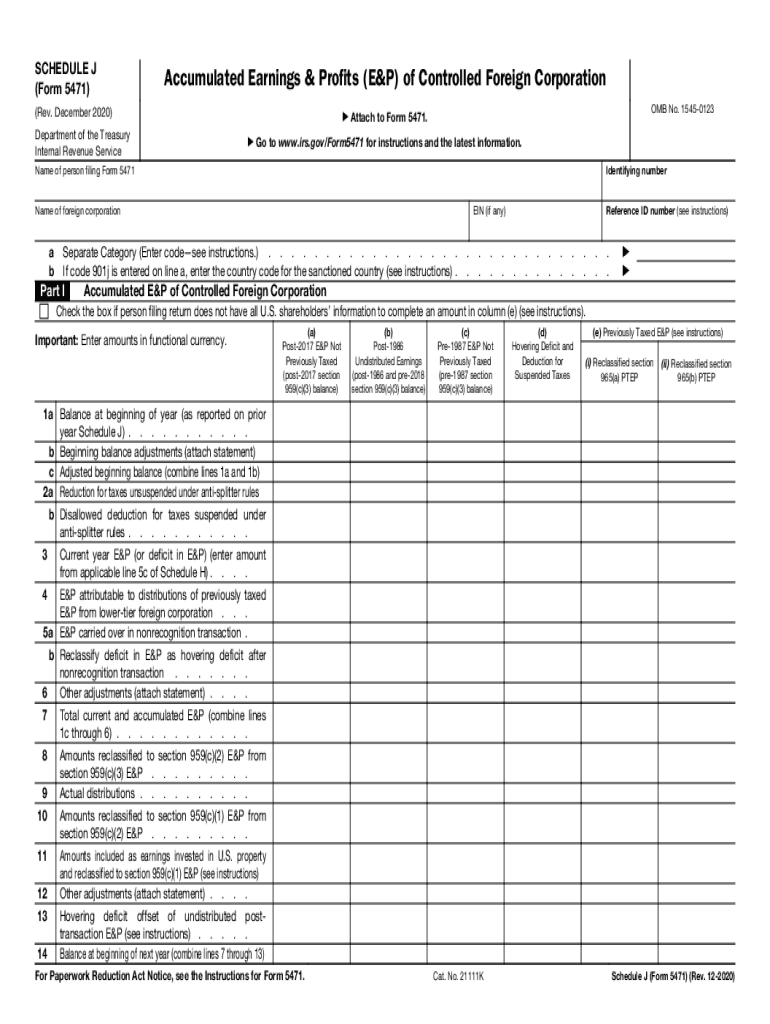

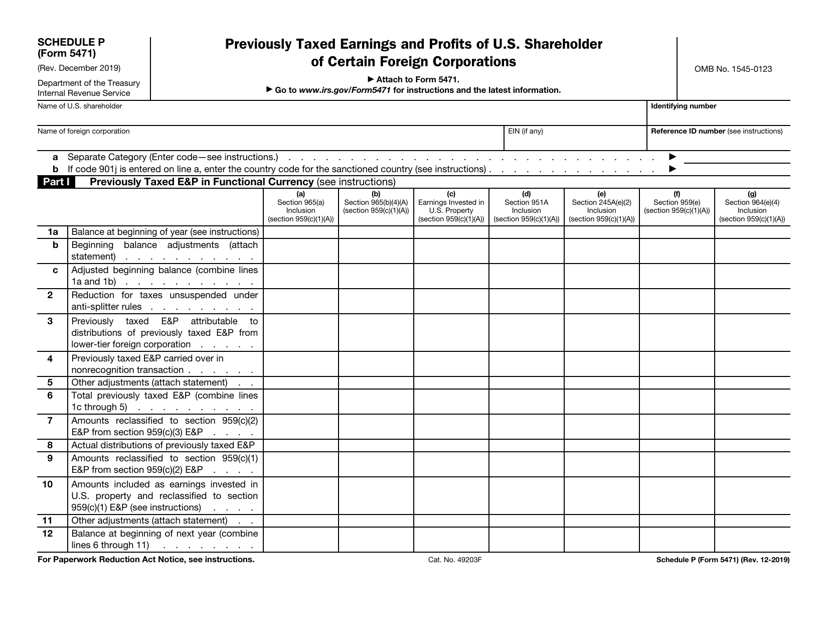

Schedule P Form 5471 - Schedule p reports the previously taxed earnings and profits. Shareholder (c) earnings invested in u.s. Schedule p (form 5471) (rev. Web description properly preparing form 5471, information return of u.s. Web instructions for form 5471(rev. Web for example, with respect to line a at the top of page 1 of schedule p, there is a new code “total” that is required for schedule p filers in certain circumstances. Shareholder of a controlled foreign. Whether or not a cfc shareholder is required to complete schedule p depends. Web (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; January 2023) (use with the december 2022 revision of form 5471 and separate schedule q;

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Schedule p (form 5471) (rev. However, category 1 and 5. Web (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; The december 2019 revision of. Web schedule p of form 5471 is used to report ptep of the u.s.

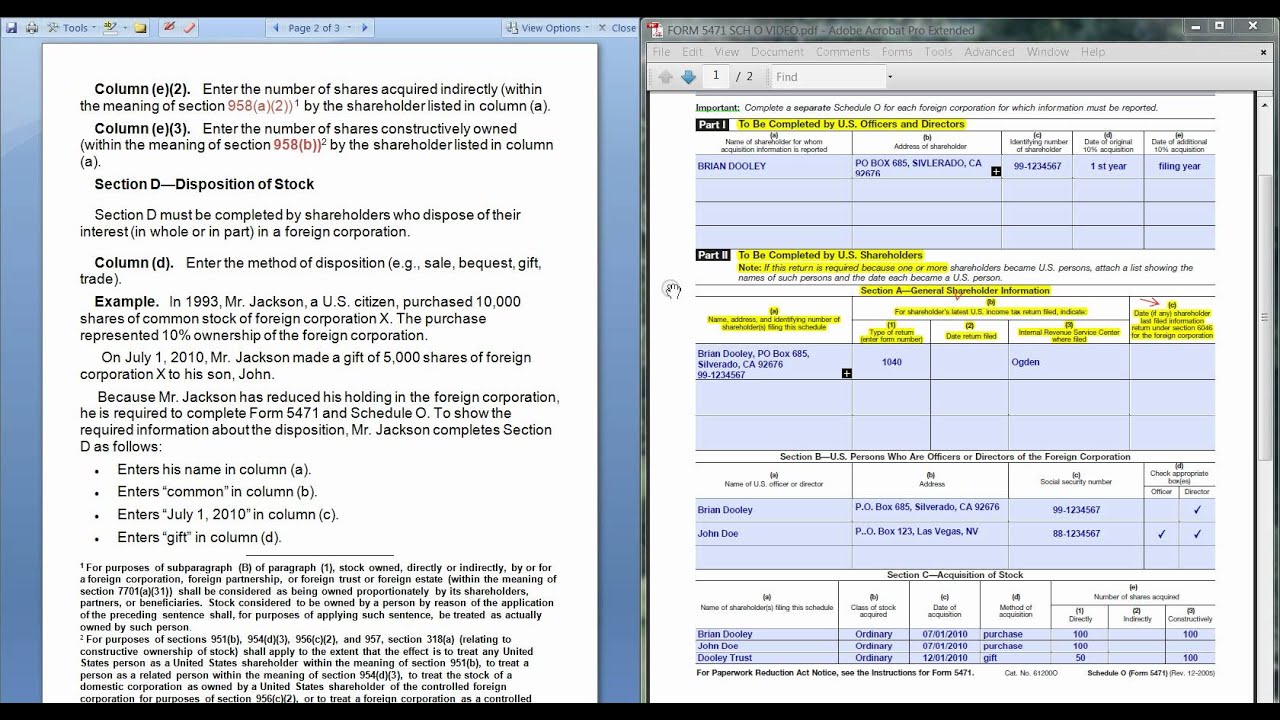

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

Web (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; No need to install software, just go to dochub, and sign up instantly and for free. Web for example, with respect to line a at the top of page 1 of schedule p, there is a new code “total” that.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Shareholder of a controlled foreign currency (“cfc”) in the cfc’s. Persons with respect to certain foreign corporations, is designed to report the. Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471. Schedule p (form 5471) (rev. Web description properly preparing form 5471, information return of u.s.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web schedule p is just one schedule of the form 5471. The december 2019 revision of. Whether or not a cfc shareholder is required to.

Schedule P Fill Out and Sign Printable PDF Template signNow

Persons with respect to certain foreign. Web (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Schedule p (form 5471) (rev. December 2020) department of the treasury internal revenue service. Unlike the previous schedule, form 5471 schedule p applies to everyone except filers from.

A Deep Dive Into IRS Form 5471 Schedule P SF Tax Counsel

Shareholder of a controlled foreign currency (“cfc”) in the cfc’s. Persons with respect to certain foreign corporations, is designed to report the. The december 2019 revision of. Web form 5471, information return of u.s. Web schedule p (form 5471) (rev.

Form 5471 Fill Out and Sign Printable PDF Template signNow

The december 2019 revision of. Web instructions for form 5471(rev. Whether or not a cfc shareholder is required to complete schedule p depends. Shareholder of certain foreign corporations schedule q. Persons with respect to certain foreign.

IRS Issues Updated New Form 5471 What's New?

Web for example, with respect to line a at the top of page 1 of schedule p, there is a new code “total” that is required for schedule p filers in certain circumstances. Web schedule p (form 5471), previously taxed earnings and profits of u.s. Shareholder of a controlled foreign currency (“cfc”) in the cfc’s. Web schedule p (form 5471).

Schedule P Previously Taxed E&P of US Shareholder IRS Form 5471

Web for example, with respect to line a at the top of page 1 of schedule p, there is a new code “total” that is required for schedule p filers in certain circumstances. Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service previously taxed earnings and profits of u.s. No need to install software, just.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web description properly preparing form 5471, information return of u.s. Web schedule p.36 schedule q.37 schedule r.40 future developments for the latest information about developments related to. Shareholder has previously taxed e&p related to section 965 that is reportable on schedule p (form 5471). Web schedule p (form 5471), previously taxed earnings and profits of u.s. Web edit, sign, and.

Web (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Unlike the previous schedule, form 5471 schedule p applies to everyone except filers from. Schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Web instructions for form 5471(rev. Web schedule p is just one schedule of the form 5471. No need to install software, just go to dochub, and sign up instantly and for free. Web schedule p.36 schedule q.37 schedule r.40 future developments for the latest information about developments related to. Schedule p reports the previously taxed earnings and profits. The december 2019 revision of. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Schedule p (form 5471) (rev. Web form 5471, information return of u.s. Web for example, with respect to line a at the top of page 1 of schedule p, there is a new code “total” that is required for schedule p filers in certain circumstances. Web schedule p of form 5471 is used to report ptep of the u.s. Shareholder of a controlled foreign currency (“cfc”) in the cfc’s. Web description properly preparing form 5471, information return of u.s. Web schedule p is a crucial component of form 5471, a comprehensive reporting requirement imposed by the u.s. Shareholder of a controlled foreign. Web schedule p (form 5471) (rev. Web schedule p (form 5471) (rev.

Whether Or Not A Cfc Shareholder Is Required To Complete Schedule P Depends.

Web schedule p is a crucial component of form 5471, a comprehensive reporting requirement imposed by the u.s. The december 2019 revision of. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web schedule p (form 5471), previously taxed earnings and profits of u.s.

Schedule P Reports The Previously Taxed Earnings And Profits.

Shareholder of a controlled foreign currency (“cfc”) in the cfc’s. Shareholder of certain foreign corporations schedule q. Web description properly preparing form 5471, information return of u.s. Schedule p (form 5471) (rev.

Web Schedule P.36 Schedule Q.37 Schedule R.40 Future Developments For The Latest Information About Developments Related To.

Shareholder of a controlled foreign. Web schedule p (form 5471) (rev. December 2020) department of the treasury internal revenue service. Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471.

Web In Order To Track The Ptep For Foreign Corporations, The Form 5471 Developed Schedule P, Which Refers To Previously.

Persons with respect to certain foreign. Web schedule p (form 5471) (rev. Schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Persons with respect to certain foreign corporations, is designed to report the.