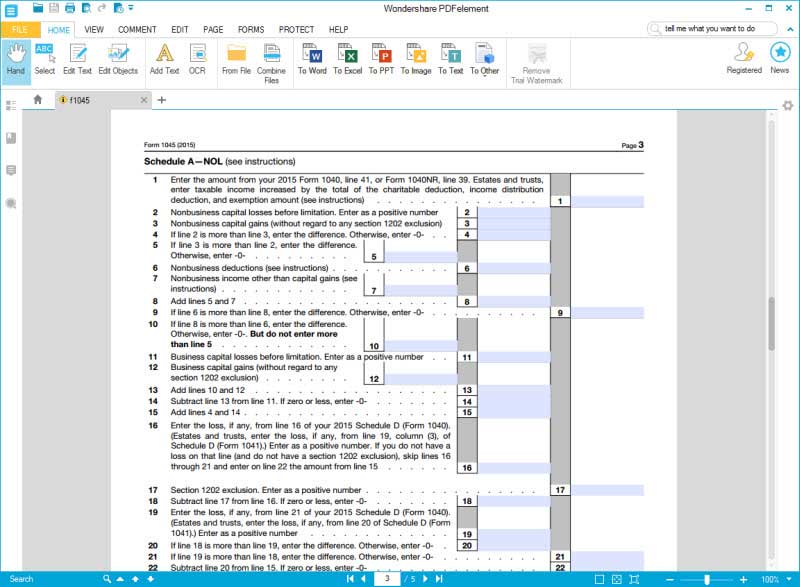

Schedule A Form 1045 - Web enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year if you. Green numbers (or 0) are user. Filing form 1045 with a carryback to a section 965 inclusion year. Web desktop navigation instructions click forms in the top left corner of the toolbar. Web about form 1045, application for tentative refund. Web enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year if you. This tax form is often used to receive a tax refund due to a business loss. An individual, estate, or trust files form 1045 to apply for a quick tax refund. Web information on how to make the election. Web attach a computation of your nol using form 1045, schedule a, and, if it applies, your nol carryover using form 1045, schedule b, discussed later.

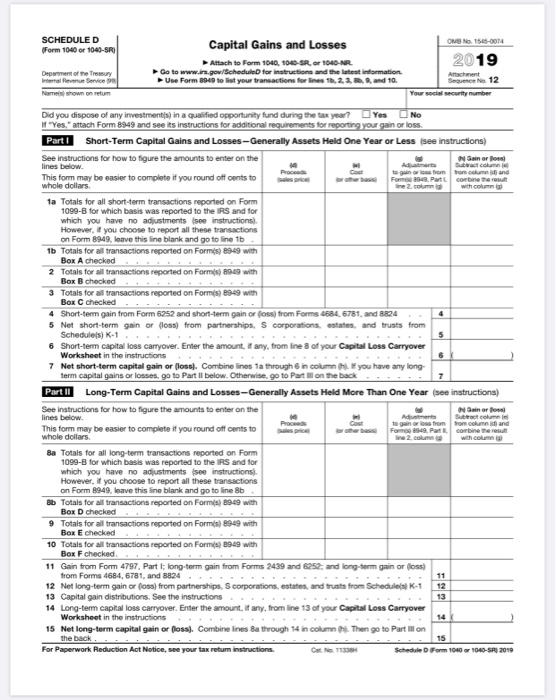

Solved Complete a 1040 Schedule D For this assignment, you

Web form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or. Application for tentative refund is an internal revenue service (irs) form used by individuals,. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line. Web definition irs form 1045 is a.

IRS Form 1045 Fill it as You Want

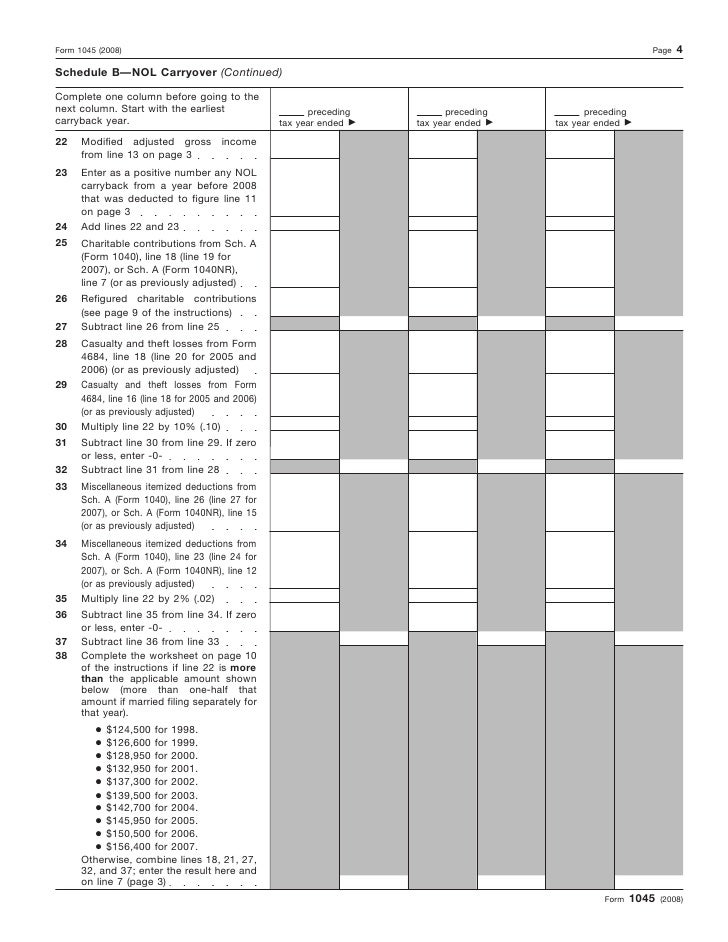

Web attach a computation of your nol using form 1045, schedule a, and, if it applies, your nol carryover using form 1045, schedule b, discussed later. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates,. Web about form 1045, application for tentative refund. Web definition irs form 1045 is a tax form.

2020 Irs Instructions Form 1045 Fill Out and Sign Printable PDF

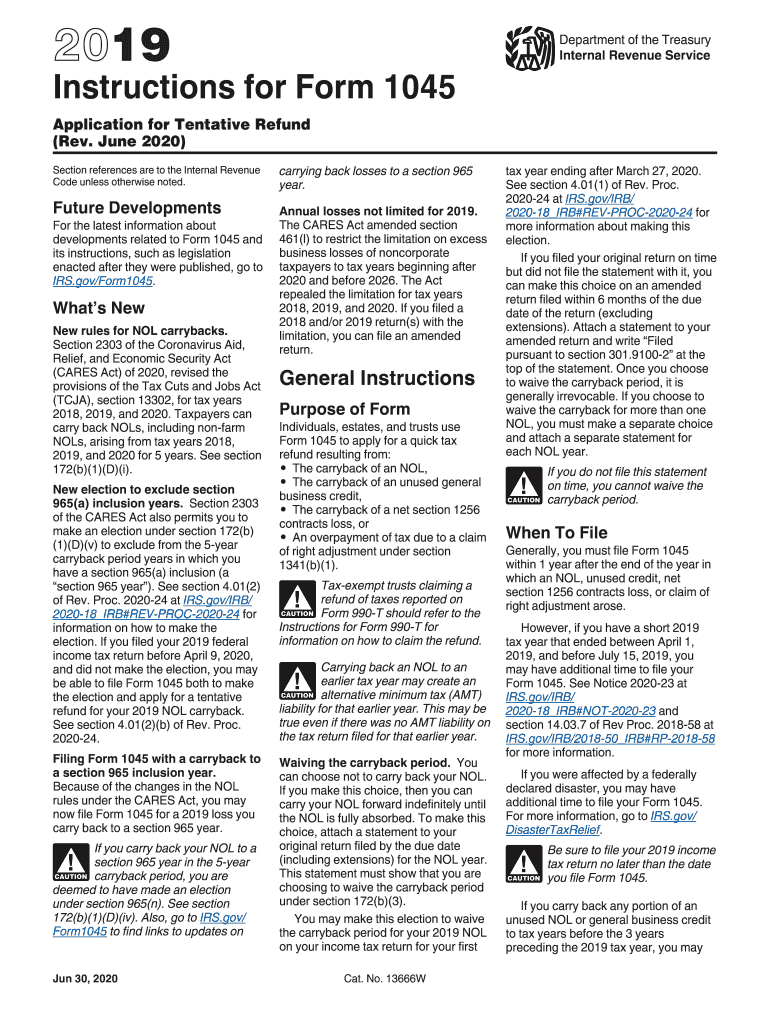

Web definition irs form 1045 is a tax form that some individuals, estates, or trusts use to quickly receive a tax refund related to a previous tax filing rather than receiving the refund by filing an amended tax return. Web a person must file form 1045 within 1 year after the end of the year in which an nol, unused.

Form 1045 Application for Tentative Refund

Web a person must file form 1045 within 1 year after the end of the year in which an nol, unused credit, a net section 1256 contract. Web enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year if you. Web form 1045 schedule a is used to compute a.

Form 1045 Application for Tentative Refund (2014) Free Download

Web information on how to make the election. Web attach to the amended return a copy of schedule a of form 1045 showing the computation of the nol and, if applicable, a copy of schedule b of form 1045. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line. Web about form 1045,.

IRS Form 1045 Fill it as You Want

An individual, estate, or trust files form 1045 to apply for a quick tax refund. Itemized deductions is an internal revenue service (irs) form for u.s. Application for tentative refund is an internal revenue service (irs) form used by individuals,. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates,. Web attach a.

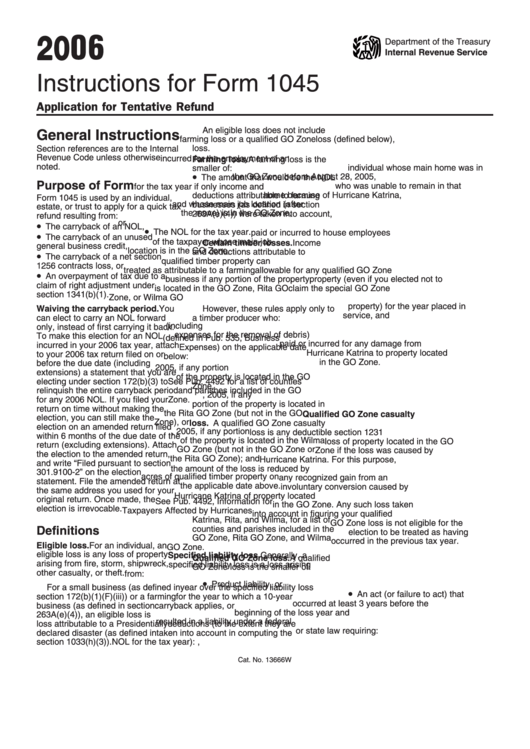

Instructions For Form 1045 Application For Tentative Refund 2006

Web about form 1045, application for tentative refund. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on. Web information on how to make the election. Web attach to the amended return a copy of schedule a of form 1045 showing the computation of the nol and, if applicable, a copy of schedule.

2020 Form 1045 2020 Blank Sample to Fill out Online in PDF

Itemized deductions is an internal revenue service (irs) form for u.s. Web desktop navigation instructions click forms in the top left corner of the toolbar. Web individuals will enter the amount on line 21 from schedule d on form 1040 as a positive number, if applicable. Click to expand the federal folder, then click to. An individual, estate, or trust.

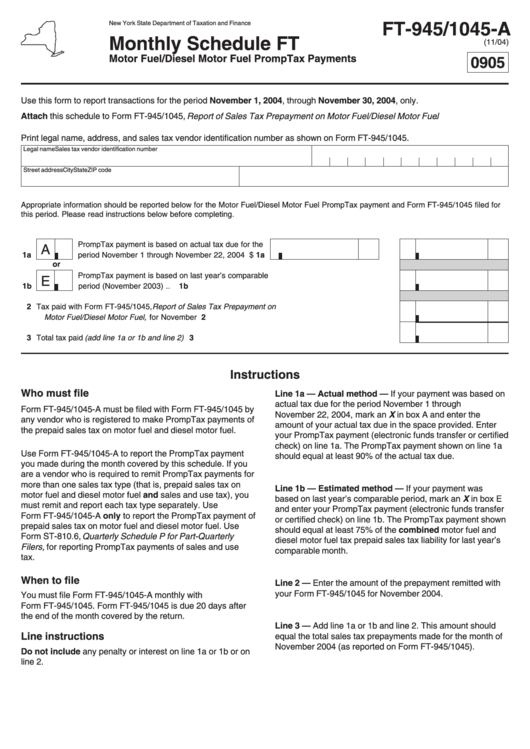

Form Ft945/1045A Monthly Schedule Ft Motor Fuel/diesel Motor Fuel

Web enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year if you. Web about form 1045, application for tentative refund. Web if you filed your 2019 federal income tax return before april 9, 2020, and did not make the election, you may be able to file form. This tax.

Publication 536, Net Operating Losses (NOLs) for Individuals, Estates

Web a person must file form 1045 within 1 year after the end of the year in which an nol, unused credit, a net section 1256 contract. This tax form is often used to receive a tax refund due to a business loss. Green numbers (or 0) are user. Web form 1045 department of the treasury internal revenue service application.

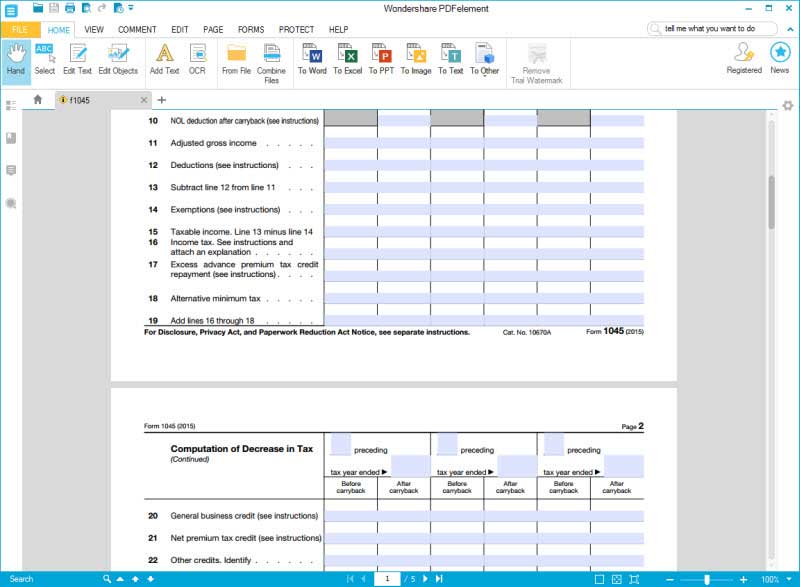

Web attach to the amended return a copy of schedule a of form 1045 showing the computation of the nol and, if applicable, a copy of schedule b of form 1045. This tax form is often used to receive a tax refund due to a business loss. Web enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year if you. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line. Web about form 1045, application for tentative refund. Web enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year if you. Filing form 1045 with a carryback to a section 965 inclusion year. Itemized deductions is an internal revenue service (irs) form for u.s. Web form 1045 department of the treasury. Web information on how to make the election. An individual, estate, or trust files form 1045 to apply for a quick tax refund. Web individuals will enter the amount on line 21 from schedule d on form 1040 as a positive number, if applicable. The schedule will appear on the right side of your screen. Web definition irs form 1045 is a tax form that some individuals, estates, or trusts use to quickly receive a tax refund related to a previous tax filing rather than receiving the refund by filing an amended tax return. Click to expand the federal folder, then click to. Green numbers (or 0) are user. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates,. Web form 1045 computation of decrease in tax (continued) preceding tax year ended: Web desktop navigation instructions click forms in the top left corner of the toolbar. Web a person must file form 1045 within 1 year after the end of the year in which an nol, unused credit, a net section 1256 contract.

Web Enter The Appropriate Amount From Your Calculations On Form 1045 That Is To Be Carried Forward To The Current Year If You.

Web definition irs form 1045 is a tax form that some individuals, estates, or trusts use to quickly receive a tax refund related to a previous tax filing rather than receiving the refund by filing an amended tax return. Web a person must file form 1045 within 1 year after the end of the year in which an nol, unused credit, a net section 1256 contract. Web desktop navigation instructions click forms in the top left corner of the toolbar. Web attach to the amended return a copy of schedule a of form 1045 showing the computation of the nol and, if applicable, a copy of schedule b of form 1045.

Green Numbers (Or 0) Are User.

Web form 1045 computation of decrease in tax (continued) preceding tax year ended: If you are claiming a net qualified disaster loss on form 4684, see the instructions for line. Web information on how to make the election. Itemized deductions is an internal revenue service (irs) form for u.s.

Click To Expand The Federal Folder, Then Click To.

Web attach a computation of your nol using form 1045, schedule a, and, if it applies, your nol carryover using form 1045, schedule b, discussed later. Web if you filed your 2019 federal income tax return before april 9, 2020, and did not make the election, you may be able to file form. Web form 1045 department of the treasury internal revenue service application for tentative refund for individuals, estates,. This tax form is often used to receive a tax refund due to a business loss.

Filing Form 1045 With A Carryback To A Section 965 Inclusion Year.

Web enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year if you. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on. The schedule will appear on the right side of your screen. Application for tentative refund is an internal revenue service (irs) form used by individuals,.