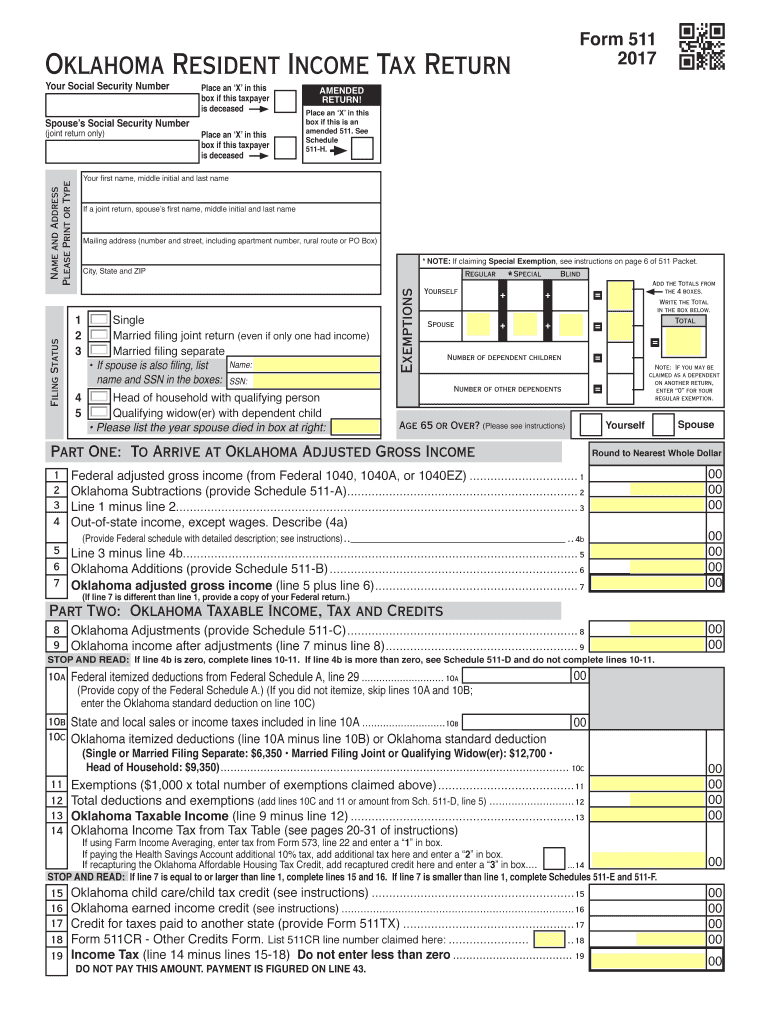

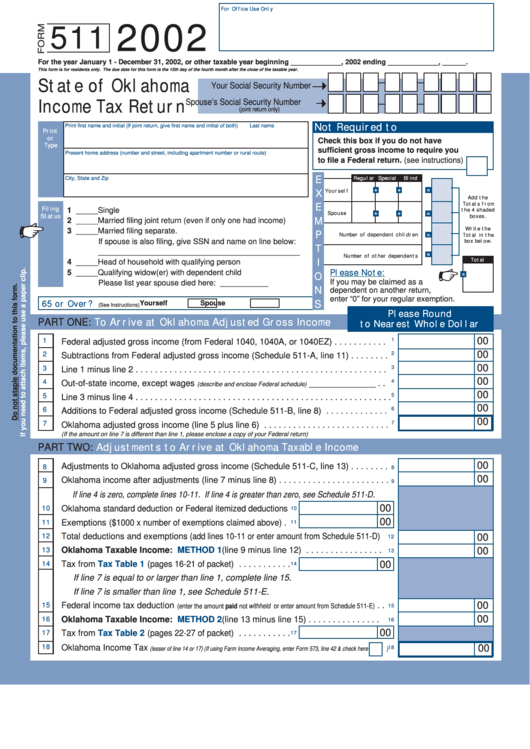

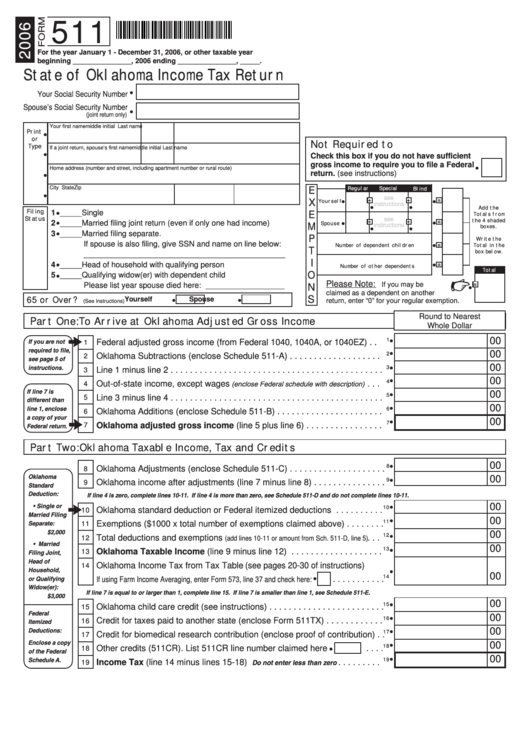

Oklahoma Tax Form 511A - To see the calculation for line. Oklahoma resident income tax return • form 511: We will update this page with a new version of. Start by gathering all the necessary documents, such as your. We will update this page with a new version of. Web how is the amount calculated on line 6 of schedule 511a for an oklahoma individual tax return? Web 2022 oklahoma resident individual income tax forms and instructions. If you have already filed your return, either electronically or by paper,. Tax credits transferred or allocated must be reported on oklahoma tax commission. • instructions for completing the form 511:

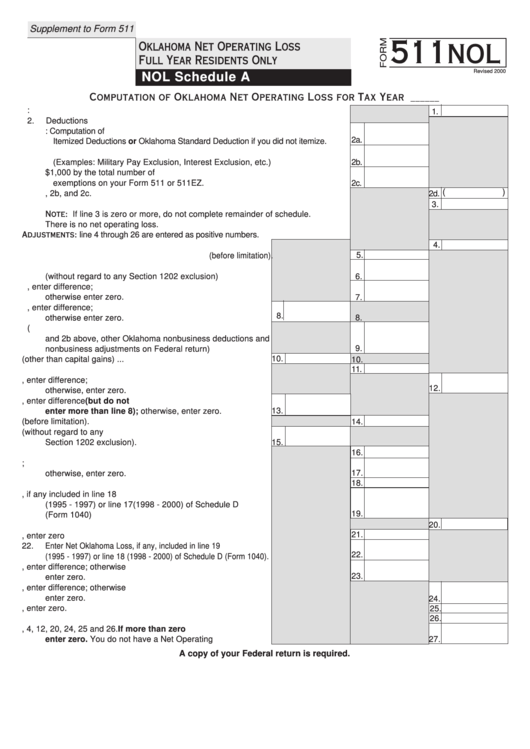

Form 511 Nol Nol Schedule A Oklahoma Net Operating Loss Full Year

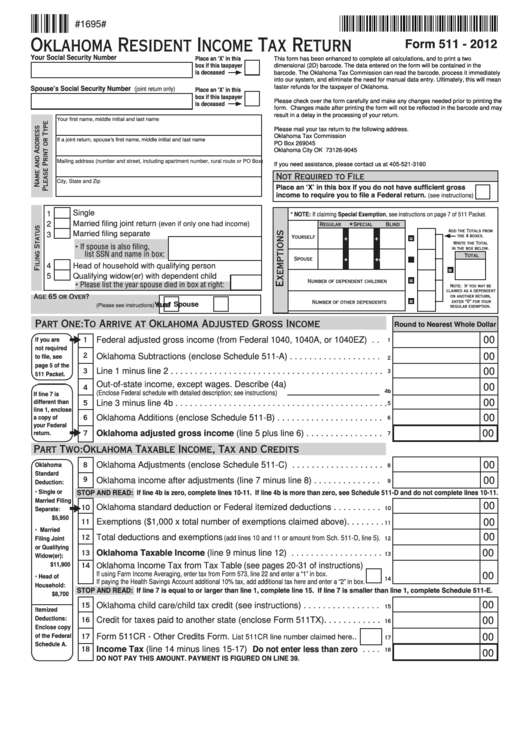

Form 511 can be efiled, or a paper copy can be filed via mail. • instructions for completing the. Oklahoma resident income tax return (metropolitan library system) form is 18 pages long and contains: • instructions for completing the form 511: Web 2021 oklahoma resident individual income tax forms and instructions.

Printable Oklahoma Tax Form 511 Printable World Holiday

Form 511 can be efiled, or a paper copy can be filed via mail. We will update this page with a new version of. Web 2020 oklahoma resident individual income tax forms and instructions. Oklahoma allows the following subtractions from income:. Web if you need to change or amend an accepted oklahoma state income tax return for the current or.

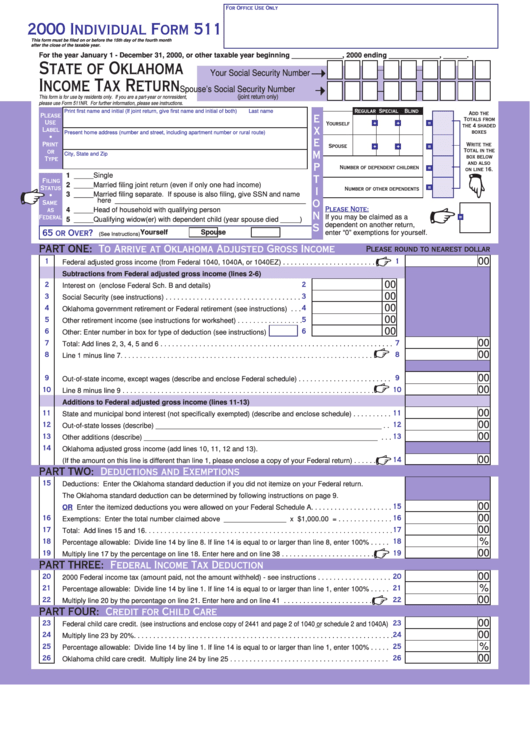

Individual Form 511 State Of Oklahoma Tax Return 2000

Web 18 rows the oklahoma income tax rate for tax year 2022 is progressive from a low of 0.25% to a high of 4.75%. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Tax credits transferred or allocated must be reported on oklahoma tax commission. Web if you.

Oklahoma tax form 511 Fill out & sign online DocHub

• instructions for completing the. Web total available credit (a + b = c) notice. Web 2022 oklahoma resident individual income tax forms and instructions. Web form 511 is the general income tax return for oklahoma residents. • instructions for completing the.

Does Oklahoma Have Personal Property Tax On Vehicles ZDOLLZ

Web 2021 oklahoma resident individual income tax forms and instructions. Oklahoma allows the following subtractions from income:. Form 511 can be efiled, or a paper copy can be filed via mail. • instructions for completing the. Web form 511 is the general income tax return for oklahoma residents.

Form 511 State Of Oklahoma Tax Return 2002 printable pdf

Web form 511 is the general income tax return for oklahoma residents. Oklahoma allows the following subtractions from income:. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. • instructions for completing the form 511: Web how to fill out oklahoma tax commission forms:

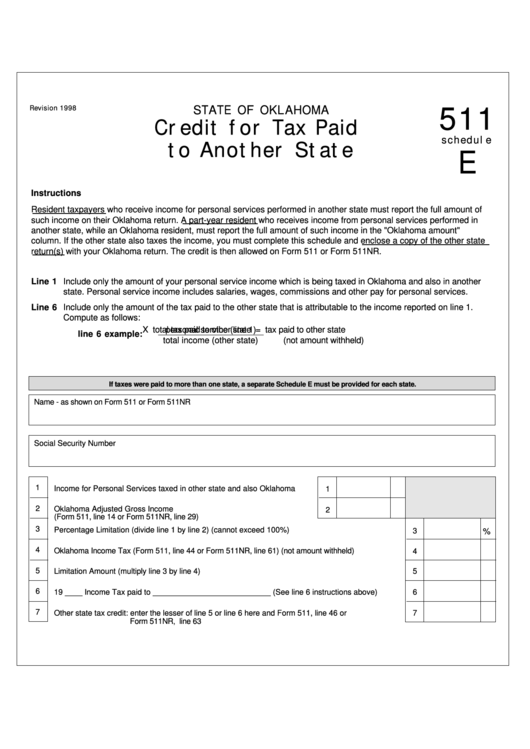

Fillable Form 511 Schedule E Credit For Tax Paid To Another State

• instructions for completing the form 511: Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Name(s) shown on form 511: • instructions for completing the.

Form 511 State Of Oklahoma Tax Return 2006 printable pdf

• instructions for completing the form 511: • instructions for completing the. To see the calculation for line. Name(s) shown on form 511: Web how is the amount calculated on line 6 of schedule 511a for an oklahoma individual tax return?

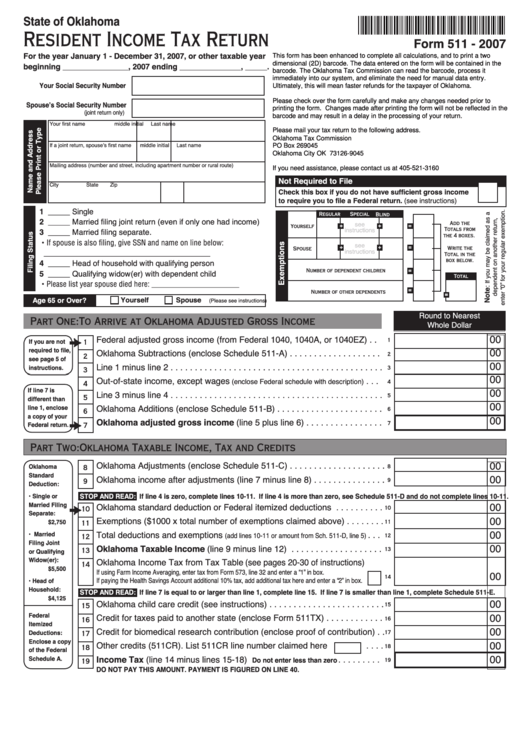

Fillable Form 511 Oklahoma Resident Tax Return 2007

Web how to fill out oklahoma tax commission forms: Name(s) shown on form 511: We will update this page with a new version of. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any.

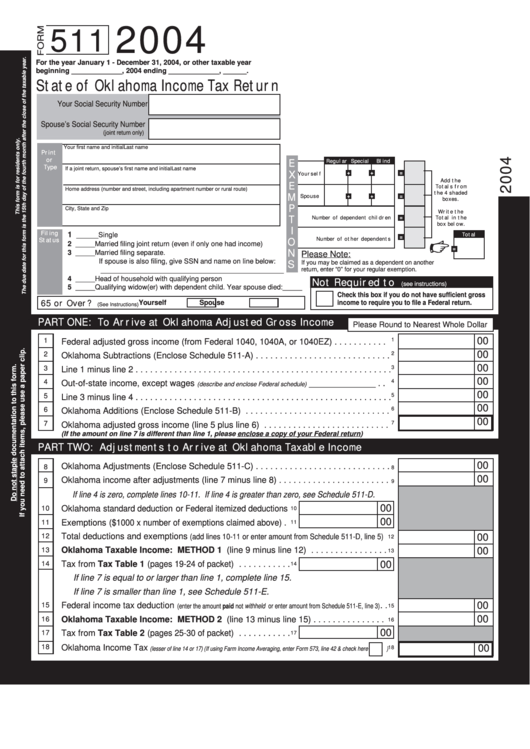

Form 511 State Of Oklahoma Tax Return 2004 printable pdf

Oklahoma resident income tax return (metropolitan library system) form is 18 pages long and contains: Web how to fill out oklahoma tax commission forms: Web this form is for income earned in tax year 2022, with tax returns due in april 2023. If you have already filed your return, either electronically or by paper,. Web the oklahoma tax commission is.

• instructions for completing the form 511: Web if you need to change or amend an accepted oklahoma state income tax return for the current or previous taxyear, you need to. Web oklahoma individual income tax declaration for electronic filing. Oklahoma resident income tax return (metropolitan library system) form is 18 pages long and contains: • instructions for completing the. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web 2021 oklahoma resident individual income tax forms and instructions. Oklahoma resident income tax return • form 511: Web how is the amount calculated on line 6 of schedule 511a for an oklahoma individual tax return? Web how to fill out oklahoma tax commission forms: Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Web 18 rows the oklahoma income tax rate for tax year 2022 is progressive from a low of 0.25% to a high of 4.75%. Start by gathering all the necessary documents, such as your. Name(s) shown on form 511: Web 2020 oklahoma resident individual income tax forms and instructions. To see the calculation for line. Tax credits transferred or allocated must be reported on oklahoma tax commission. Web total available credit (a + b = c) notice. Web form 511 is the general income tax return for oklahoma residents. We will update this page with a new version of.

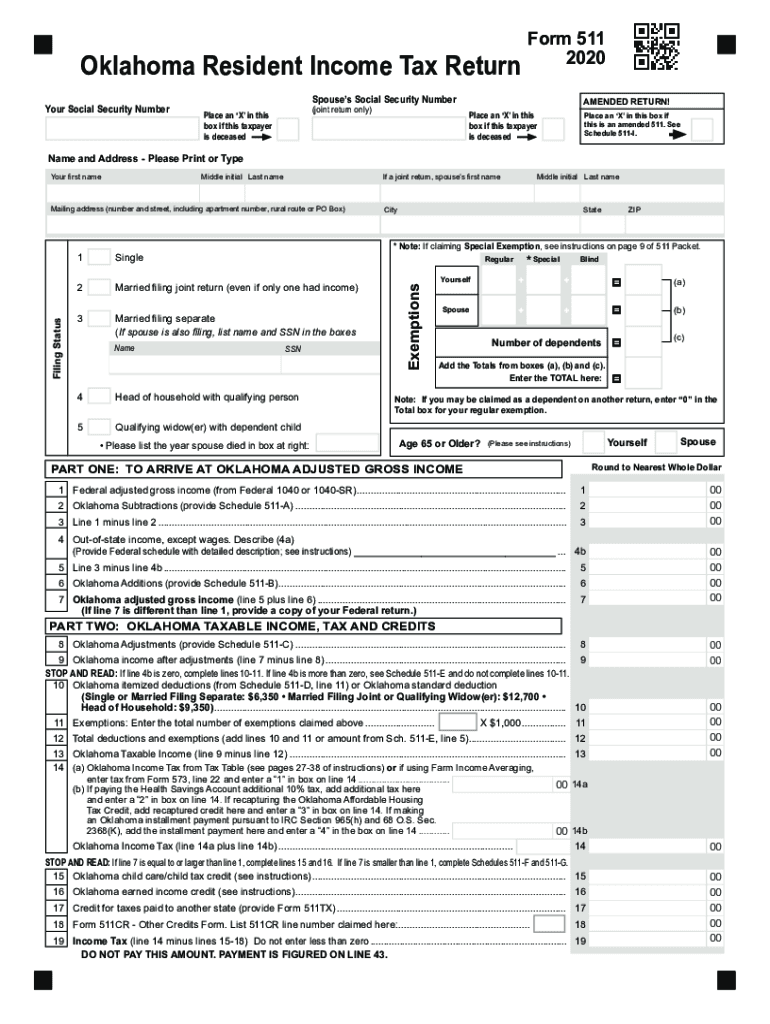

Web 2020 Oklahoma Resident Individual Income Tax Forms And Instructions.

Web 2022 oklahoma resident individual income tax forms and instructions. We will update this page with a new version of. We will update this page with a new version of. Web how is the amount calculated on line 6 of schedule 511a for an oklahoma individual tax return?

To See The Calculation For Line.

Web form 511 is the general income tax return for oklahoma residents. Web 2021 oklahoma resident individual income tax forms and instructions. Web 18 rows the oklahoma income tax rate for tax year 2022 is progressive from a low of 0.25% to a high of 4.75%. Web this form is for income earned in tax year 2022, with tax returns due in april 2023.

If You Have Already Filed Your Return, Either Electronically Or By Paper,.

Name(s) shown on form 511: • instructions for completing the form 511: Web oklahoma individual income tax declaration for electronic filing. Oklahoma resident income tax return • form 511:

Start By Gathering All The Necessary Documents, Such As Your.

Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. • instructions for completing the. Web how to fill out oklahoma tax commission forms: Tax credits transferred or allocated must be reported on oklahoma tax commission.