Nevada Tax Cap Form - Web the clark county assessor's office will be mailing post cards today to residential property owners who have not. Web a clark county assessor addresses the property tax cap situation. Web the deadline to appeal the tax cap for the 2023/2024 fiscal year is june 30, 2023. Web welcome to the nevada tax center the easiest way to manage your business tax filings with the nevada. People still have until next year to apply. Web posted at 9:45 pm, jun 27, 2022 and last updated 6:39 am, jun 30, 2022 las vegas (ktnv) — you could be paying. Below you will find an example of how to calculate the tax on a new home. Web the nevada state legislature has passed a law to provide property tax relief to all citizens. _____ this section to be completed for residential. Las vegas (ktnv) — the deadline to file your property tax cap form for this.

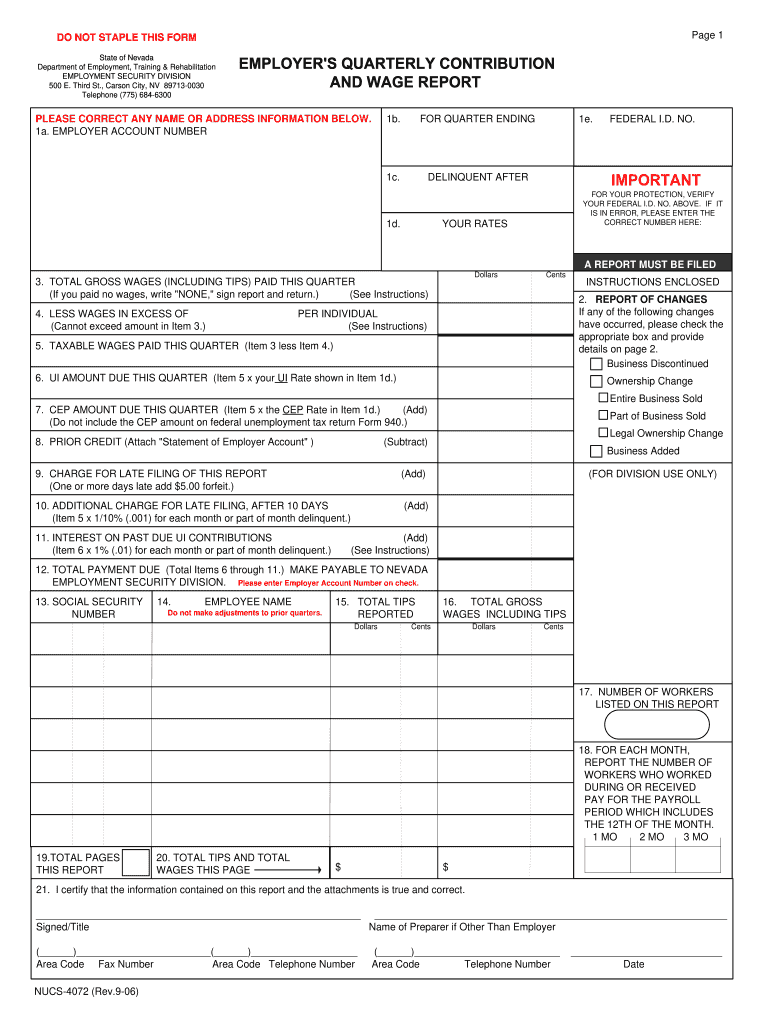

Nevada employer quarterly contribution report Fill out & sign online

Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). Web nevadatax is our online system for registering, filing, or paying many of thetaxes administered by the department. How can nevada have no state. Web welcome to the nevada tax center the easiest way to manage your business tax filings with the nevada. Watch this video explaining property tax.

Form TXR01.01C Download Fillable PDF or Fill Online Combined Sales and

Web the deadline for filing a federal form 1040 return for the 2022 tax year is april 18, 2023. Web the clark county assessor's office will be mailing post cards today to residential property owners who have not. People still have until next year to apply. You may obtain an appeal form by calling our. Nrs 361.4723 provides a partial.

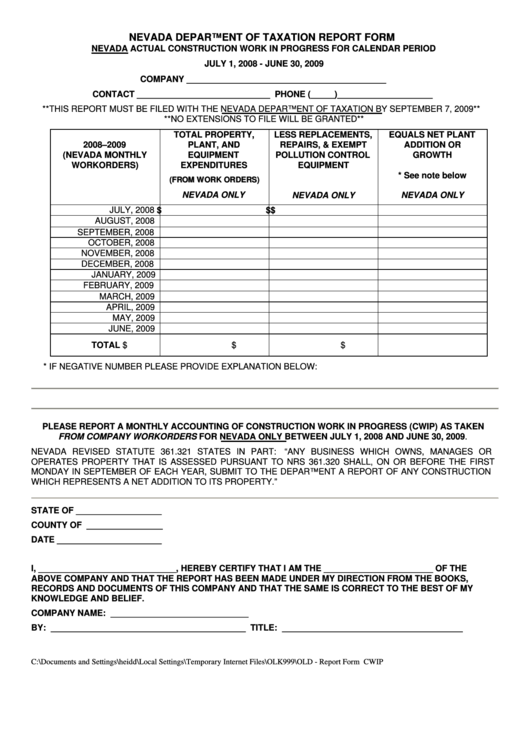

Report Form Nevada Department Of Taxation 2008 printable pdf download

You may obtain an appeal form by calling our. Web all properties not specifically noted as a primary residence will face the 8% tax cap, according to assembly bill 489. Nrs 361.4723 provides a partial. Web a clark county assessor addresses the property tax cap situation. How can nevada have no state.

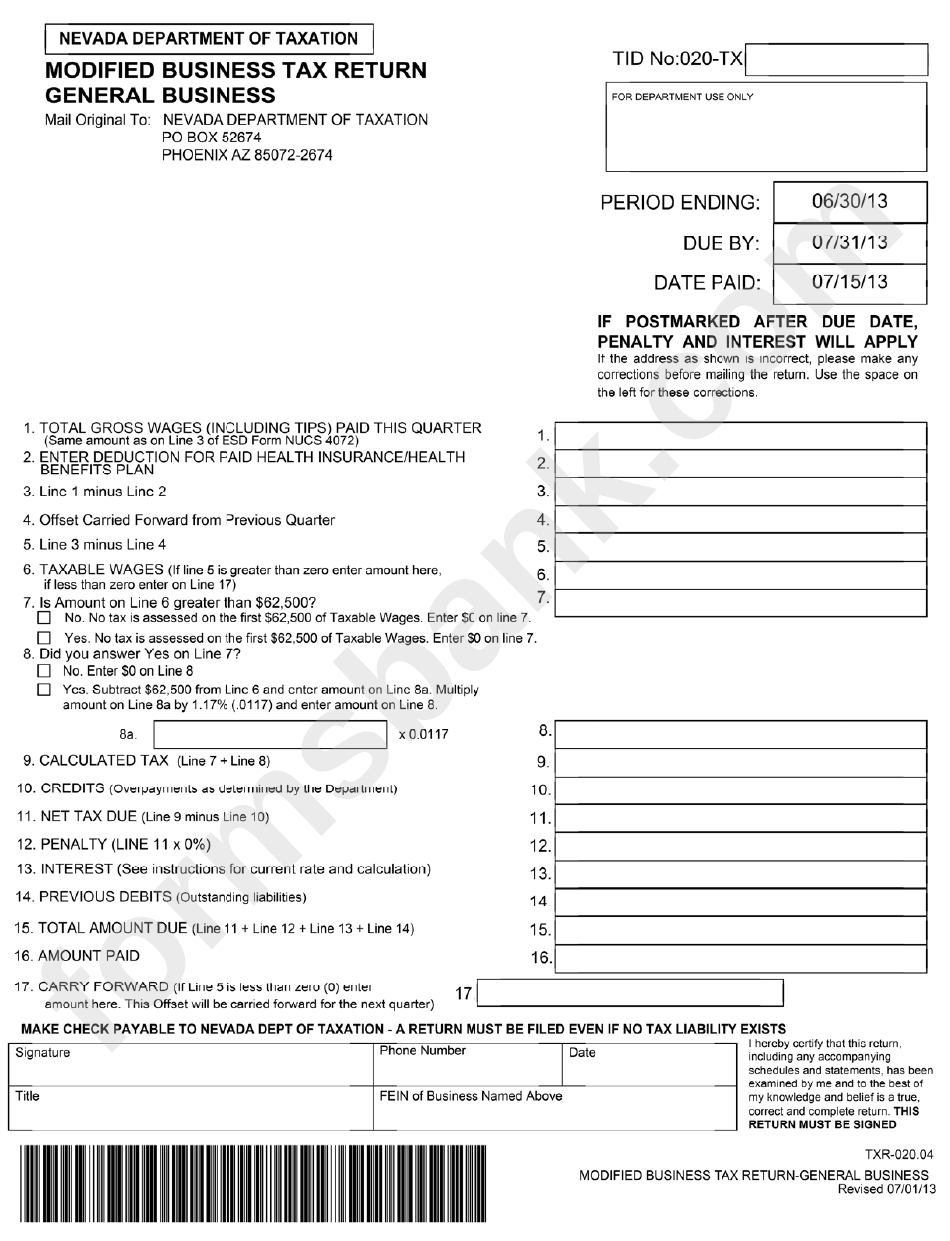

Modified Business Tax Return Form Nevada Department Of Taxation

Web for property that is your primary residence in nevada or property that is rented at or below the low income housing (hud) rent level,. Below you will find an example of how to calculate the tax on a new home. Las vegas (ktnv) — the deadline to file your property tax cap form for this. Web 2023/2024 property tax.

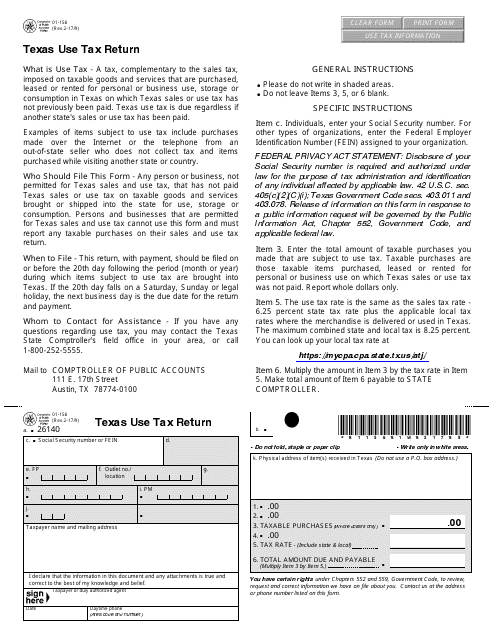

Blank Nv Sales And Use Tax Form Blank Nv Sales And Use Tax Form

Below you will find an example of how to calculate the tax on a new home. Web “to fix the upcoming tax cap that is 8 percent for next fiscal year or starting july 1, which is next week, you. Watch this video explaining property tax cap. Web the nevada state legislature has passed a law to provide property tax.

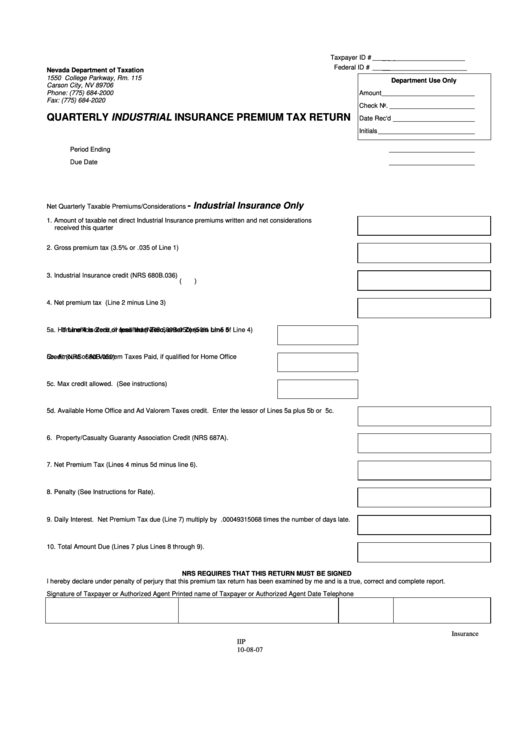

Fillable Quarterly Industrial Insurance Premium Tax Return Nevada

Web the deadline to appeal the tax cap for the 2023/2024 fiscal year is june 30, 2023. Web the deadline for filing a federal form 1040 return for the 2022 tax year is april 18, 2023. How can nevada have no state. Web and last updated 7:10 am, jul 01, 2022. Nrs 361.4723 provides a partial.

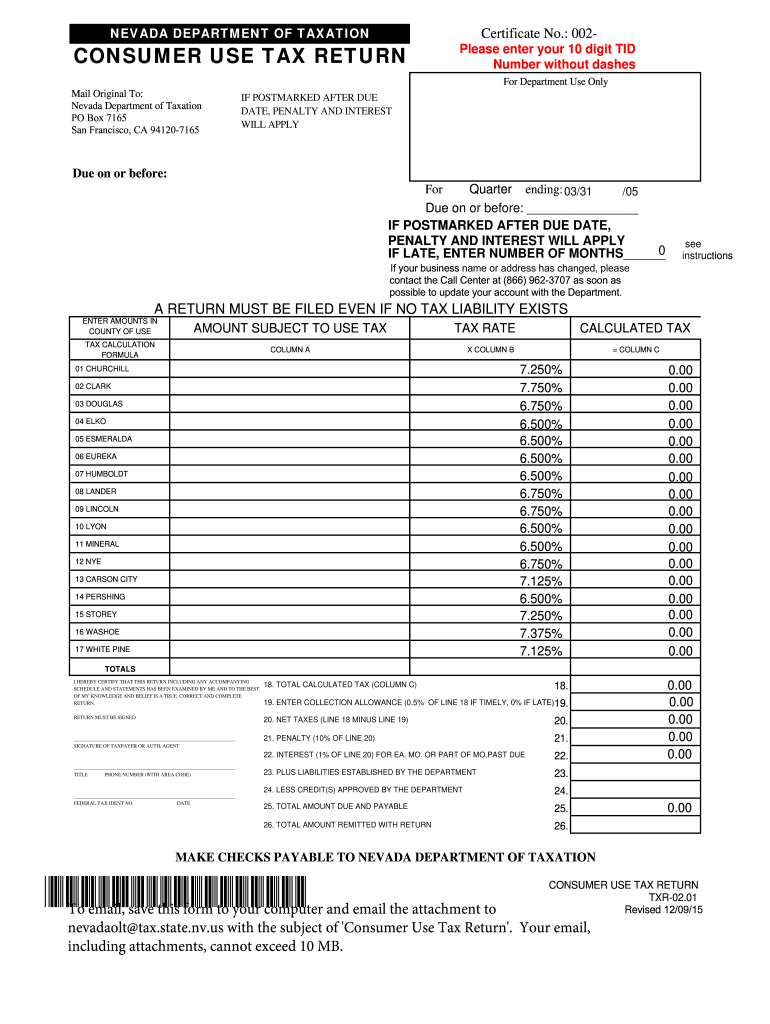

20152022 Form NV TXR02.01 Fill Online, Printable, Fillable, Blank

Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after. Web and last updated 7:10 am, jul 01, 2022. Nrs 361.4723 provides a partial. Web the nevada state legislature has passed a law to provide property tax relief to all citizens. Web 2023/2024 property tax cap.

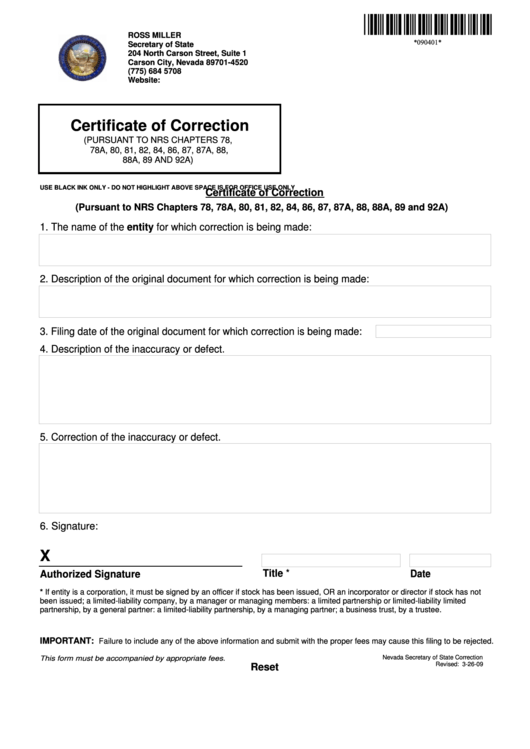

Fillable Certificate Of Correction Nevada Secretary Of State

Web posted at 9:45 pm, jun 27, 2022 and last updated 6:39 am, jun 30, 2022 las vegas (ktnv) — you could be paying. Web and last updated 7:10 am, jul 01, 2022. Web all properties not specifically noted as a primary residence will face the 8% tax cap, according to assembly bill 489. 29, 2022 at 5:26 pm pdt.

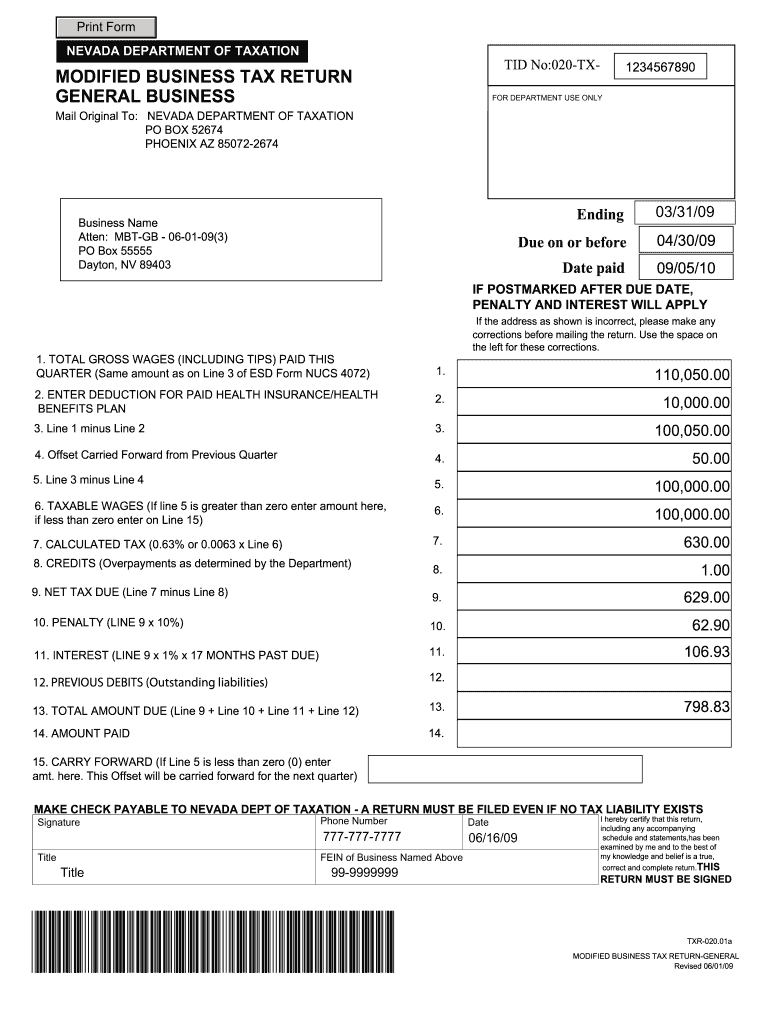

Nevada Modified Business Tax Form Fill Out and Sign Printable PDF

Web for property that is your primary residence in nevada or property that is rented at or below the low income housing (hud) rent level,. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). Web the deadline for filing a federal form 1040 return for the 2022 tax year is april 18, 2023. Below you will find an.

Laughlin Buzz Clark County, Nevada Tax Cap (Abatement) Notice

Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after. Web the clark county assessor's office will be mailing post cards today to residential property owners who have not. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other.

Below you will find an example of how to calculate the tax on a new home. You may obtain an appeal form by calling our. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). Web nevadatax is our online system for registering, filing, or paying many of thetaxes administered by the department. People still have until next year to apply. How can nevada have no state. Web the nevada state legislature has passed a law to provide property tax relief to all citizens. Web the deadline to appeal the tax cap for the 2023/2024 fiscal year is june 30, 2023. Web the clark county assessor's office will be mailing post cards today to residential property owners who have not. You may obtain an appeal form by calling our. Web nrs 361.4723 provides a partial abatement of taxes. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after. Web a clark county assessor addresses the property tax cap situation. Web welcome to the nevada tax center the easiest way to manage your business tax filings with the nevada. Web posted at 9:45 pm, jun 27, 2022 and last updated 6:39 am, jun 30, 2022 las vegas (ktnv) — you could be paying. Web for property that is your primary residence in nevada or property that is rented at or below the low income housing (hud) rent level,. Web the deadline to appeal the tax cap for the 2022/2023 fiscal year is june 30, 2023. Web 2023/2024 property tax cap claim form file by june 30, 2024 washoe county 2023/2024 low tax cap 3% high tax. Nrs 361.4723 provides a partial. Las vegas (ktnv) — the deadline to file your property tax cap form for this.

29, 2022 At 5:26 Pm Pdt Las Vegas, Nev.

Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to. Nrs 361.4723 provides a partial. Las vegas (ktnv) — the deadline to file your property tax cap form for this. Web the deadline to appeal the tax cap for the 2022/2023 fiscal year is june 30, 2023.

Web The Deadline To Appeal The Tax Cap For The 2023/2024 Fiscal Year Is June 30, 2023.

Web nevadatax is our online system for registering, filing, or paying many of thetaxes administered by the department. Web the clark county assessor's office will be mailing post cards today to residential property owners who have not. Web the form is at temp tax cap form 22.pdf (clarkcountynv.gov). Web 2023/2024 property tax cap claim form file by june 30, 2024 washoe county 2023/2024 low tax cap 3% high tax.

Web For Property That Is Your Primary Residence In Nevada Or Property That Is Rented At Or Below The Low Income Housing (Hud) Rent Level,.

Web the nevada state legislature has passed a law to provide property tax relief to all citizens. Web a clark county assessor addresses the property tax cap situation. People still have until next year to apply. You may obtain an appeal form by calling our.

Web All Properties Not Specifically Noted As A Primary Residence Will Face The 8% Tax Cap, According To Assembly Bill 489.

Below you will find an example of how to calculate the tax on a new home. Web welcome to the nevada tax center the easiest way to manage your business tax filings with the nevada. Web posted at 9:45 pm, jun 27, 2022 and last updated 6:39 am, jun 30, 2022 las vegas (ktnv) — you could be paying. Web the deadline for filing a federal form 1040 return for the 2022 tax year is april 18, 2023.