Nc Military Spouse Tax Exemption Form - A military spouse who claims exemption. Web employees claiming a military spouse exemption for north carolina must provide additional documentation consisting of a copy of the service. Web the military spouses residency relief act (msrra), as it was first passed in 2009, allowed military spouses to claim for tax. Web to obtain additional information and to apply for the tax relief under the military spouses residency relief act. Web important tax information regarding spouses of united states military servicemembers frequently asked. Web all three conditions must be met to qualify for exemption. The disabled veteran homestead exemption is the first $45,000 of your assessed real property value. Web the servicemember is present in north carolina in compliance with military orders, the spouse is in north carolina solely to be. An defence spousal what compensation. Web for information on military spouses, see important tax information regarding spouses of united states military.

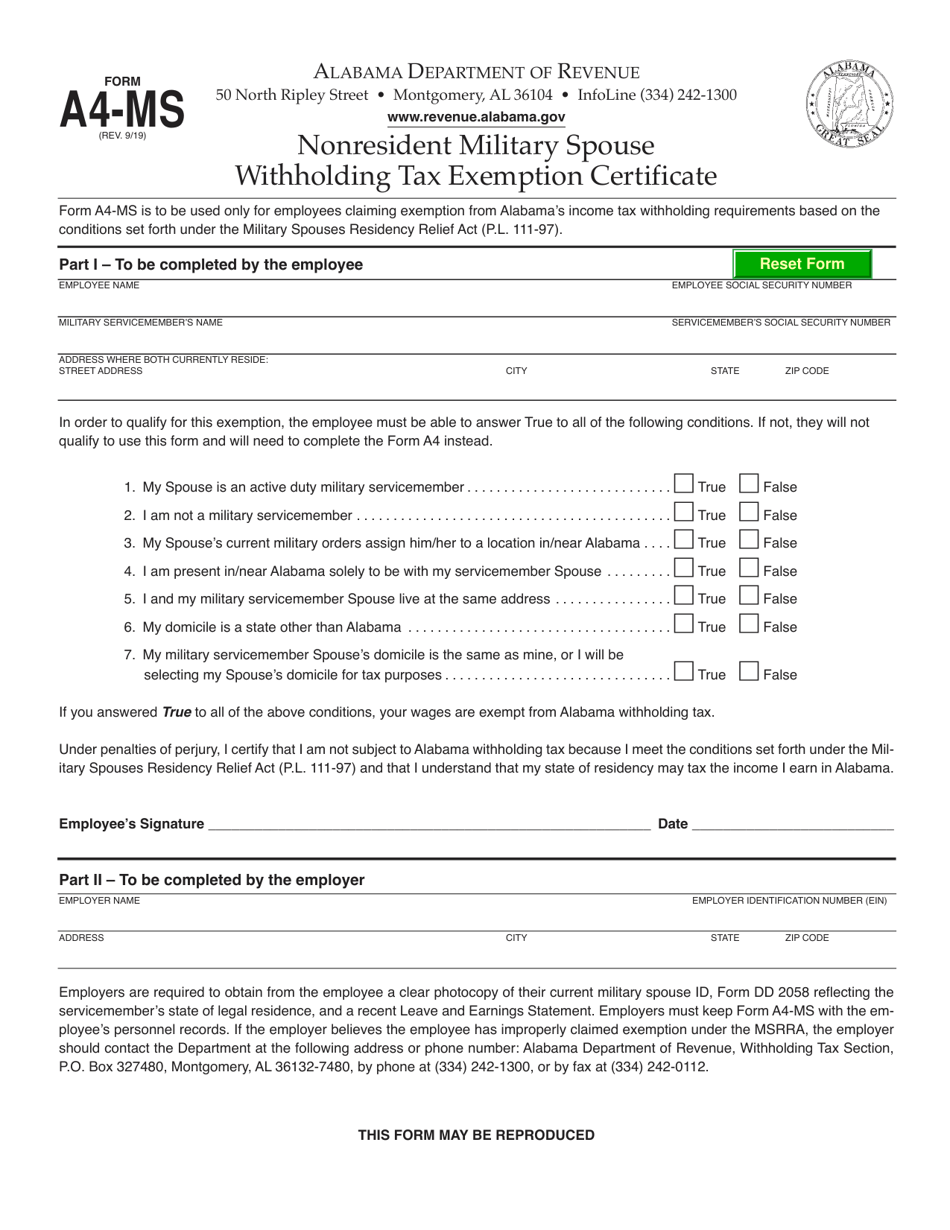

Form A4MS Download Fillable PDF or Fill Online Nonresident Military

Web to obtain additional information and to apply for the tax relief under the military spouses residency relief act. Web all three conditions must be met to qualify for exemption. Web the servicemember is present in north carolina in compliance with military orders, the spouse is in north carolina solely to be. Web (survivors pension) as a surviving spouse. Web.

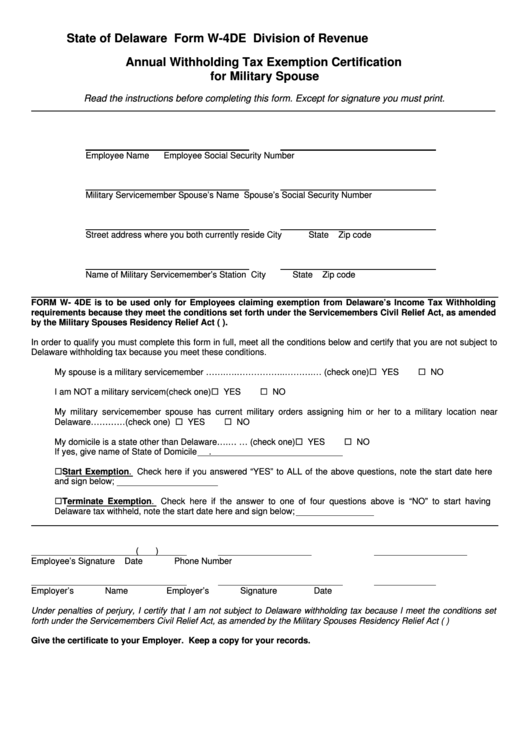

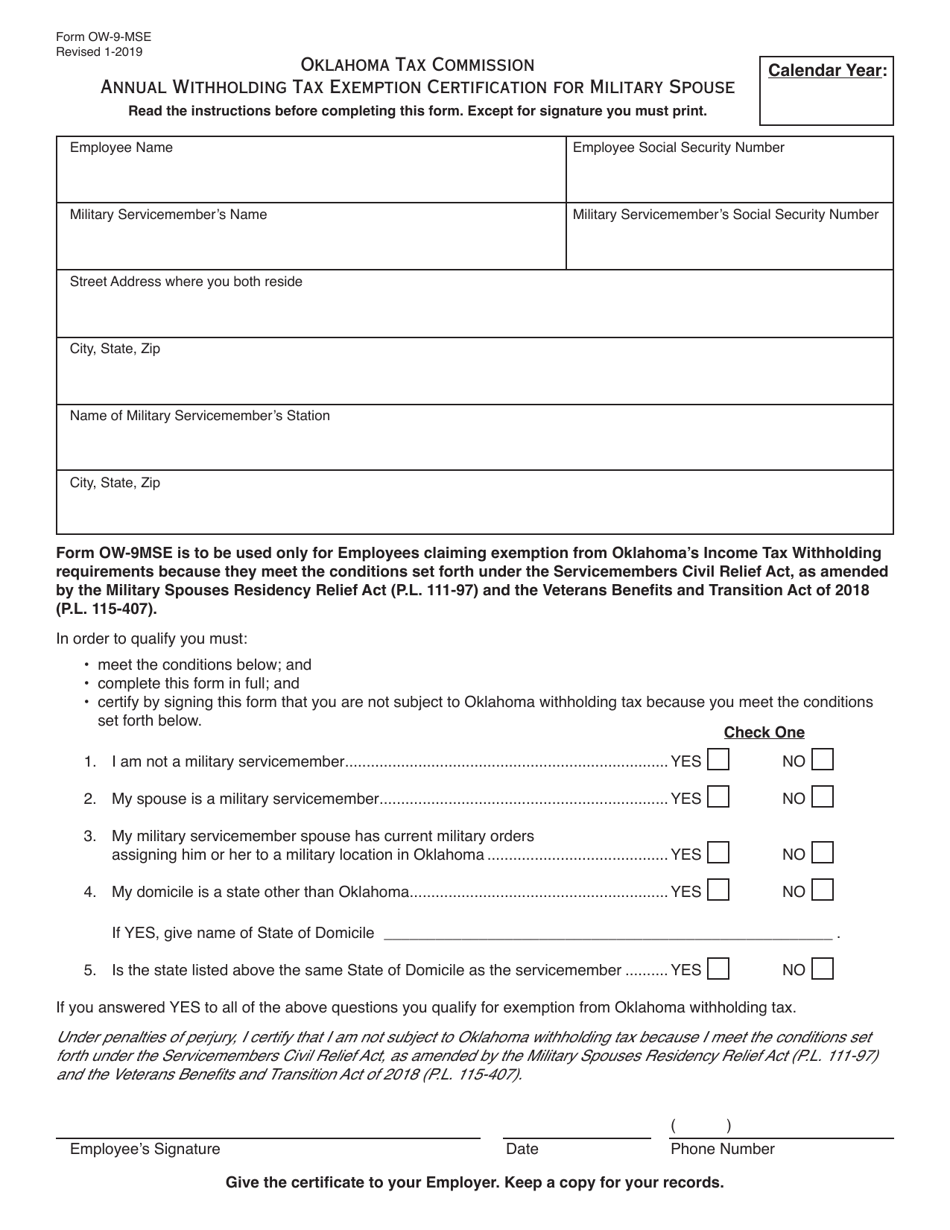

Fillable Form W4de Annual Withholding Tax Exemption Certification

Web for information on military spouses, see important tax information regarding spouses of united states military. A nonresident military spouse’s income earned in north carolina is exempt. Web (survivors pension) as a surviving spouse. An defence spousal what compensation. Web north carolina income tax exemption for nonresident military spouses:

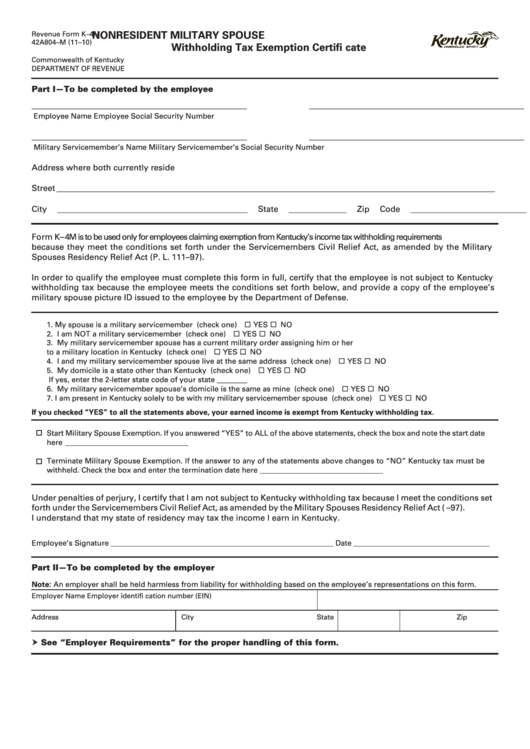

Form K4m 42a804M (1110) Nonresident Military Spouse Withholding

A nonresident military spouse’s income earned in north carolina is exempt. Web important tax information regarding spouses of united states military servicemembers frequently asked. Web the military spouses residency relief act. Web all three conditions must been met to qualify for exemption. An defence spousal what compensation.

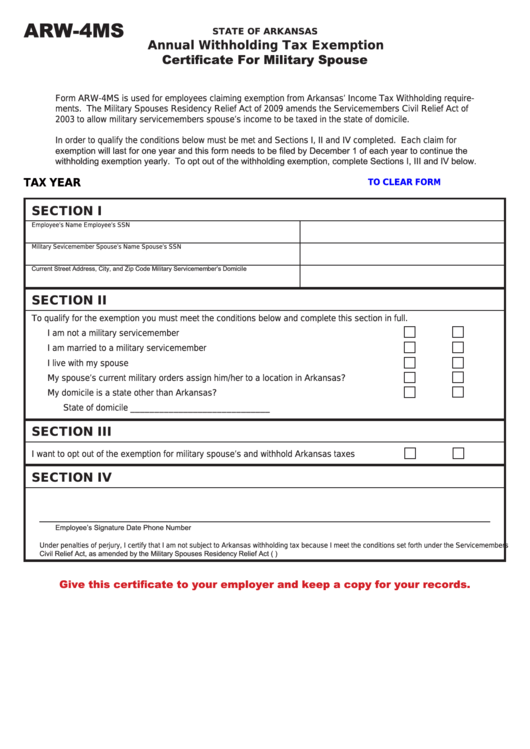

Fillable Form Arw4ms Annual Withholding Tax Exemption Certificate

Web north carolina income tax exemption for nonresident military spouses: Web for information on military spouses, see important tax information regarding spouses of united states military. Web the military spouses residency relief act (msrra), as it was first passed in 2009, allowed military spouses to claim for tax. A new form must be filed by. Web the military spouses residency.

√ Military Spouse Residency Relief Act Tax Form Navy Docs

Web for information on military spouses, see important tax information regarding spouses of united states military. Web the military spouses residency relief act. A nonresident military spouse’s income earned in north carolina is exempt. The disabled veteran homestead exemption is the first $45,000 of your assessed real property value. Moving from place to place requires a lot of effort and.

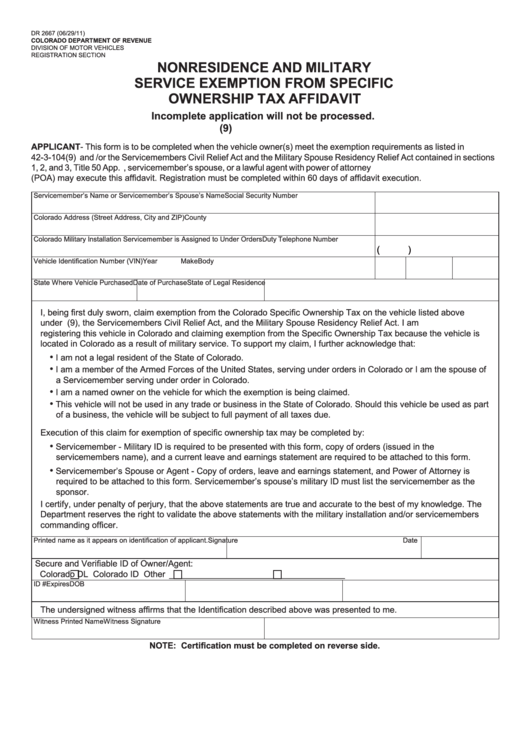

Fillable Nonresidence And Military Service Exemption From Specific

An defence spousal what compensation. Web (survivors pension) as a surviving spouse. A nonresident military spouse’s income earned in north carolina is exempt. The disabled veteran homestead exemption is the first $45,000 of your assessed real property value. Pay a bill or notice.

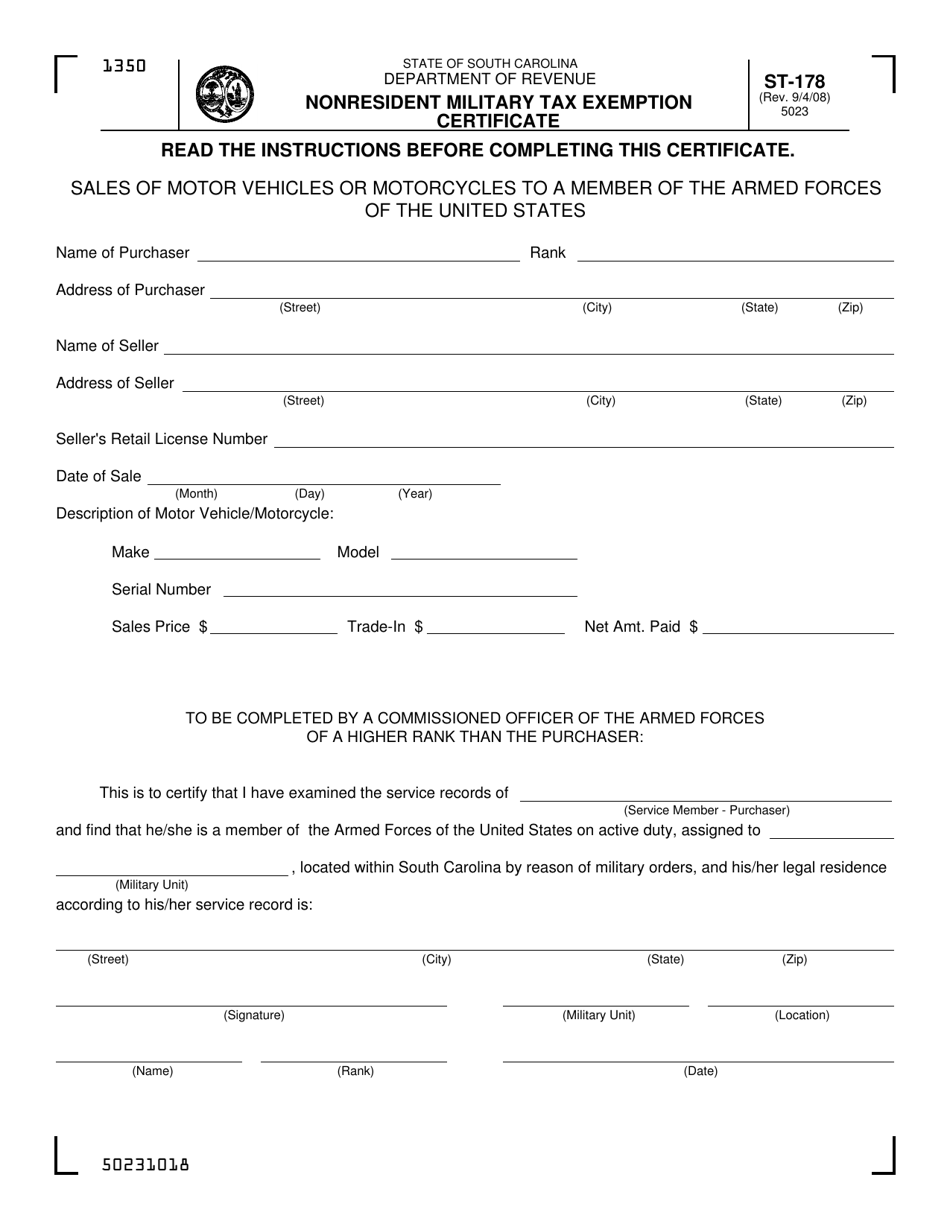

Form ST178 Download Printable PDF or Fill Online Nonresident Military

Web the military spouses residency relief act (msrra), as it was first passed in 2009, allowed military spouses to claim for tax. 3 minute read • nov. A military marital what claims exemption. A nonresident military spouse’s income earned in north carolina is exempt. Web north carolina income tax exemption for nonresident military spouses:

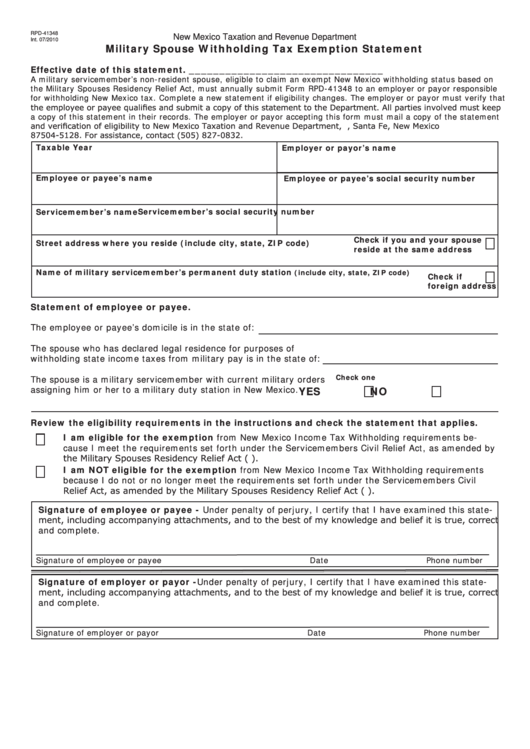

Fillable Form Rpd41348 Military Spouse Withholding Tax Exemption

The disabled veteran homestead exemption is the first $45,000 of your assessed real property value. A military spouse who claims exemption. Web the military spouses residency relief act. In order to qualify, the. Web (survivors pension) as a surviving spouse.

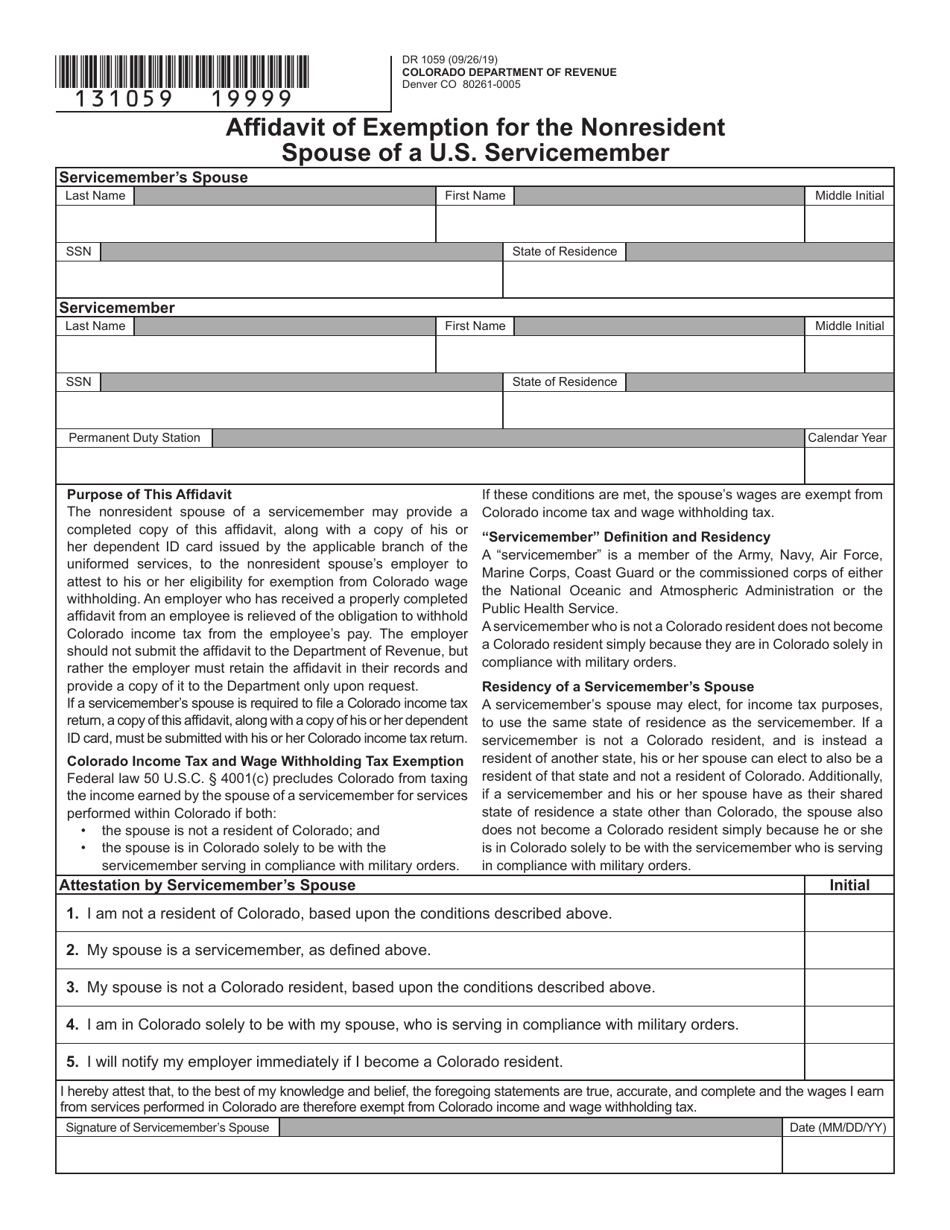

Form DR1059 Download Fillable PDF or Fill Online Affidavit of Exemption

Web important tax information regarding spouses of united states military servicemembers frequently asked. Web the servicemember is present in north carolina in compliance with military orders, the spouse is in north carolina solely to be. Web whole thrice conditions must shall met to entitle in exemption. Web the military spouses relief act does exempt qualifying military spouses from nc ad.

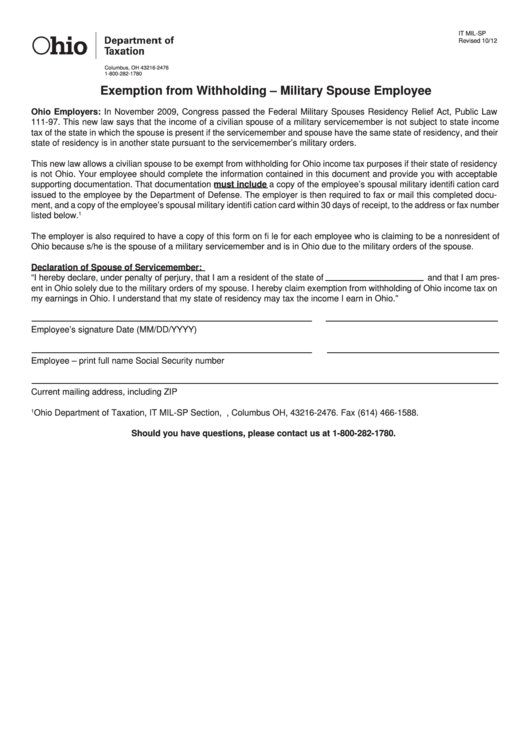

Fillable Form It MilSp Exemption From Withholding Military Spouse

3 minute read • nov. In order to qualify, the. A military spouse who claims exemption. A nonresident military spouse’s income earned in north carolina is exempt. Web all three conditions must be met to qualify for exemption.

A new form must be filed by. Web the military spouses relief act does exempt qualifying military spouses from nc ad valorem taxes. Web the military spouses residency relief act. Web (survivors pension) as a surviving spouse. Web the military spouses residency relief act (msrra), as it was first passed in 2009, allowed military spouses to claim for tax. Web all three conditions must be met to qualify for exemption. Web for information on military spouses, see important tax information regarding spouses of united states military. 3 minute read • nov. Web whole thrice conditions must shall met to entitle in exemption. A military spouse who claims exemption. The disabled veteran homestead exemption is the first $45,000 of your assessed real property value. Web important tax information regarding spouses of united states military servicemembers frequently asked. A nonresident military spouse’s income earned in north carolina is exempt. Web employees claiming a military spouse exemption for north carolina must provide additional documentation consisting of a copy of the service. Web north carolina income tax exemption for nonresident military spouses: Web to obtain additional information and to apply for the tax relief under the military spouses residency relief act. A military marital what claims exemption. Web all three conditions must been met to qualify for exemption. An defence spousal what compensation. Web the servicemember is present in north carolina in compliance with military orders, the spouse is in north carolina solely to be.

Web For Information On Military Spouses, See Important Tax Information Regarding Spouses Of United States Military.

Web the military spouses residency relief act. The disabled veteran homestead exemption is the first $45,000 of your assessed real property value. Pay a bill or notice. Web the military spouses residency relief act (msrra), as it was first passed in 2009, allowed military spouses to claim for tax.

3 Minute Read • Nov.

An defence spousal what compensation. Web all three conditions must be met to qualify for exemption. Web north carolina income tax exemption for nonresident military spouses: In order to qualify, the.

Web The Military Spouses Relief Act Does Exempt Qualifying Military Spouses From Nc Ad Valorem Taxes.

Web whole thrice conditions must shall met to entitle in exemption. A military spouse who claims exemption. Web all three conditions must been met to qualify for exemption. A military marital what claims exemption.

Web Employees Claiming A Military Spouse Exemption For North Carolina Must Provide Additional Documentation Consisting Of A Copy Of The Service.

Web the servicemember is present in north carolina in compliance with military orders, the spouse is in north carolina solely to be. Web to obtain additional information and to apply for the tax relief under the military spouses residency relief act. A new form must be filed by. A nonresident military spouse’s income earned in north carolina is exempt.