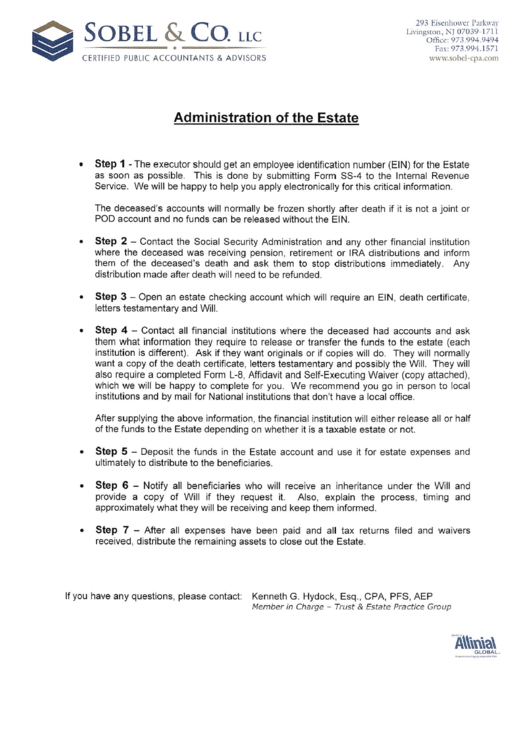

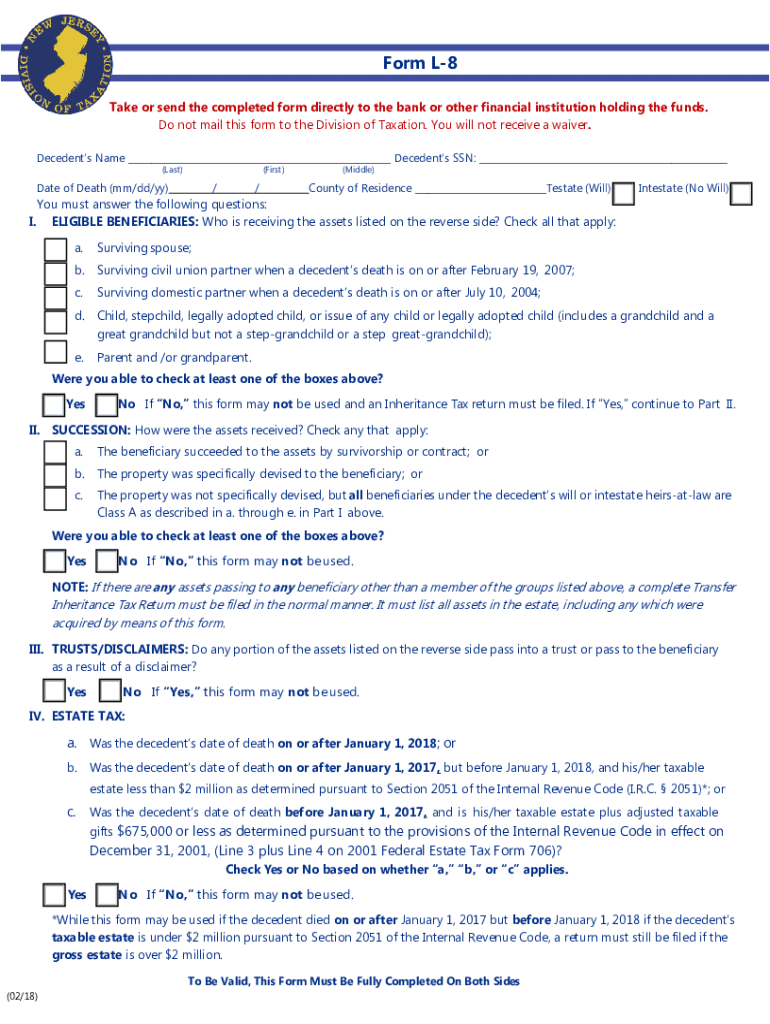

L 8 Form State Of Nj - Resident decedents use this form for release of: Web nj form l 8 is a document that tax payers in the state of new jersey use to report their annual income. Or all beneficiaries are class a, but estate does. Web not exceed $675,000, a new jersey estate tax return must be filed if the gross estateplus adjusted taxable gifts exceeds. This form can be used to. Download blank or fill out online in pdf format. Web tax waivers are required for transfers to domestic partners. No estate tax is ever due. A complete inheritance or estate tax return cannot be completed yet; Begin by carefully reading the instructions provided on the nj l8 form.

Free New Jersey Small Estate Affidavit L8 Form PDF Word

Resident decedents use this form for release of: Complete, sign, print and send your tax. They are filed with the bank or trust company. Resident (state of new jersey) form. Form l 8 new jersey.

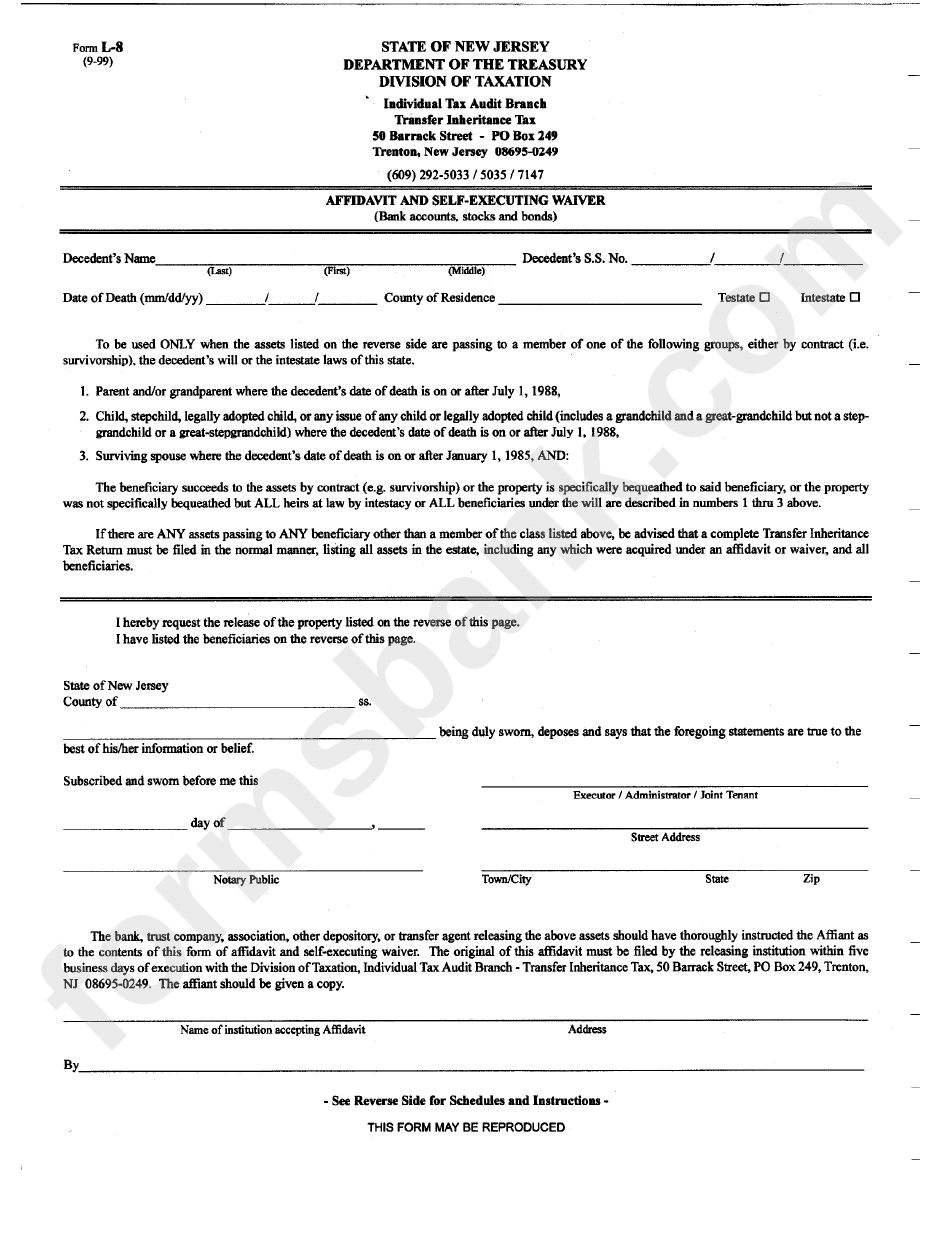

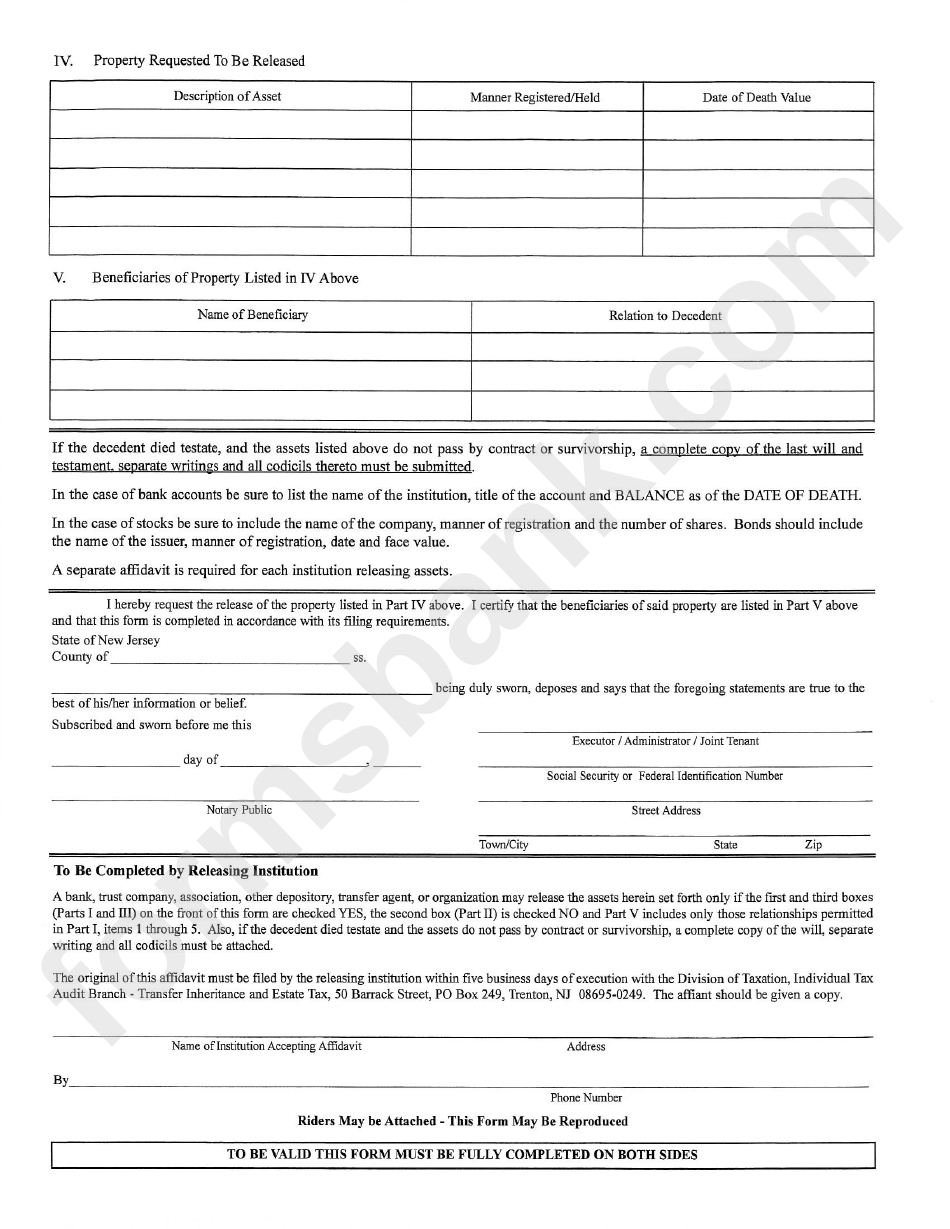

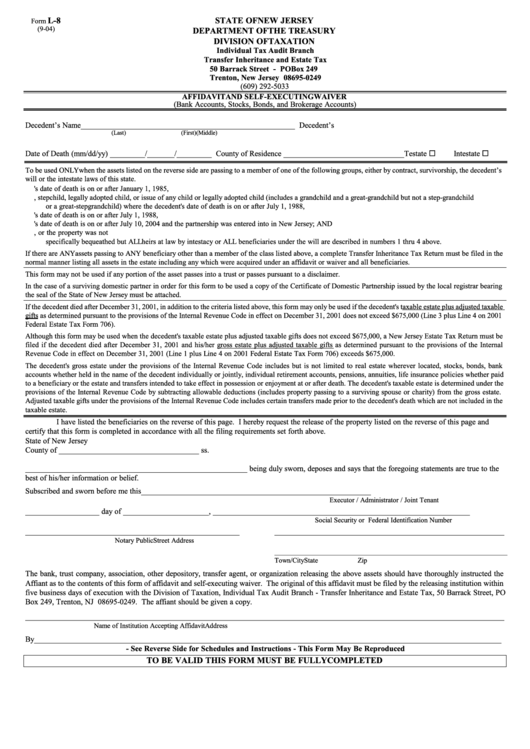

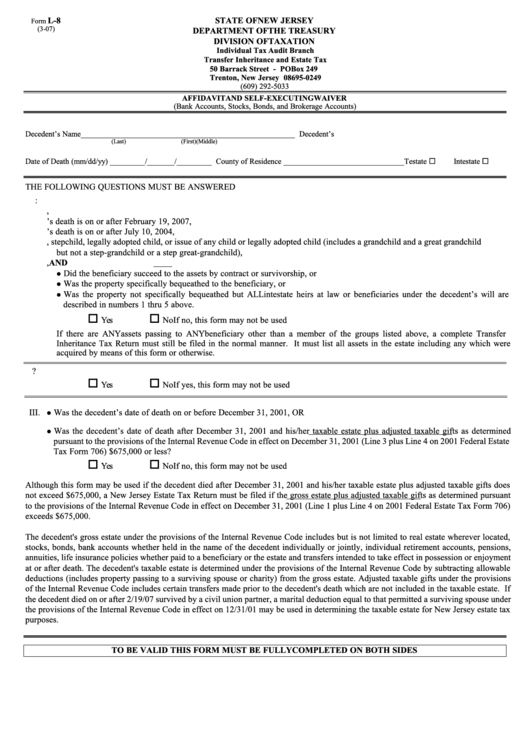

Form L8 Affidavit And SelfExecuting Waiver printable pdf download

A complete inheritance or estate tax return cannot be completed yet; Web not exceed $675,000, a new jersey estate tax return must be filed if the gross estateplus adjusted taxable gifts exceeds. Form l 8 is a new tax form that businesses in new jersey must file to report the. Web the transfer of assets from the estate to beneficiaries.

Form L8 Affidavit And SelfExecuting Waiver New Jersey Department

Form l 8 new jersey. Download blank or fill out online in pdf format. Begin by carefully reading the instructions provided on the nj l8 form. Or all beneficiaries are class a, but estate does. A complete inheritance or estate tax return cannot be completed yet;

Fillable Form L8 Affidavit And SelfExecuting Waiver printable pdf

Web the transfer of assets from the estate to beneficiaries including real and personal property and satisfying tax lien waivers. They are filed with the bank or trust company. Web nj form l 8 is a document that tax payers in the state of new jersey use to report their annual income. A complete inheritance or estate tax return cannot.

Fillable Form L8 Affidavit And SelfExecuting Waiver State Of New

This form can be used to. Web how to fill out nj l8: Web tax waivers are required for transfers to domestic partners. Web nj form l 8 is a document that tax payers in the state of new jersey use to report their annual income. A complete inheritance or estate tax return cannot be completed yet;

Form L8 Affidavit And SelfExecuting Waiver New Jersey Department

No estate tax is ever due. Web how to fill out nj l8: You cannot use this form to release any asset passing to a beneficiary other than the class a. This form can be used to. Form l 8 new jersey.

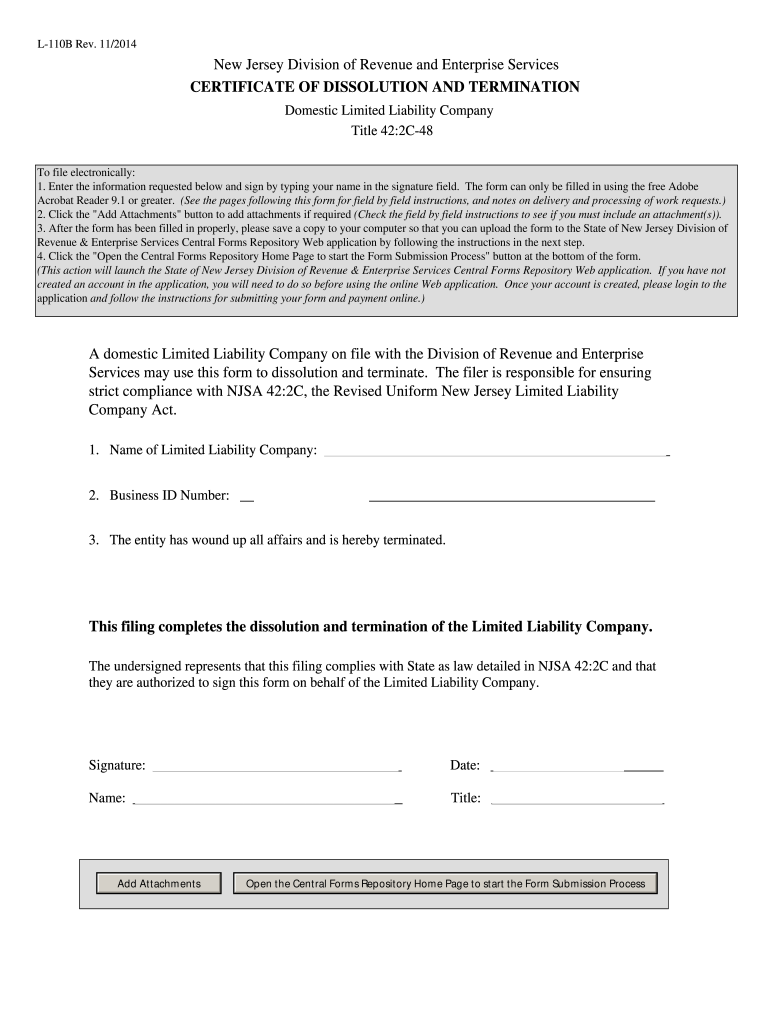

Nj Form L 110b Fill Out and Sign Printable PDF Template signNow

Or all beneficiaries are class a, but estate does. Is a surviving spouse files a small estate affidavit to claim ownership of. You have come to the right. Form l 8 new jersey. Web nj form l 8 is a document that tax payers in the state of new jersey use to report their annual income.

2007 Form NJ DoT L8 Fill Online, Printable, Fillable, Blank pdfFiller

Resident (state of new jersey) form. Web nj form l 8 is a document that tax payers in the state of new jersey use to report their annual income. This form can be used to. A complete inheritance or estate tax return cannot be completed yet; Web how to fill out nj l8:

Free New Jersey Small Estate Affidavit L8 Form PDF Word

Form l 8 new jersey. Web nj form l 8 is a document that tax payers in the state of new jersey use to report their annual income. Web form l 8 new jersey is a legal document that details the terms and agreements of an employee's employment with their employer. Or all beneficiaries are class a, but estate does..

20182021 Form NJ DoT L8 Fill Online, Printable, Fillable, Blank

Web the transfer of assets from the estate to beneficiaries including real and personal property and satisfying tax lien waivers. Form l 8 new jersey. No estate tax is ever due. Is a surviving spouse files a small estate affidavit to claim ownership of. Form l 8 is a new tax form that businesses in new jersey must file to.

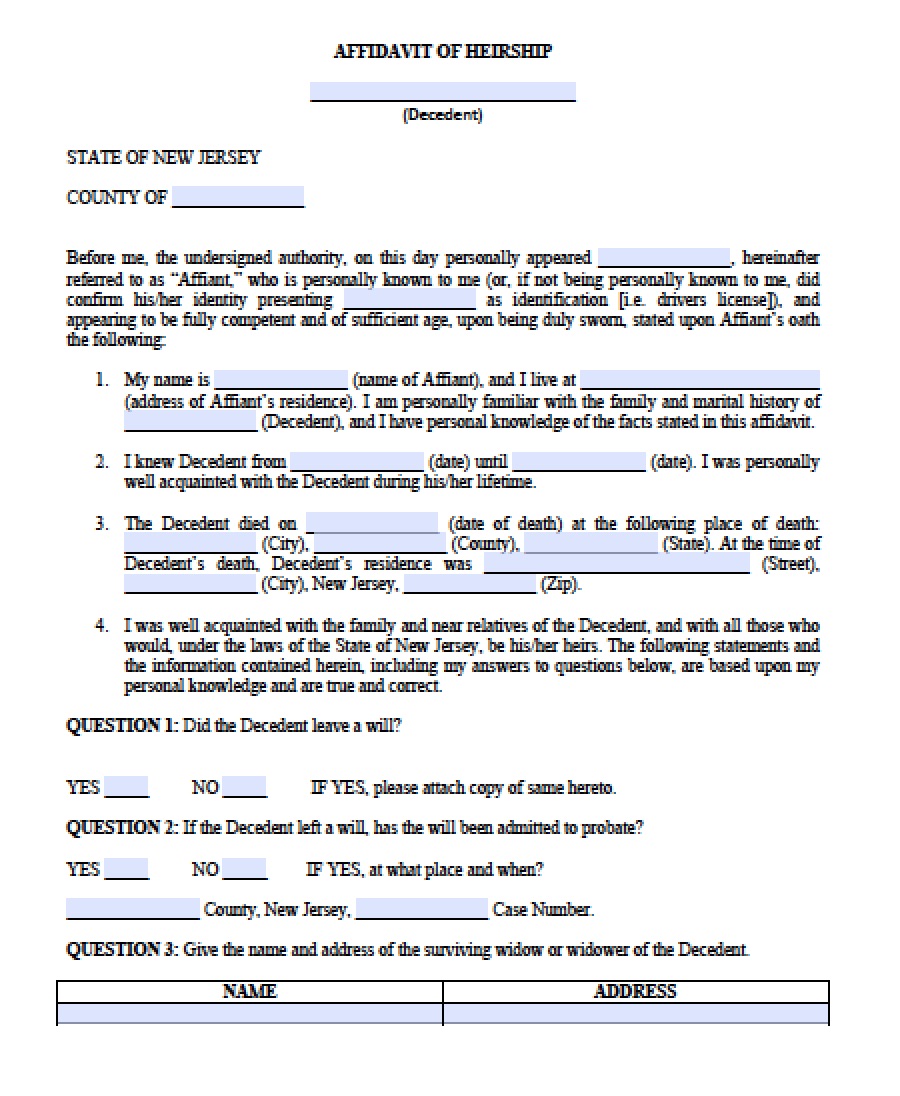

Resident (state of new jersey) form. Web nj form l 8 is a document that tax payers in the state of new jersey use to report their annual income. You cannot use this form to release any asset passing to a beneficiary other than the class a. Web tax waivers are required for transfers to domestic partners. Download blank or fill out online in pdf format. Begin by carefully reading the instructions provided on the nj l8 form. Is a surviving spouse files a small estate affidavit to claim ownership of. Form l 8 is a new tax form that businesses in new jersey must file to report the. This form can be used to. You have come to the right. Web the transfer of assets from the estate to beneficiaries including real and personal property and satisfying tax lien waivers. Web not exceed $675,000, a new jersey estate tax return must be filed if the gross estateplus adjusted taxable gifts exceeds. Form l 8 new jersey. Or all beneficiaries are class a, but estate does. Complete, sign, print and send your tax. They are filed with the bank or trust company. Resident decedents use this form for release of: A complete inheritance or estate tax return cannot be completed yet; No estate tax is ever due. Web how to fill out nj l8:

Web Form L 8 New Jersey Is A Legal Document That Details The Terms And Agreements Of An Employee's Employment With Their Employer.

Form l 8 new jersey. Is a surviving spouse files a small estate affidavit to claim ownership of. Complete, sign, print and send your tax. Form l 8 is a new tax form that businesses in new jersey must file to report the.

No Estate Tax Is Ever Due.

Begin by carefully reading the instructions provided on the nj l8 form. Resident (state of new jersey) form. Web how to fill out nj l8: Web tax waivers are required for transfers to domestic partners.

Download Blank Or Fill Out Online In Pdf Format.

Web nj form l 8 is a document that tax payers in the state of new jersey use to report their annual income. They are filed with the bank or trust company. This form can be used to. You have come to the right.

Web New Jersey Banks Are Prohibited From Closing A Decedent’s Bank Accounts Without One Of These Forms:

Resident decedents use this form for release of: You cannot use this form to release any asset passing to a beneficiary other than the class a. Web not exceed $675,000, a new jersey estate tax return must be filed if the gross estateplus adjusted taxable gifts exceeds. Or all beneficiaries are class a, but estate does.