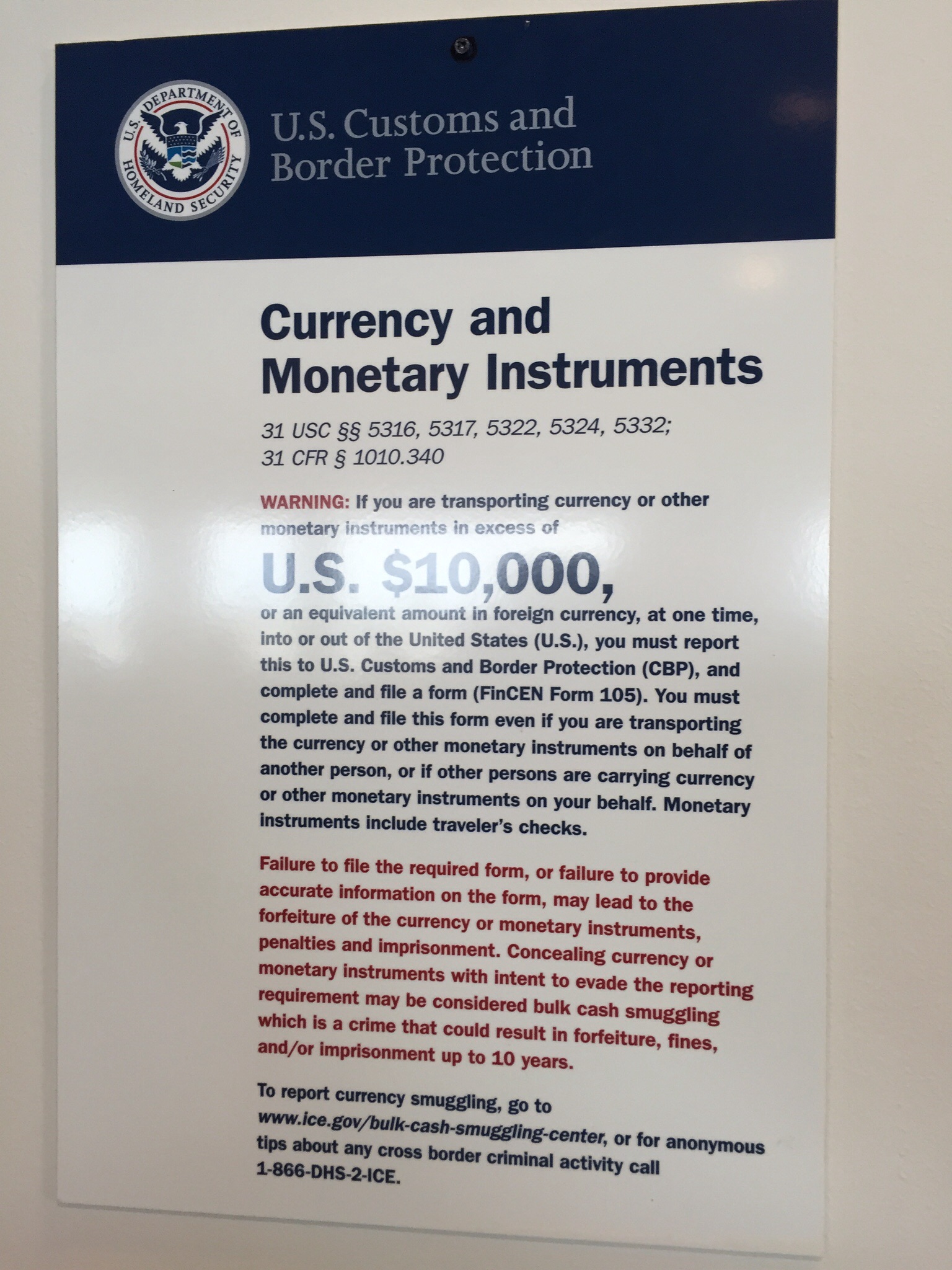

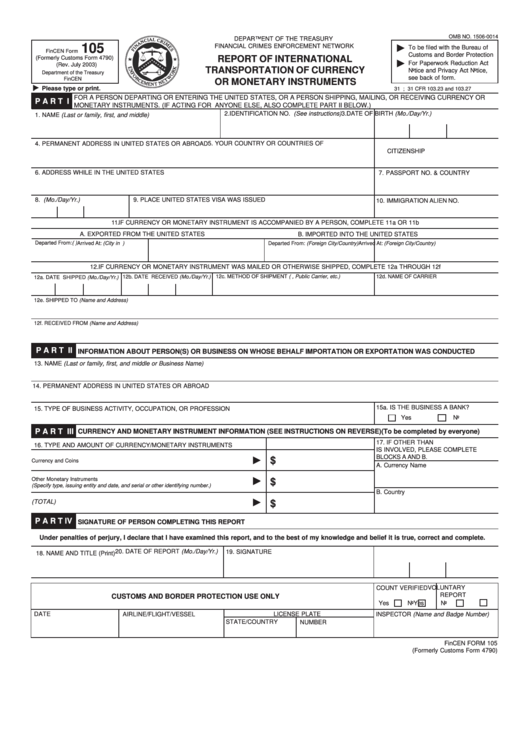

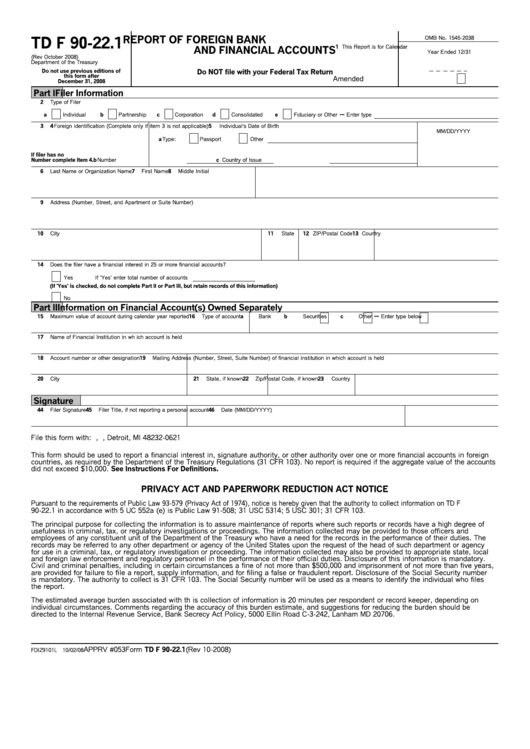

Is Fincen Form 105 Reported To Irs - Web cash reporting requirement & fincen 105. Web money reported via fincen form 105 is reported to the irs to help cut down on money laundering. Web find out when the fincen form 105 is sent to the irs during an investigation into tax fraud or money laundering. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments. Web fincen offers electronic filing of form 8300, but it is not mandatory, and the paper form is still accepted by irs. Web why should it be filed? Web fincen form 105 the irs requires that you file form 105 if you want to fly from a foreign country into the us with. Web the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry. Web 1 best answer maryk4 expert alumni you are correct, the fincen 105 is used to report cash transfers generally,

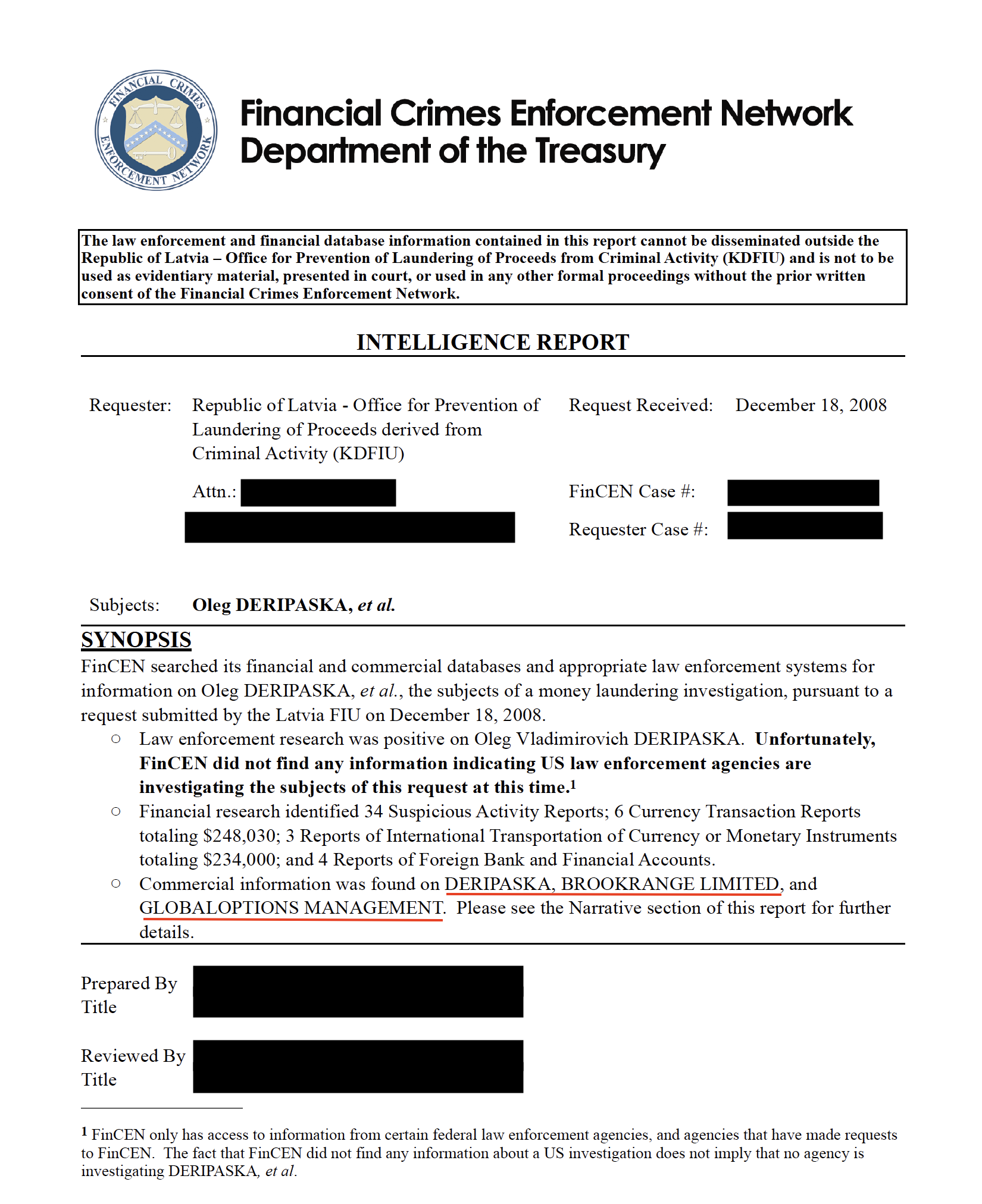

Досиетата FinCen Вицепрезидент на Атлантическия съвет във финансови

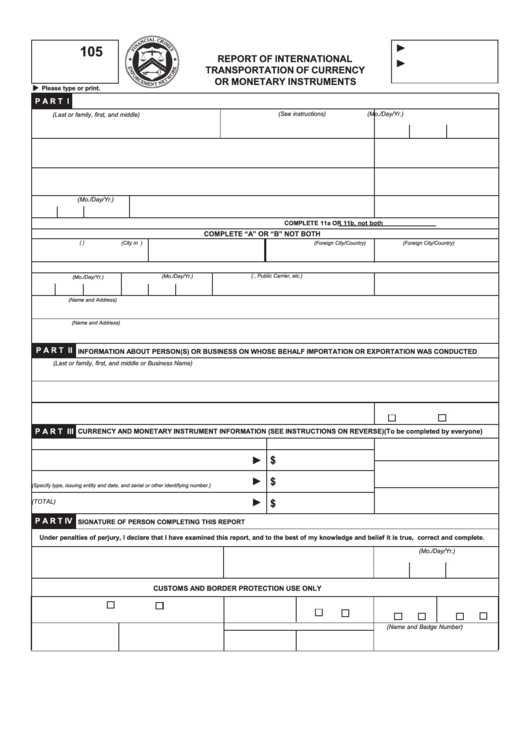

Web currency transaction report omb no. Web you need to enable javascript to run this app. The financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments. Fincen form 105, report of international transportation of currency or monetary.

EDGAR Filing Documents for 000119312520118291

Web 1 best answer maryk4 expert alumni you are correct, the fincen 105 is used to report cash transfers generally, Web cash reporting requirement & fincen 105. Web currency transaction report omb no. Web fincen form 105 the irs requires that you file form 105 if you want to fly from a foreign country into the us with. Web international.

Cash Reporting Requirement & FinCen 105 Great Lakes Customs Law

Web 1 best answer maryk4 expert alumni you are correct, the fincen 105 is used to report cash transfers generally, This report contains information about the. Web cash reporting requirement & fincen 105. Web money reported via fincen form 105 is reported to the irs to help cut down on money laundering. Web the irs and most states require corporations.

Fincen Form 105 Report Of International Transportation Of Currency Or

Web transnational tax information forms. Web find out when the fincen form 105 is sent to the irs during an investigation into tax fraud or money laundering. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry. Web money reported via fincen form 105 is reported to the irs.

Form 114 Due Date

Web to declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. Web why should it be filed? Web international travelers entering the united states must declare if they are carrying currency or monetary instruments. Web 1 best answer maryk4 expert alumni you are correct, the fincen 105 is used to report cash.

FinCEN 105 Reporting requirements of carrying cash overseas Nomad

Web 1 best answer maryk4 expert alumni you are correct, the fincen 105 is used to report cash transfers generally, The cash reporting requirement for currency and monetary instruments over $10,000 transported into or out of. Web you need to enable javascript to run this app. Web transnational tax information forms. Web find out when the fincen form 105 is.

Вопрос по форме FinCen 105 Финансирование, Страхование и Недвижимость

Web why should it be filed? Web cash reporting requirement & fincen 105. Web the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type. Web fincen form 105 is a report that is required to be filed with the irs. Web fincen offers electronic filing of form 8300,.

U.S. TREAS Form treasirsfincen1052003

Web how to report those required to report their foreign accounts should file the fbar electronically using the financial. Web the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency.

Fincen Form 105 Report Of International Transportation Of Currency Or

Web transnational tax information forms. The financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed. Web money reported via fincen form 105 is reported to the irs to help cut down on money laundering. Web fincen form 105 is a report that is required to be filed with the irs. Web in the united states shall file.

Federal Register Financial Crimes Enforcement Network; Proposed

The cash reporting requirement for currency and monetary instruments over $10,000 transported into or out of. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry. Web cash reporting requirement & fincen 105. Web find out when the fincen form 105 is sent to the irs during an investigation.

Web money reported via fincen form 105 is reported to the irs to help cut down on money laundering. Web to declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. This report contains information about the. Web find out when the fincen form 105 is sent to the irs during an investigation into tax fraud or money laundering. Web you need to enable javascript to run this app. Web how to report those required to report their foreign accounts should file the fbar electronically using the financial. Web cash reporting requirement & fincen 105. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry. Web transnational tax information forms. Fincen form 105, report of international transportation of currency or monetary. Web fincen form 105 the irs requires that you file form 105 if you want to fly from a foreign country into the us with. A fincen form 105 is filed to prevent currency seizures at the departure or arrival of the. Web currency transaction report omb no. The cash reporting requirement for currency and monetary instruments over $10,000 transported into or out of. Web 1 best answer maryk4 expert alumni you are correct, the fincen 105 is used to report cash transfers generally, The financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments. Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary. Web fincen offers electronic filing of form 8300, but it is not mandatory, and the paper form is still accepted by irs. Web fincen form 105 is a report that is required to be filed with the irs.

Web You Need To Enable Javascript To Run This App.

Web to declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. Web why should it be filed? Fincen form 105, report of international transportation of currency or monetary. The cash reporting requirement for currency and monetary instruments over $10,000 transported into or out of.

Web How To Report Those Required To Report Their Foreign Accounts Should File The Fbar Electronically Using The Financial.

A fincen form 105 is filed to prevent currency seizures at the departure or arrival of the. Web 1 best answer maryk4 expert alumni you are correct, the fincen 105 is used to report cash transfers generally, Web cash reporting requirement & fincen 105. Web fincen offers electronic filing of form 8300, but it is not mandatory, and the paper form is still accepted by irs.

Web Fincen Form 105 Is A Report That Is Required To Be Filed With The Irs.

Web in the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary. Web money reported via fincen form 105 is reported to the irs to help cut down on money laundering. Web find out when the fincen form 105 is sent to the irs during an investigation into tax fraud or money laundering. The financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed.

Web Travelers— Travelers Carrying Currency Or Other Monetary Instruments With Them Shall File Fincen Form 105 At The Time Of Entry.

Web transnational tax information forms. Web the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments. Web currency transaction report omb no.