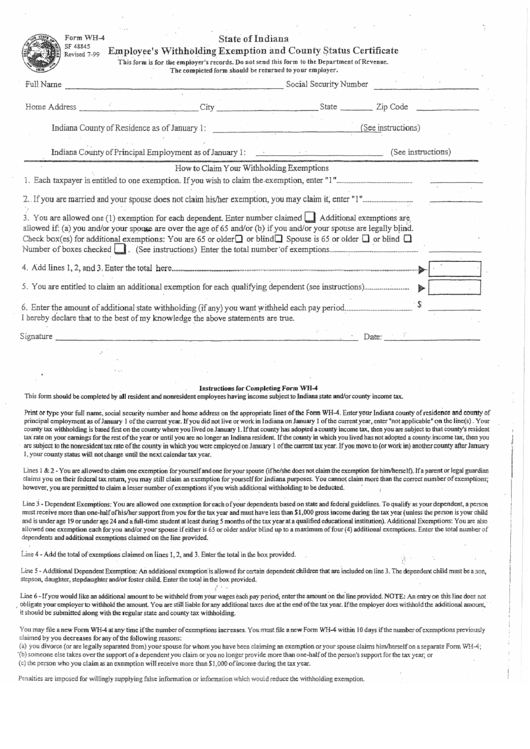

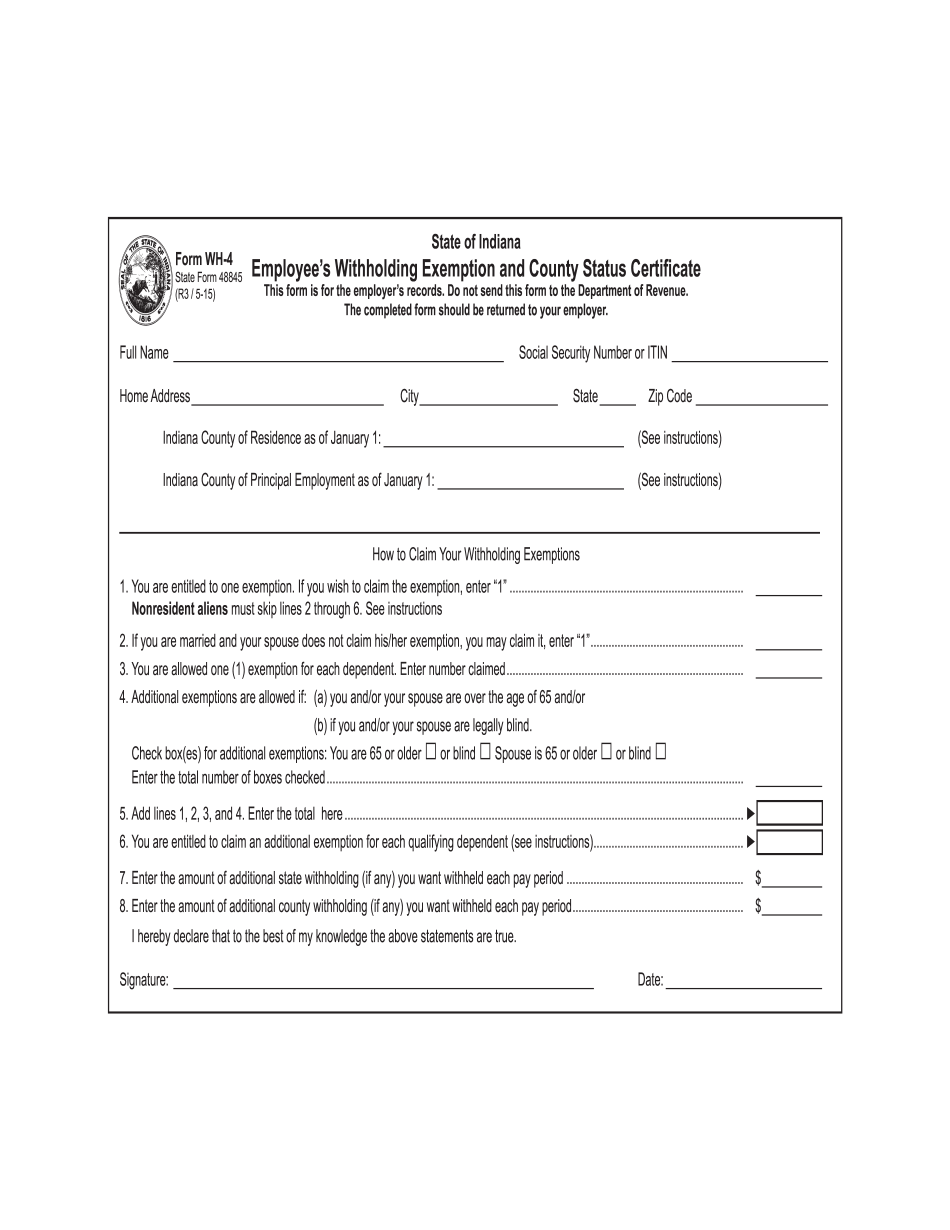

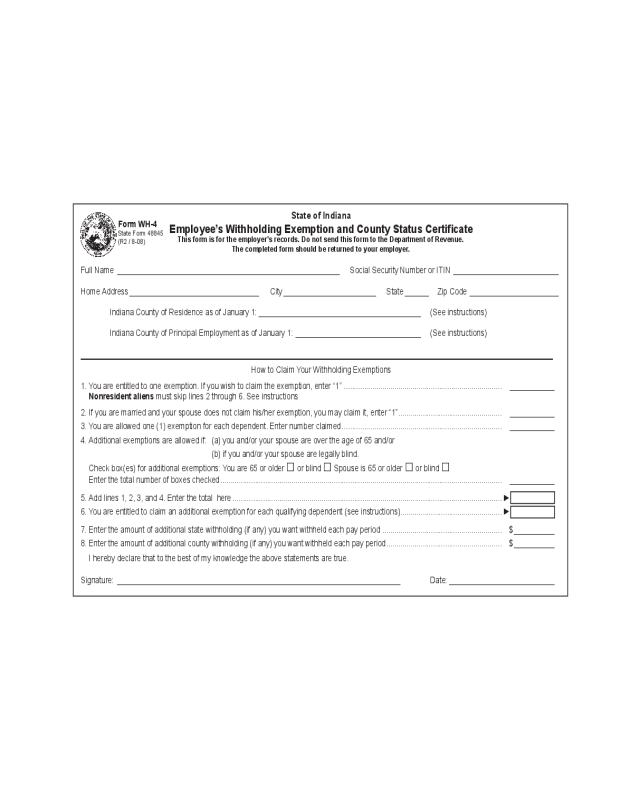

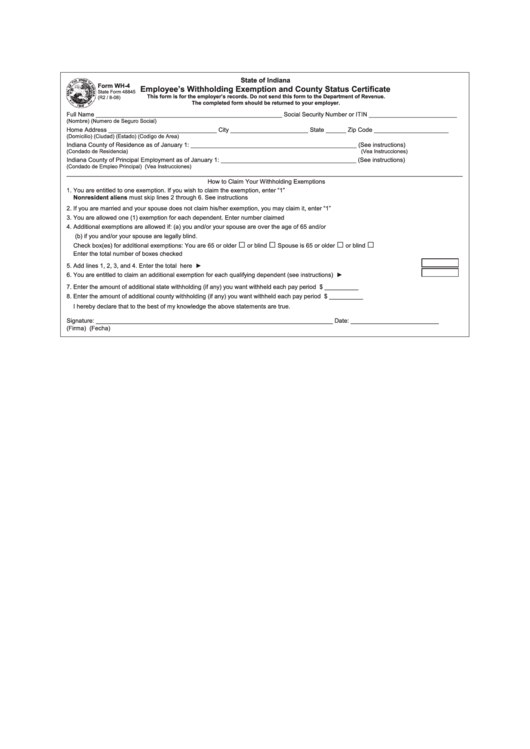

Indiana State Tax Form Wh 4 - Underpayment of indiana withholding filing. State of indiana employee’s withholding exemption and county status certificate this form is for. File my taxes as an indiana resident while i am in the. Know when i will receive my tax refund. In the first section, the information required is: Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web i want to find indiana tax forms. Web register and file this tax online via intime. The form comprises two sections in which an employee is required to fill in their personal details and details for claiming withholding exemptions. Web prior year tax forms can be found in the indiana state prior year tax forms webpage.

Form Wh4 Employee'S Withholding Exemption And County Status

Indiana county of residence as. Social security number or itin; State of indiana employee’s withholding exemption and county status certificate this form is for. Web most employees are entitled to deduct $1,500 per year per qualifying dependent exemption claimed on line 6 of his/her. Not seeing the form you need?

Indiana WH4 Printable Form IN W4 Form (State Tax Withholding)

The form comprises two sections in which an employee is required to fill in their personal details and details for claiming withholding exemptions. Underpayment of indiana withholding filing. In the first section, the information required is: State of indiana employee’s withholding exemption and county status certificate this form is for. Social security number or itin;

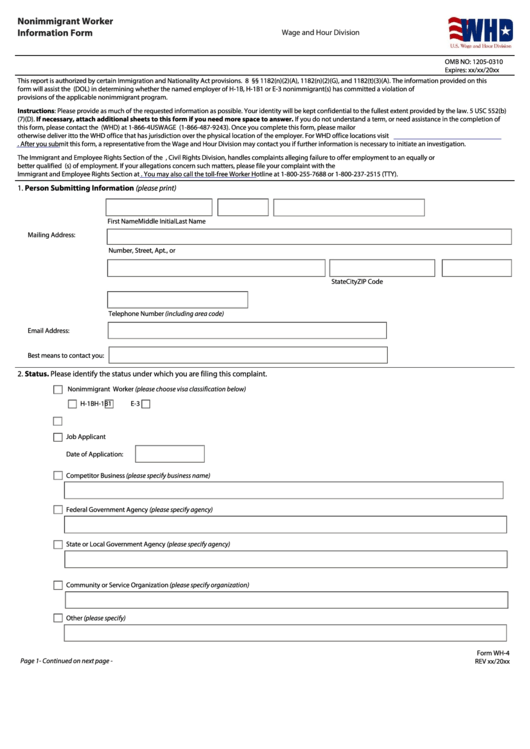

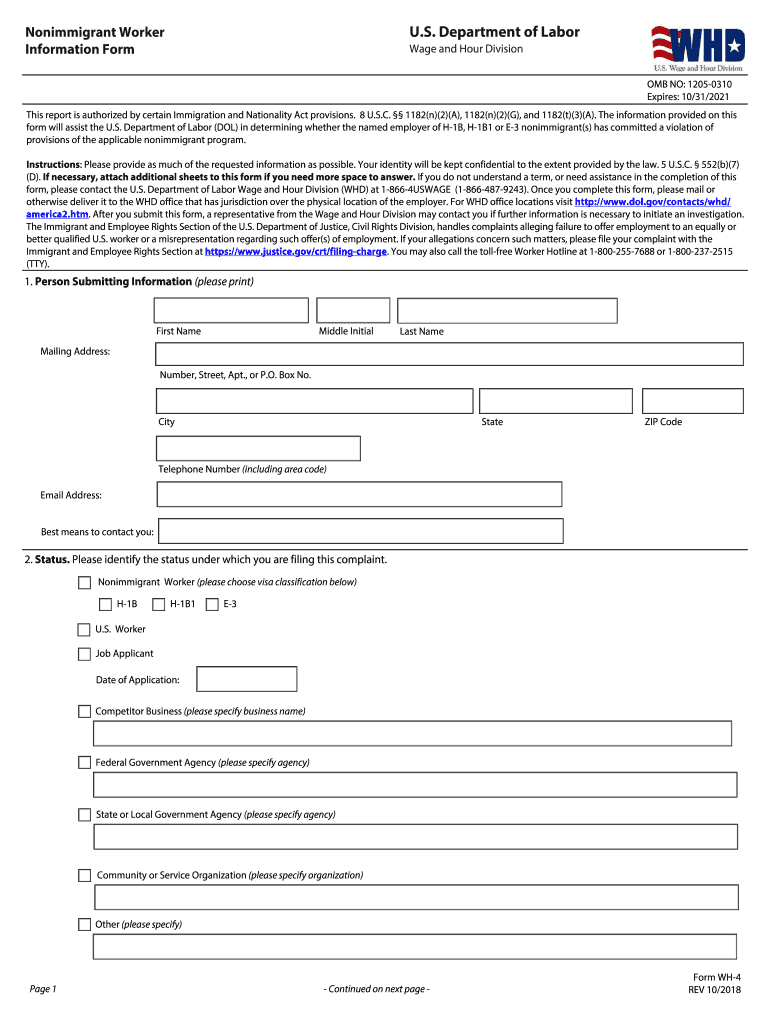

Fillable Form Wh4 Nonimmigrant Worker Information U.s. Department

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Indiana county of residence as. File my taxes as an indiana resident while i am in the. In the first section, the information required is: Underpayment of indiana withholding filing.

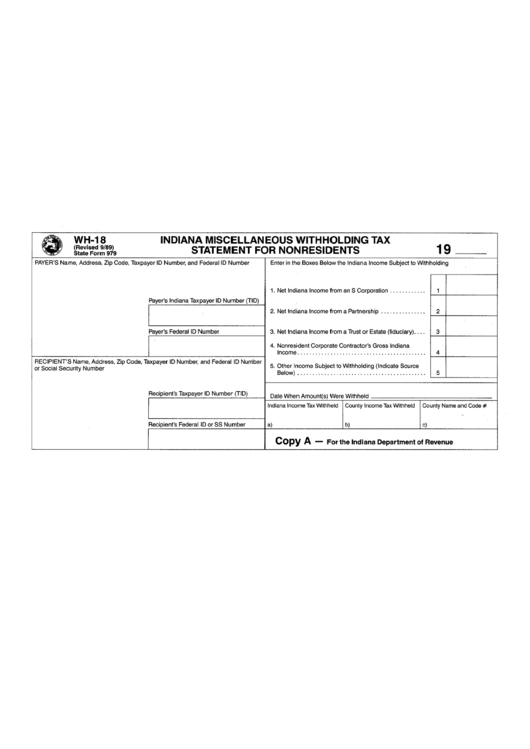

Fillable Form Wh18 Indiana Miscellaneous Withholding Tax Statement

Web register and file this tax online via intime. In the first section, the information required is: Web dor business tax withholding income tax if you have employees working at your business, you’ll need to collect. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. State of indiana employee’s withholding.

Employee's Withholding Exemption and County Status Certificate

Web i want to find indiana tax forms. In the first section, the information required is: File my taxes as an indiana resident while i am in the. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web this form should be completed by all resident and nonresident employees having.

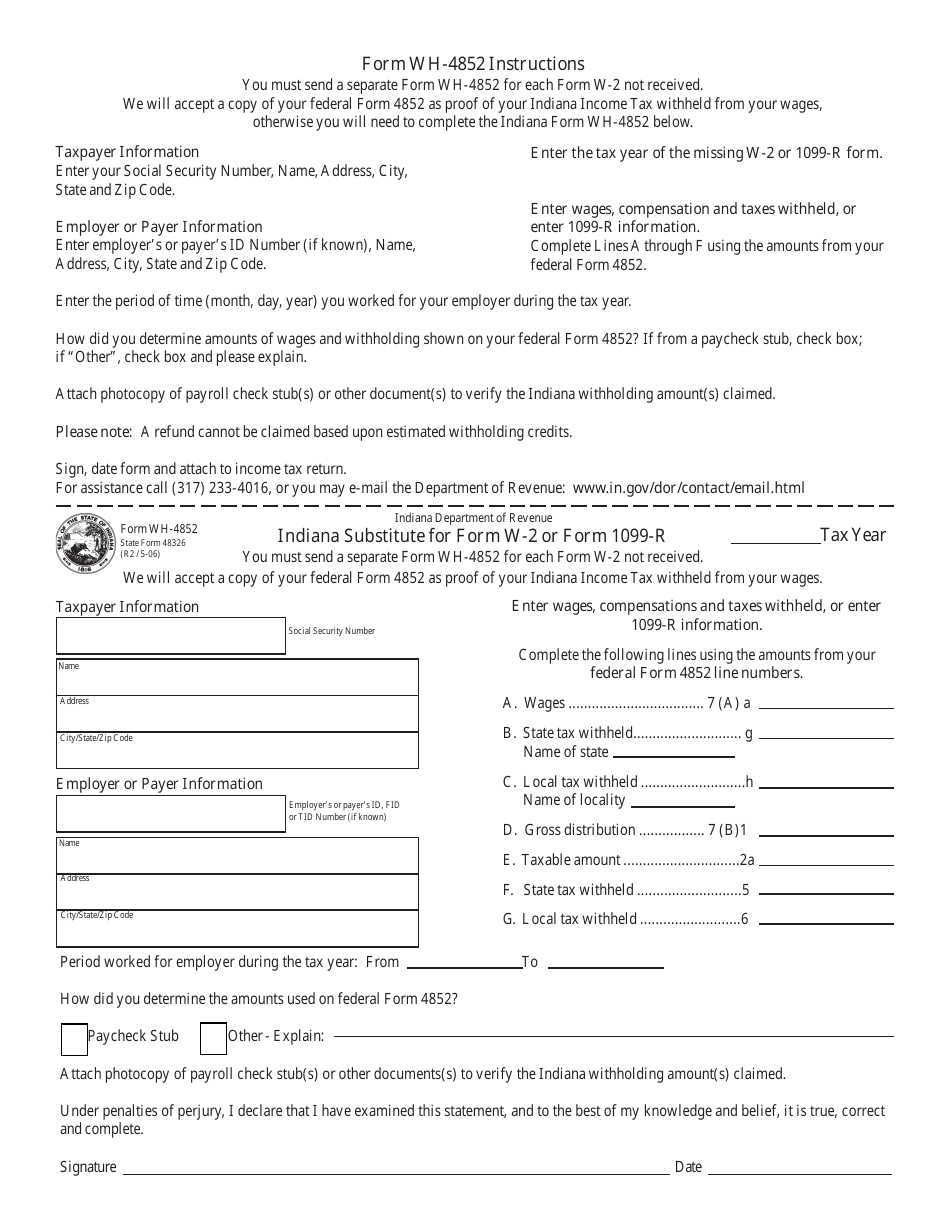

Form WH4852 Download Fillable PDF or Fill Online Indiana Substitute

Know when i will receive my tax refund. Underpayment of indiana withholding filing. Web prior year tax forms can be found in the indiana state prior year tax forms webpage. File my taxes as an indiana resident while i am in the. Not seeing the form you need?

criminal history background check form 2022 Fill out & sign online

Web prior year tax forms can be found in the indiana state prior year tax forms webpage. Social security number or itin; Indiana county of residence as. Web i want to find indiana tax forms. Underpayment of indiana withholding filing.

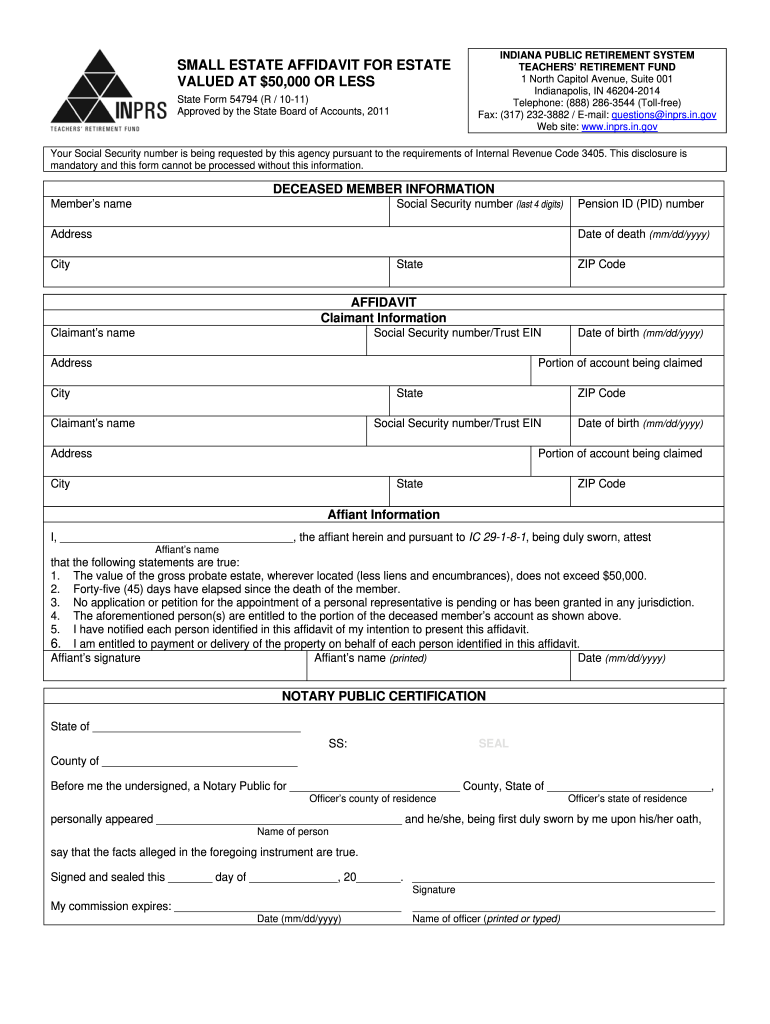

Indiana State Form 54794 2020 Fill and Sign Printable Template Online

Indiana county of residence as. Social security number or itin; Web register and file this tax online via intime. In the first section, the information required is: Web dor business tax withholding income tax if you have employees working at your business, you’ll need to collect.

Form Wh 4 Fill Out and Sign Printable PDF Template signNow

Social security number or itin; Web dor business tax withholding income tax if you have employees working at your business, you’ll need to collect. Web register and file this tax online via intime. Web prior year tax forms can be found in the indiana state prior year tax forms webpage. Underpayment of indiana withholding filing.

Fillable Form Wh4 Employee'S Withholding Exemption And County Status

The form comprises two sections in which an employee is required to fill in their personal details and details for claiming withholding exemptions. Know when i will receive my tax refund. State of indiana employee’s withholding exemption and county status certificate this form is for. File my taxes as an indiana resident while i am in the. Web this form.

Underpayment of indiana withholding filing. Web prior year tax forms can be found in the indiana state prior year tax forms webpage. In the first section, the information required is: Web most employees are entitled to deduct $1,500 per year per qualifying dependent exemption claimed on line 6 of his/her. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Not seeing the form you need? Web i want to find indiana tax forms. Employee’s withholding exemption and county status certificate. Web dor business tax withholding income tax if you have employees working at your business, you’ll need to collect. File my taxes as an indiana resident while i am in the. Web register and file this tax online via intime. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Social security number or itin; Indiana county of residence as. The form comprises two sections in which an employee is required to fill in their personal details and details for claiming withholding exemptions. Know when i will receive my tax refund. State of indiana employee’s withholding exemption and county status certificate this form is for.

File My Taxes As An Indiana Resident While I Am In The.

Web i want to find indiana tax forms. Indiana county of residence as. Not seeing the form you need? Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or.

Web Prior Year Tax Forms Can Be Found In The Indiana State Prior Year Tax Forms Webpage.

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Know when i will receive my tax refund. Underpayment of indiana withholding filing. Web register and file this tax online via intime.

Web Dor Business Tax Withholding Income Tax If You Have Employees Working At Your Business, You’ll Need To Collect.

Web most employees are entitled to deduct $1,500 per year per qualifying dependent exemption claimed on line 6 of his/her. The form comprises two sections in which an employee is required to fill in their personal details and details for claiming withholding exemptions. In the first section, the information required is: Employee’s withholding exemption and county status certificate.

Social Security Number Or Itin;

State of indiana employee’s withholding exemption and county status certificate this form is for.