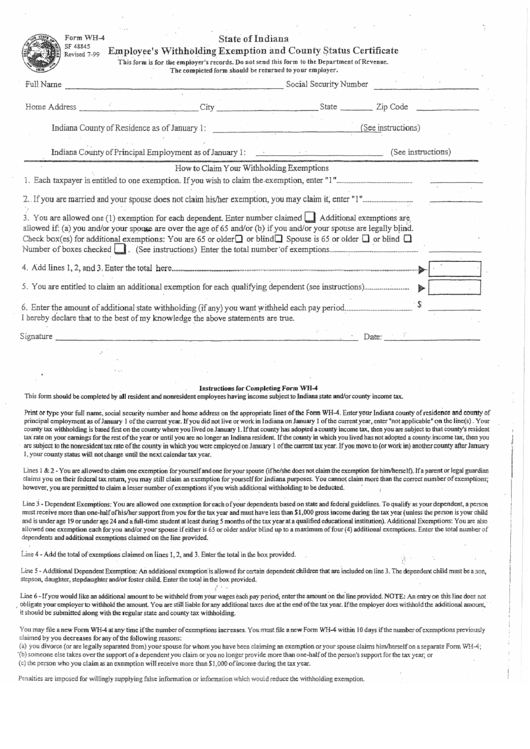

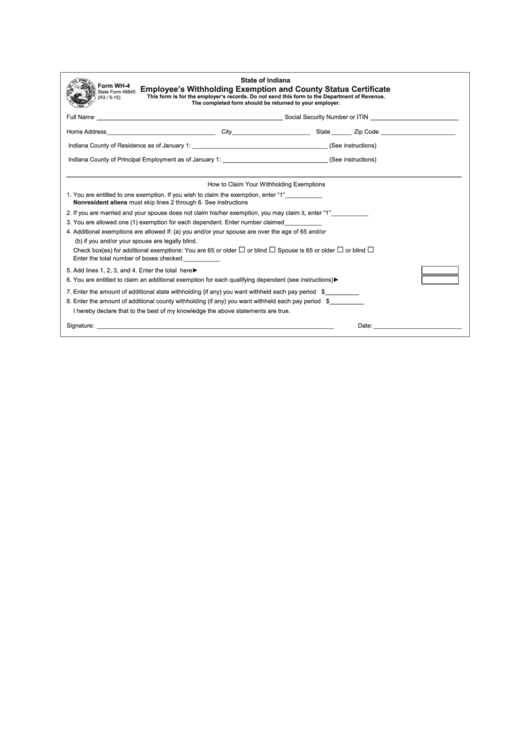

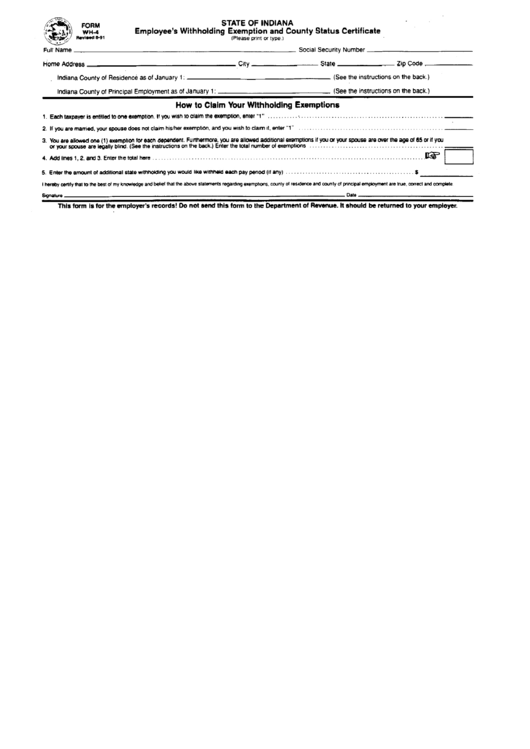

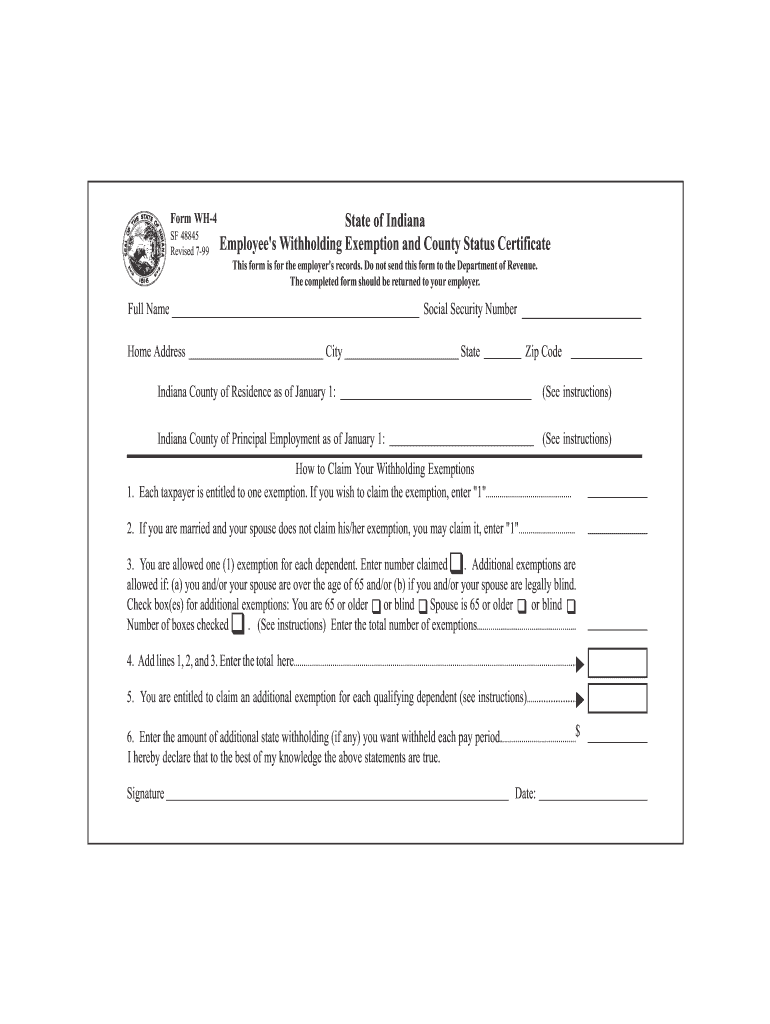

Indiana Form Wh-4 - Do not send this form to the department of revenue.the. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or. The form must be forwarded to the wage and. Most employees are entitled to deduct $1,500. Table b is used to figure additional dependent exemptions. Web a pdf document for indiana employees to claim their withholding exemptions and county status.

Download Form WH4 State of Indiana for Free TidyTemplates

Table b is used to figure additional dependent exemptions. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web a pdf document for indiana employees to claim their withholding exemptions and county status. Do not send this form to the department of revenue.the. Most employees are entitled to deduct $1,500.

Form Wh4 Employee'S Withholding Exemption And County Status

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the. The form must be forwarded to the wage and. Table b is used to figure additional dependent exemptions. Most employees are entitled to.

Fillable Form Wh4 Employee'S Withholding Exemption And County Status

Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or. Table b is used to figure additional dependent exemptions. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web a pdf document for indiana employees to claim their withholding exemptions and county.

Fillable Form Wh4 Employee'S Withholding Exemption And County Status

Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the. Web a pdf document for indiana employees to claim their withholding exemptions and county status. Do not send this form to the department of.

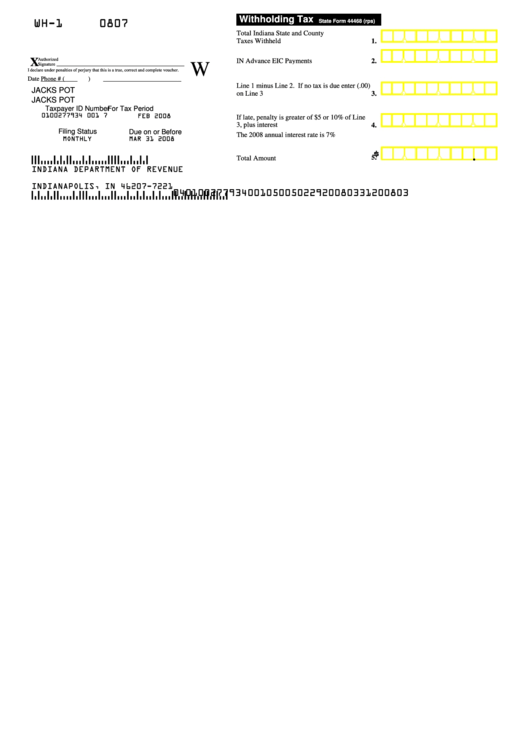

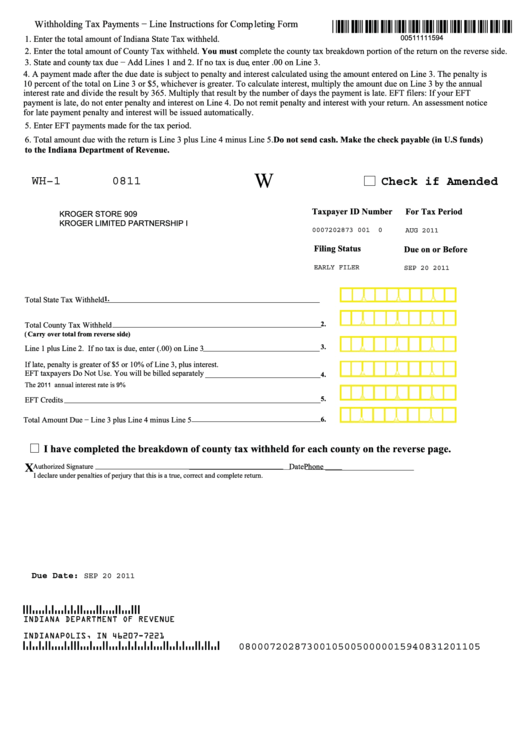

Form Wh1 Withholding Tax printable pdf download

Do not send this form to the department of revenue.the. Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or. The form must be forwarded to the wage and. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the. Table b is used to.

1996 IN Form 46800 Fill Online, Printable, Fillable, Blank pdfFiller

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Most employees are entitled to deduct $1,500. Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or. Web to register for withholding for indiana, the business must have an employer identification number (ein).

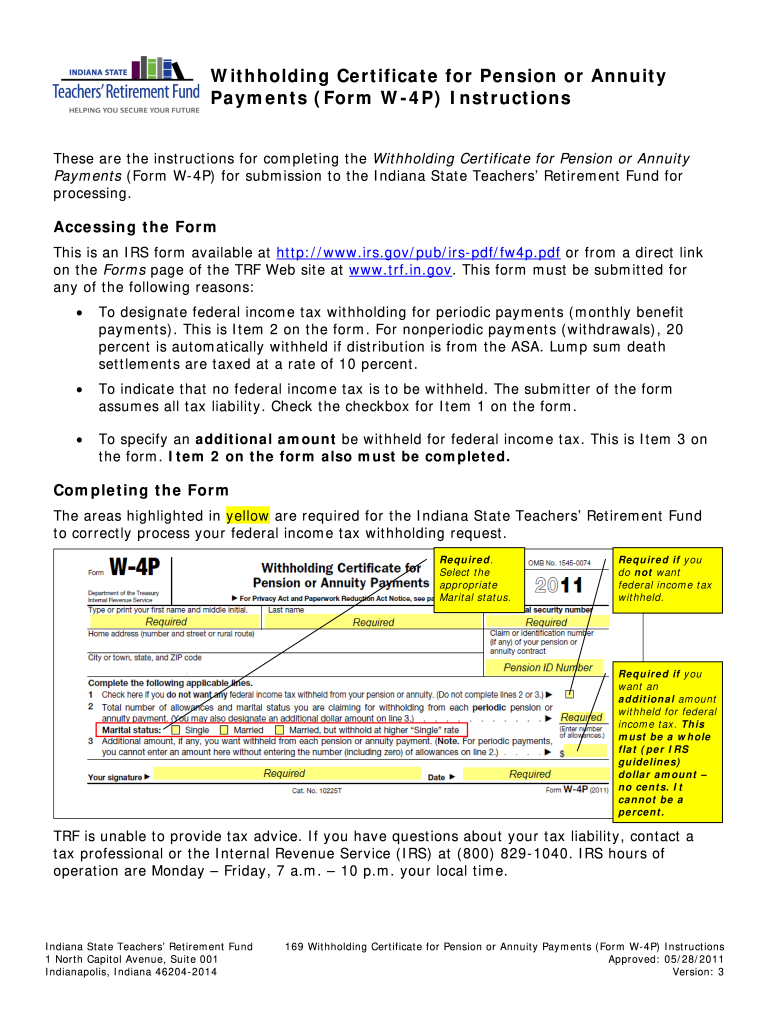

Indiana W4 Fill Out and Sign Printable PDF Template signNow

Web to register for withholding for indiana, the business must have an employer identification number (ein) from the. Most employees are entitled to deduct $1,500. Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or. Web this form should be completed by all resident and nonresident employees having income subject to indiana.

How Do I Claim 0 On My W 4 2020 eetidesigns

Do not send this form to the department of revenue.the. Web a pdf document for indiana employees to claim their withholding exemptions and county status. Table b is used to figure additional dependent exemptions. Most employees are entitled to deduct $1,500. Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or.

What Is Withholding Tax / What OASDI Tax Is and Why You Should Care

Most employees are entitled to deduct $1,500. Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or. The form must be forwarded to the wage and. Web a pdf document for indiana employees to claim their withholding exemptions and county status. Do not send this form to the department of revenue.the.

Indiana Wh 4 Form Fill Out and Sign Printable PDF Template signNow

Web a pdf document for indiana employees to claim their withholding exemptions and county status. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the. The form must be forwarded to the wage.

Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or. Web a pdf document for indiana employees to claim their withholding exemptions and county status. Most employees are entitled to deduct $1,500. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Table b is used to figure additional dependent exemptions. Do not send this form to the department of revenue.the. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the. The form must be forwarded to the wage and.

Web A Pdf Document For Indiana Employees To Claim Their Withholding Exemptions And County Status.

Most employees are entitled to deduct $1,500. Table b is used to figure additional dependent exemptions. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or. Web this form should be completed by all resident and nonresident employees having income subjectto indiana state and/or.

The Form Must Be Forwarded To The Wage And.

Do not send this form to the department of revenue.the. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the.