How To Fill Out Onlyfans Tax Form - Web below we have mentioned steps that you have to follow to file onlyfans taxes. Web to obtain your onlyfans tax form, you need to make sure that your mailing address is up to date on the. Web starting in whatever tax year you created your onlyfans account, you must notify hmrc immediately that you must submit. Estimated taxes the money that you are paid by onlyfans or myystar will not have any taxes taken out of it and so you will have to pay estimated taxes yourself during the year. To fill out the onlyfans w9 form, you will need to provide your legal name,. Web here are the tax forms you'll come across while filing your onlyfans taxes in order: Login to your only fans account and go to your profile page. Web pay how to file onlyfans tax form online may 17, 2023 6 mins read as an onlyfans creator, you must report and pay. Web as an onlyfans creator, you may also receive tax forms from the platform itself. Web if you are an onlyfans 1099 content creator, you'll need to know how to file your taxes on of end of the year.

Can I File Back Taxes Online

Web you will receive a 1099nec form that reflects the total amount onlyfans or myystar paid you during the year in box 1. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you. Web watch on how do you fill out the onlyfans.

How to file OnlyFans taxes (W9 and 1099 forms explained)

Web to put it simply, here is generally what you’ll need to file your taxes as an onlyfans content creator: Web as an onlyfans creator, you may also receive tax forms from the platform itself. Web starting in whatever tax year you created your onlyfans account, you must notify hmrc immediately that you must submit. Web pay how to file.

16+ VIP How To Fill Out W 9 Form For Onlyfans Leaked Photo

Web not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over. Web you will receive a 1099nec form that reflects the total amount onlyfans or myystar paid you during the year in box 1. Web if you are resident in the united states and earn more than.

Taxes for Onlyfans Tips for Beginners Etsy

Web starting in whatever tax year you created your onlyfans account, you must notify hmrc immediately that you must submit. Web to put it simply, here is generally what you’ll need to file your taxes as an onlyfans content creator: Web if you are an onlyfans 1099 content creator, you'll need to know how to file your taxes on of.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you. Web you can claim online or use form p85 to tell hmrc that you’ve left or are leaving the uk and want to claim back tax. Web to obtain your onlyfans tax form,.

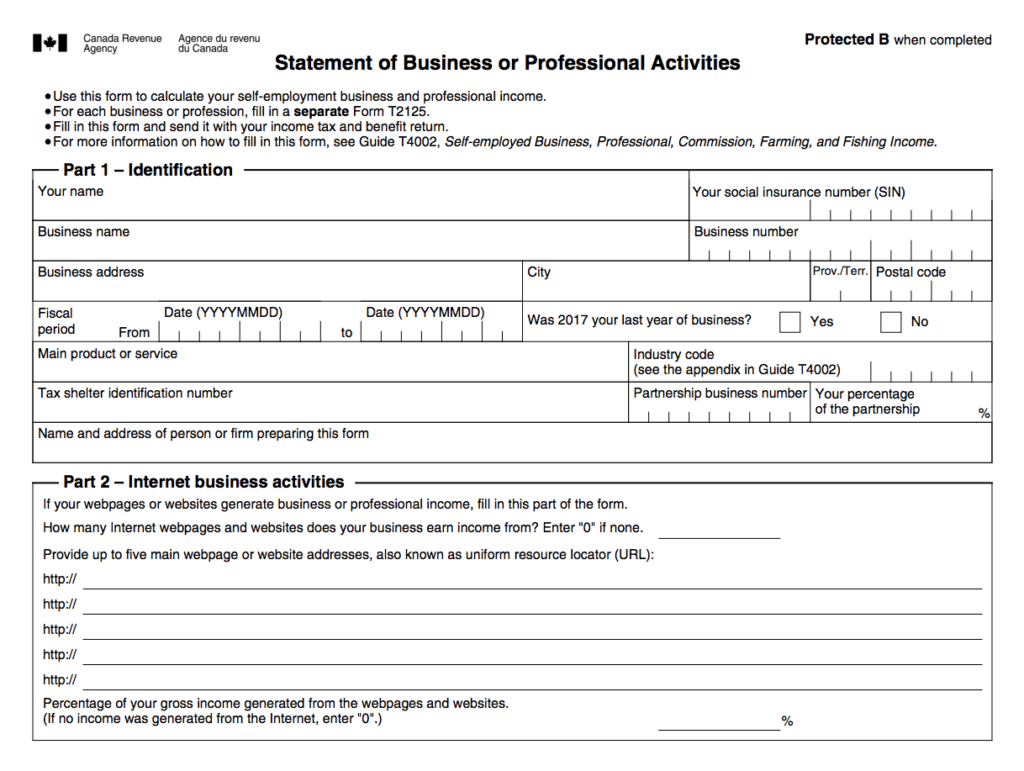

OnlyFans Creators Canadian Tax Guide Vlogfluence

Web you will receive a 1099nec form that reflects the total amount onlyfans or myystar paid you during the year in box 1. Web pay how to file onlyfans tax form online may 17, 2023 6 mins read as an onlyfans creator, you must report and pay. Web if you are an onlyfans 1099 content creator, you'll need to know.

16+ VIP How To Fill Out W 9 Form For Onlyfans Leaked Photo

Web not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over. Web if you are an onlyfans 1099 content creator, you'll need to know how to file your taxes on of end of the year. Web pay how to file onlyfans tax form online may 17, 2023.

How to file OnlyFans taxes (W9 and 1099 forms explained)

Web you can claim online or use form p85 to tell hmrc that you’ve left or are leaving the uk and want to claim back tax. Web based on www.doola.com, there are three steps to follow when filing taxes as an onlyfans creator: Web to put it simply, here is generally what you’ll need to file your taxes as an.

Filing taxes for onlyfans 👉👌5 steps for getting started on OnlyFans

Web to put it simply, here is generally what you’ll need to file your taxes as an onlyfans content creator: Web you will receive a 1099nec form that reflects the total amount onlyfans or myystar paid you during the year in box 1. Web watch on how do you fill out the onlyfans w9 form? Web based on www.doola.com, there.

OnlyFans Taxes What Taxes Do I File? [2023 US Guide]

Web based on www.doola.com, there are three steps to follow when filing taxes as an onlyfans creator: Web you will receive a 1099nec form that reflects the total amount onlyfans or myystar paid you during the year in box 1. Web to put it simply, here is generally what you’ll need to file your taxes as an onlyfans content creator:.

Web below we have mentioned steps that you have to follow to file onlyfans taxes. Web watch on how do you fill out the onlyfans w9 form? You will get a form that you have to. Web to put it simply, here is generally what you’ll need to file your taxes as an onlyfans content creator: Web starting in whatever tax year you created your onlyfans account, you must notify hmrc immediately that you must submit. Web to obtain your onlyfans tax form, you need to make sure that your mailing address is up to date on the. Onlyfans may send a 1099 form to. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you. Web based on www.doola.com, there are three steps to follow when filing taxes as an onlyfans creator: If you’re an onlyfans creator, the internal revenue service (irs) considers you a. Web you can claim online or use form p85 to tell hmrc that you’ve left or are leaving the uk and want to claim back tax. Web if you somehow lost your onlyfans 1099 form, you can download a copy directly from your onlyfans' website account. Login to your only fans account and go to your profile page. Estimated taxes the money that you are paid by onlyfans or myystar will not have any taxes taken out of it and so you will have to pay estimated taxes yourself during the year. Web pay how to file onlyfans tax form online may 17, 2023 6 mins read as an onlyfans creator, you must report and pay. Web you will receive a 1099nec form that reflects the total amount onlyfans or myystar paid you during the year in box 1. Web as an onlyfans creator, you may also receive tax forms from the platform itself. Web not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over. To fill out the onlyfans w9 form, you will need to provide your legal name,. Web if you are an onlyfans 1099 content creator, you'll need to know how to file your taxes on of end of the year.

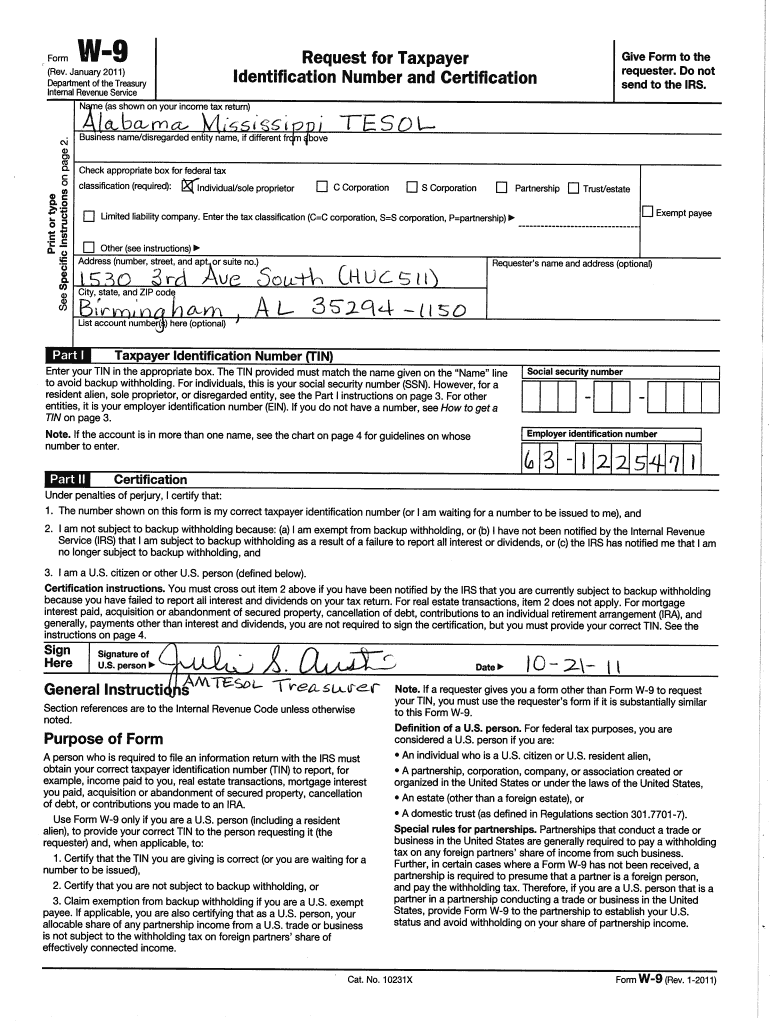

To Fill Out The Onlyfans W9 Form, You Will Need To Provide Your Legal Name,.

Web as an onlyfans creator, you may also receive tax forms from the platform itself. Web watch on how do you fill out the onlyfans w9 form? Web below we have mentioned steps that you have to follow to file onlyfans taxes. Web if you are resident in the united states and earn more than $600 from onlyfans, you should receive a 1099 form from the different brands you.

Web To Put It Simply, Here Is Generally What You’ll Need To File Your Taxes As An Onlyfans Content Creator:

If you’re an onlyfans creator, the internal revenue service (irs) considers you a. Estimated taxes the money that you are paid by onlyfans or myystar will not have any taxes taken out of it and so you will have to pay estimated taxes yourself during the year. Web to obtain your onlyfans tax form, you need to make sure that your mailing address is up to date on the. Login to your only fans account and go to your profile page.

Web You Will Receive A 1099Nec Form That Reflects The Total Amount Onlyfans Or Myystar Paid You During The Year In Box 1.

Also, you only have to. Web starting in whatever tax year you created your onlyfans account, you must notify hmrc immediately that you must submit. Web if you are an onlyfans 1099 content creator, you'll need to know how to file your taxes on of end of the year. Web if you somehow lost your onlyfans 1099 form, you can download a copy directly from your onlyfans' website account.

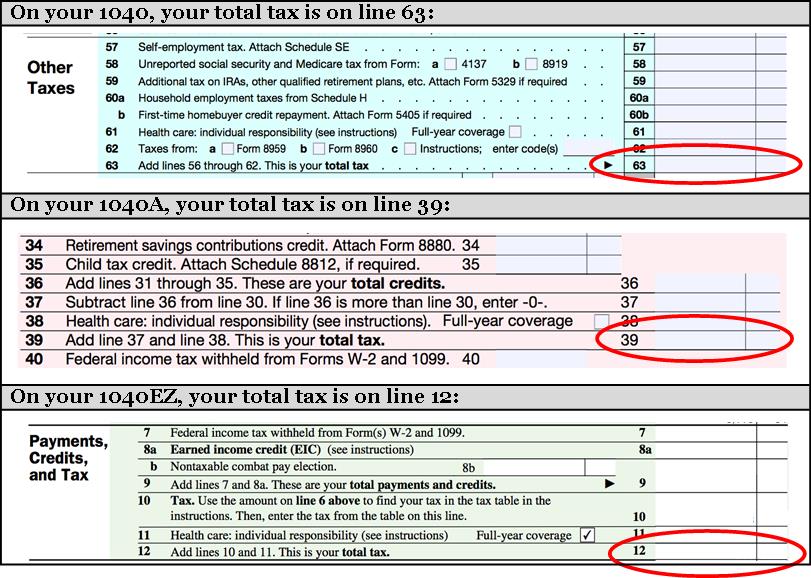

Web Here Are The Tax Forms You'll Come Across While Filing Your Onlyfans Taxes In Order:

Web based on www.doola.com, there are three steps to follow when filing taxes as an onlyfans creator: Onlyfans may send a 1099 form to. Web you can claim online or use form p85 to tell hmrc that you’ve left or are leaving the uk and want to claim back tax. You will get a form that you have to.

![OnlyFans Taxes What Taxes Do I File? [2023 US Guide]](https://freecashflow.io/wp-content/uploads/2021/11/W-9.png)