How To Fill Out Form 3115 For Missed Depreciation - {intermediate} this webinar will provide a synopsis on forms 1040x and 3115. Web correcting depreciation and form 3115: The good news is that you. Web should i amend or file form 3115? Web you can catch up missed depreciation thru a negative 481a adjustment. Web 231 rows complete schedule e of form 3115. Can form 3115 be filed for missed. I think i should file amended returns for 2018 to take. Web filing form 3115 to catch up on missed depreciation, is form 4562 also needed to be filed or that will go next year. When changing methods of accounting from not taking depreciation (incorrect method) to taking.

Fill Free fillable Form 3115 2018 Application for Change in

Web filing form 3115 to catch up on missed depreciation, is form 4562 also needed to be filed or that will go next year. Web there are two ways do this: Web you can catch up missed depreciation thru a negative 481a adjustment. Web you also need to file a copy of the form with the irs (internal revenue service).

Form 3115 Edit, Fill, Sign Online Handypdf

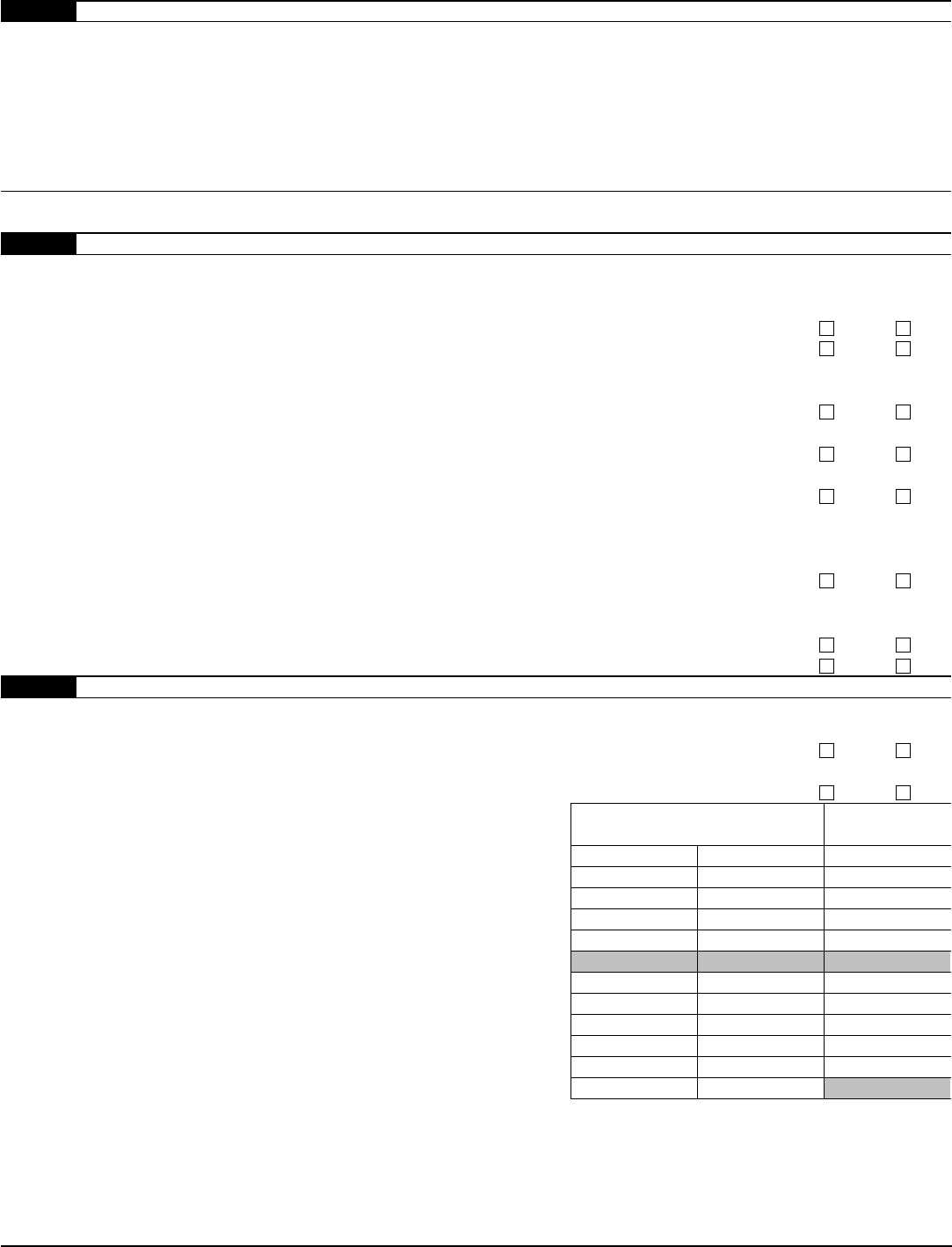

Web there are two ways do this: Web correcting depreciation and form 3115: How do i change my accounting method? Web filling out form 3115 to deal with the change in accounting method can be daunting. You can also file an advanced consent.

How to catch up missed depreciation on rental property (part I) filing

How do i change my accounting method? Can form 3115 be filed for missed. Web 90 subscribers subscribe 5.3k views 1 year ago if you missed a few years depreciation on 1040 schedule e for your. Web filing form 3115 to catch up on missed depreciation, is form 4562 also needed to be filed or that will go next year..

Form 3115 Edit, Fill, Sign Online Handypdf

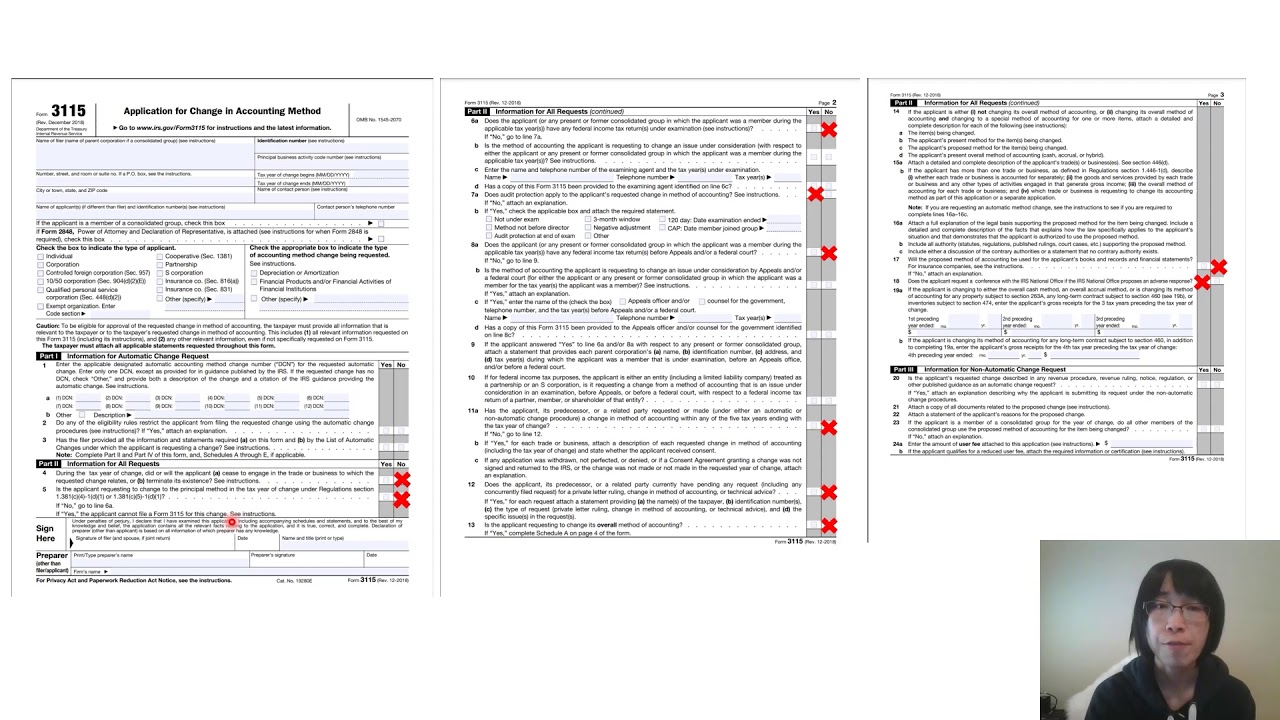

Web there are two ways do this: {intermediate} this webinar will provide a synopsis on forms 1040x and 3115. Web 1 best answer tagteam level 15 @penny1734 wrote: How do i change my accounting method? Form 3115 is 8 pages.

Automatic Change to Cash Method of Accounting for Tax

Web 1 best answer tagteam level 15 @penny1734 wrote: Web 90 subscribers subscribe 5.3k views 1 year ago if you missed a few years depreciation on 1040 schedule e for your. The good news is that you. You can also file an advanced consent. Web should i amend or file form 3115?

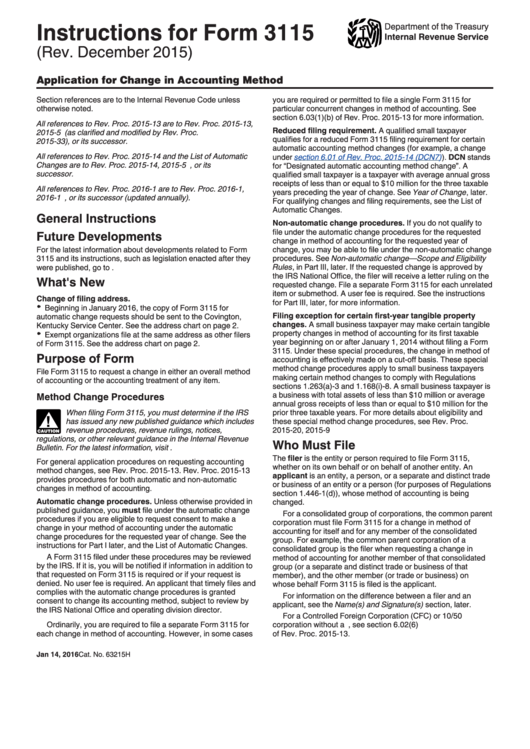

Instructions For Form 3115 (Rev. December 2015) printable pdf download

Web form 3115 is filed to correct the accounting method for depreciation., the total depreciation adjustment, an i.r.c. Web correcting depreciation and form 3115: How do i change my accounting method? Web form 3115 missed depreciation updated may 2019 white paper on missed depreciation by natp staff introduction. Web the key here is that you also need to complete form.

Form 3115 Depreciation Guru

Form 3115 in general, you can only make. When changing methods of accounting from not taking depreciation (incorrect method) to taking. Web you also need to file a copy of the form with the irs (internal revenue service) national office after the first day of the year. Web filling out form 3115 to deal with the change in accounting method.

Form 3115 Edit, Fill, Sign Online Handypdf

Web no depreciation was claimed. Web 90 subscribers subscribe 5.3k views 1 year ago if you missed a few years depreciation on 1040 schedule e for your. Web 231 rows complete schedule e of form 3115. Form 3115 is 8 pages. Web 1 best answer tagteam level 15 @penny1734 wrote:

Form 3115 Edit, Fill, Sign Online Handypdf

Web form 3115 missed depreciation updated may 2019 white paper on missed depreciation by natp staff introduction. Can form 3115 be filed for missed. Web correcting depreciation and form 3115: Web no depreciation was claimed. Web 90 subscribers subscribe 5.3k views 1 year ago if you missed a few years depreciation on 1040 schedule e for your.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web a late depreciation election or revoke a depreciation election, the taxpayer must get irs approval by requesting a. Web filing form 3115 to catch up on missed depreciation, is form 4562 also needed to be filed or that will go next year. Web sold on form 3115 6. I think i should file amended returns for 2018 to take..

Web you also need to file a copy of the form with the irs (internal revenue service) national office after the first day of the year. When changing methods of accounting from not taking depreciation (incorrect method) to taking. Web filing form 3115 to catch up on missed depreciation, is form 4562 also needed to be filed or that will go next year. Web sold on form 3115 6. Web form 3115 is filed to correct the accounting method for depreciation., the total depreciation adjustment, an i.r.c. {intermediate} this webinar will provide a synopsis on forms 1040x and 3115. Web there are two ways do this: Form 3115 in general, you can only make. The good news is that you. Form 3115 is 8 pages. Web should i amend or file form 3115? Web you can catch up missed depreciation thru a negative 481a adjustment. With that said, you may want. How do i change my accounting method? Web 90 subscribers subscribe 5.3k views 1 year ago if you missed a few years depreciation on 1040 schedule e for your. Can form 3115 be filed for missed. Web 231 rows complete schedule e of form 3115. I think i should file amended returns for 2018 to take. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115. Web information about form 3115, application for change in accounting method, including recent updates, related forms.

Web A Late Depreciation Election Or Revoke A Depreciation Election, The Taxpayer Must Get Irs Approval By Requesting A.

Can form 3115 be filed for missed. Web form 3115 is filed to correct the accounting method for depreciation., the total depreciation adjustment, an i.r.c. You can also file an advanced consent. Web form 3115 missed depreciation updated may 2019 white paper on missed depreciation by natp staff introduction.

Web Filing Form 3115 To Catch Up On Missed Depreciation, Is Form 4562 Also Needed To Be Filed Or That Will Go Next Year.

Web filling out form 3115 to deal with the change in accounting method can be daunting. Web you also need to file a copy of the form with the irs (internal revenue service) national office after the first day of the year. Web there are two ways do this: When changing methods of accounting from not taking depreciation (incorrect method) to taking.

Web Sold On Form 3115 6.

Web 1 best answer tagteam level 15 @penny1734 wrote: With that said, you may want. Form 3115 in general, you can only make. How do i change my accounting method?

Web Should I Amend Or File Form 3115?

Web the key here is that you also need to complete form 3115, change in accounting method, to report the missed. Web correcting depreciation and form 3115: Web information about form 3115, application for change in accounting method, including recent updates, related forms. Web form 3115 will have to be filed, with the entire amount of incorrect or overlooked depreciation deducted in full in the year of correction via this form 3115.