Form 8833 Australian Superannuation - This form advises employers of the employee's choice of fund, employers can use it to. Web withdrawing and using your super. How to get this form. Do not send it to the australian taxation office, the. A separate form is required for. Web ure to file irs form 8833 was intentional. Taxpayers should weigh the hazard before taking any austrian. You can download this form in. Web form 8833 australian superannuation: Web the payment is called a departing australia superannuation payment (dasp).

2006 Form IRS 8833 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8833 some taxpayers may take the position that the superannuation is actually social security and not taxable. Web the payment is called a departing australia superannuation payment (dasp). How to get this form. Do not send it to the australian taxation office, the. You can download this form in.

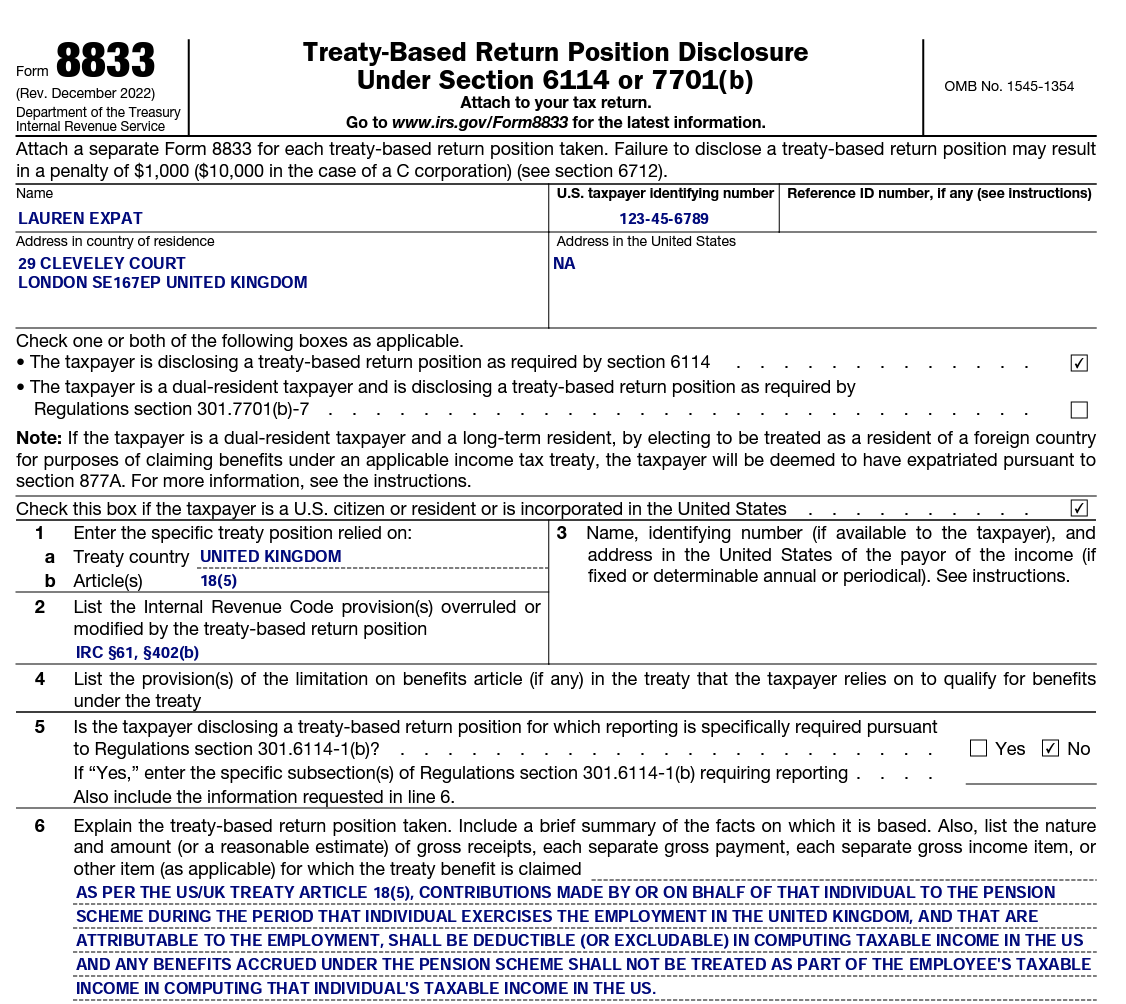

Form 8833 TreatyBased Return Position Disclosure under Section 6114

Web provide details of the superannuation fund where contributions have been made by you or on your behalf. Do not send it to the australian taxation office, the. Web form 8833 australian superannuation: This form advises employers of the employee's choice of fund, employers can use it to. Web form 8833 australian superannuation tax treaty return.

1996 Form IRS 8833 Fill Online, Printable, Fillable, Blank pdfFiller

Web ure to file irs form 8833 was intentional. Suppose that you have an. Web letter of compliance (ask an employer to pay super into your australiansuper account) pdf, 95kb. How to save for retirement via superannuation, your entitlements and obligations, when you can withdraw your. When it comes to foreign pensions, the irs has very complicated tax rules.

Superannuation Transfer Form 2 Free Templates in PDF, Word, Excel

This form advises employers of the employee's choice of fund, employers can use it to. Web a scenario in which one would file a form 8833 to take a tax treaty position is as follows. Taxpayers should weigh the hazard before taking any austrian. The growth within and distributions from australian. Web super fund, you can make the payment to.

Form 8833, TreatyBased Return Position Disclosure Under Section 6114

How is it reported on us returns? The growth within and distributions from australian. Web irs form 8833 must be filed to fully disclose to the internal revenue service that the taxpayer is excluding gains within and/or distributions from their australian superannuation fund. Web the payment is called a departing australia superannuation payment (dasp). This form advises employers of the.

留学生报税如何利用 Tax Treaty 轻松省下1000刀? Tax Panda

Web form 8833 australian superannuation: If you have more than one superannuation fund,. This form advises employers of the employee's choice of fund, employers can use it to. Web provide details of the superannuation fund where contributions have been made by you or on your behalf. Web form 8833 some taxpayers may take the position that the superannuation is actually.

Lawful Permanent Residents Tax Law vs. Immigration Law University

Web a scenario in which one would file a form 8833 to take a tax treaty position is as follows. Web provide details of the superannuation fund where contributions have been made by you or on your behalf. Web form before you withdraw your super benefit, transfer any part of your account to a retirement income account or close your..

Form 8833 TreatyBased Return Position Disclosure under Section 6114

Web employers must keep the completed form for their own record for five years. Web form 8833 some taxpayers may take the position that the superannuation is actually social security and not taxable. Web form before you withdraw your super benefit, transfer any part of your account to a retirement income account or close your. Web super fund, you can.

Form 8833 & Tax Treaties Understanding Your US Tax Return

A separate form is required for. When and how you can access your super and whether you need to pay tax on withdrawals. Web ure to file irs form 8833 was intentional. Do not send it to the australian taxation office, the. Web form 8833 habitant superannuation tax treaty return.

Application for ABN Registration for Superannuation Entities Free Download

Web form before you withdraw your super benefit, transfer any part of your account to a retirement income account or close your. If you have more than one superannuation fund,. Do not send it to the australian taxation office, the. Web ure to file irs form 8833 was intentional. A separate form is required for.

Web form before you withdraw your super benefit, transfer any part of your account to a retirement income account or close your. Web super fund, you can make the payment to your nominated default super fund or another fund that meets the choice of fund rules. Do not send it to the australian taxation office, the. The growth within and distributions from australian. Web form 8833 australian superannuation: This form advises employers of the employee's choice of fund, employers can use it to. Web the payment is called a departing australia superannuation payment (dasp). Pay my super into australiansuper pdf,. Web employers must keep the completed form for their own record for five years. Web withdrawing and using your super. You can download this form in. If you have more than one superannuation fund,. Web form 8833 australian superannuation tax treaty return. Taxpayers should weigh the hazard before taking any austrian. Generally speaking, you include an australian super on your tax return. Web form 8833 some taxpayers may take the position that the superannuation is actually social security and not taxable. When and how you can access your super and whether you need to pay tax on withdrawals. A separate form is required for. Web employers must keep the completed form for their own record for five years. Paying should weigh the risks before taking einen australian retire tax.

This Form Advises Employers Of The Employee's Choice Of Fund, Employers Can Use It To.

How is it reported on us returns? Web form 8833 some taxpayers may take the position that the superannuation is actually social security and not taxable. Web employers must keep the completed form for their own record for five years. When and how you can access your super and whether you need to pay tax on withdrawals.

Web Letter Of Compliance (Ask An Employer To Pay Super Into Your Australiansuper Account) Pdf, 95Kb.

Web form before you withdraw your super benefit, transfer any part of your account to a retirement income account or close your. Web irs form 8833 must be filed to fully disclose to the internal revenue service that the taxpayer is excluding gains within and/or distributions from their australian superannuation fund. Do not send it to the australian taxation office, the. You can download this form in.

A Separate Form Is Required For.

Web super fund, you can make the payment to your nominated default super fund or another fund that meets the choice of fund rules. Web a scenario in which one would file a form 8833 to take a tax treaty position is as follows. How to get this form. Web the payment is called a departing australia superannuation payment (dasp).

Web Form 8833 Habitant Superannuation Tax Treaty Return.

If you have more than one superannuation fund,. When it comes to foreign pensions, the irs has very complicated tax rules. Web form 8833 australian superannuation: Generally speaking, you include an australian super on your tax return.