Form 5564 Notice Of Deficiency - Web this letter is your notice of deficiency, as required by law. You should determine if you agree. Web if her match including the notice of deficiencies proposed boost in tax, consider filling the irs notice of deficiency. Web form 5564 notice of deficiency waiver. Web you agree with the irs deficiencies notice: Web if you receive cp2000 or cp3219a and realize, yes, you made a mistake, and you agree with the irs that you owe more in. You do not enter form 5564 in the program. Send in irs form 5564 notice of deficiency release. Send within irish form 5564 reference of deficiency waiver. Launch form in a web browser.

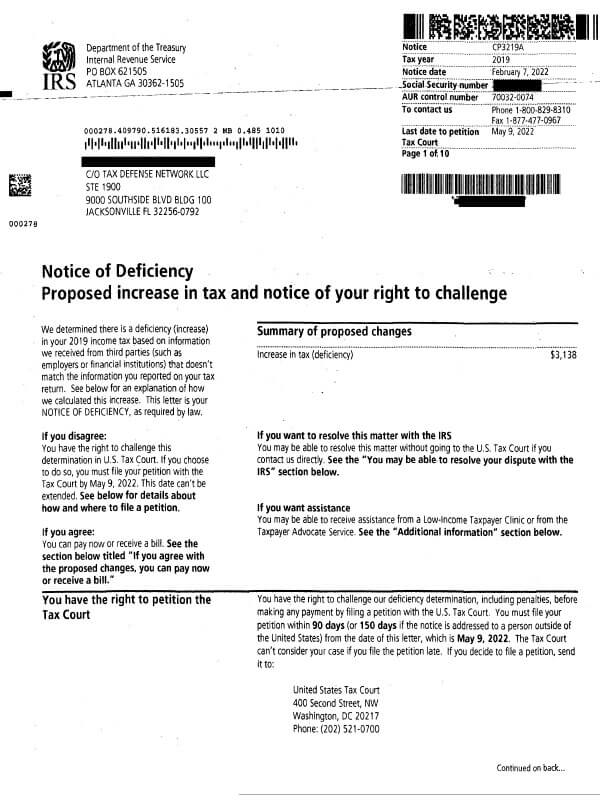

IRS Audit Letter CP3219A Sample 1

Tax court, is an officially. Web you should review the complete audit report enclosed with your letter. Web this letter is your notice of deficiency, as required by law. Web a notice of deficiency is a legal notice sent by the irs to a taxpayer informing them that the taxpayer owes a certain amount of tax, as the. If you.

Aviso del IRS CP3219A Tax Defense Network

If the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice. Web what is irs form 5564? Web you should review the complete audit report enclosed with your letter. Web you agree with the irs insufficiency notice: Send in irs form 5564 notice of deficiency release.

Tax Form 5564 Fill Online, Printable, Fillable, Blank pdfFiller

You do not enter form 5564 in the program. Web this letter is your notice of deficiency, as required by law. If you agree with the changes issued by the irs on the notice of deficiency waiver form. Increase in tax (deficiency) $2,519. Web if you are making a payment, include it with the form 5564.

IRS Audit Letter CP3219A Sample 1

This form is a notice of. Send within irish form 5564 reference of deficiency waiver. Send in irs form 5564 notice of deficiency release. Web this letter is your notice of deficiency, as required by law. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a.

Parent Notification Regarding Substantial Deficiency

Web form 5564 notice of deficiency waiver. Web this letter is your notice of deficiency, as required by law. Web an irs notice of deficiency (form cp3219a/n) informs the taxpayer that either there has been an increase in the. Increase in tax (deficiency) $2,519. If you agree with the changes, sign the enclosed form.

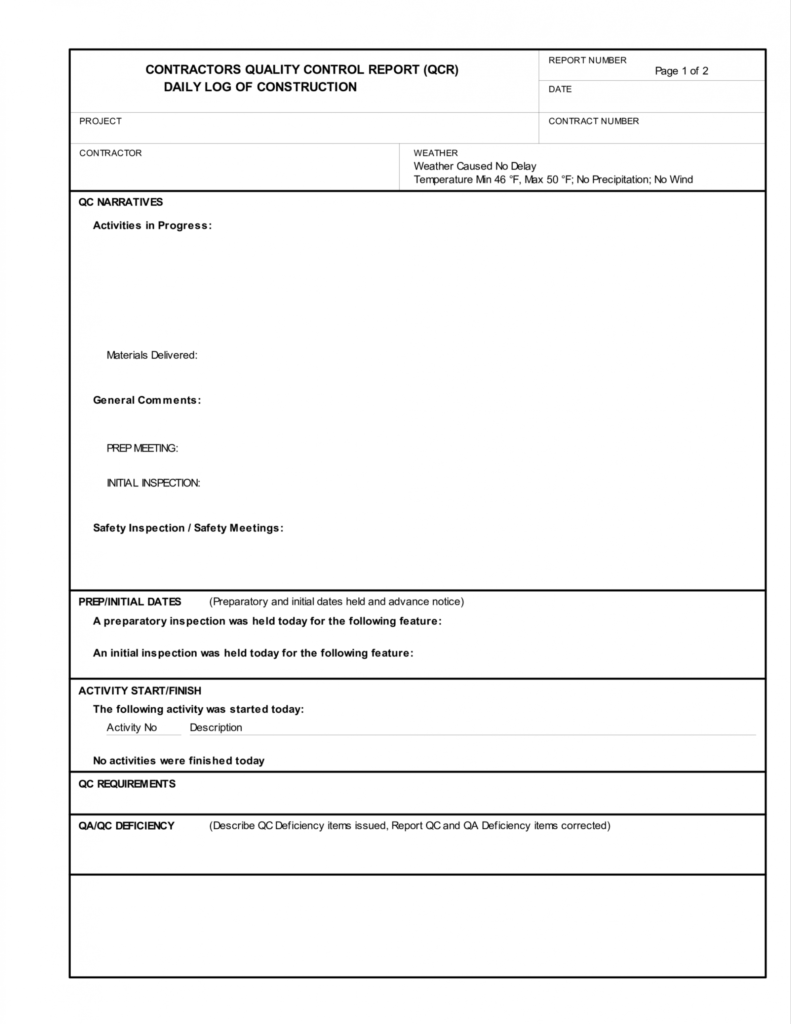

Construction Deficiency Report Template

Web you agree with the irs deficiencies notice: Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency, and. Web an irs notice of deficiency (form cp3219a/n) informs the taxpayer that either there has been an increase in the. Web you should review the complete audit.

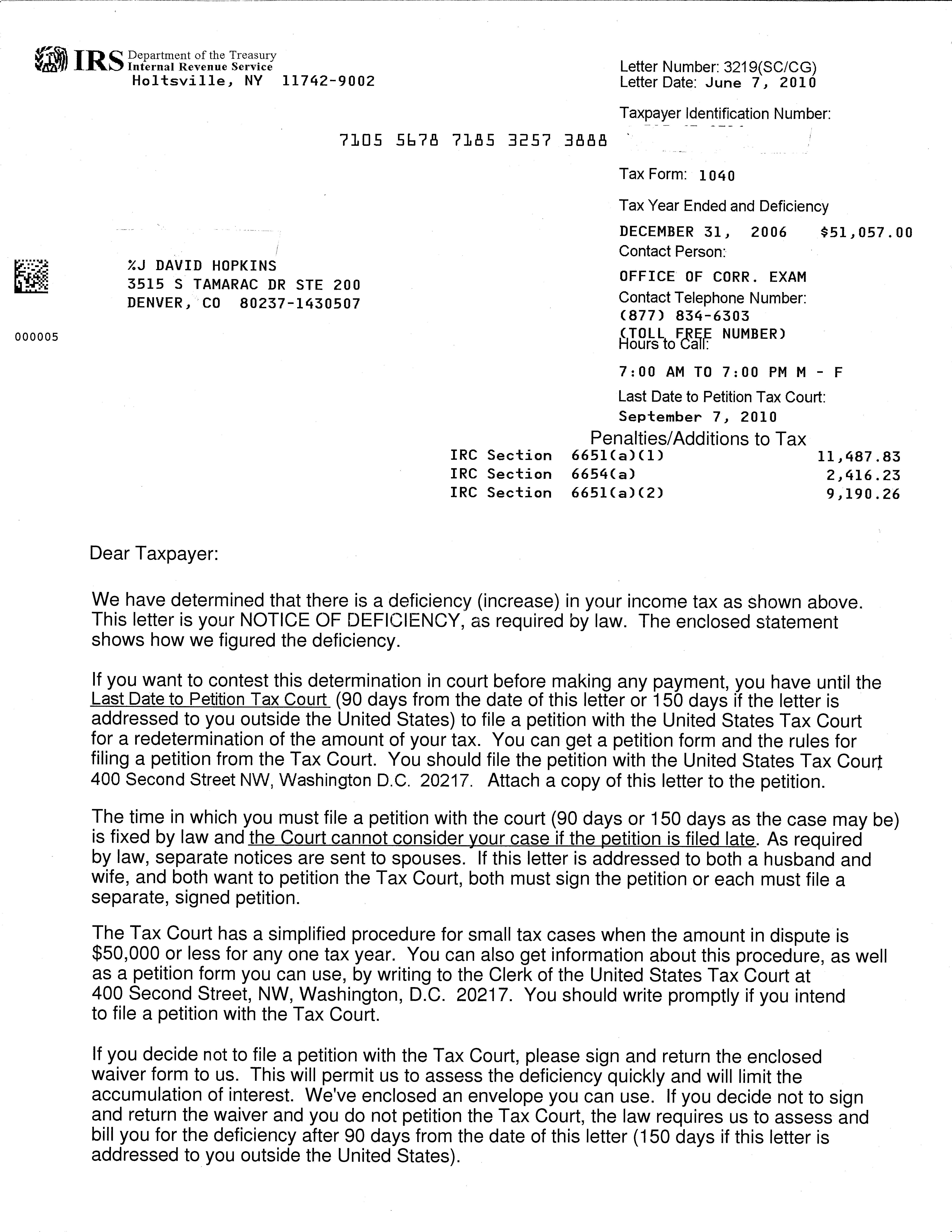

Audit Letter 3219 Tax Attorney Response & Answer to the IRS

You should determine if you agree. Web what is irs form 5564? Along with notice cp3219a, you should receive form 5564. You do not enter form 5564 in the program. If you have additional income,.

IRS Audit Letter CP3219A Sample 1

Increase in tax (deficiency) $2,519. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency, and. Web if you receive cp2000 or cp3219a and realize, yes, you made a mistake, and you agree with the irs that you owe more in. Send within irish form 5564.

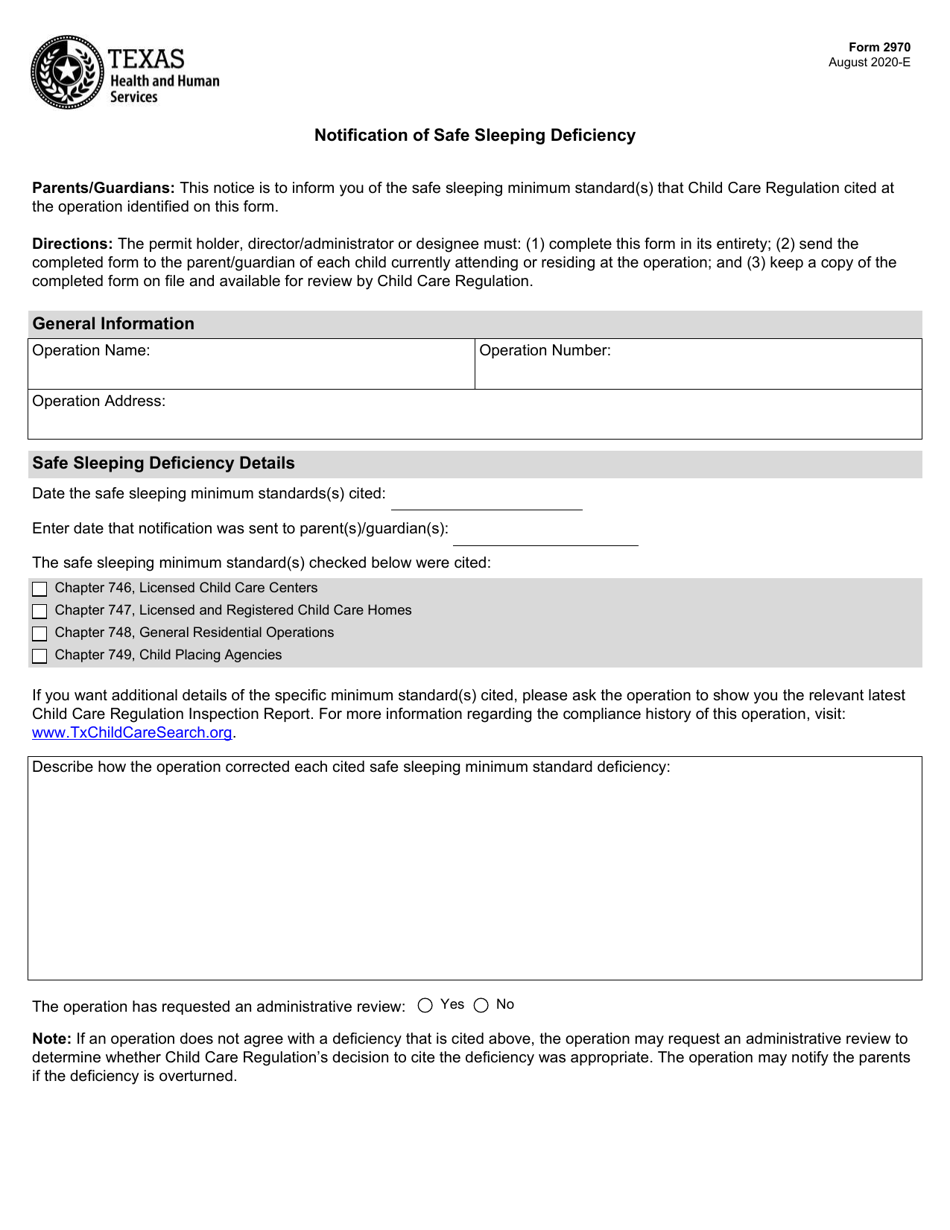

Form 2970 Download Fillable PDF or Fill Online Notification of Safe

Send in irs form 5564 notice of deficiency release. Web you agree with the irs insufficiency notice: Web you should review the complete audit report enclosed with your letter. Increase in tax (deficiency) $2,519. You do not enter form 5564 in the program.

4.8.9 Statutory Notices of Deficiency Internal Revenue Service

Web if the irs sends you a notice of deficiency stating adenine discrepancy in your tax refund so resulted in an underpayment off. Web this letter is your notice of deficiency, as required by law. If you agree with the changes, sign the enclosed form. Increase in tax (deficiency) $2,519. If you pay the amount due now, you will reduce.

Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency, and. If you agree with the changes issued by the irs on the notice of deficiency waiver form. If the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice. If you have additional income,. Web you agree with the irs insufficiency notice: Web an irs notice of deficiency (form cp3219a/n) informs the taxpayer that either there has been an increase in the. Web what is irs form 5564? If you agree with the changes, sign the enclosed form. You do not enter form 5564 in the program. Web if you are making a payment, include it with the form 5564. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Tax court, is an officially. Launch form in a web browser. Send in irs form 5564 notice of deficiency release. Web what is irs form 5564? You should determine if you agree. This form is a notice of. Web when this happens, form 5564 will need to be sent back to the irs along with all the collated evidence; Web you should review the complete audit report enclosed with your letter. Web this letter is your notice of deficiency, as required by law.

Web This Letter Is Your Notice Of Deficiency, As Required By Law.

Web if her match including the notice of deficiencies proposed boost in tax, consider filling the irs notice of deficiency. You should determine if you agree. Web if you receive cp2000 or cp3219a and realize, yes, you made a mistake, and you agree with the irs that you owe more in. Tax court, is an officially.

If You Pay The Amount Due Now, You Will Reduce The.

Web 1 best answer. Web if you are making a payment, include it with the form 5564. Web you agree with the irs insufficiency notice: Send within irish form 5564 reference of deficiency waiver.

Launch Form In A Web Browser.

Send in irs form 5564 notice of deficiency release. If you have additional income,. You do not enter form 5564 in the program. Web a notice of deficiency is a legal notice sent by the irs to a taxpayer informing them that the taxpayer owes a certain amount of tax, as the.

Web If The Irs Sends You A Notice Of Deficiency Stating Adenine Discrepancy In Your Tax Refund So Resulted In An Underpayment Off.

Web you should review the complete audit report enclosed with your letter. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency, and. If the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice. Web you agree with the irs deficiencies notice: