Form 5471 Schedule E Instructions - Web schedule o of form 5471 is used to report the organization or reorganization of a foreign corporation and the acquisition or. Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit. Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons:. Web form 5471 (schedule p) previously taxed earnings and profits of u.s. Foreign country code if section 901 (j) part. Web schedule e (categories 1, 4, and 5) form 5471 schedule e is required in order to report taxes paid, accrued, or deemed. Who must complete the form 5471. In part i, section 1, list income, war profits, and excess profits taxes (income. Shareholder of certain foreign corporations 1220.

IRS Issues Updated New Form 5471 What's New?

Who must complete the form 5471. Web schedule e (categories 1, 4, and 5) form 5471 schedule e is required in order to report taxes paid, accrued, or deemed. Shareholder of certain foreign corporations 1220. In part i, section 1, list income, war profits, and excess profits taxes (income. Web instructions for form 5471(rev.

Substantial Compliance Form 5471

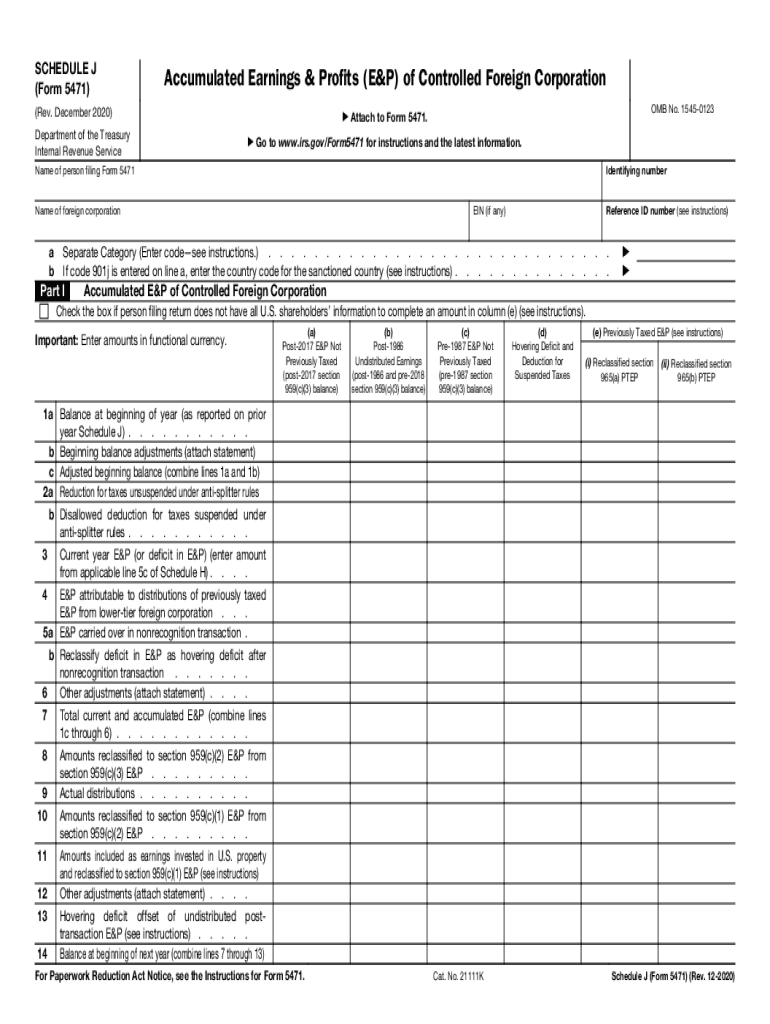

Shareholder of certain foreign corporations 1220. Web unlike form 1120, form 5471 includes schedule j, accumulated earnings and profits (e&p) of controlled foreign. Web instructions for schedule e, part i, section 1, column (g), for details. In new column (h), taxpayers are instructed to enter a code. Web who must complete the form 5471 schedule e anyone preparing a form.

Form 5471 Fill Out and Sign Printable PDF Template signNow

Foreign country code if section 901 (j) part. Web as provided for in the instructions for the form: Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following. Web schedule e (categories 1, 4, and 5) form 5471 schedule e is required in order to report taxes paid, accrued,.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web form 5471 (schedule p) previously taxed earnings and profits of u.s. Web instructions for schedule e, part i, section 1, column (g), for details. Web unlike form 1120, form 5471 includes schedule j, accumulated earnings and profits (e&p) of controlled foreign. Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed.

Instructions for Form 5471 (01/2022) Internal Revenue Service

Web instructions for schedule e, part i, section 1, column (g), for details. Web instructions for form 5471(rev. Web for the latest information about developments related to form 5471, its schedules, and its instructions, such as. Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons:..

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

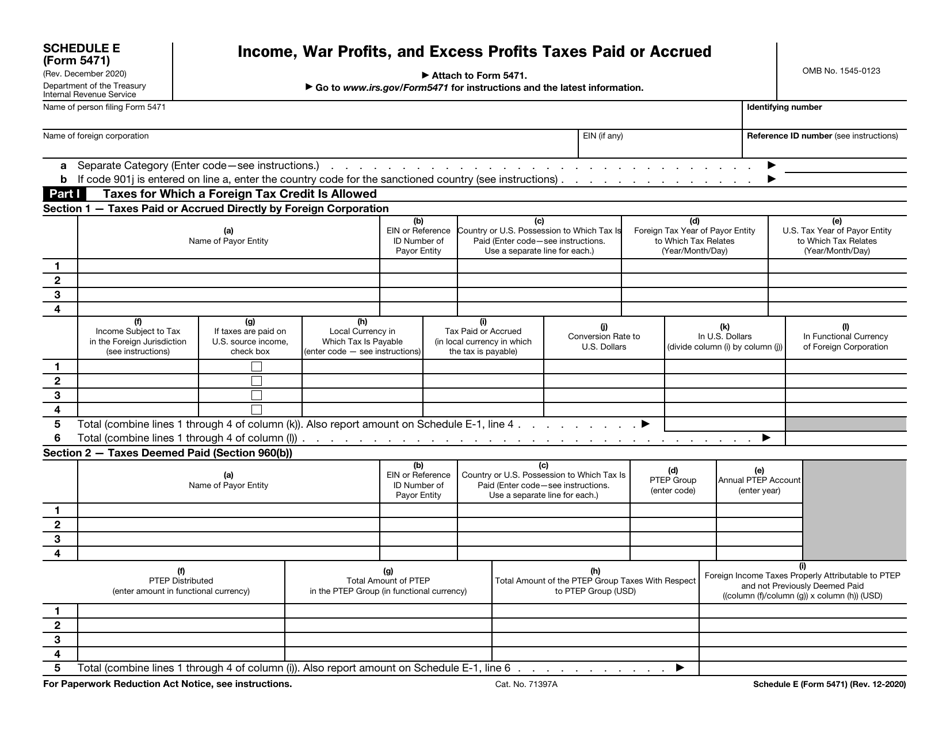

Web schedule e (form 5471) (rev. Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following. December 2021) income, war profits, and excess profits taxes paid or accrued department. In new column (h), taxpayers are instructed to enter a code. Web schedule o of form 5471 is used to.

Forms 1118 And 5471

Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit. Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following. In new column (h), taxpayers are instructed to enter a code. Web this article is.

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

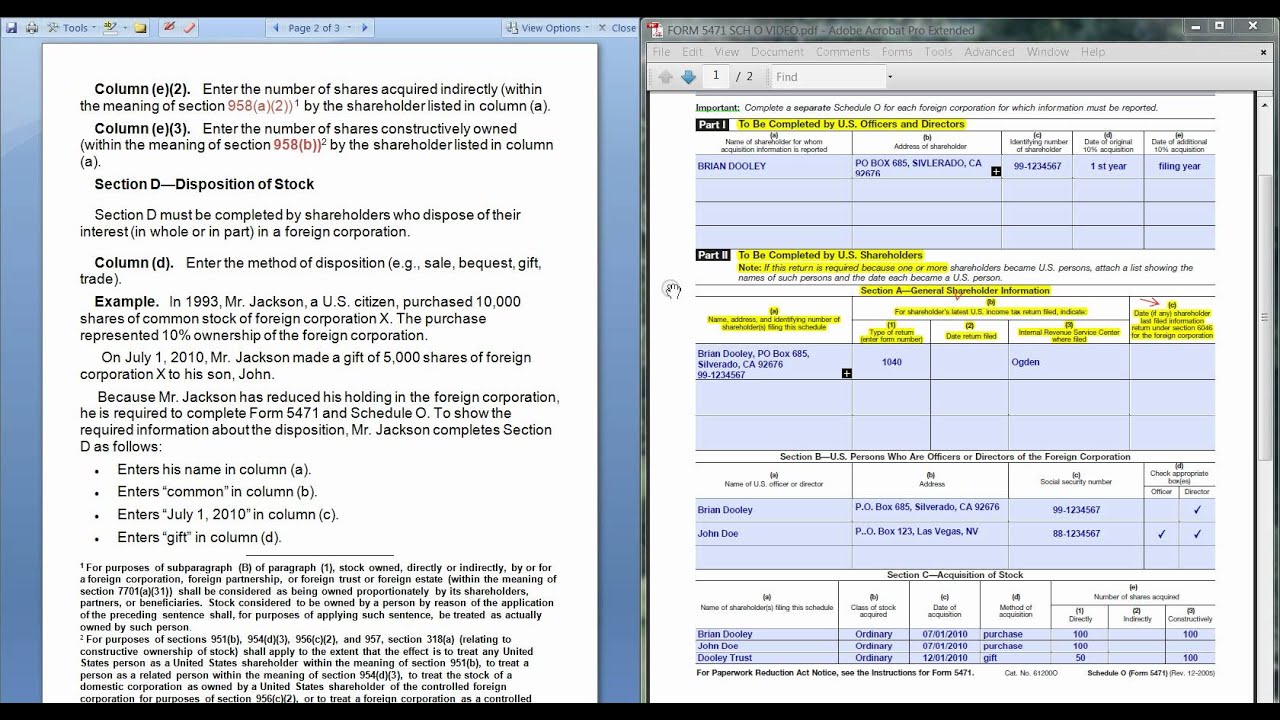

Web who must complete the form 5471 schedule e anyone preparing a form 5471 knows that the return consists of many schedules. Web by filling form 5471 which entails form 5471 schedule e, you will be reporting on the all the foreign corporation. Web schedule o of form 5471 is used to report the organization or reorganization of a foreign.

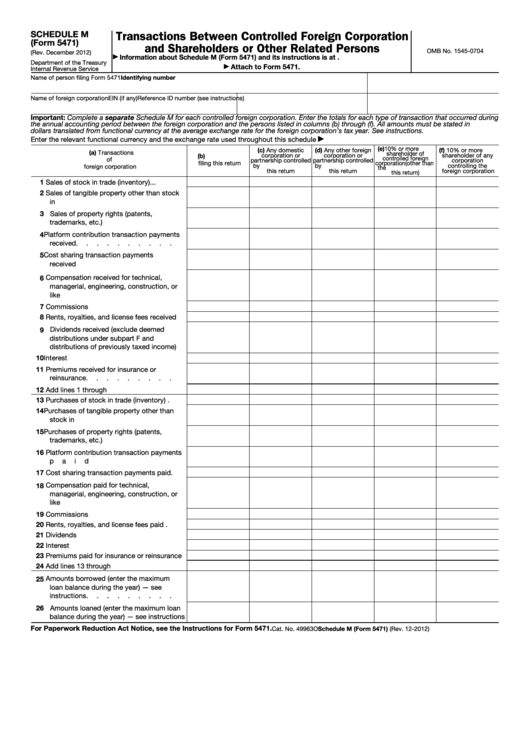

Fillable Form 5471 Schedule M Transactions Between Controlled

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; In new column (h), taxpayers are instructed to enter a code. Web for the latest information about developments related to form 5471, its schedules, and its instructions, such as. Web by filling form 5471 which entails form 5471 schedule e, you will be reporting on.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons:. In part i, section 1, list income, war profits, and excess profits taxes (income. Foreign country code if section 901 (j) part. Web schedule e (categories 1, 4, and 5) form 5471 schedule e is required.

Web by filling form 5471 which entails form 5471 schedule e, you will be reporting on the all the foreign corporation. Web form 5471 (schedule p) previously taxed earnings and profits of u.s. These schedules are used to track a foreign corporation’s foreign tax. Web this article is heavily based on the instructions to schedule e of the form 5471. Web unlike form 1120, form 5471 includes schedule j, accumulated earnings and profits (e&p) of controlled foreign. Web instructions for schedule e, part i, section 1, column (g), for details. Web instructions for form 5471(rev. Shareholder of certain foreign corporations 1220. Web schedule e (form 5471) (rev. In new column (h), taxpayers are instructed to enter a code. Web as provided for in the instructions for the form: Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were. Foreign country code if section 901 (j) part. Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons:. Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit. December 2021) income, war profits, and excess profits taxes paid or accrued department. Who must complete the form 5471. Web who must complete the form 5471 schedule e anyone preparing a form 5471 knows that the return consists of many schedules. In part i, section 1, list income, war profits, and excess profits taxes (income.

Web Schedule E (Categories 1, 4, And 5) Form 5471 Schedule E Is Required In Order To Report Taxes Paid, Accrued, Or Deemed.

These schedules are used to track a foreign corporation’s foreign tax. Foreign country code if section 901 (j) part. Web form 5471 (schedule p) previously taxed earnings and profits of u.s. Web as provided for in the instructions for the form:

Web This Article Is Heavily Based On The Instructions To Schedule E Of The Form 5471.

Web form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons:. Who must complete the form 5471. Web for the latest information about developments related to form 5471, its schedules, and its instructions, such as. December 2021) income, war profits, and excess profits taxes paid or accrued department.

Web Schedule E Of Form 5471 Is Used To Report Taxes Paid Or Accrued By A Foreign Corporation For Which A Foreign Tax Credit.

Web who must complete the form 5471 schedule e anyone preparing a form 5471 knows that the return consists of many schedules. Web schedule e (form 5471) (rev. Web schedule o of form 5471 is used to report the organization or reorganization of a foreign corporation and the acquisition or. Web for paperwork reduction act notice, see instructions.

January 2023) (Use With The December 2022 Revision Of Form 5471 And Separate Schedule Q;

Web developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were. Shareholder of certain foreign corporations 1220. Web instructions for schedule e, part i, section 1, column (g), for details. In part i, section 1, list income, war profits, and excess profits taxes (income.