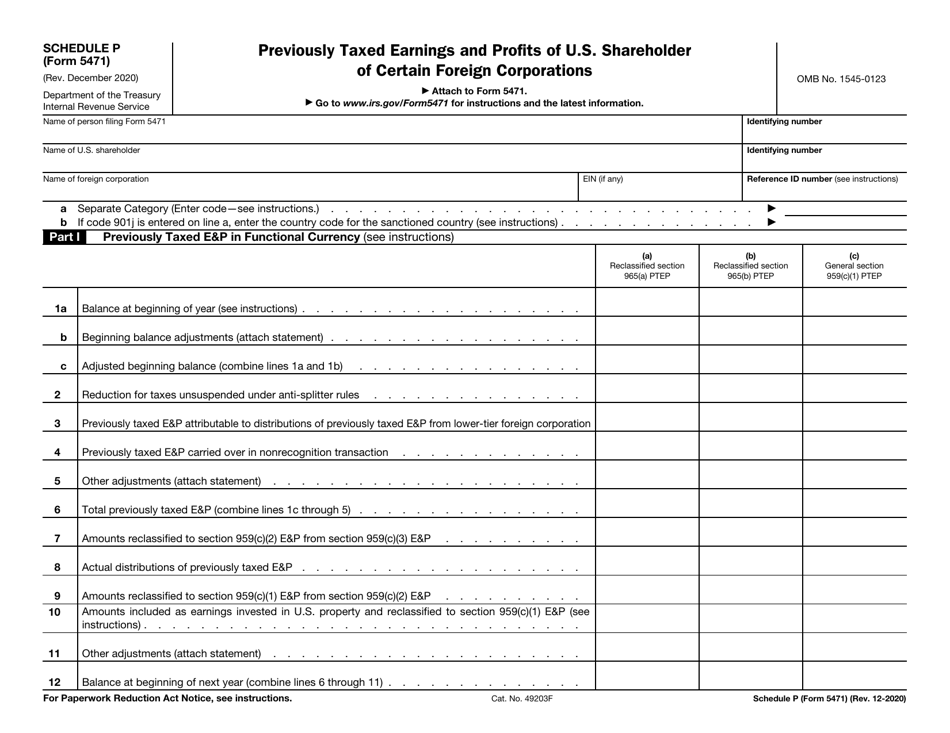

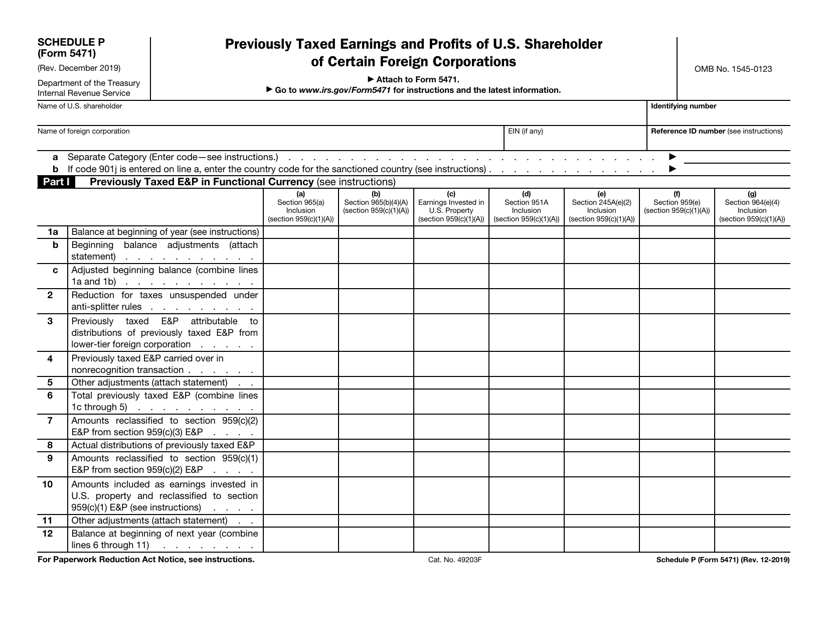

Form 5471 Sch P - So, starting with form 5471 schedule q,. Web schedule p (form 5471) (rev. Web on form 5471, schedule p of form 5471 is used to report previously taxed earnings and profits (“step”) of a u.s. Web schedule p (form 5471) (rev. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. January 2022) (use with the december 2021. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously. Shareholder of certain foreign corporations foreign. Web for example, with respect to line a at the top of page 1 of schedule p, there is a new code “total” that is required for schedule p filers in certain circumstances.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Web instructions for form 5471(rev. Web what are the filing requirements for form 5471? Web what category of filer must file attach a schedule p to their form 5471 schedule p must be completed by category 1,. December 2020) department of the treasury internal revenue service. Shareholder of a controlled foreign currency (“cfc”) in.

Form 5471 Fill Out and Sign Printable PDF Template signNow

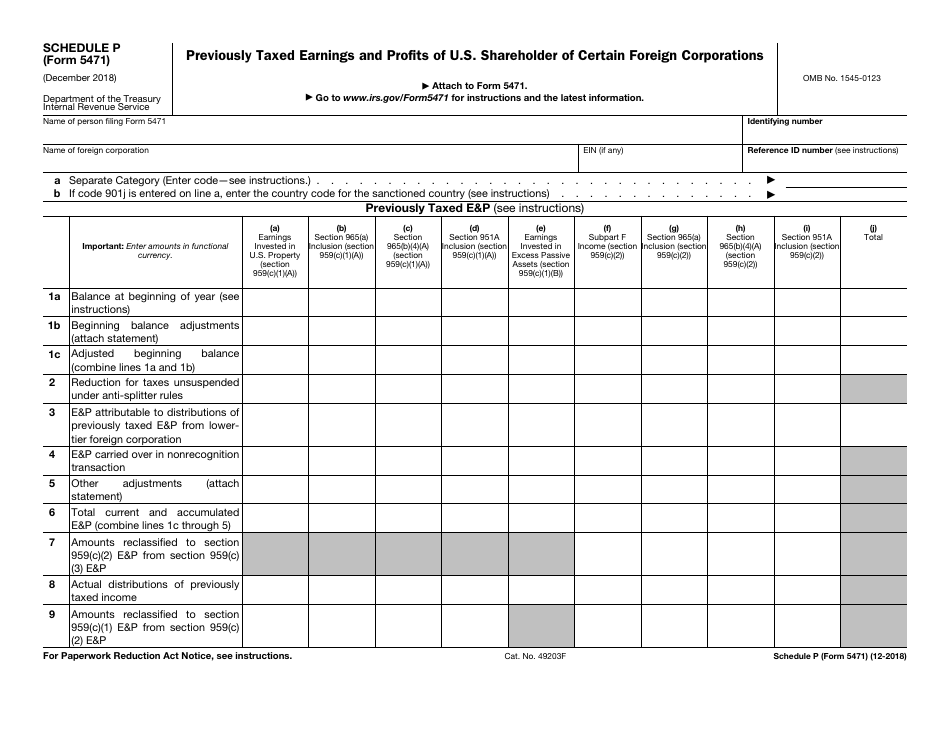

Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. Web on form 5471, schedule p of form 5471 is used to report previously taxed earnings and profits (“step”) of a u.s. Use the table below to determine the filing requirements for form. Web usp completes form 5471 including schedule q for cfc. Web outline form.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. Persons with respect to certain foreign corporations, is designed to report the. Schedule p of form 5471 is used to report ptep of the u.s. Shareholder of certain foreign corporations foreign. Shareholder of certain foreign corporations 1220.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

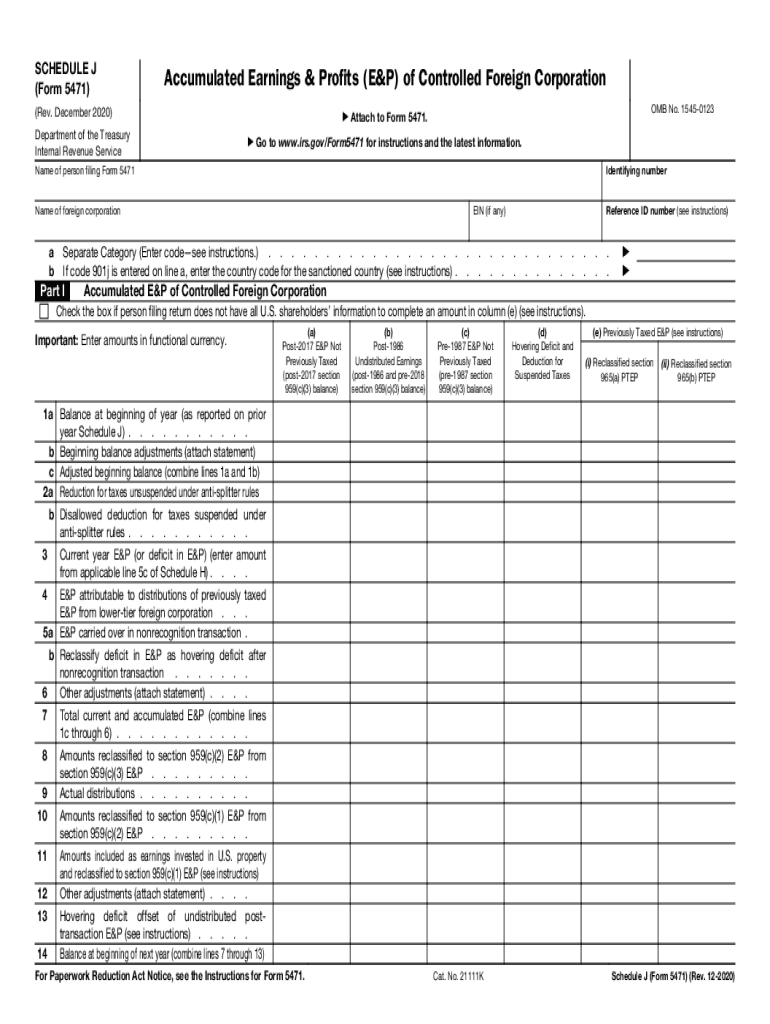

Web what to do with schedule j (5471)? An overview underlying rules and regulations anticipated guidance schedule e, income, war profits,. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously. Web schedule p (form 5471) (rev. January 2023) (use with the december 2022 revision of form 5471 and separate.

Schedule P Previously Taxed E&P of US Shareholder IRS Form 5471

The code for country x is x. Web for example, with respect to line a at the top of page 1 of schedule p, there is a new code “total” that is required for schedule p filers in certain circumstances. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously..

Substantial Compliance Form 5471

Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously. Shareholder of a controlled foreign currency (“cfc”) in. January 2022) (use with the december 2021. Web 5471 schedule p form: S corporation employee's additional tax and medicare tax for employee's.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Web schedule p (form 5471), previously taxed earnings and profits of u.s. Web form 5471 (schedule p) previously taxed earnings and profits of u.s. Web schedule p (form 5471) (rev. An overview underlying rules and regulations anticipated guidance schedule e, income,.

Form 5471 Information Return of U.S. Persons with Respect to Certain

Web what category of filer must file attach a schedule p to their form 5471 schedule p must be completed by category 1,. Shareholder of certain foreign corporations foreign. Web schedule p (form 5471) (rev. An overview underlying rules and regulations anticipated guidance schedule e, income, war profits,. Web must be removed before printing.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Web for example, with respect to line a at the top of page 1 of schedule p, there is a new code “total” that is required for schedule p filers in certain circumstances. Web must be removed before printing. An overview underlying rules and regulations anticipated guidance schedule e, income, war profits,. Shareholder of a controlled foreign currency (“cfc”) in..

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Web form 5471, information return of u.s. Web schedule p (form 5471), previously taxed earnings and profits of u.s. Persons with respect to certain foreign corporations, is designed to report the. Web what to do with schedule j (5471)? Shareholder of a controlled foreign currency (“cfc”) in.

Web schedule p (form 5471) (rev. Persons with respect to certain foreign corporations, is designed to report the. Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously. So, starting with form 5471 schedule q,. Web outline form 5471: Web schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Web 5471 schedule p form: Shareholder of a controlled foreign corporation. Web must be removed before printing. An overview underlying rules and regulations anticipated guidance schedule e, income, war profits,. Web what category of filer must file attach a schedule p to their form 5471 schedule p must be completed by category 1,. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web usp completes form 5471 including schedule q for cfc. December 2020) department of the treasury internal revenue service. Web what to do with schedule j (5471)? Web schedule p (form 5471), previously taxed earnings and profits of u.s. Shareholder of certain foreign corporations 1220. Web form 5471, information return of u.s. Shareholder of certain foreign corporations foreign.

Web Schedule P Of Form 5471 Is Used To Report Previously Taxed Earnings And Profits (“Ptep”) Of A U.s.

S corporation employee's additional tax and medicare tax for employee's. So, starting with form 5471 schedule q,. Web instructions for form 5471(rev. Use the table below to determine the filing requirements for form.

January 2022) (Use With The December 2021.

Web usp completes form 5471 including schedule q for cfc. Shareholder of a controlled foreign corporation. Web schedule p (form 5471) (rev. An overview underlying rules and regulations anticipated guidance schedule e, income, war profits,.

Shareholder Of Certain Foreign Corporations Foreign.

Web schedule p (form 5471) (december 2018) department of the treasury internal revenue service. Web the following information, in combination with other information known to the partners, including form 5471, schedule p, is. Web what are the filing requirements for form 5471? Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously.

Web On Form 5471, Schedule P Of Form 5471 Is Used To Report Previously Taxed Earnings And Profits (“Step”) Of A U.s.

Web for example, with respect to line a at the top of page 1 of schedule p, there is a new code “total” that is required for schedule p filers in certain circumstances. Shareholder of a controlled foreign currency (“cfc”) in. Web form 5471, information return of u.s. Schedule p of form 5471 is used to report ptep of the u.s.