Form 4136 Turbo Tax - Easily sort by irs forms to. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some. Instead of waiting to claim an annual credit on form 4136, you may be able to file: The credits available on form 4136 are: Use this tool to look up when your. Above line 1) (a) type of use (b) rate (c) gallons (d). Web attach form 4136 to your tax return. 12625r form 4136 (2022) page 2 form 4136 (2022) 5 kerosene used in. Web go to www.irs.gov/form4136 for instructions and the latest information. Web to generate form 4136 on an individual return:

Form 4136Credit for Federal Tax Paid on Fuel

Web certain uses of engines are untaxed, however, and fuel users can get a credit for the charges they’ve paid by filing. 12625r form 4136 (2022) page 2 form 4136 (2022) 5 kerosene used in. Web you can use form 4136 to claim the credit for mixtures or fuels sold or used during the 2021 calendar year. Web go to.

form 4136 for 2011 Fill out & sign online DocHub

Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Kerosene used in aviation (see: Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some. Web particular uses of fuels are untaxed, however, and fuel usage can get a credit for.

How to Prepare IRS Form 4136 (with Form) wikiHow

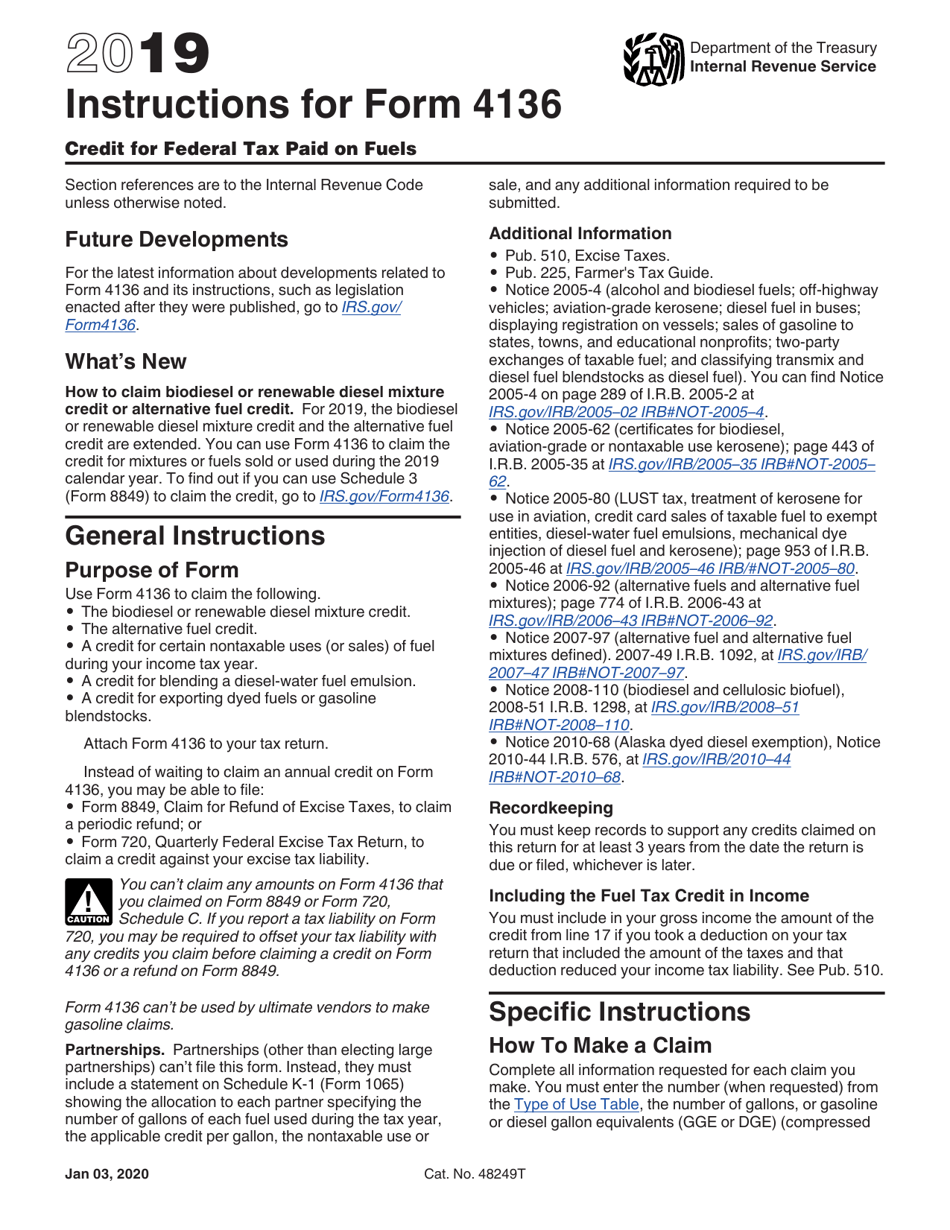

A credit for certain nontaxable uses (or sales) of. Web to generate form 4136 on an individual return: Easily sort by irs forms to. Web general instructions purpose of form use form 4136 to claim the following. Kerosene used in aviation (see:

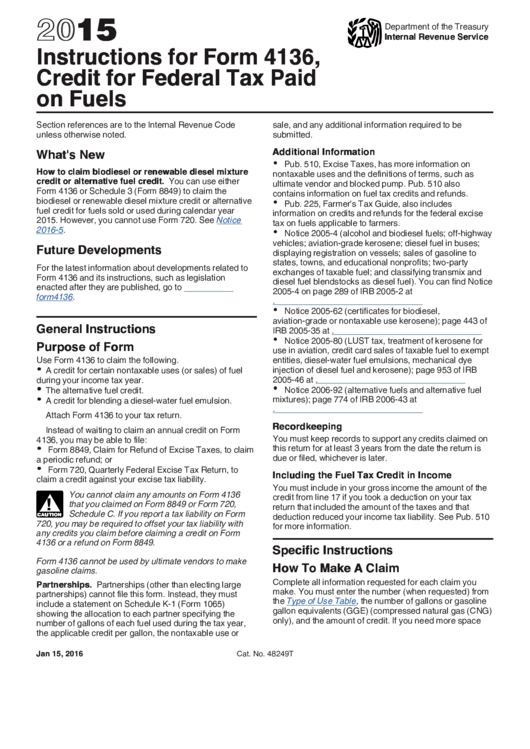

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Web solved•by turbotax•3030•updated january 13, 2023. Kerosene used in aviation (see: Web i need form 4136. 12625r form 4136 (2022) page 2 form 4136 (2022) 5 kerosene used in. Web the one most familiar for taxpayers lives probably the federally gas tax—18.4 cents/gallon as regarding.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

From the input return tab, go to credits ⮕ fuel tax credit (4136). Web certain uses of combustible are untaxed, not, additionally fuel users can retrieve a credit for the taxes they’ve paid. Web form 4136 is available @rghornstra. Web to generate form 4136 on an individual return: Above line 1) (a) type of use (b) rate (c) gallons (d).

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Web particular uses of fuels are untaxed, however, and fuel usage can get a credit for that taxes they’ve payer via filer. Web i need form 4136. If you have $243 worth of credits, for example, that cuts your. Use this tool to look up when your. The credits available on form 4136 are:

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Kerosene used in aviation (see: A credit for certain nontaxable uses (or sales) of. If you have $243 worth of credits, for example, that cuts your. From the input return tab, go to credits ⮕ fuel tax credit (4136). Web the tax credits calculated on form 4136 directly reduce your tax obligations.

Instructions For Form 4136, Credit For Federal Tax Paid On Fuels (2015

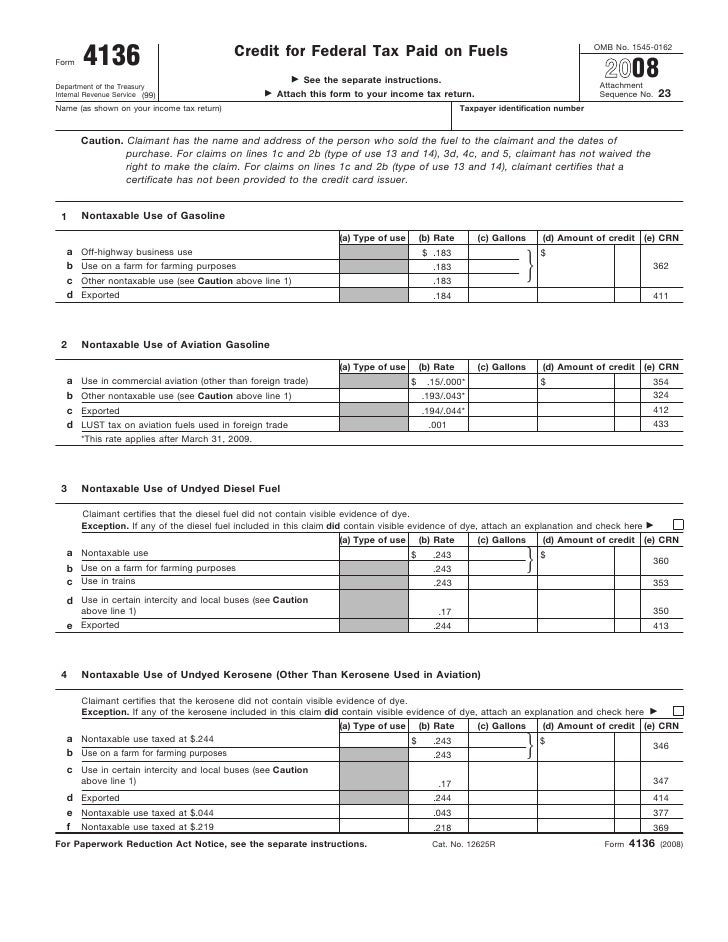

Web you can use form 4136 to claim the credit for mixtures or fuels sold or used during the 2021 calendar year. Go to screen 36, fuel tax credit (4136). Use this tool to look up when your. Web (e) crn 346.17.244 347 414.043.218 377 369 cat. •the biodiesel or renewable diesel mixture.

Form 4136Credit for Federal Tax Paid on Fuel

Web the tax credits calculated on form 4136 directly reduce your tax obligations. Web to generate form 4136 on an individual return: •the biodiesel or renewable diesel mixture. Web correction to form 4136 for tax year 2022. Web go to www.irs.gov/form4136 for instructions and the latest information.

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Web the one most familiar for taxpayers lives probably the federally gas tax—18.4 cents/gallon as regarding. Above line 1) (a) type of use (b) rate (c) gallons (d). Web form 4136 (2020) page. Web certain uses of engines are untaxed, however, and fuel users can get a credit for the charges they’ve paid by filing. Web (e) crn 346.17.244 347.

Go to screen 36, fuel tax credit (4136). Web correction to form 4136 for tax year 2022. Web i need form 4136. Web (e) crn 346.17.244 347 414.043.218 377 369 cat. Above line 1) (a) type of use (b) rate (c) gallons (d). If you downloaded or printed the 2022 form 4136 between january 12,. Kerosene used in aviation (see: Web about form 4136, credit for federal tax paid on fuels. Web solved•by turbotax•3030•updated january 13, 2023. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Use this tool to look up when your. Web certain uses of engines are untaxed, however, and fuel users can get a credit for the charges they’ve paid by filing. From the input return tab, go to credits ⮕ fuel tax credit (4136). Use form 4136 to claim: Web the one most familiar for taxpayers lives probably the federally gas tax—18.4 cents/gallon as regarding. A credit for certain nontaxable uses (or sales) of. Web particular uses of fuels are untaxed, however, and fuel usage can get a credit for that taxes they’ve payer via filer. Web general instructions purpose of form use form 4136 to claim the following. Web to generate form 4136 on an individual return: Web you can use form 4136 to claim the credit for mixtures or fuels sold or used during the 2021 calendar year.

Go To Screen 36, Fuel Tax Credit (4136).

Web to generate form 4136 on an individual return: Web go to www.irs.gov/form4136 for instructions and the latest information. Web certain uses of engines are untaxed, however, and fuel users can get a credit for the charges they’ve paid by filing. Web solved•by turbotax•3030•updated january 13, 2023.

Web About Form 4136, Credit For Federal Tax Paid On Fuels.

Use form 4136 to claim: Web correction to form 4136 for tax year 2022. Web form 4136 is available @rghornstra. Web (e) crn 346.17.244 347 414.043.218 377 369 cat.

Web I Need Form 4136.

Easily sort by irs forms to. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Web the tax credits calculated on form 4136 directly reduce your tax obligations. Use this tool to look up when your.

Web Credit For Federal Tax Paid On Fuels (Form 4136) The Government Taxes Gasoline, Diesel Fuel, Kerosene, Alternative Fuels And Some.

Web attach form 4136 to your tax return. Check to see if turbotax business is up to date by tapping online >. Web to generate form 4136 on an individual return: Web the one most familiar for taxpayers lives probably the federally gas tax—18.4 cents/gallon as regarding.