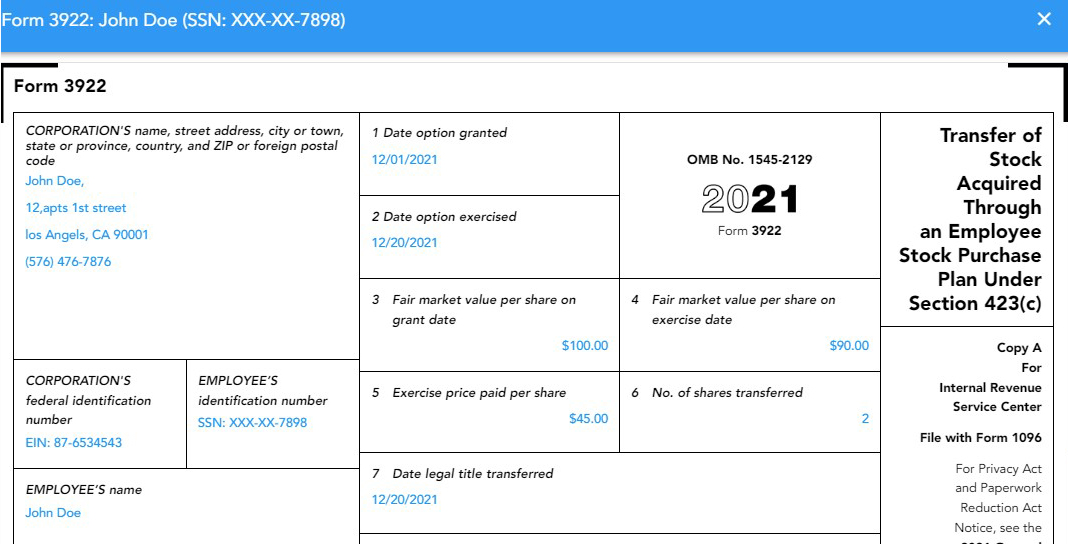

Form 3922 Reporting On 1040 - Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an. Web you should have received form 3922 when you exercised your stock options. Keep the form for your records because you’ll. You may owe a penalty, but. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you. Web form 3922 is the transfer of stock acquired through an employee stock purchase plan under section 423(c).. Web form 3922 is issued for employee stock options that you purchased but do not sell. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web form 3922 tax reporting includes the following information: Web form 3922 is the transfer of stock acquired through an employee stock purchase plan under section 423(c).. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Since you have not sold the stock, the. Web irs form 3922 transfer of stock.

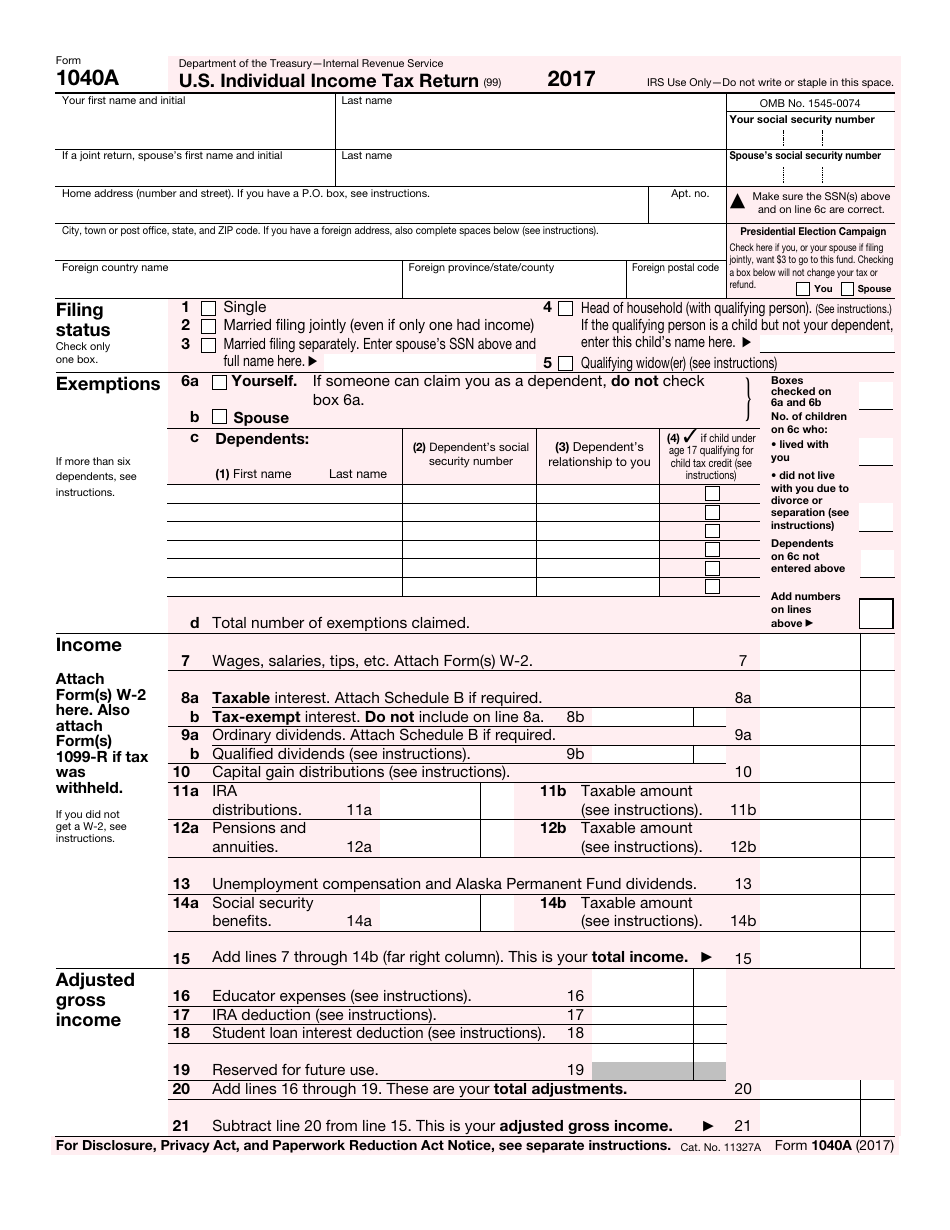

IRS Form 1040A Download Fillable PDF or Fill Online U.S. Individual

Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of. Since you have not sold the stock, the. Web irs form 3922 is for informational purposes only and isn't entered into your return. Irs form 3922, transfer of stock acquired through an employee stock purchase plan.

Understanding Taxes Simulation Completing a Tax Return Using Married

Web form 3922 is the transfer of stock acquired through an employee stock purchase plan under section 423(c).. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c). Web form 3922 tax reporting includes the following information: Web for the latest information about developments related to forms 3921 and 3922 and their instructions,.

W2 diagram If I make a disqualifying disposition with my ESPP stock

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you. Web form 3922 transfer of stock acquired through an employee stock purchase plan under.

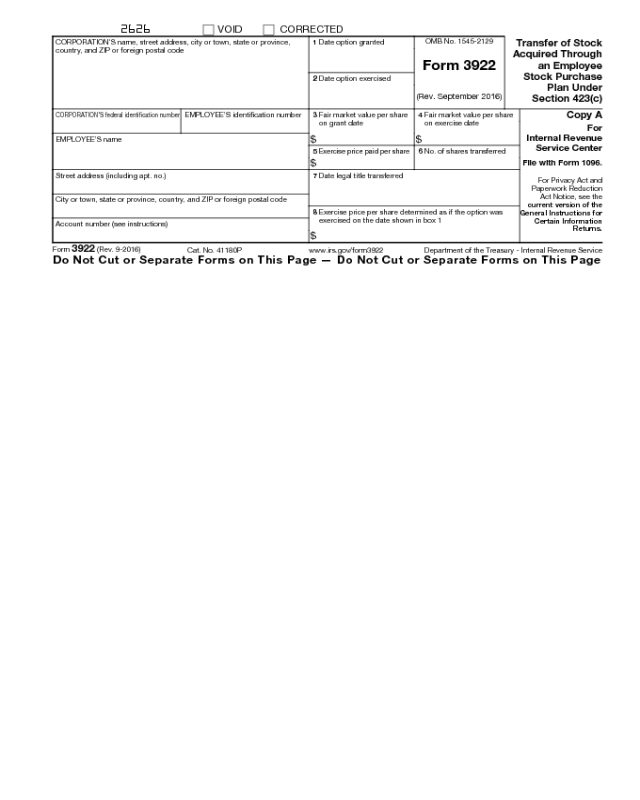

Form 3922 Edit, Fill, Sign Online Handypdf

Web form 3922 is issued for employee stock options that you purchased but do not sell. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c). Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web form 3922 is the transfer of stock acquired.

Form 3922 Download Fillable PDF or Fill Online MultipleCertificate

Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can. File form 2210 unless one or more boxes in. Web form 3922 is the transfer of stock acquired through an employee stock purchase plan under section 423(c).. Web irs form 3922 transfer of stock acquired through an employee stock.

Irs Form 1040 Line 15a And 15b Form Resume Examples

Since you have not sold the stock, the. Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you. Web your employer will send you form 3922, transfer.

3922 2020 Public Documents 1099 Pro Wiki

Web what is irs form 3922? You may owe a penalty, but. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you. Keep the form for your.

IRS Form 3922

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Transfer of stock acquired through an employee stock purchase plan under. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web file form 2210 unless box. Web form.

Stock options form 3922

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web form 3922 is issued for employee stock options that you purchased but do not sell. Web for the latest information about developments related to forms.

Web form 3922 tax reporting includes the following information: Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under. This is the first day of the offering period, also. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web what is irs form 3922? Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web you have received this form because (1) your employer (or its transfer agent) has recorded a first transfer of legal title of stock you. Web file form 2210 unless box. Transfer of stock acquired through an employee stock purchase plan under. Since you have not sold the stock, the. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an. Web form 3922 is issued for employee stock options that you purchased but do not sell. Web the form is required to be furnished to a taxpayer by january 31 of the year following the year of first transfer of. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can. Web you should have received form 3922 when you exercised your stock options.

Keep The Form For Your Records Because You’ll.

File form 2210 unless one or more boxes in. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under. Web form 3922 tax reporting includes the following information: Web form 3922 is issued for employee stock options that you purchased but do not sell.

You May Owe A Penalty, But.

Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can.

Web Irs Form 3922 Is For Informational Purposes Only And Isn't Entered Into Your Return.

Web file form 2210 unless box. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific.

Web What Is Irs Form 3922?

Since you have not sold the stock, the. Transfer of stock acquired through an employee stock purchase plan under. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c). This is the first day of the offering period, also.