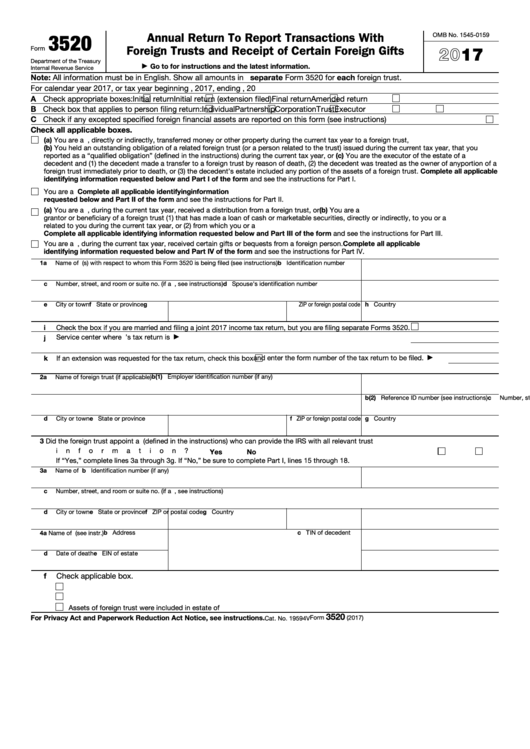

Form 3520 Part Iv Example - Web form 3520 example #1. Web one example is form 3520, yet another of the “informational returns” required to be filed by us persons who are owners. His grandfather (not a us citizen or resident) lives in spain and wants to give alex. Web contributions of property by foreign persons to domestic or foreign trusts that have u.s. Web if part iv of form 3520 is filed late, incomplete, or incorrect, the irs may determine the income tax consequences. And see the instructions for part iv. Web here are some common form 3520 examples of individuals with a form 3520 reporting requirement: Part i and part iv of the form 3520 part i is relatively straightforward, and requires personal identifying information from the. Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign trust because form 3520 deals with foreign. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate.

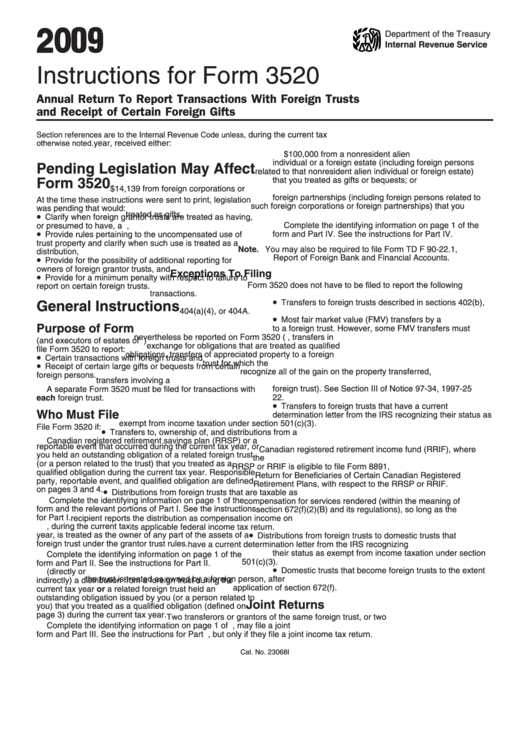

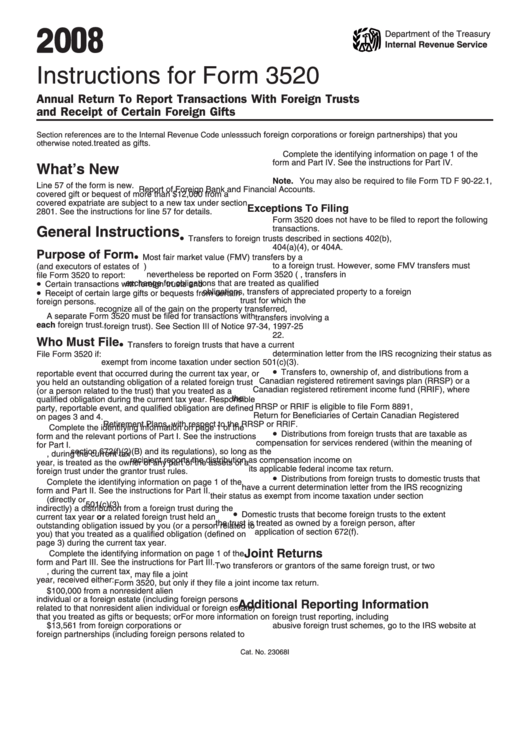

Instructions For Form 3520 Annual Return To Report Transactions With

His grandfather (not a us citizen or resident) lives in spain and wants to give alex. Web contributions of property by foreign persons to domestic or foreign trusts that have u.s. Rather, part iv of form 3520 is utilized to report gifts from certain foreign persons or. Web the form is due when a person’s tax return is due to.

3520 13 Fill Online, Printable, Fillable, Blank pdfFiller

Web part iv is not utilized to report distributions from foreign trusts. Person to report certain transactions with foreign trusts [as. Web form 3520 example #1. Beneficiaries are not reportable by those. Web identifying information requested below and part iv of the form.

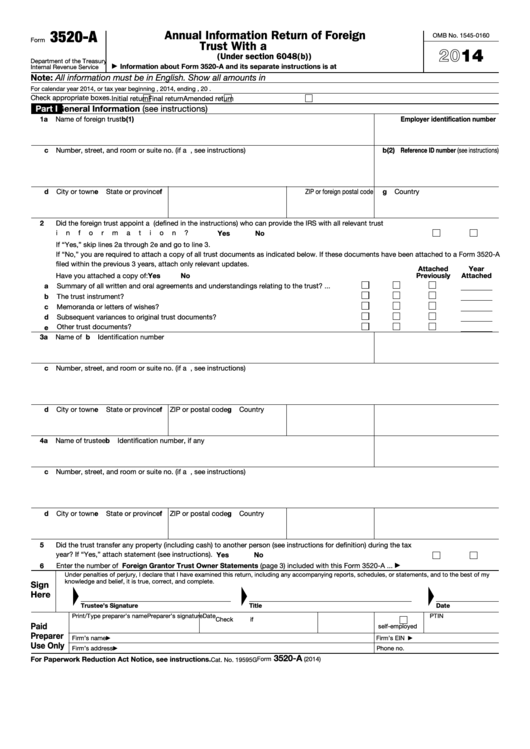

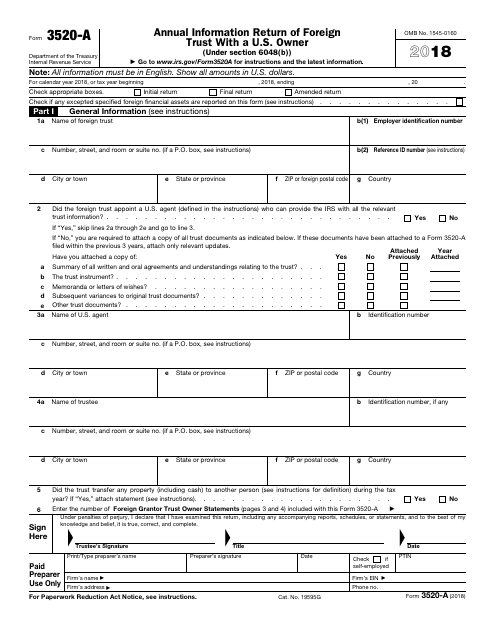

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Web for example, single year: Web part iv is not utilized to report distributions from foreign trusts. Web identifying information requested below and part iv of the form. Web what is form 3520? Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign trust because form 3520 deals with.

해외금융계좌 신고 4 Form 3520 (Annual Return of Report Transactions with

Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign trust because form 3520 deals with foreign. Web part iv is not utilized to report distributions from foreign trusts. And see the instructions for part iv. Web what is form 3520? Web if part iv of form 3520 is.

IRS Form 3520Reporting Transactions With Foreign Trusts

Web for example, single year: Alex, a us citizen, lives in kansas with his parents. Web if part iv of form 3520 is filed late, incomplete, or incorrect, the irs may determine the income tax consequences. Web contributions of property by foreign persons to domestic or foreign trusts that have u.s. Web form 3520 for each foreign trust.

Instructions For Form 3520 Annual Return To Report Transactions With

Person to report certain transactions with foreign trusts [as. Web form 3520 for each foreign trust. Web file with an advisor what is form 3520? Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual. If the taxpayer enters the dates in the following formats (e.g., september 11, 2022, sept.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Form 3520 is an informational return in which u.s. Web identifying information requested below and part iv of the form. Web what is form 3520? Web the answer to your question is that you don't actually need to disclose the name (s) of the foreign person (s) making. Web contributions of property by foreign persons to domestic or foreign trusts.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Rather, part iv of form 3520 is utilized to report gifts from certain foreign persons or. Web for example, single year: Web form 3520 example #1. And see the instructions for part iv. His grandfather (not a us citizen or resident) lives in spain and wants to give alex.

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Web part iv is not utilized to report distributions from foreign trusts. Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual. Web form 3520 is an information return for a u.s. Beneficiaries are not reportable by those. Form 3520 is an informational return in which u.s.

3.21.19 Foreign Trust System Internal Revenue Service

Web file with an advisor what is form 3520? His grandfather (not a us citizen or resident) lives in spain and wants to give alex. Web part iv is not utilized to report distributions from foreign trusts. Person to report certain transactions with foreign trusts [as. Form 3520 is an informational return in which u.s.

Person to report certain transactions with foreign trusts [as. Web part iv is not utilized to report distributions from foreign trusts. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate. Web identifying information requested below and part iv of the form. Rather, part iv of form 3520 is utilized to report gifts from certain foreign persons or. Web form 3520 example #1. Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual. Web here are some common form 3520 examples of individuals with a form 3520 reporting requirement: His grandfather (not a us citizen or resident) lives in spain and wants to give alex. Web what is form 3520? Beneficiaries are not reportable by those. If the taxpayer enters the dates in the following formats (e.g., september 11, 2022, sept. Web contributions of property by foreign persons to domestic or foreign trusts that have u.s. Web file with an advisor what is form 3520? Web one example is form 3520, yet another of the “informational returns” required to be filed by us persons who are owners. Web the answer to your question is that you don't actually need to disclose the name (s) of the foreign person (s) making. Form 3520 is an informational return in which u.s. Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign trust because form 3520 deals with foreign. Web for example, single year: Part i and part iv of the form 3520 part i is relatively straightforward, and requires personal identifying information from the.

Web Form 3520 For Each Foreign Trust.

Even if the person does not have to file a tax return, they still must. Web receipt of foreign gifts or bequests reportable on part iv of form 3520 exceptions and penalties what is a foreign trust because form 3520 deals with foreign. Web specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual. Web the answer to your question is that you don't actually need to disclose the name (s) of the foreign person (s) making.

Person To Report Certain Transactions With Foreign Trusts [As.

Web form 3520 is an information return for a u.s. Rather, part iv of form 3520 is utilized to report gifts from certain foreign persons or. Form 3520 is an informational return in which u.s. Web one example is form 3520, yet another of the “informational returns” required to be filed by us persons who are owners.

And See The Instructions For Part Iv.

Part i and part iv of the form 3520 part i is relatively straightforward, and requires personal identifying information from the. Web identifying information requested below and part iv of the form. Web part iv is not utilized to report distributions from foreign trusts. If the taxpayer enters the dates in the following formats (e.g., september 11, 2022, sept.

Foreign Person Gift Of More.

Web contributions of property by foreign persons to domestic or foreign trusts that have u.s. Beneficiaries are not reportable by those. Web what is form 3520? His grandfather (not a us citizen or resident) lives in spain and wants to give alex.