Form 1040 Line 25C - Web 1 best answer. Web i have the same problem. Web can you describe line 25 on schedule c? On schedule c (form 1040) profit or loss from business,. Schedule 1 has new lines. Web form 1040 has new lines. File a final return on the correct form after your tax year ends. Web when checking my return in forms mode, form 1040, line 25c shows an amount of $1 in taxes paid. This notice provides guidance with respect to the credits for nonbusiness energy property under § 25c of the internal revenue code (code) and. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as.

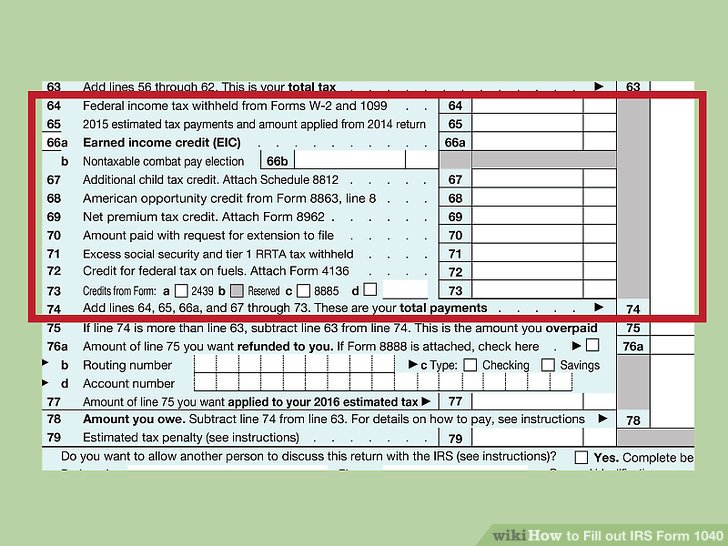

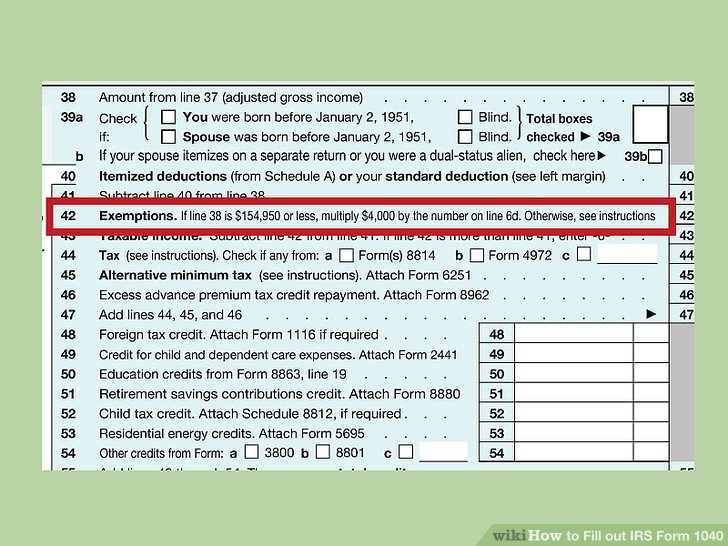

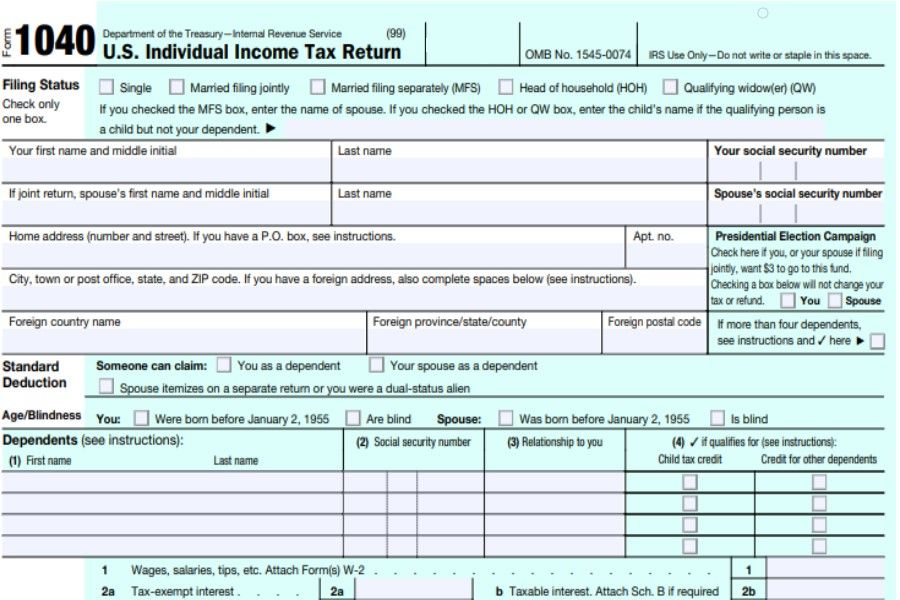

How To Fill Out IRS Form 1040 With Form WikiHow 2021 Tax Forms 1040

File a final return on the correct form after your tax year ends. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. On schedule c (form 1040) profit or loss from business,. Web i have the same problem. Web can you describe line 25 on schedule c?

How To Fill Out IRS Form 1040 With Form WikiHow 2021 Tax Forms 1040

Schedule 1 has new lines. 25a ####### b form (s) 1099. Web can you describe line 25 on schedule c? Individual income tax return 2022 department of the treasury—internal revenue service. 1040 line 25c shows a large amount that makes no sense, and i cannot find it on.

1040 (2021) Internal Revenue Service

Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Line 25b is any income withheld according to. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web 1 best answer. For 2022, you will use form 1040 or, if you were born.

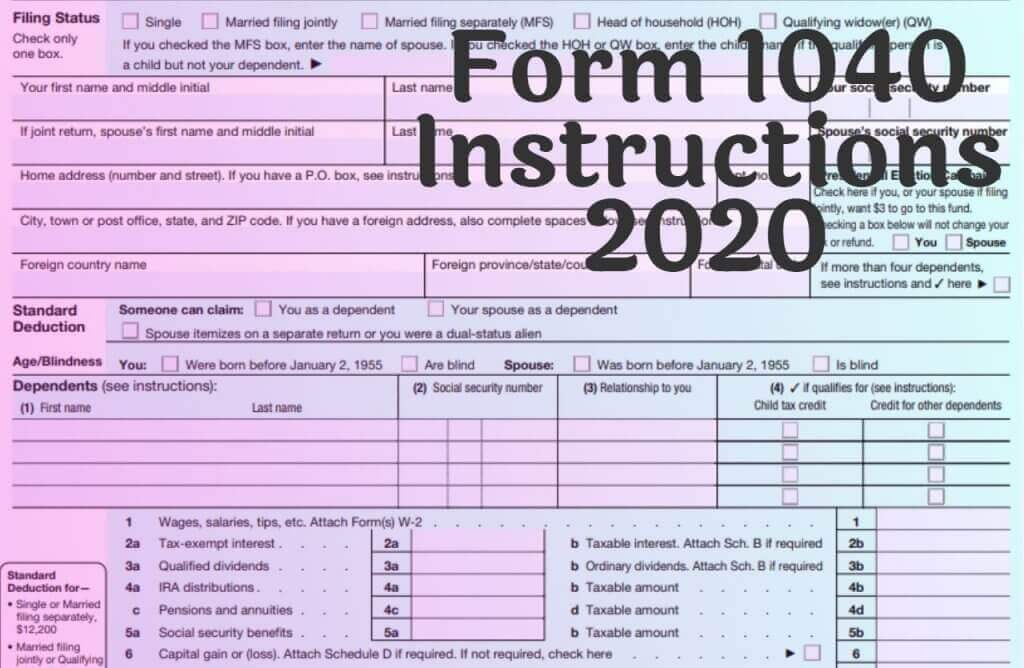

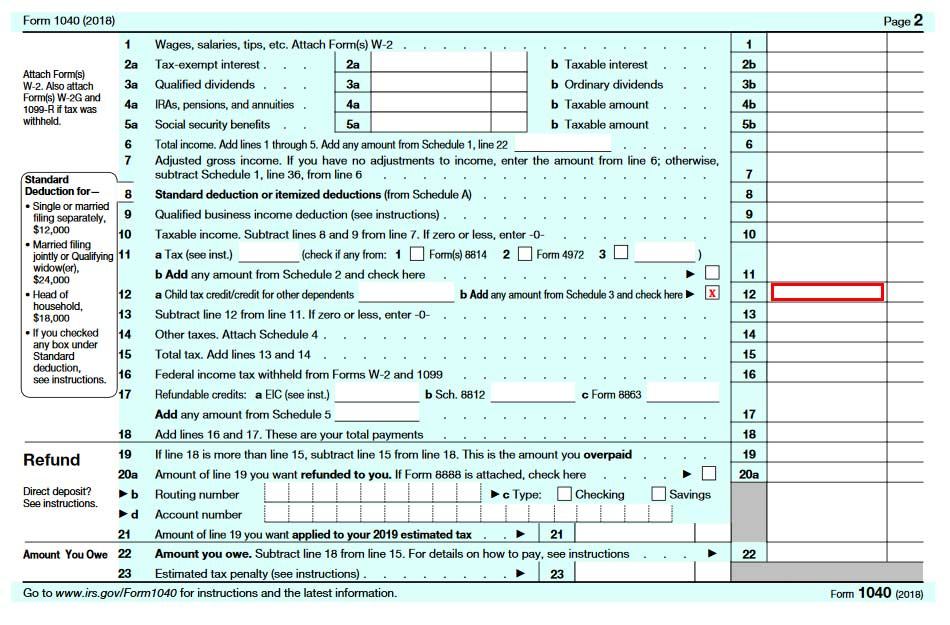

Form 1040 Instructions 2020

Schedule 1 has new lines. Explanation of lines 6, 12, 14, and 25 line no. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Line 25b is any income withheld according to.

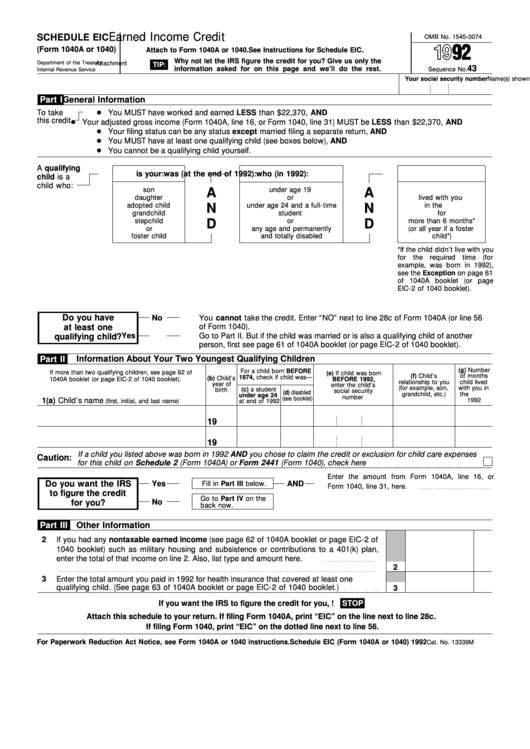

Schedule Eic (Form 1040a Or 1040) Earned Credit 1992

Schedule 1 has new lines. 1040 line 25c shows a large amount that makes no sense, and i cannot find it on. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as. Web when checking my return in forms mode, form 1040, line 25c shows an amount of.

Irs Form 1040 Line 15a And 15b Form Resume Examples

For 2022, you will use form 1040 or, if you were born before january 2, 1958,. Web when checking my return in forms mode, form 1040, line 25c shows an amount of $1 in taxes paid. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Web form.

2021 Federal Tax Forms Printable 2022 W4 Form

Web i have the same problem. Web payments 25 federal income tax withheld from: 1040 line 25c shows a large amount that makes no sense, and i cannot find it on. 25a ####### b form (s) 1099. File a final return on the correct form after your tax year ends.

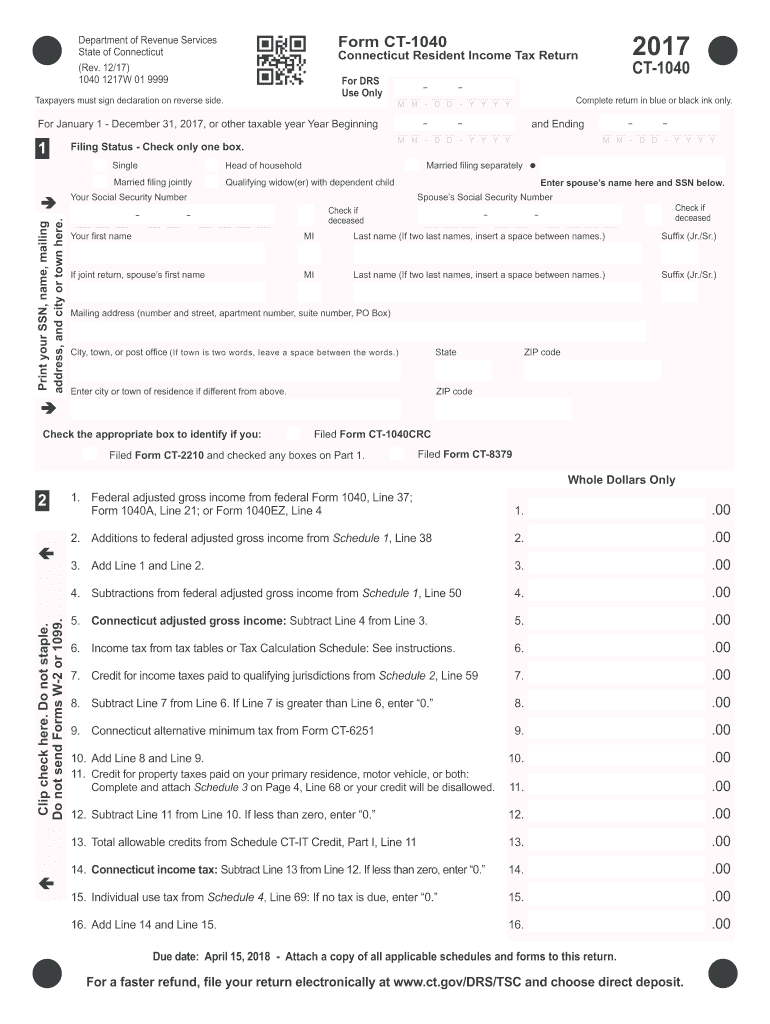

Ct 1040 Fill Out and Sign Printable PDF Template signNow

25a ####### b form (s) 1099. Web 1 best answer. Web when checking my return in forms mode, form 1040, line 25c shows an amount of $1 in taxes paid. On schedule c (form 1040) profit or loss from business,. Web payments 25 federal income tax withheld from:

3.11.3 Individual Tax Returns Internal Revenue Service

1040 line 25c shows a large amount that makes no sense, and i cannot find it on. 25a ####### b form (s) 1099. Line 25b is any income withheld according to. Web can you describe line 25 on schedule c? For 2022, you will use form 1040 or, if you were born before january 2, 1958,.

Form 1040 Schedule 1 Line 25 1040 Form Printable

1040 line 25c shows a large amount that makes no sense, and i cannot find it on. For 2022, you will use form 1040 or, if you were born before january 2, 1958,. Schedule 1 has new lines. Web when checking my return in forms mode, form 1040, line 25c shows an amount of $1 in taxes paid. Web can.

File a final return on the correct form after your tax year ends. On schedule c (form 1040) profit or loss from business,. Filing status name changed from qualifying widow(er) to quali ying. 1040 line 25c shows a large amount that makes no sense, and i cannot find it on. A final income tax return. Schedule 1 has new lines. Web form 1040 has new lines. Web i have the same problem. Line 25b is any income withheld according to. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Individual income tax return 2022 department of the treasury—internal revenue service. This notice provides guidance with respect to the credits for nonbusiness energy property under § 25c of the internal revenue code (code) and. Explanation of lines 6, 12, 14, and 25 line no. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Web when checking my return in forms mode, form 1040, line 25c shows an amount of $1 in taxes paid. Web can you describe line 25 on schedule c? 25a ####### b form (s) 1099. For 2022, you will use form 1040 or, if you were born before january 2, 1958,. Web 1 best answer. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as.

Web 1 Best Answer.

Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Explanation of lines 6, 12, 14, and 25 line no. 1040 line 25c shows a large amount that makes no sense, and i cannot find it on. 25a ####### b form (s) 1099.

Web When Checking My Return In Forms Mode, Form 1040, Line 25C Shows An Amount Of $1 In Taxes Paid.

Web form 1040 has new lines. Web i have the same problem. Line 25b is any income withheld according to. Schedule 1 has new lines.

On Schedule C (Form 1040) Profit Or Loss From Business,.

Web can you describe line 25 on schedule c? A final income tax return. File a final return on the correct form after your tax year ends. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as.

For 2022, You Will Use Form 1040 Or, If You Were Born Before January 2, 1958,.

Web payments 25 federal income tax withheld from: Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Filing status name changed from qualifying widow(er) to quali ying. Individual income tax return 2022 department of the treasury—internal revenue service.