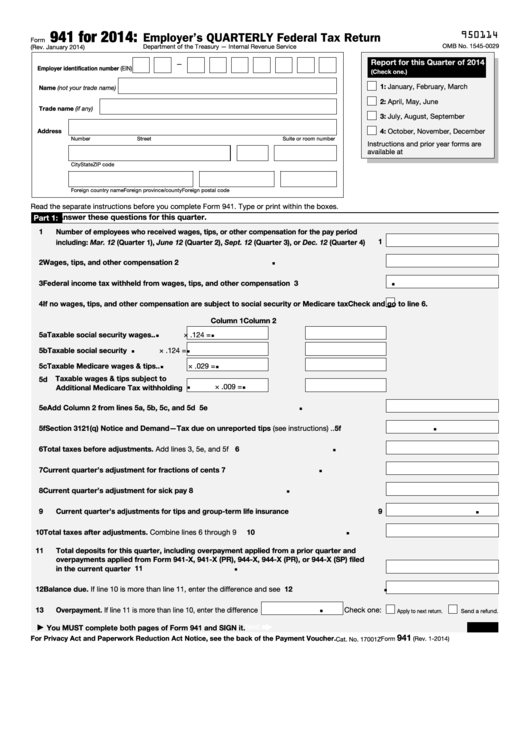

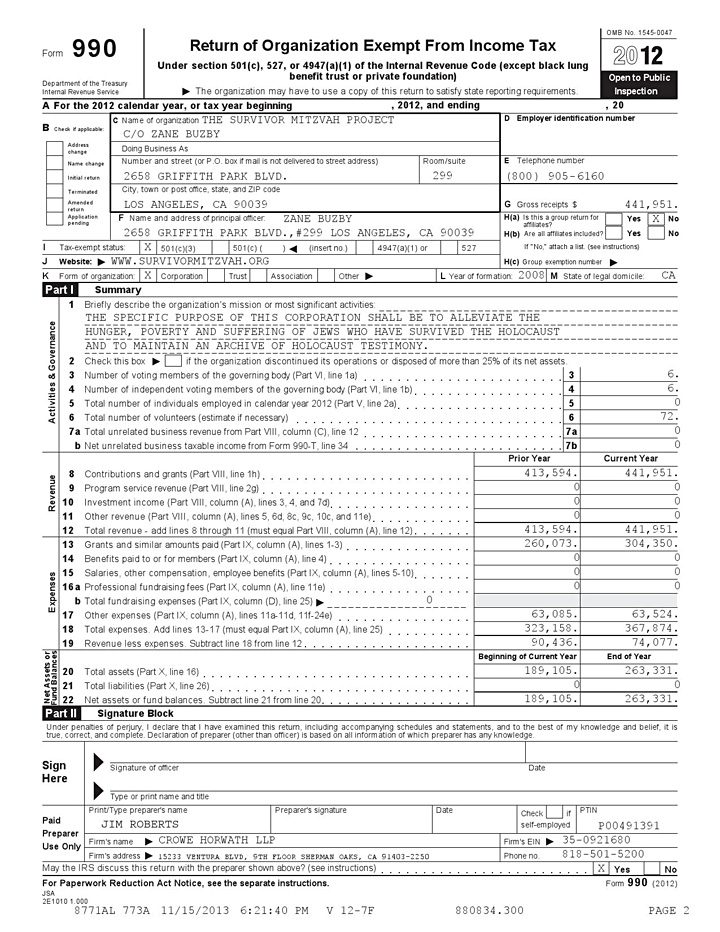

Federal Form 941 For 2014 - Web 1 2 941 for 2014: Web form941 for 2014: Department of the treasury — internal. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Employers quarterly federal tax return department of the treasury internal. Employer’s quarterly federal tax return department of the treasury — internal. Web 1 facts about the irs 941 for 2014 pdf template; We ask for the information on form 941 to carry out the internal revenue laws of. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and. January 2014) employer’s quarterly federal tax return.

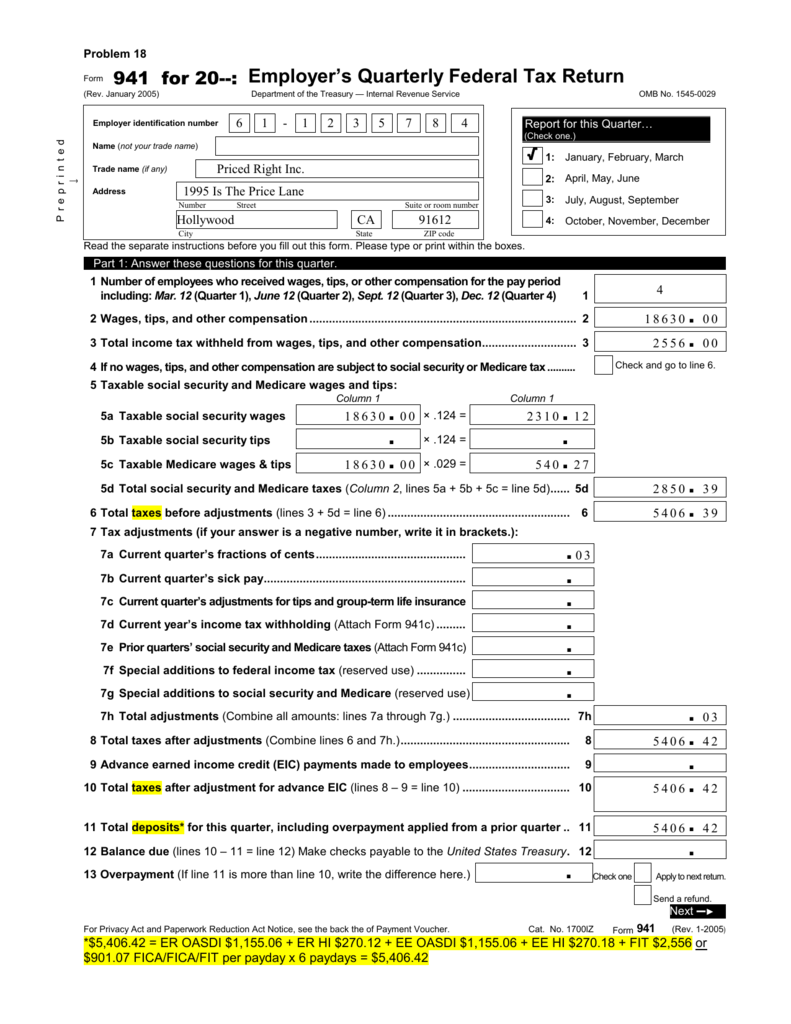

Federal 14 Form 14 Federal 14 Form Tips You Need To Learn Now AH

January 2014) employer’s quarterly federal tax return. Irs form 941 is more commonly known as the employer's quarterly federal tax return. We ask for the information on form 941 to carry out the internal revenue laws of. January 2014) 941 for 2014: Employer’s quarterly federal tax return department of the treasury — internal.

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Department of the treasury — internal. Web 1 2 941 for 2014: Employer’s quarterly federal tax return 970114 (rev. However, if you pay an amount with form 941 that should’ve. January 2014) employer’s quarterly federal tax return.

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

However, if you pay an amount with form 941 that should’ve. Web february 28, 2022 · 9 minute read. 950114 employer’s quarterly federal tax return form omb no. Read the separate instructions before you complete form. Department of the treasury — internal.

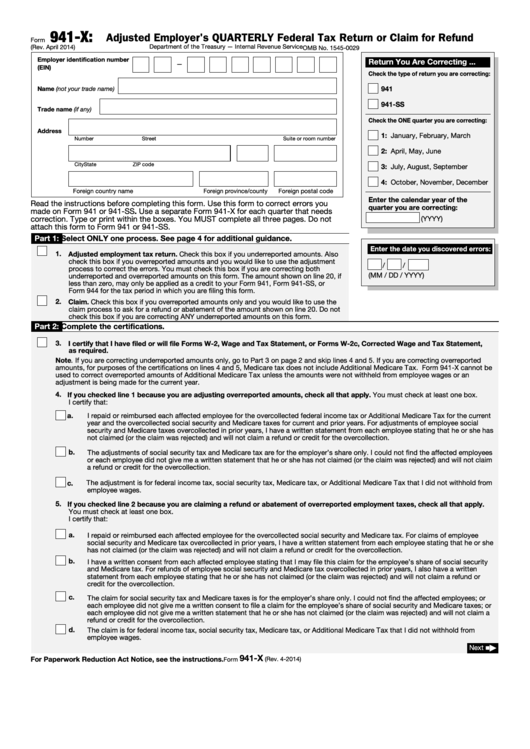

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

Web form941 for 2014: 2 why is the irs form 941 for 2014 pdf used? Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income. Irs form 941 is more commonly known as the employer's quarterly federal tax return. Web employers must file a quarterly form 941 to report wages paid,.

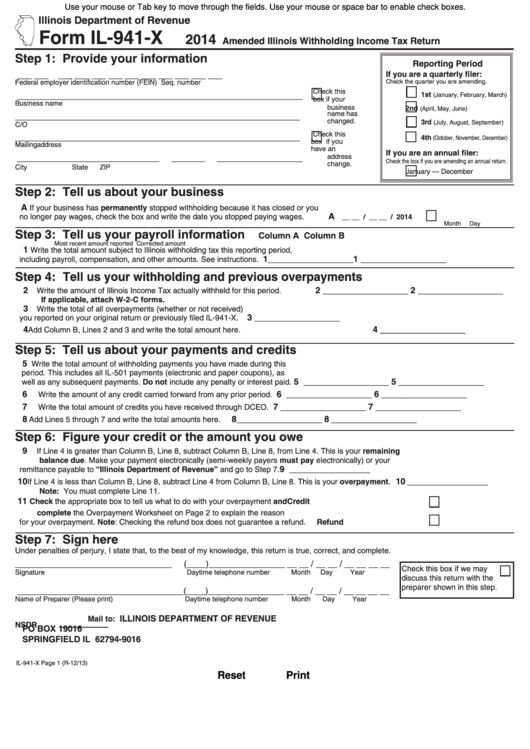

Fillable Form Il941X Amended Illinois Withholding Tax Return

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and. Employers quarterly federal tax return department of the treasury internal. January 2014) employer’s quarterly federal tax return department of the treasury — internal. Web 1 2 941 for 2014: Web employers must file a quarterly form 941 to report wages paid, tips your employees.

Irs 941 Instructions Publication 15 All Are Here

Web go to www.irs.gov/form941 for instructions and the latest information. January 2014) department of the. Read the separate instructions before you complete form. Department of the treasury — internal. Web form941 for 2014:

Form 941 (Schedule R) Allocation Schedule for Aggregate Form 941

Employer’s quarterly federal tax return department of the treasury — internal. January 2014) employer’s quarterly federal tax return department of the. Employer’s quarterly federal tax return 970114 (rev. Web what is irs form 941? We ask for the information on form 941 to carry out the internal revenue laws of.

Tax Return January 2017

2 why is the irs form 941 for 2014 pdf used? The social security tax rate is 6.2% each for the employee and employer, unchanged. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web 1 facts about the irs 941 for 2014 pdf template; Web information about form 941, employer's.

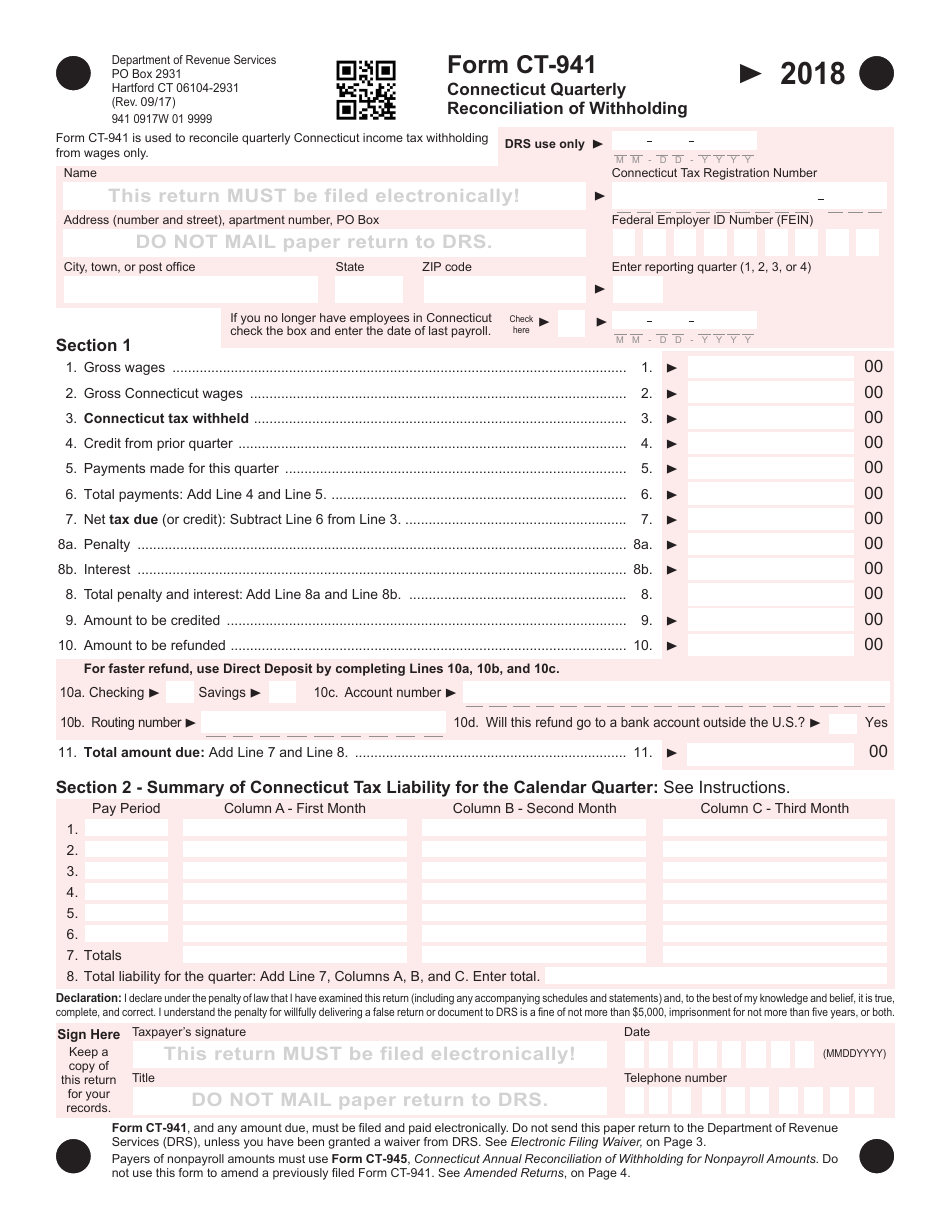

Form CT941 Download Printable PDF or Fill Online Connecticut Quarterly

Web 1 2 941 for 2014: Irs form 941 is more commonly known as the employer's quarterly federal tax return. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and. However, if you pay an amount with form 941 that should’ve. Read the separate instructions before you complete form.

[Solved] Form 941 for 2021 Employer's QUARTERLY Federal Tax Return

Web form941 for 2014: January 941 2014) for 2014: Read the separate instructions before you complete form. January 2014) department of the. Web february 28, 2022 · 9 minute read.

Department of the treasury — internal. We ask for the information on form 941 to carry out the internal revenue laws of. January 2014) department of the. January 2014) employer’s quarterly federal tax return department of the treasury — internal. 2 why is the irs form 941 for 2014 pdf used? Web form 941 for 2014: Irs form 941 is more commonly known as the employer's quarterly federal tax return. The social security tax rate is 6.2% each for the employee and employer, unchanged. Employers quarterly federal tax return department of the treasury internal. 950114 employer’s quarterly federal tax return form omb no. Web form941 for 2014: January 2014) 941 for 2014: Employer’s quarterly federal tax return department of the treasury — internal. Web 1 facts about the irs 941 for 2014 pdf template; Web february 28, 2022 · 9 minute read. This is the form your business uses to. Web 1 2 941 for 2014: Employer’s quarterly federal tax return 970114 (rev. January 2014) employer’s quarterly federal tax return. Web form 941 for 2014:

Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal.

Employers quarterly federal tax return department of the treasury internal. Web what is irs form 941? Irs form 941 is more commonly known as the employer's quarterly federal tax return. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income.

Department Of The Treasury — Internal.

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; January 941 2014) for 2014: Web go to www.irs.gov/form941 for instructions and the latest information. January 2014) employer’s quarterly federal tax return.

Web 1 2 941 For 2014:

January 2014) employer’s quarterly federal tax return department of the treasury — internal. January 2014) 941 for 2014: Web employers must file a quarterly form 941 to report wages paid, tips your employees have received, federal income tax withheld, and. 2 why is the irs form 941 for 2014 pdf used?

January 2014) Employer’s Quarterly Federal Tax Return Department Of The.

However, if you pay an amount with form 941 that should’ve. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and. Web form 941 for 2014: Web form941 for 2014: