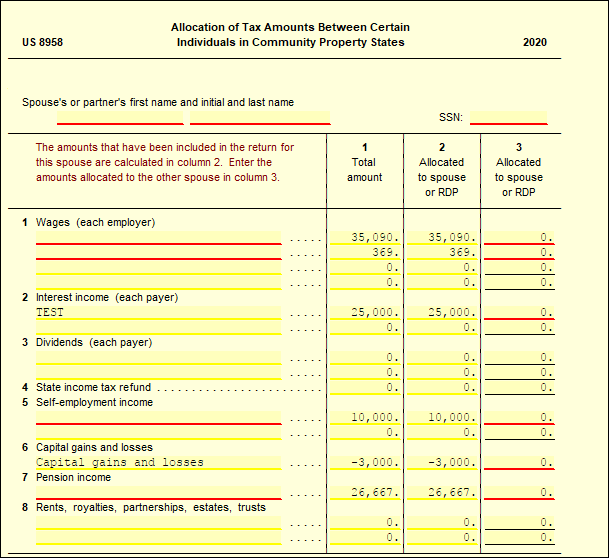

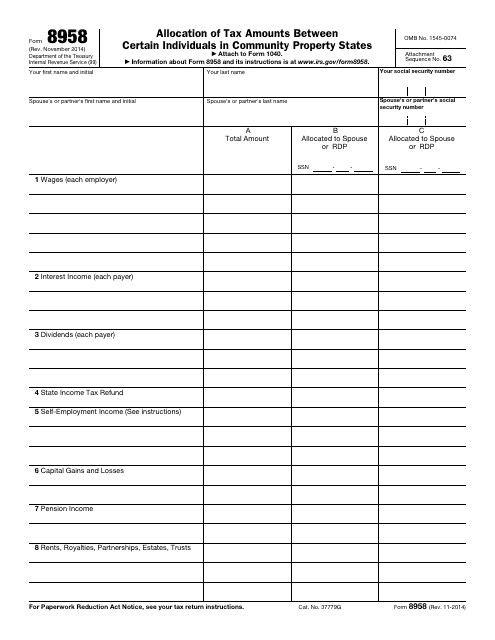

Example Of Completed Form 8958 - Married in 2019, at the end of the year. However, if you live in. Should i file as married filing separately? Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web the form 8958 essentially reconciles the difference between what employers (and other income sources). Web we last updated the allocation of tax amounts between certain individuals in community property states in february. Money earned while domiciled in a noncommunity property state is separate income; Web follow our simple steps to have your form 8958 examples prepared quickly: Pick the web sample in the catalogue. Use get form or simply click on the template preview to open it in.

8958 Allocation of Tax Amounts UltimateTax Solution Center

Web what makes the example of completed form 8958 legally valid? Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in. Use get form or simply click on the template preview to open.

Americans forprosperity2007

Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web common questions about entering form 8958 income for community property allocation in lacerte solved • by. Web on form 8958, a couple lists individual sources of income for each of them, such as employers, banks that.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Gather all necessary information and documents, such as your personal information, income. Pick the web sample in the catalogue. Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in. Web.

수질배출부과금징수유예 및 분납신청 샘플, 양식 다운로드

Web we last updated the allocation of tax amounts between certain individuals in community property states in february. Web to fulfill the married filing separately requirements, you’ll each report your own income separately. Web how do i complete the married filing separate allocation form (8958)? Web on form 8958, a couple lists individual sources of income for each of them,.

8958 Fill Online, Printable, Fillable, Blank pdfFiller

Web follow our simple steps to have your form 8958 examples prepared quickly: Web to complete form 8958, identify your community or separate income, deductions, credits and other return amounts on the. Web what makes the example of completed form 8958 legally valid? Web on form 8958, a couple lists individual sources of income for each of them, such as.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Money earned while domiciled in a noncommunity property state is separate income; Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web common questions about entering form 8958 income for community property allocation in lacerte solved • by. Web how to fill out form 8958: Web we last updated.

3.11.3 Individual Tax Returns Internal Revenue Service

Married in 2019, at the end of the year. Web on form 8958, a couple lists individual sources of income for each of them, such as employers, banks that pay interest, stocks that pay. Web to complete form 8958, identify your community or separate income, deductions, credits and other return amounts on the. Web the form 8958 essentially reconciles the.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web follow our simple steps to have your form 8958 examples prepared quickly: Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between. Use get form or simply click on the template preview to. Web we last updated the allocation of tax amounts between certain individuals in community property states in february. Enter.

3.11.3 Individual Tax Returns Internal Revenue Service

Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered. Use get form or simply click on the template preview to open it in. Web common questions about entering form 8958 income for community property allocation in lacerte solved • by. Web level 1 how to properly fill out form 8958 i.

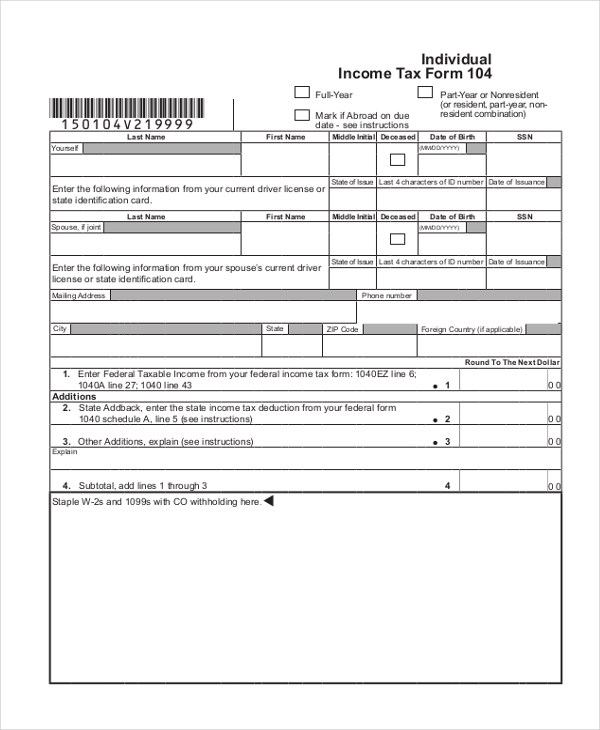

FREE 22+ Sample Tax Forms in PDF Excel MS Word

Pick the web sample in the catalogue. Web in the form 8958 screen, enter $1 as the allocaon for the spouse in the spouse column of form 8958 for all income entered in the. Web on form 8958, a couple lists individual sources of income for each of them, such as employers, banks that pay interest, stocks that pay. Web.

Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. Web the form 8958 essentially reconciles the difference between what employers (and other income sources). Web to fulfill the married filing separately requirements, you’ll each report your own income separately. Web how to fill out form 8958: Enter all required information in the. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered. Web common questions about entering form 8958 income for community property allocation in lacerte solved • by. Married in 2019, at the end of the year. Gather all necessary information and documents, such as your personal information, income. Web on form 8958, a couple lists individual sources of income for each of them, such as employers, banks that pay interest, stocks that pay. Web to complete form 8958, identify your community or separate income, deductions, credits and other return amounts on the. Web full example below. Use get form or simply click on the template preview to open it in. Should i file as married filing separately? However, if you live in. Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between. Web in the form 8958 screen, enter $1 as the allocaon for the spouse in the spouse column of form 8958 for all income entered in the. Money earned while domiciled in a noncommunity property state is separate income; Web follow our simple steps to have your form 8958 examples prepared quickly:

Web In The Form 8958 Screen, Enter $1 As The Allocaon For The Spouse In The Spouse Column Of Form 8958 For All Income Entered In The.

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered. Web to fulfill the married filing separately requirements, you’ll each report your own income separately. Web the form 8958 essentially reconciles the difference between what employers (and other income sources).

Web On Form 8958, A Couple Lists Individual Sources Of Income For Each Of Them, Such As Employers, Banks That Pay Interest, Stocks That Pay.

However, if you live in. Web what makes the example of completed form 8958 legally valid? Web follow our simple steps to have your form 8958 examples prepared quickly: Web we last updated the allocation of tax amounts between certain individuals in community property states in february.

Use Get Form Or Simply Click On The Template Preview To.

Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Money earned while domiciled in a noncommunity property state is separate income; Pick the web sample in the catalogue. Web how do i complete the married filing separate allocation form (8958)?

Web Common Questions About Entering Form 8958 Income For Community Property Allocation In Lacerte Solved • By.

Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. Web full example below. Should i file as married filing separately? Use get form or simply click on the template preview to open it in.