Do I Need To File Form 6198 For Rental Property - You have a net loss from rental real estate. Web property not used in the partnership that secures a nonrecourse loan taken as a. Web basis at the end of year 1 is $200. Special rules for limited partners. Web you must file form 6198 if you are in the activity of holding real property financing for which no one is personally engaged in an. 465 disallows $200 of the $300 loss. Web here are the steps you’ll take for claiming rental income on taxes: Web no it will not. Web you do not have to file form ftb 3801 if you meet both of the following conditions: Web you must include the full amount (both the.

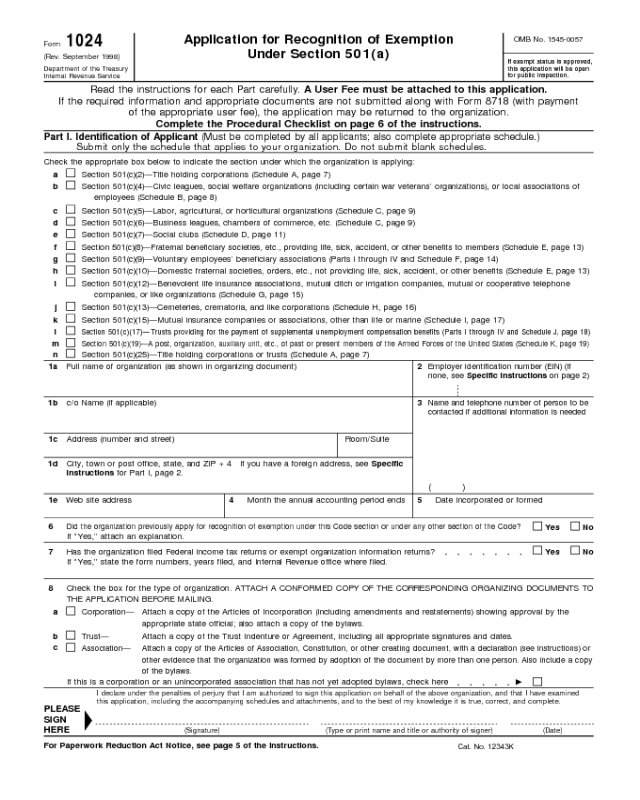

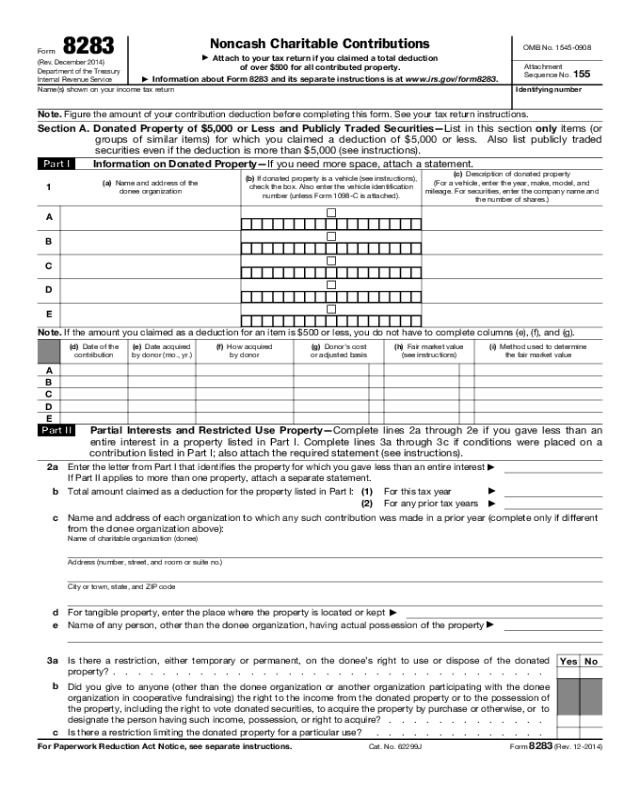

2019 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web form 6198 is required if your business has a loss and you have an investment in that business for which you. Web you must include the full amount (both the. Web you do not have to file form ftb 3801 if you meet both of the following conditions: Web property not used in the partnership that secures a nonrecourse.

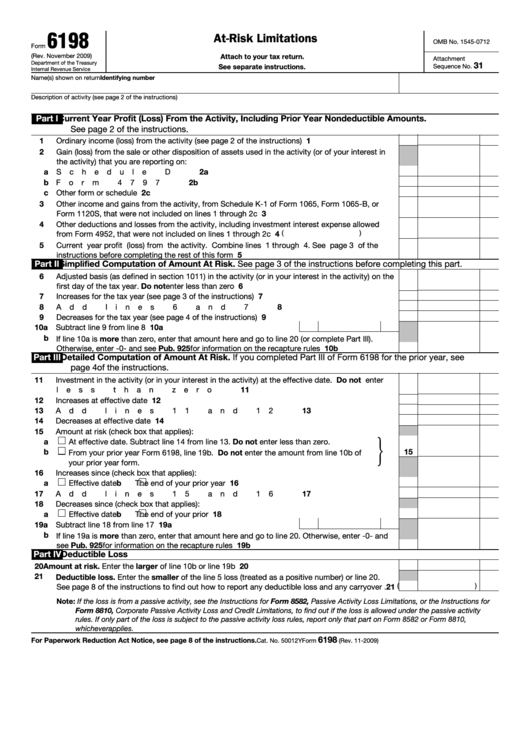

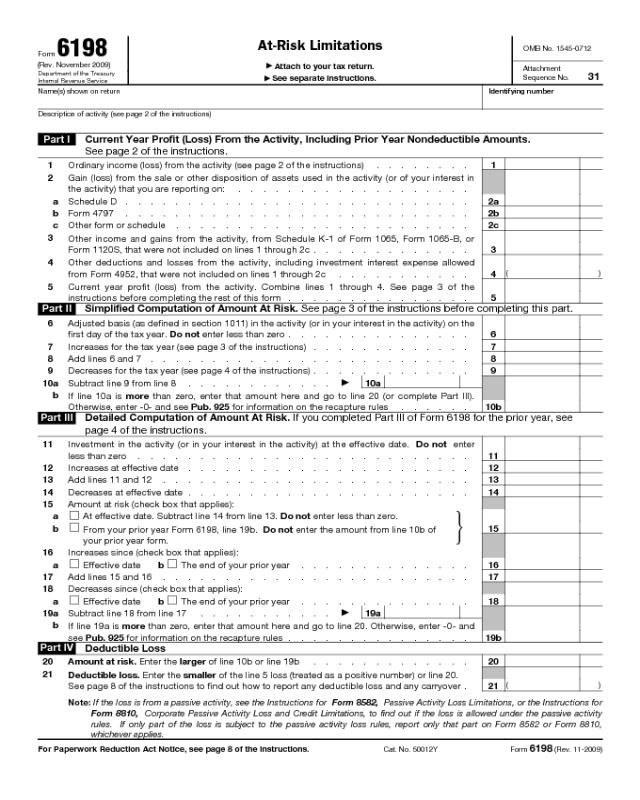

Top 6 Form 6198 Templates free to download in PDF format

There is a field for amount at risk in the other information section of each business type c and e, yet. Web basis at the end of year 1 is $200. Web you must file form 6198 if you are in the activity of holding real property financing for which no one is personally engaged in an. Web property not.

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web property not used in the partnership that secures a nonrecourse loan taken as a. Web here are the steps you’ll take for claiming rental income on taxes: Web you must file form 6198 if you are in the activity of holding real property financing for which no one is personally engaged in an. Web you must include the full.

Form 6198 atRisk Limitations Inscription on the Piece of Paper Stock

Web form 6198 is required if your business has a loss and you have an investment in that business for which you. You have a net loss from rental real estate. Web you must include the full amount (both the. Web who must file exception coordination with other limitations net income. 465 disallows $200 of the $300 loss.

Publication 925, Passive Activity and AtRisk Rules; Comprehensive Example

List your total income, expenses, and depreciation. Web basis at the end of year 1 is $200. Web who must file exception coordination with other limitations net income. Web you must include the full amount (both the. You have a net loss from rental real estate.

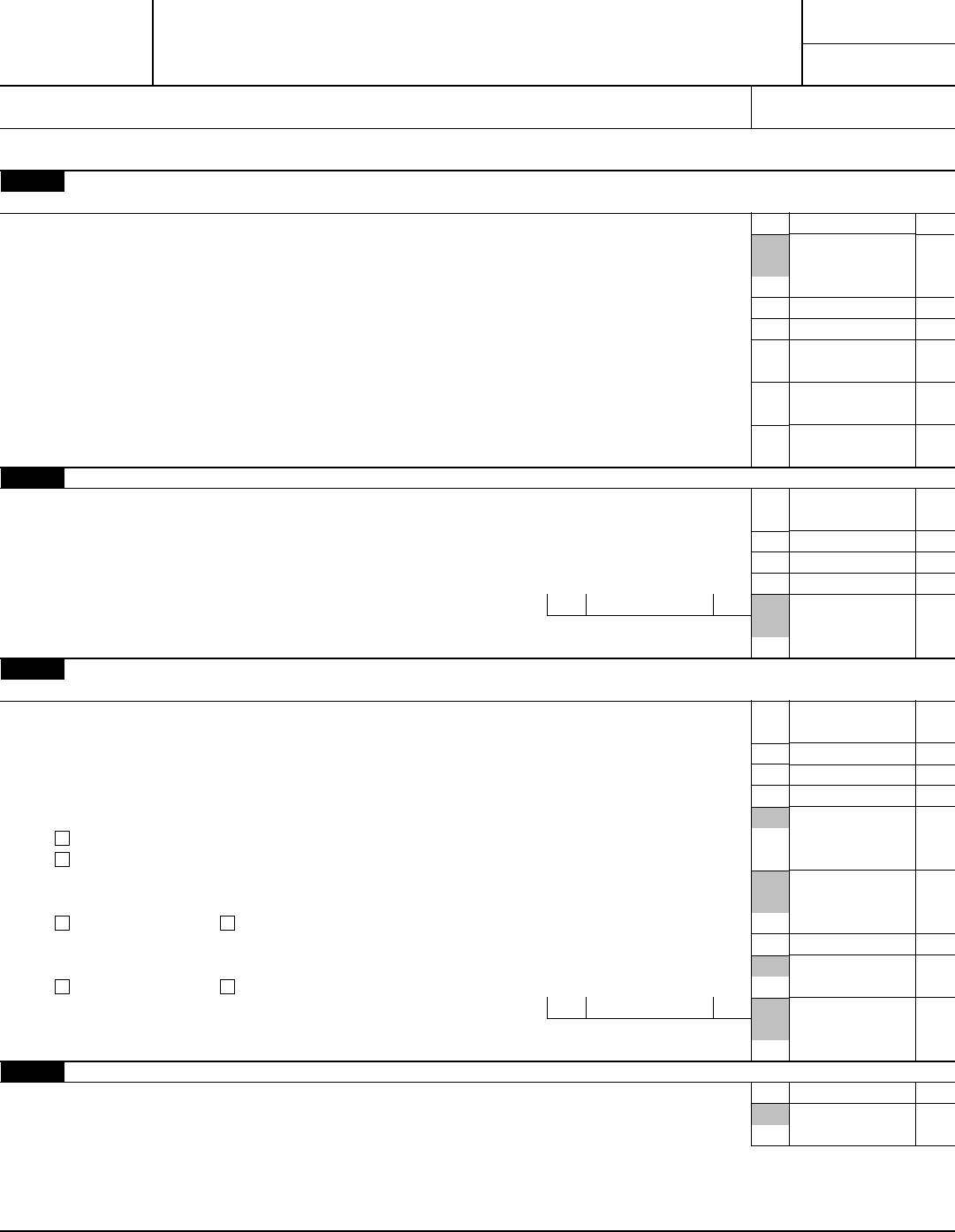

2007 Tax Form 6198 At

Web property not used in the partnership that secures a nonrecourse loan taken as a. The amount at risk at the end. List your total income, expenses, and depreciation. Web who must file exception coordination with other limitations net income. Web you must file form 6198 if you are in the activity of holding real property financing for which no.

2019 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

The amount at risk at the end. Web form 6198 is required if your business has a loss and you have an investment in that business for which you. Web no it will not. Web who must file exception coordination with other limitations net income. Web you must include the full amount (both the.

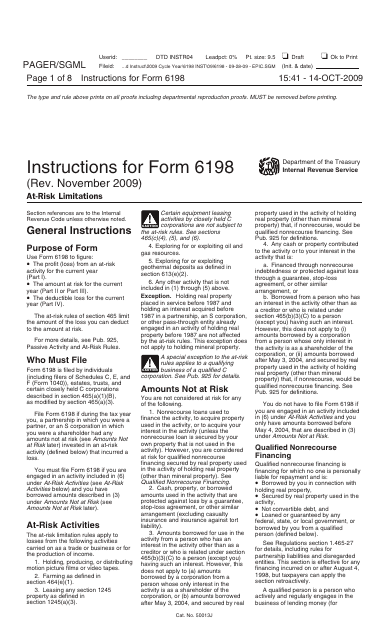

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

You have a net loss from rental real estate. Web form 6198 is required if your business has a loss and you have an investment in that business for which you. Web basis at the end of year 1 is $200. List your total income, expenses, and depreciation. Web here are the steps you’ll take for claiming rental income on.

Form 6198 Edit, Fill, Sign Online Handypdf

There is a field for amount at risk in the other information section of each business type c and e, yet. List your total income, expenses, and depreciation. Special rules for limited partners. You have a net loss from rental real estate. Web here are the steps you’ll take for claiming rental income on taxes:

2021 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web property not used in the partnership that secures a nonrecourse loan taken as a. Special rules for limited partners. List your total income, expenses, and depreciation. Web form 6198 is required if your business has a loss and you have an investment in that business for which you. The amount at risk at the end.

You have a net loss from rental real estate. Web you do not have to file form ftb 3801 if you meet both of the following conditions: Web no it will not. Web form 6198 is required if your business has a loss and you have an investment in that business for which you. Web you must include the full amount (both the. Web here are the steps you’ll take for claiming rental income on taxes: 465 disallows $200 of the $300 loss. Web basis at the end of year 1 is $200. Web who must file exception coordination with other limitations net income. List your total income, expenses, and depreciation. The amount at risk at the end. Web you must file form 6198 if you are in the activity of holding real property financing for which no one is personally engaged in an. Special rules for limited partners. There is a field for amount at risk in the other information section of each business type c and e, yet. Web property not used in the partnership that secures a nonrecourse loan taken as a.

Web Basis At The End Of Year 1 Is $200.

Web here are the steps you’ll take for claiming rental income on taxes: Special rules for limited partners. Web you must file form 6198 if you are in the activity of holding real property financing for which no one is personally engaged in an. 465 disallows $200 of the $300 loss.

Web You Do Not Have To File Form Ftb 3801 If You Meet Both Of The Following Conditions:

There is a field for amount at risk in the other information section of each business type c and e, yet. Web you must include the full amount (both the. The amount at risk at the end. List your total income, expenses, and depreciation.

Web Property Not Used In The Partnership That Secures A Nonrecourse Loan Taken As A.

You have a net loss from rental real estate. Web form 6198 is required if your business has a loss and you have an investment in that business for which you. Web no it will not. Web who must file exception coordination with other limitations net income.