Ca Form 592-Pte - Web learn about the new forms and requirements for reporting and remitting withholding on distributions of california source income by. Corporation name, street address, city, state code,. Either state form 565 or 568 should. Web this publication provides guidance on withholding requirements to assist you to: Web two new forms: Cch axcess™ tax and cch® prosystem fx®. Web procedure go to california > other information worksheet. Do not use form 592 if any of the following apply: Web the faqs clarify: Web form 592 is also used to report withholding payments for a resident payee.

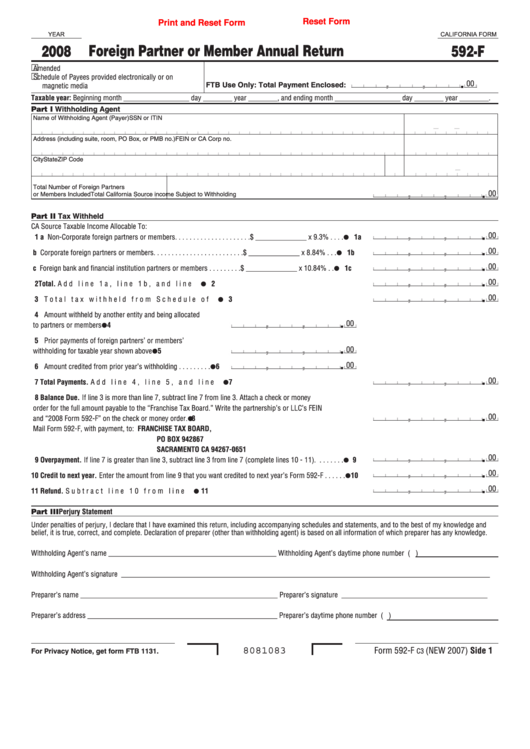

Fillable California Form 592F Foreign Partner Or Member Annual

To learn about your privacy rights, how we may use your information, and the consequences for not. 2022, 592, instructions for form. Web the faqs clarify: If the partnership has foreign. Web form 592 is also used to report withholding payments for a resident payee.

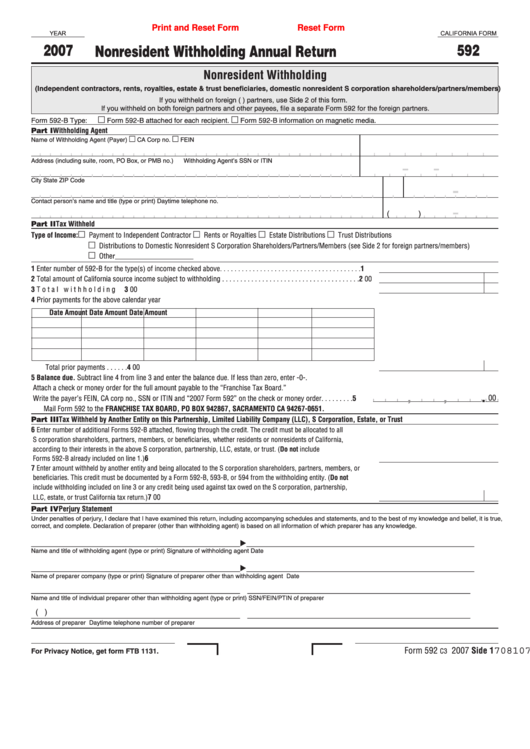

California Form 592 Nonresident Withholding Annual Return 2007

Web learn about the new forms and requirements for reporting and remitting withholding on distributions of california source income by. Do not use form 592 if any of the following apply: Do not use form 592 if any of the following apply: Either state form 565 or 568 should. Web procedure go to california > other information worksheet.

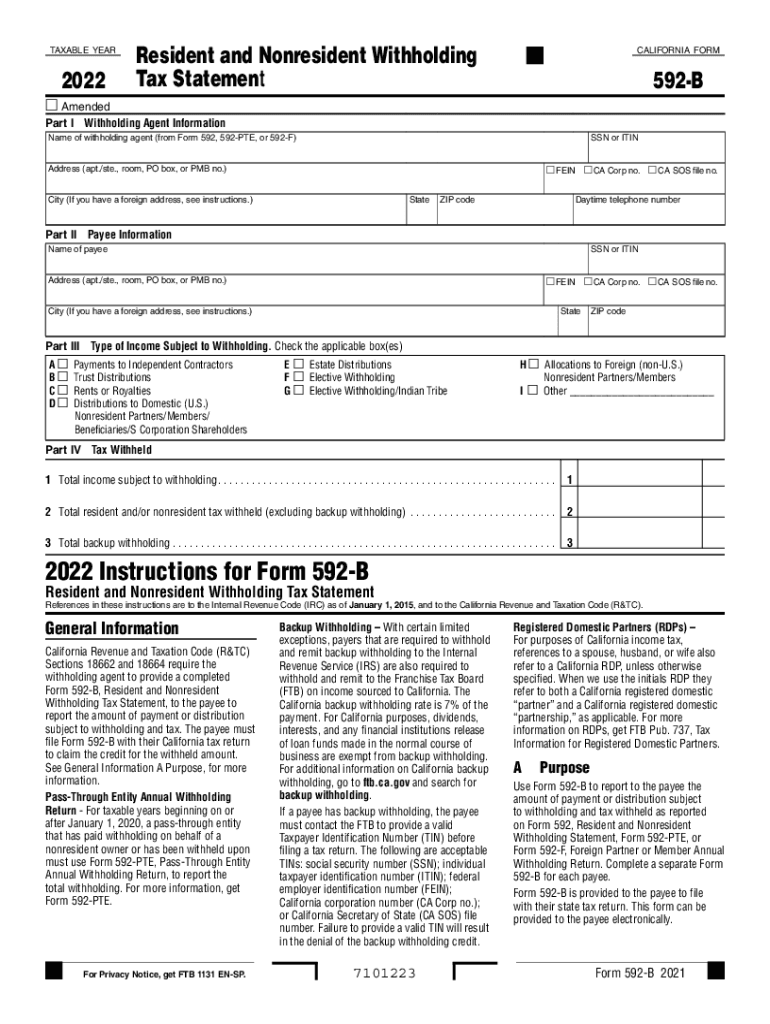

Www Ftb Ca Govforms20212021 Form 592 Resident and Nonresident

Cch axcess™ tax and cch® prosystem fx®. Do not use form 592 if any of the following apply: Either state form 565 or 568 should. Web two new forms: To learn about your privacy rights, how we may use your information, and the consequences for not.

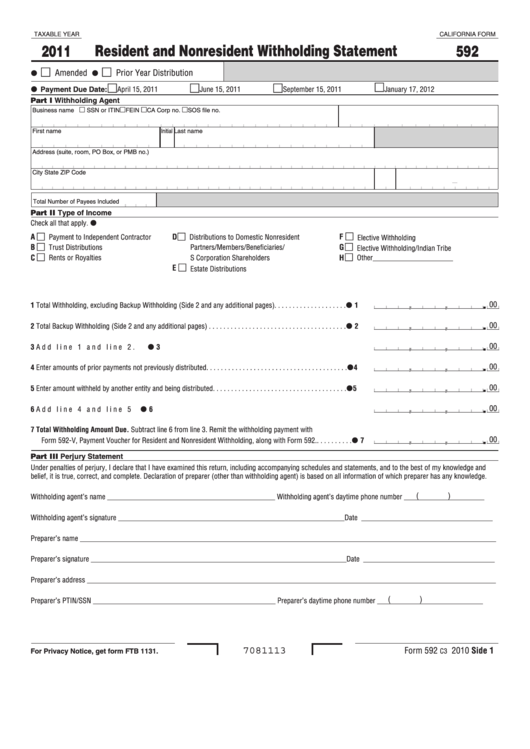

Fillable California 592 Form Resident And Nonresident Withholding

If the partnership has foreign. Corporation name, street address, city, state code,. Cch axcess™ tax and cch® prosystem fx®. Web this publication provides guidance on withholding requirements to assist you to: Web two new forms:

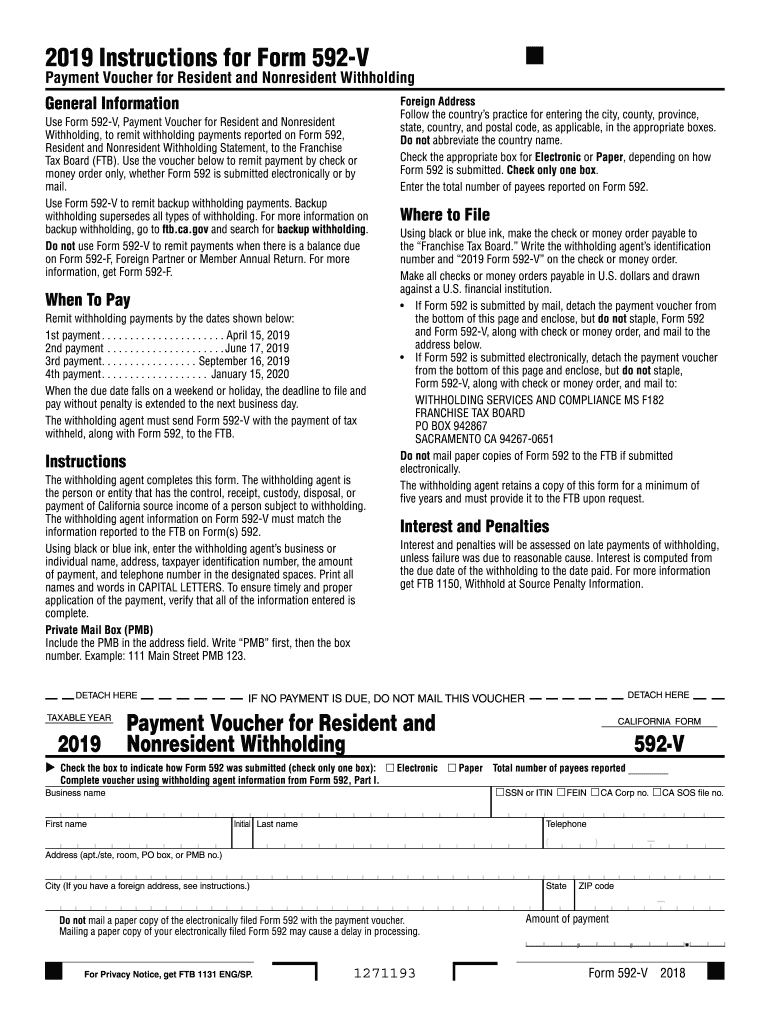

2019 Form CA FTB 592V Fill Online, Printable, Fillable, Blank pdfFiller

Web two new forms: If the partnership has foreign. 2022, 592, instructions for form. Web the faqs clarify: Do not use form 592 if any of the following apply:

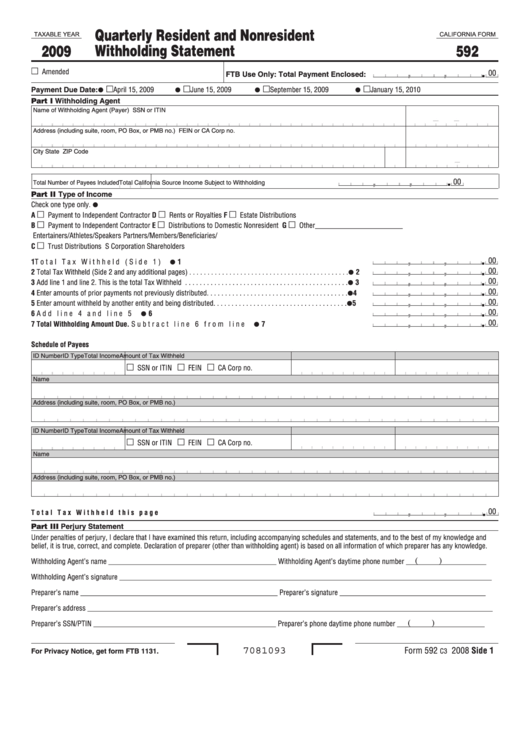

Fillable California Form 592 Quarterly Resident And Nonresident

Either state form 565 or 568 should. Do not use form 592 if any of the following apply: Web form 592 is also used to report withholding payments for a resident payee. Web the faqs clarify: • withhold on payments to nonresident.

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. Web two new forms: Web this publication provides guidance on withholding requirements to assist you to: Web procedure go to california > other information worksheet. 2022, 592, instructions for form.

2013 Form CA FTB 592 Fill Online, Printable, Fillable, Blank pdfFiller

Web this publication provides guidance on withholding requirements to assist you to: General information, check if total withholding at end of year. Corporation name, street address, city, state code,. Web state of california franchise tax board corporate logo. • withhold on payments to nonresident.

2021 Form CA FTB 592V Fill Online, Printable, Fillable, Blank pdfFiller

Web procedure go to california > other information worksheet. Do not use form 592 if any of the following apply: Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. • withhold on payments to nonresident. If the partnership has foreign.

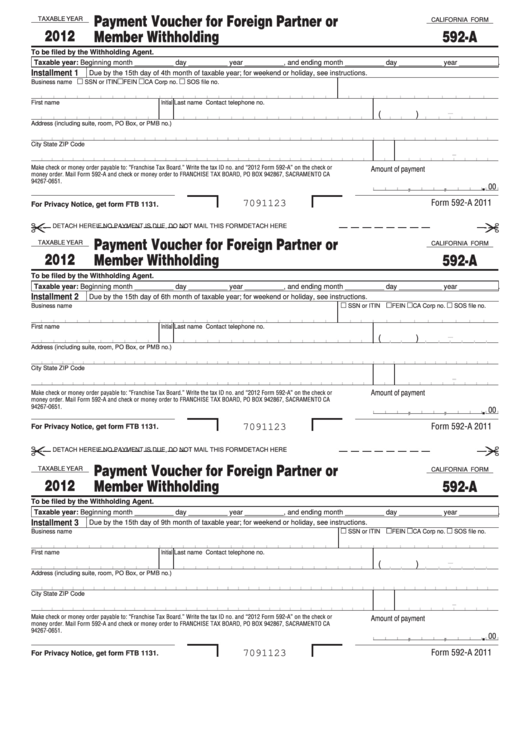

Fillable California Form 592A Payment Voucher For Foreign Partner Or

Web this publication provides guidance on withholding requirements to assist you to: Corporation name, street address, city, state code,. Web state of california franchise tax board corporate logo. Web procedure go to california > other information worksheet. • withhold on payments to nonresident.

To learn about your privacy rights, how we may use your information, and the consequences for not. Web form 592 is also used to report withholding payments for a resident payee. General information, check if total withholding at end of year. • withhold on payments to nonresident. Do not use form 592 if any of the following apply: Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. Do not use form 592 if any of the following apply: Web form 592 is also used to report withholding payments for a resident payee. Web learn about the new forms and requirements for reporting and remitting withholding on distributions of california source income by. Web two new forms: 2022, 592, instructions for form. Web the faqs clarify: Either state form 565 or 568 should. Web state of california franchise tax board corporate logo. Corporation name, street address, city, state code,. Web this publication provides guidance on withholding requirements to assist you to: Web procedure go to california > other information worksheet. If the partnership has foreign. Cch axcess™ tax and cch® prosystem fx®.

Web This Publication Provides Guidance On Withholding Requirements To Assist You To:

Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. Web procedure go to california > other information worksheet. To learn about your privacy rights, how we may use your information, and the consequences for not. Do not use form 592 if any of the following apply:

Web Learn About The New Forms And Requirements For Reporting And Remitting Withholding On Distributions Of California Source Income By.

Web state of california franchise tax board corporate logo. 2022, 592, instructions for form. Cch axcess™ tax and cch® prosystem fx®. • withhold on payments to nonresident.

Web Two New Forms:

Web form 592 is also used to report withholding payments for a resident payee. Either state form 565 or 568 should. General information, check if total withholding at end of year. If the partnership has foreign.

Web Form 592 Is Also Used To Report Withholding Payments For A Resident Payee.

Corporation name, street address, city, state code,. Do not use form 592 if any of the following apply: Web the faqs clarify: